Shares of Australian Financial Group(ASX:AFG)moved up to 4.93%, trading at AU$2.340 a share (25 February 2022, 11 AM AEDT). The shares have turned north post the financial company’s result announcement for first half of 2022.

Snapshot of AFG’s financial performance

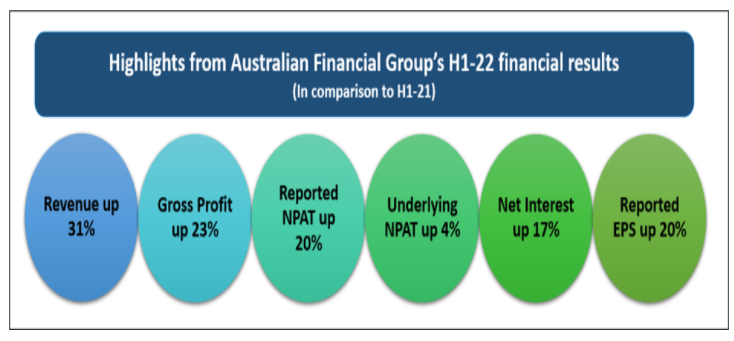

For the first half of FY22, AFG delivered a recorded NPAT (net profit after tax) at an increase of 20.3% over the same period in 2020. AFG’s diversified business model helped deliver growth in profitability and shareholder returns.

AFG’s residential settlements were up 47% on prior period and revenue from aggregation segment soared 35%. AFG Security’s loan book expanded 36.1% and AFG Home Loans white label settlements were up 46% on prior period. As a result,Underlying NPATfrom continuing operations was up 4.4% on prior comparative period.

The net cash flows from operating activities were down 42.2%, mainly due to reversal of a strong positive working capital movement in June 2021. Based on the above and a 20% growth in EPS, AFG declared aninterim dividendof 7 cents per share, up 19% on H1-21. As of date the company’s dividend yield is around 5.66%.

Fintelligence and AFG’s digital push

On 22 December 2021, AFGacquireda 75% stake in leading asset finance aggregator-Fintelligence, for AU$54.6 million, funded primarily by a new corporate debt facility.

Fintelligence owns a proprietary tech platform which as claimed by AFG, significantly expands its asset finance distribution network, adding 350 more brokers to it. Fintelligence also provides an in-house referral service to AFG’s existing residential brokers alongside a direct-to-consumer web presence.

In addition to this, AFG has also acquired a stake in BrokerEngine, a fintech specialising in advanced automation. BrokerEngine is to integrate with AFG’s technology platform while retaining its brand and product offerings.

AFG believes that its growing digital ecosystem shall significantly accelerate value creation, benefitting its broker network, lender partners, and ultimately customers.

Management Commentary

AFG’s CEO Bailey believes, the results underwrite AFG’s ability to maintain an ‘excellent’ dividend payout policy, backed by strong cash flow generation capability.

AFG’s road ahead

AFG’s current trading conditions as claimed by the group, affirm its growth trajectory, and supports its dividend policy. However, the company seems to remain mindful of the changing economic environment.

As claimed by AFG, one in every ten Australian residential mortgages are now arranged by an AFG broker. Therefore, AFG is positive about the mortgage market and seeks opportunities for AFG to accelerate growth in other asset classes. Also, AFG believes that these factors translate into its strong position to deliver ongoing broker and shareholder value.

Comments