- Financial stocks got an "alpha signal" and could be set to outperform the S&P(SP500)(NYSEARCA:SPY)in the next few months, according to the latest BofA Securities client flow survey.

- Financial Select Sector SPDR Fund (NYSEARCA:XLF)are up about 0.2% premarket, the leading S&P sector with the 10-year Treasury yield (NYSEARCA:TBT)(NASDAQ:TLT) up another 2 basis points to 1.31%.

- Weekly buybacks in Financials from clients were the highest on record since 2010 and nearly a record as a percent of market cap, BofA says.

- "Buybacks by corporate clients accelerated from the prior week to the highest level since mid-March, driven by Financials," strategists led by Jill Carey Hall write in a note. "Financials has now overtaken Tech as the sector with the largest dollar amount buybacks so far this year."

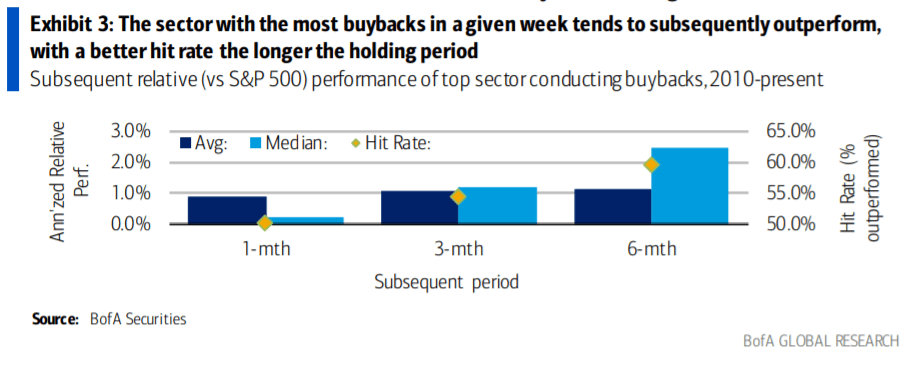

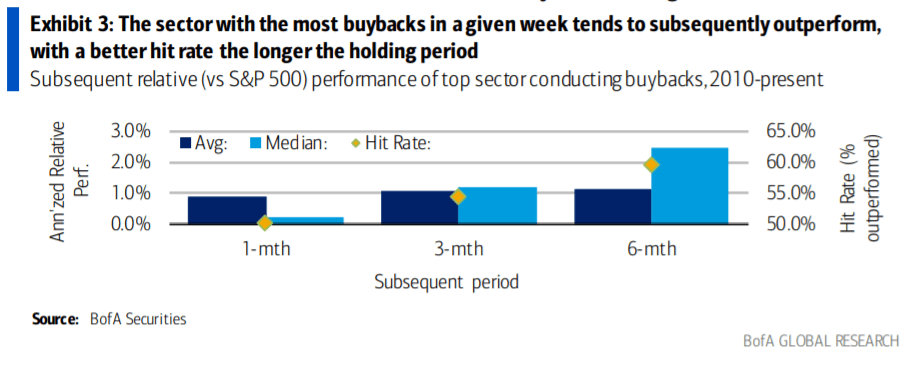

- "Based on our flows data from 2010 to today, we have found that the S&P 500 sector buying back the largest dollar amount in a given week have tended to outperform over the next several months with a >50% hit rate," Hall says.

- "YTD, corporate client buybacks across sectors are +49% y/y but still far from pre-COVID levels: -14% vs. 2019 at this time, and one of the weakest years post-crisis so far when normalized by market cap," Hall adds.

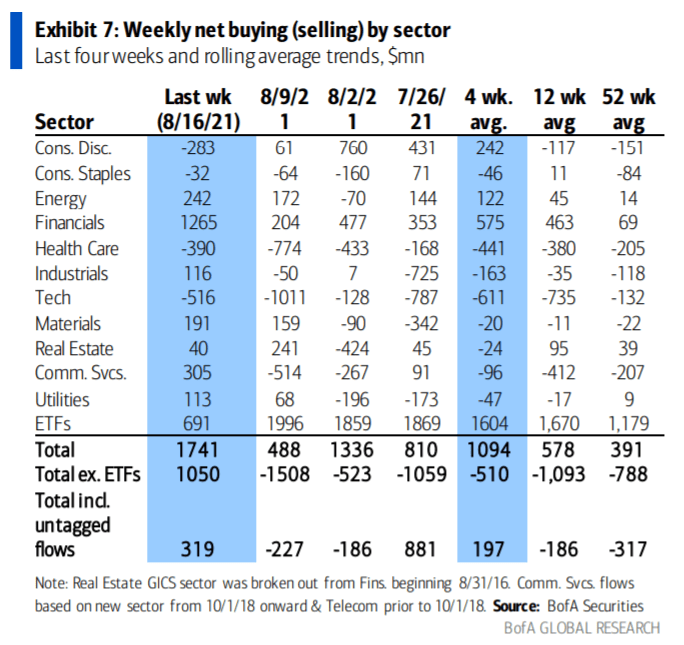

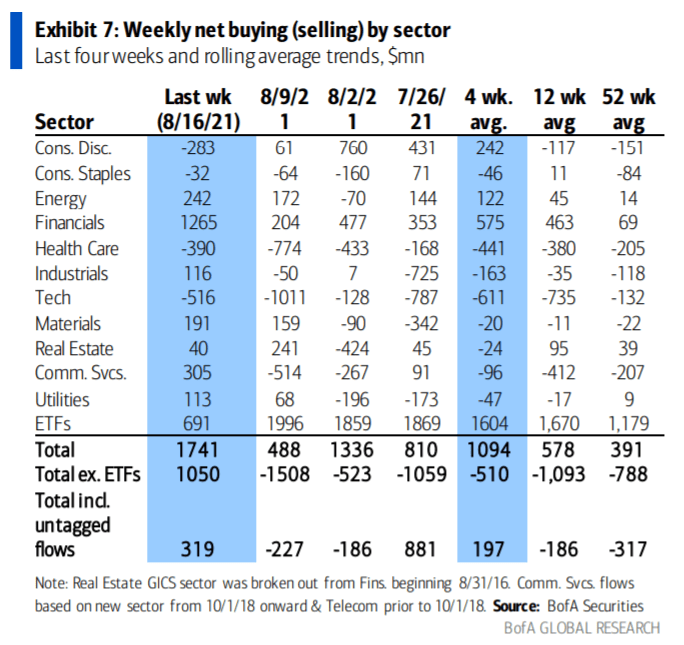

- Overall, clients broke a two-week selling streak, buying a relatively small net amount of $300M.

- Hedge funds drove the buying with the biggest inflow in five months, while institutional and retail investors sold.

- Seven of the 11 S&P sectors saw inflows. Financials were on top with the sixth-largest inflows on record. Technology Select Sector SPDR Fund (NYSEARCA:XLK), Health Care Select Sector SPDR Fund (NYSEARCA:XLV), Consumer Discretionary(NYSEARCA:XLY)and Consumer Staples(NYSEARCA:XLP)had net selling.

- Excluding buybacks, The Communication Services Select Sector SPDR Fund (NYSEARCA:XLC), Materials Select Sector SPDR Fund (NYSEARCA:XLB) and Energy Select Sector SPDR Fund (NYSEARCA:XLE) led inflows.

- This morning, Dick's Sporting Goods raised its buyback program to $400M, along with issuing a special dividend.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Comments