Friday morning’s release of the personal consumption expenditures price index for November will be the last major potential catalyst for this year’s macro-driven stock market. A continued pullback in the Federal Reserve’s preferred inflation gauge could set off a year-end rally, while a hotter-than-expected print might extend stocks’ recent selloff.

The Bureau of Economic Analysis will release the November personal income and expenditures report at 8:30 a.m. ET on Dec. 23.

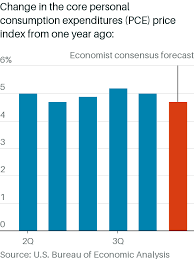

Economists expect the core personal-consumption expenditures price index, or PCE deflator, to have been up 0.2% in November, for a year-over-year increase of 4.7%. That would follow a 0.22% rise in October. The headline PCE deflator is forecast to have climbed 0.1% in November, and 5.5% year over year.

For much of this year, investorsh ave been fighting the Fed. Central-bank officials say that inflation is sticky and that the Fed will need to keep interest rates higher for longer to bring price growth down. As for the market, pricing implies that investors are betting that inflation will come down sufficiently in 2023 for the Fed to lower interest rates in the back half of the year.

Friday’s data will help to show who’s more right, at least for now.

Fed officials’ latest Summary of Economic Projections, or the so-called dot plot released earlier this month, showed a median expectation for core PCE inflation to end 2022 at 4.8%. The December data won’t be out until late January. The median dots are 3.5% in 2023 and 2.5% in 2024.

“We think that [Friday’s report] will confirm that inflation is moderating as measured by the PCED,” wrote Ed Yardeni, president of Yardeni Research. “It should also confirm that consumers are still spending, though more on services than goods. It should show that in addition to excess saving, wages are rising faster than prices, boosting consumers’ purchasing power. That would all be consistent with a soft landing.”The S&P 500 is down about 5% in just over a week, and many sectors and stocks are oversold. It wouldn’t take much good news on the inflation front for stocks to bounce, especially this late in the year when markets tend to do well on low trading volume.

The core consumer price index, which uses different weights and methodology to calculate inflation, rose 0.2% in November, cutting its year-over-year rise to 6.0%. The November core producer price index was up 0.3% in the month, or 4.9% from a year earlier. The PCE basket includes elements of both.

Alex Pelle, U.S. economist at Mizuho Securities USA, expects a hotter PCE deflator on Friday for a few reasons. “The first is financial services, which PCE mostly draws from PPI,” he wrote. “Second is used vehicles, which has a lower weight in PCE. Thirdly, we have the combination of medical services and health insurance. These are also mostly drawn from PPI and—particularly with insurance—are ‘artificially’ low in CPI. This helps partly explain why the Fed is less sanguine on the inflation outlook than the market.”

Pelle sees a 0.3% increase in the core PCE deflator in November.

There will also be data in Friday’s report on November consumer personal income and expenditures. Economists’ consensus estimates call for a 0.4% month-over-month increases in both earnings and spending, compared with gains of 0.7% and 0.8%, respectively, in October.

Comments