The banks have all turned in a solid set of earnings, so which one should you pick for your investment portfolio?

Investors may feel uncomfortable with the recent surge in interest rates as the US Federal Reserve adjusts its monetary policy to tackle soaring inflation.

The trio of local banks, however, has benefitted greatly from the central bank’s move.

DBS Group (SGX: D05) led the pack by reporting a record-high net profit of S$8.2 billion along with a special dividend of S$0.50.

United Overseas Bank Ltd (SGX: U11), or UOB, followed suit with its highest-ever net profit of S$4.6 billion, while OCBC Ltd (SGX: O39) hiked its final dividend by 43% year on year as it also turned in a sterling report card.

With all three banks announcing a surge in net interest income along with record-high profits, it can be tough to decide which to buy.

We decided to line the trio alongside one another to see which qualifies as the best investment choice.

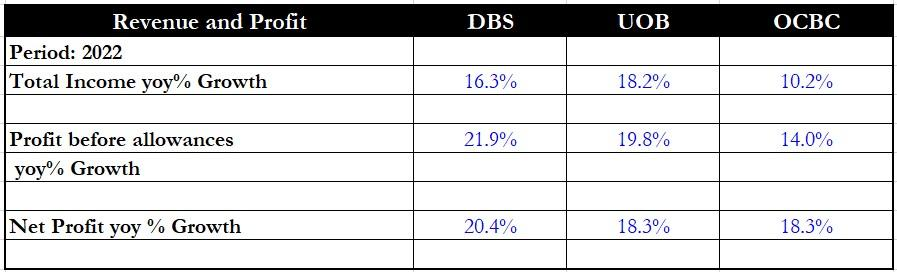

Financials

All three banks saw their net interest income (NII) surge higher in tandem with higher interest rates.

UOB saw the best uplift in total income with an 18.2% year on year rise.

DBS, however, chalked up the best rise in profit before allowances and net profit growth among the three banks.

Winner: DBS

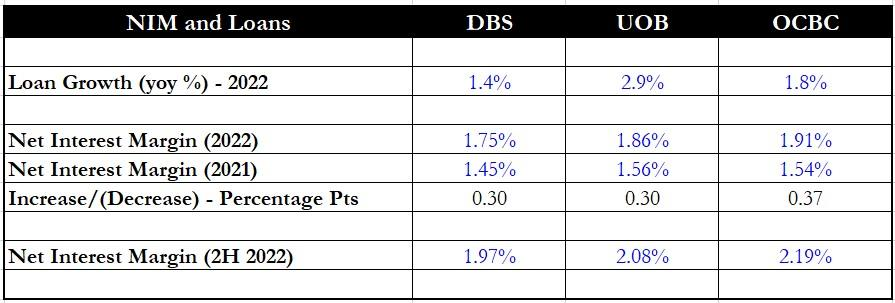

NIMs and loan growth

Next, we look at each lender’s loan growth and the net interest margin (NIM) increase.

UOB is the clear winner here with a 2.9% year on year increase in customer loans to S$319.7 billion.

Both DBS and OCBC also reported loan growth but it was much smaller at 1.4% and 1.8% year on year, respectively.

The NIM increase has been very pronounced for all three banks as all saw a sharp jump in NIM for 2022 compared to a year ago.

OCBC, however, comes out tops with the highest NIM among the trio at 1.91%.

OCBC also saw the largest percentage point increase of 0.37 compared to the 0.3 that its peers reported.

For the second half of 2022 (2H 2022), OCBC also stood high with a NIM of 2.19%, better than the 1.97% reported by DBS and the 2.08% logged by UOB.

Winner: OCBC

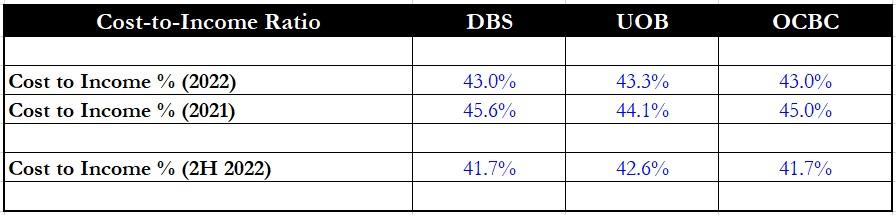

Cost-to-income ratio

Moving on, we surveyed each bank’s cost-to-income ratio to find out which lender was the most efficient.

It was a close fight as both DBS and OCBC reported a cost-to-income ratio of 43%, and both banks also had the same cost-to-income ratio of 41.7% for 2H 2022.

DBS wins this round as it recorded a slightly larger improvement in this ratio from 45.6% in 2022 to 43% in 2021, a fall of 2.6 percentage points.

In contrast, OCBC’s improved its ratio by just two percentage points from 45% to 43%.

Winner: DBS

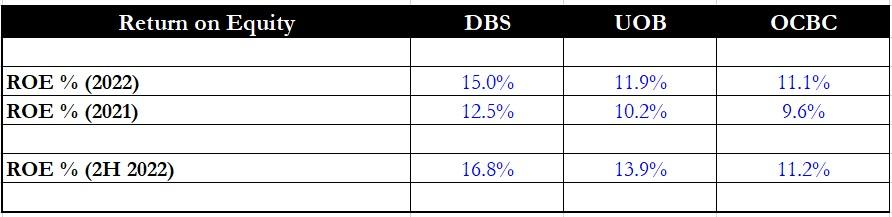

Return on equity (ROE)

The fourth attribute is the return on equity (ROE) for each bank, which measures the profit generated per dollar of income for each lender.

A higher ROE will signify that the bank could generate more profit for every dollar of income it earned.

DBS takes the cake here with a 15% ROE for 2022, and its 2H 2022 ROE of 16.8% is also much better than the other two banks’ ROEs.

What’s more, DBS also chalked up the biggest ROE improvement of 2.5 percentage points as compared to UOB’s 1.7 percentage point increase and OCBC’s 1.5 percentage point improvement.

Winner: DBS

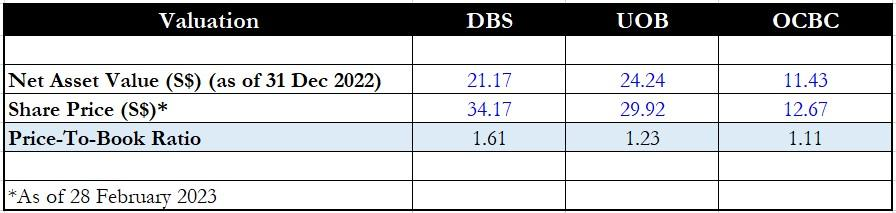

Valuation

An analysis of the banks would not be complete without a quick check on valuation.

Each bank’s valuation had not changed much since the previous time we compared the trio.

DBS is still trading at 1.6 times price-to-book (P/B), although this is lower than 1.67 times PB just three months ago.

OCBC remains the cheapest bank of the three at just 10% above its book value, while UOB’s share price is hovering around 23% above its net asset value.

Winner: OCBC

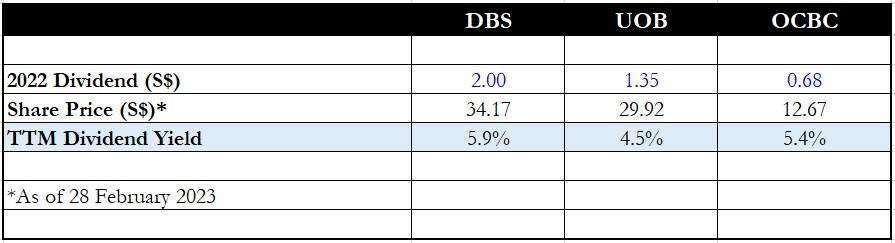

Dividend yield

Aside from valuation, some investors also rely on dividend yield as an additional data point on whether to buy a stock.

The good news is that all three banks have raised their dividends in line with their strong results.

DBS is the champion here with a trailing 12-month (TTM) dividend yield of 5.9%, but investors should note that the lender’s total dividend of S$2 included a S$0.50 special dividend.

After adjusting for this special dividend, DBS’ dividend yield falls to 4.4%, the lowest among the three.

OCBC emerged as the winner after the adjustment with a TTM dividend yield of 5.4%.

Winner: OCBC

Get Smart: Cheap with a high yield

After collating the data, it appears OCBC is the winner with the highest TTM dividend yield along with the cheapest valuation.

However, it will be prudent to monitor each bank to assess the risks that it faces as the possibility of a recession, coupled with high interest rates, may dampen loan growth and result in more bad loans moving forward.

Comments