Booking Holdings reports impressive Q4 earnings, with profit soaring and revenue exceeding expectations. However, geopolitical tensions cast a shadow over the company's performance. Explore the resilience and vulnerabilities of the travel industry titan in the face of global events.

It was a Thursday unlike any other for investors and industry watchers of Booking Holdings. As the clock ticked past the closing bell, eyes were glued to the screens, awaiting the fourth-quarter earnings report of a titan in the travel industry. What followed was a dizzying mix of triumph and uncertainty, painting a complex picture of a sector at the mercy of global events.

The Earnings Beat: A Silver Lining

The headline numbers were nothing short of impressive. Booking Holdings, a beacon in the travel sector, reported a robust Q4 profit of $32.00 per share, handily beating expectations. Revenue, too, soared to $4.78 billion, eclipsing forecasts. These figures were emblematic of a company not just surviving but thriving amidst the turbulence, with net profit swelling by 29% and revenue marking an 18% year-over-year increase. A closer look at the numbers revealed a 16% uptick in gross travel bookings, alongside significant growth in rental car days and airline tickets sold. This performance, by any standard, was a testament to the company's resilience and strategic acumen.

The Shadow of Geopolitical Tensions

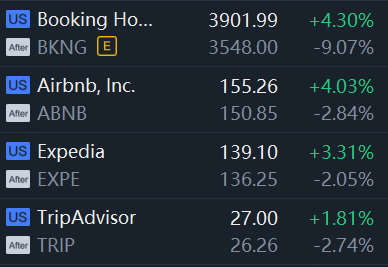

Yet, beneath the glossy surface of these stellar numbers lurked a stark reminder of the vulnerability inherent in global commerce. The ongoing conflict in the Middle East emerged as a specter, casting a long shadow over the company's otherwise luminous report. Room nights booked, a key indicator of the company's health and future prospects, saw a 9.2% increase for Q4, falling short of the anticipated 9.7%. When isolating the data, excluding business associated with Israel, room nights booked actually surged by 11%, spotlighting the acute sensitivity of the travel industry to regional tensions. This revelation sent ripples across the market, triggering a downturn in shares of not just Booking Holdings but also other stalwarts of the travel sphere, including Expedia, Airbnb, and Tripadvisor, all of which traded lower in the aftermath. The impact was a sobering reminder of the tightrope walk that is navigating a business in tumultuous times.

Looking Beyond the Horizon

In spite of the immediate aftershocks, the horizon isn't devoid of hope. The initiation of a quarterly cash dividend of $8.75 per share, as announced by Booking Holdings, is a bold statement of confidence in the company's long-term trajectory. Moreover, the company's cash and cash equivalents, albeit slightly decreased to $12.1 billion from $12.2 billion, remain a formidable war chest, poised to weather storms and seize opportunities. Prior to the earnings announcement, shares had reached an all-time high of $3918.00, underscoring a 64% increase year-over-year and mirroring investor optimism in the face of adversity.

The unfolding saga of Booking Holdings, set against the backdrop of geopolitical unrest, serves as a poignant narrative of resilience and vulnerability intertwined. As the company, and indeed the entire travel industry, steers through these choppy waters, the journey ahead promises to be one of cautious optimism, guided by the twin stars of strategic foresight and adaptability.

Comments