Market Overview

Wall Street ended mixed on Thursday (Dec. 1) as a selloff in Salesforce weighed on the Dow, while traders digested U.S. data that suggested the Federal Reserve's interest rate hikes are working. The S&P 500 declined 0.09% to end the session at 4,076.57 points. The Nasdaq gained 0.13% to 11,482.45 points. Dow Jones Industrial Average declined 0.56% to 34,395.01 points.

Regarding the options market, a total volume of 40,966,020 contracts was traded on Thursday, down 11% from the previous trading day. Tesla's option trading was active ahead of Semi electric-truck launch. Bullish bets on AMC Entertainment surged. Netflix and Salesforce saw unusual activity in options trading. The option trading activities of betting on Chinamarkets remained active.

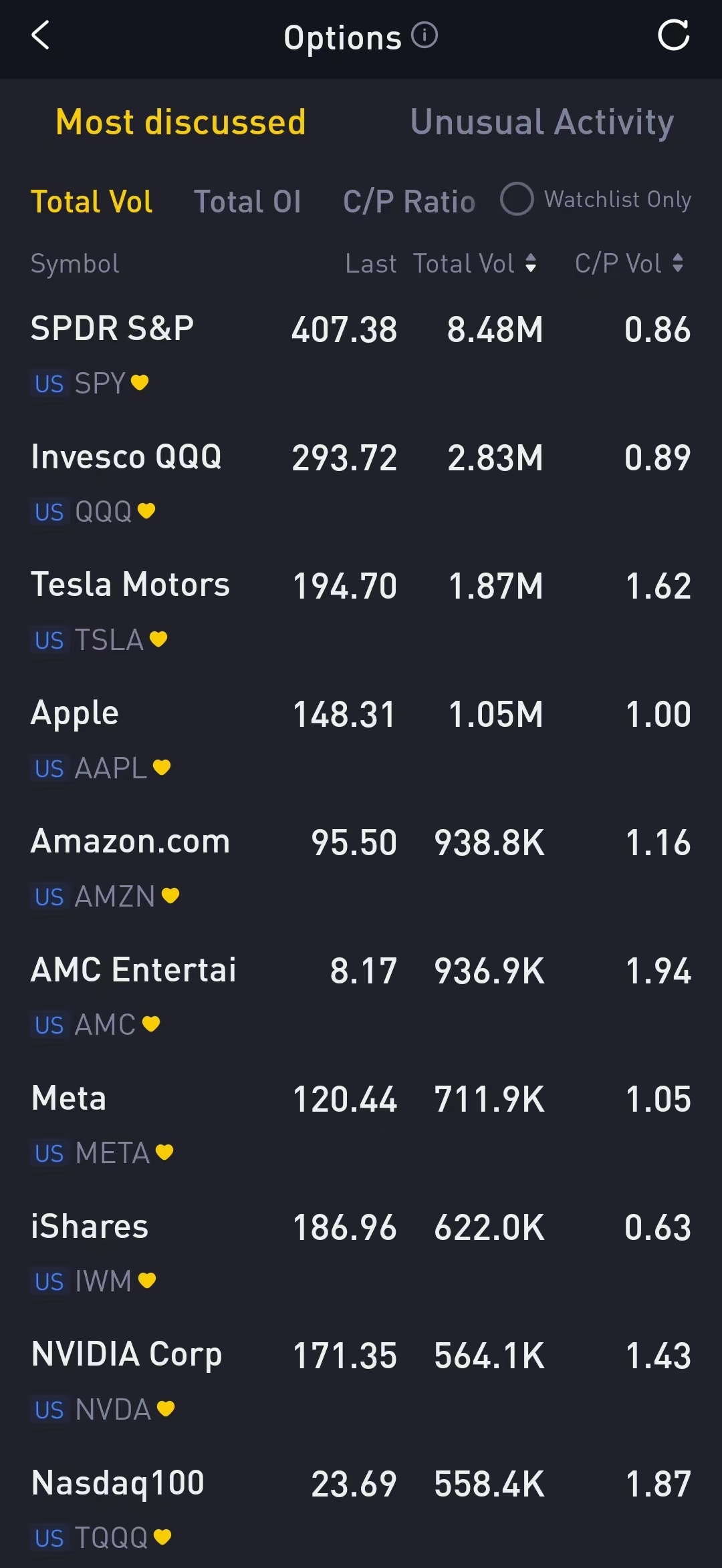

Top 10 Option Volumes

Top 10: SPY, QQQ, TSLA, AAPL, AMZN, AMC, META, IWM, NVDA, TQQQ

Options related to equity index ETFs are popular with investors, with 8.48 million SPDR S&P500 ETF Trust (SPY) and 2.83 million Invest QQQ Trust ETF (QQQ) options contracts trading on Monday.

Total trading volume for SPY and QQQ decreased by 5% and 10%, respectively, from the previous day. 56% of SPY trades bet on bearish options.

Tesla Inc. stock ended flat Thursday after weaving in and out of losses most of the session, as investors awaited the launch of the company’s electric commercial truck, the Semi, after years of delays.

There are 1.87 million Tesla option contracts traded on Thursday. Call options account for 62% of overall option trades. Particularly high volume was seen for the $200 strike call option expiring December 2, with 217,022 contracts trading.

The invitation-only event was held Thursday evening at the electric-vehicle maker’s plant outside of Reno, Nev., and CEO Elon Musk drove one of three Semis in front of a crowd at the factory. The company aims to produce 50,000 trucks a year in 2024. Tesla did not announce a price for the Semi.

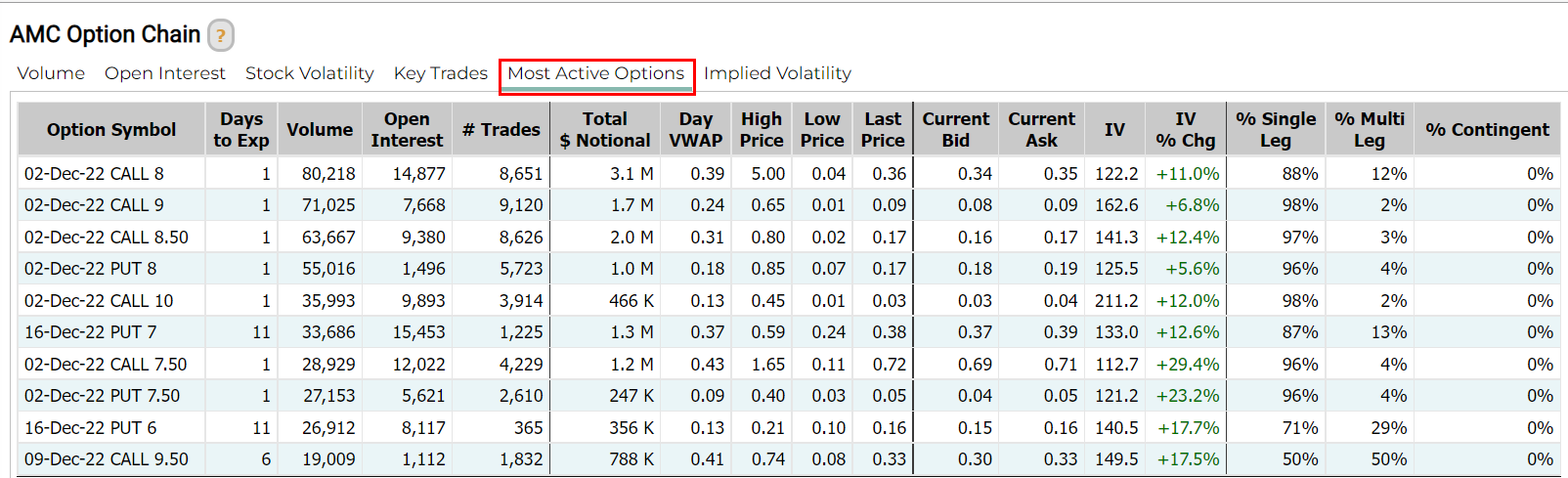

AMC Entertainment shares jumped most since may as bullish bets surge. The movie-theater operator -- one of the poster children for the meme-stock mania of 2021 -- skyrocketed 27% Thursday to $9.15 at one time, its biggest jump since May 12. And the shares closed higher 13% at $8.17. Trading activity in call options was triple the average over the past 20 days, with investors snapping up contracts that were out of the money.

There are 936.9K AMC Entertainment option contracts traded on Thursday. Call options account for 66% of overall option trades. Particularly high volume was seen for the $8 strike call option expiring December 2, with 80,218 contracts trading.

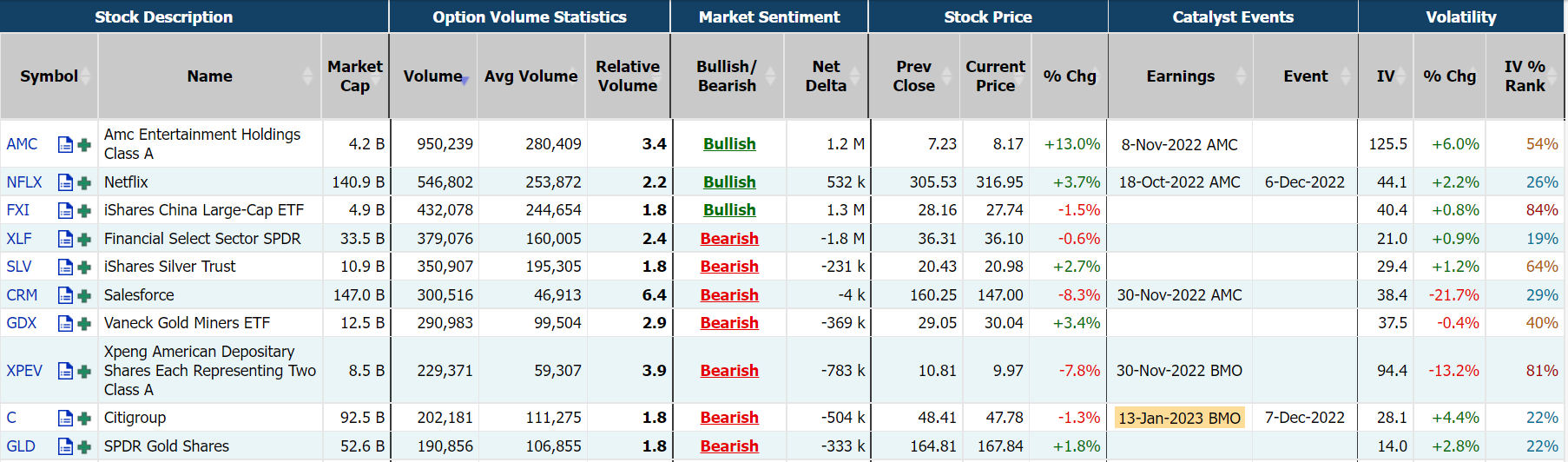

Unusual Options Activity

American streaming platform, Netflix will allow its tens of thousands of users around the world to preview its video content in advance to provide feedback starting next year, according to a recent report. At the moment, there are reports that more than 2,000 subscribers can currently preview Netflix’s video content. They provided valuable feedback to Netflix and helped content producers further improve their work to attract more users to watch.

In addition, Netflix co-CEO Reed Hastings was once famously steadfast about the company's pioneering streaming service remaining free of ads. It took a reversal in subscriber growth to start to change his mind - and now hesays he regrets not introducing an ad-supported version sooner.

There are 548.4K Netflix option contracts traded on Thursday. Call options account for 57% of overall option trades. Particularly high volume was seen for the $320 strike put option expiring December 2, with 50,354 contracts trading.

Shares of Salesforce Inc fell about 8% on Thursday after co-CEO Bret Taylor's sudden exit caught Wall Street off guard and raised concerns about the merit in having two leaders.

There are 301.2K Salesforce option contracts traded on Thursday. Call options account for 58% of overall option trades. Particularly high volume was seen for the $150 strike put option expiring December 2, with 9,088 contracts trading.

Meanwhile, The option trading activities of betting on China markets remained active. iShares China Large-Cap ETF (FXI) and XPeng both saw unusual activity in options trading.

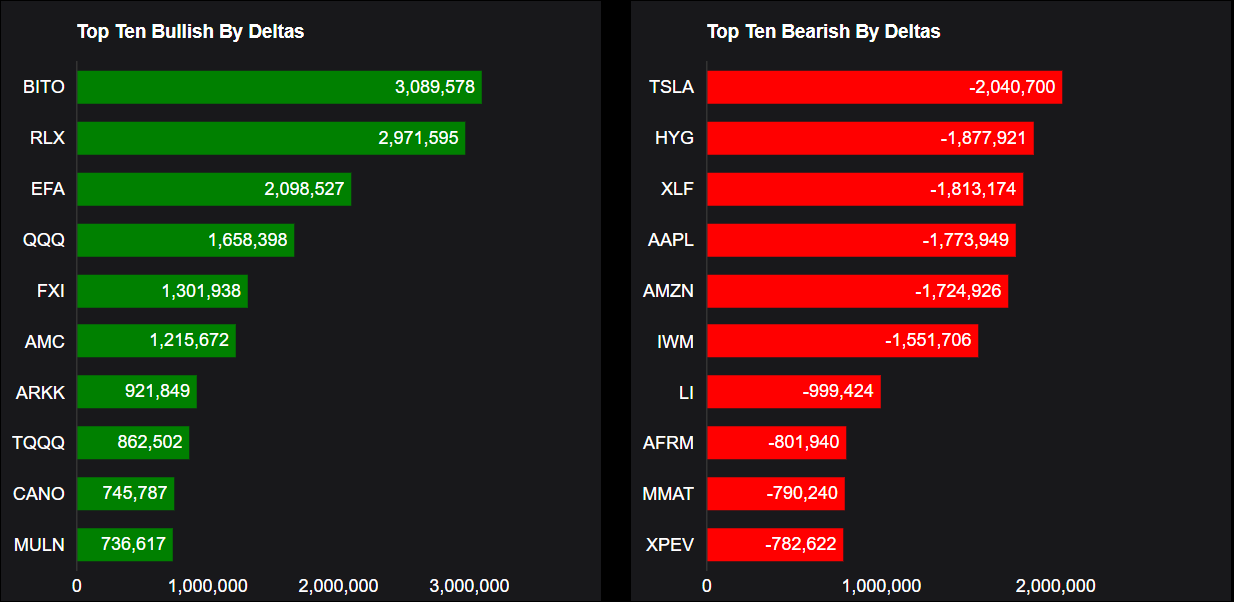

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: BITO, RLX, EFA, QQQ, FXI, AMC, ARKK, TQQQ, CANO, MULN

Top 10 bearish stocks: TSLA, HYG, XLF, AAPL, AMZN, IWM, LI, AFRM, MMAT, XPEV

If you are interested in options and you want to:

- Share experiences and ideas on options trading.

- Read options-related market updates/insights.

- Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments