Exchange-traded funds saw net outflows for the first time since September, as investors navigated a mixed bag of economic data.

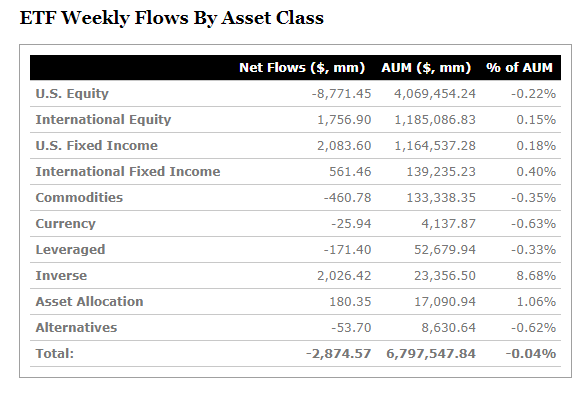

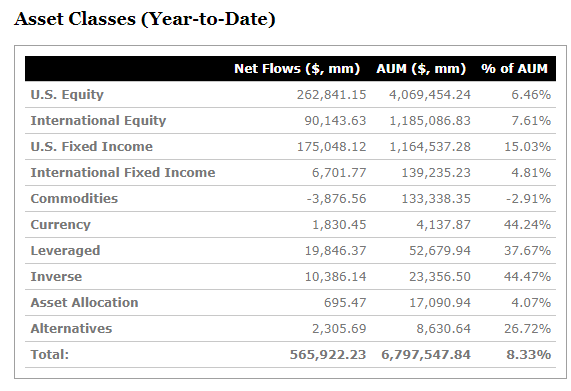

ETFs recorded almost $2.9 billion in outflows in the week ending Dec. 2, down from the $11 billion that piled in the week before. The S&P 500 climbed 1.1% during the week, while the Nasdaq rose 2.1%.

Stocks gyrated throughout the week, moving decisively higher after the central bank’s head, Jerome Powell, signaled on Wednesday a smaller interest rate hike as early as December, then posted losses after a better-than-expected jobs report last week rekindled fears of a looming recession.

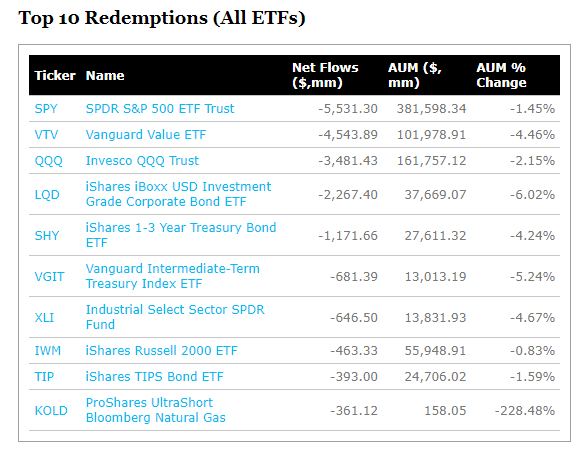

U.S. equity-focused ETFs posted $8.8 billion in outflows, down from the $895 million seen in the previous week. Funds that recorded the greatest outflows included the SPDR S&P 500 ETF Trust (SPY), the Invesco QQQ Trust (QQQ)and the iShares Russell 2000 ETF (IWM), which lost nearly $10.5 billion, cumulatively, according to ETF.com data.

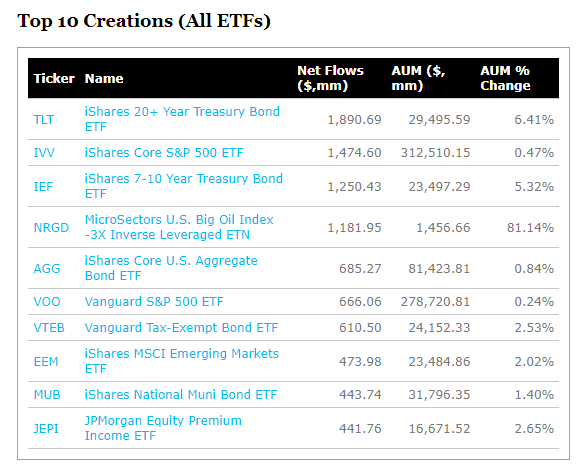

Meanwhile, U.S. fixed income funds pulled in $2.1 billion. Among the top performers were the iShares 20+ Year Treasury Bond ETF (TLT),the iShares 7-10 Year Treasury Bond ETF (IEF) and the iShares Core U.S. Aggregate Bond ETF (IGG). Still, the asset class netted lower inflows than the $5.9 billion seen the week prior.

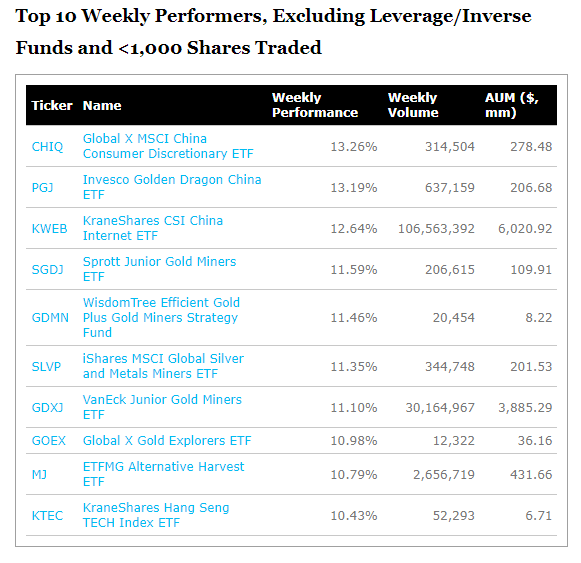

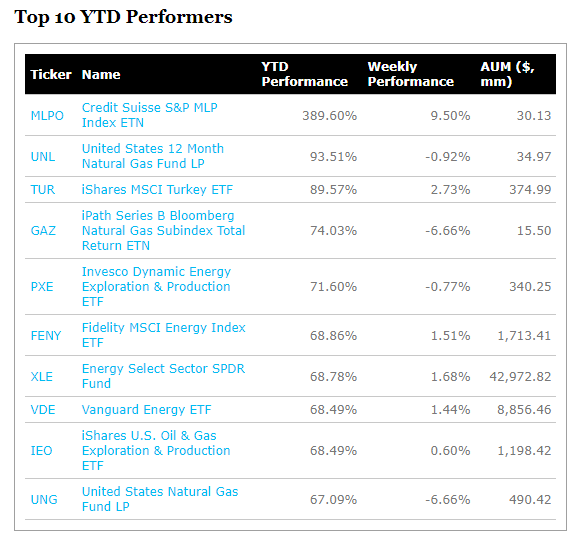

For a full list of last week’s top inflows and outflows, see the tables below:

Comments