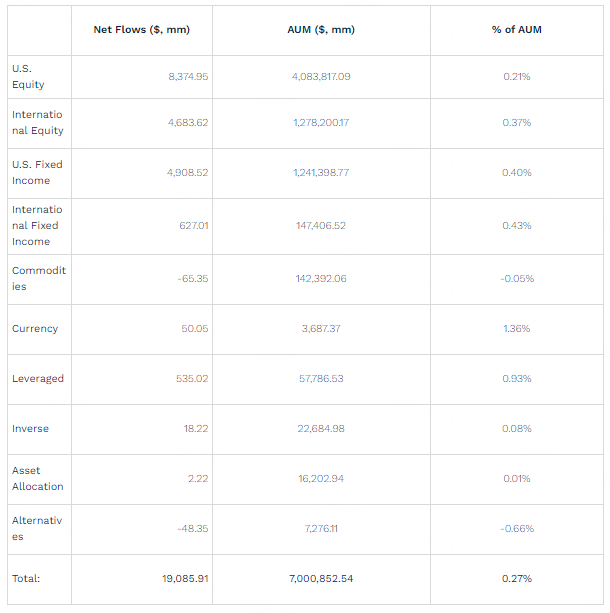

Last week, U.S.-listed ETFs had their best week of inflows since the nearly $6 billion in outflows that occurred during the week ended March 24, 2023. The more than 3,000 ETFs trading on U.S. markets pulled in $19.1 billion during the week ending April 14, boosting their total assets to $7 trillion, a key milestone for the industry.

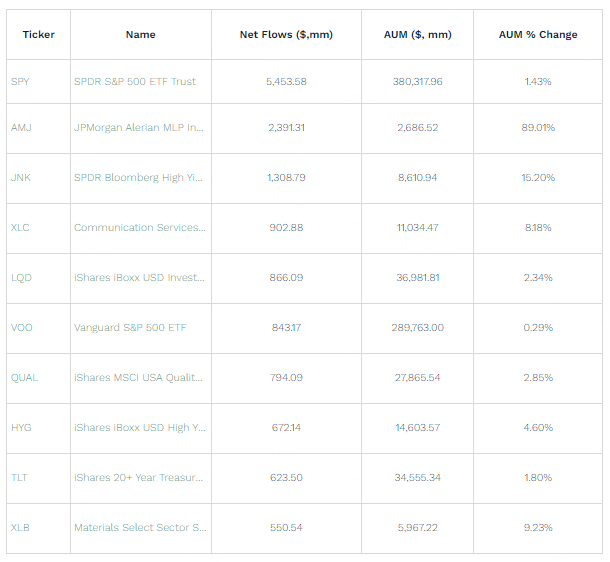

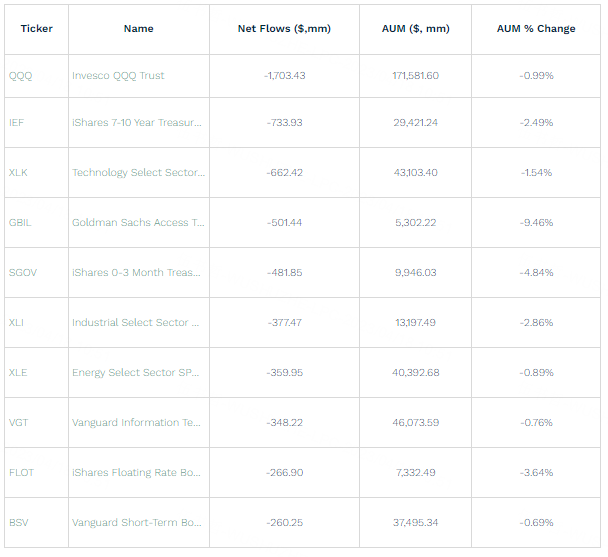

Two industry stalwarts saw the largest inflows and outflows during the week, with the SPDR S&P 500 ETF Trust (SPY) pulling in $5.4 billion and the Invesco QQQ Trust (QQQ) losing $1.7 billion. Investors seemed to gain some more optimism about markets last week after the CPI print indicated inflation was continuing to moderate. That boosted different areas of the market, but traditional technology in particular looked to be excluded from that excitement.

The JPMorgan Alerian MLP Index ETN (AMJ) gained $2.4 billion last week, likely drawing investor interest due to the announcement earlier this month that OPEC+ would be cutting its production targets more than originally planned.

At the same time, the Communication Services Select Sector SPDR Fund (XLC) saw nearly $903 million in inflows, and the Materials Select Sector SPDR Fund (XLB) added $550.5 million. The Vanguard S&P 500 ETF (VOO) and the iShares MSCI USA Quality Factor ETF (QUAL) pulled in $843.2 million and $794.1 million, respectively.

QQQ was joined on the biggest outflows list for the week by the Technology Select Sector SPDR Fund (XLK), which lost $662.4 million, and the Vanguard Information Technology ETF (VGT), which dropped $348.2 million. While inflation has slowed considerably, it looks like investors are still wary of technology.

U.S. fixed income saw flows diverge based on credit quality and maturity. Two key high-yield bond ETFs were represented in the top 10 for flows, with the SPDR Bloomberg High Yield Bond ETF (JNK) and the iShares iBoxx USD High Yield Corporate Bond ETF (HYG) gaining $1.3 billion and $672.1 million, respectively. The iShares 20+ Year Treasury Bond ETF (TLT), one of the top five funds for year-to-date flows, pulled in $623.5 million.

But intermediate- and short-term Treasury funds didn’t fare so well, and were represented in the biggest outflows list by four ETFs. The iShares 7-10 Year Treasury Bond ETF (IEF) lost $733.9 million, and the Goldman Sachs Access Treasury 0-1 Year ETF (GBIL) and the iShares 0-3 Month Treasury Bond ETF (SGOV) dropped $501.4 million and $481.9 million, respectively. The Vanguard Short-Term Bond ETF (BSV) lost $260.3 million during the week.

For a full list of last week’s top inflows and outflows, see the tables below:

Top 10 Creations (All ETFs)

Top 10 Redemptions (All ETFs)

ETF Weekly Flows By Asset Class

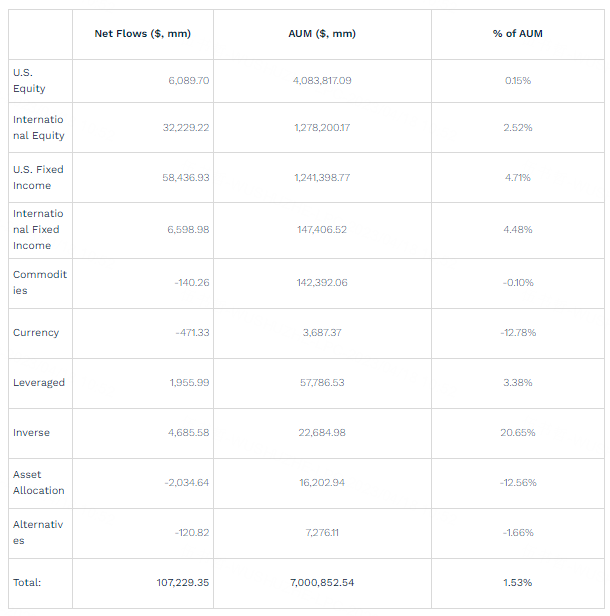

Asset Classes (Year-to-Date)

Comments