Market Overview

Major U.S. stock indexes closed over 1% higher on Tuesday (Jan. 31) as labor cost data encouraged investors about the Federal Reserve's aggressive approach to taming inflation a day ahead of the central bank's critical policy decision. The S&P 500 tallied its first January increase since 2019, gaining 6.2%, while the tech-heavy Nasdaq jumped 10.7% for the month - its biggest January percentage rise since 2001.

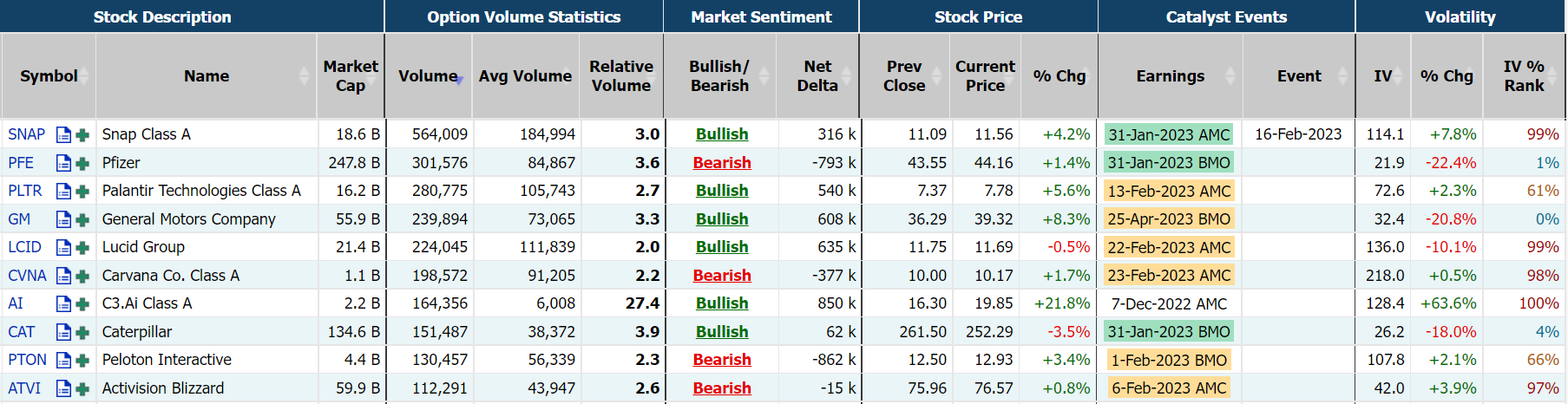

Regarding the options market, a total volume of 33,595,432 contracts was traded on Tuesday, down 11% from the previous trading day. AMD, Snap, Pfizer and GM saw unusual activities before or after earnings.

Top 10 Option Volumes

Top 10: SPY, QQQ, TSLA, IWM, HYG, AMZN, AMD, VIX, AAPL, SNAP

Options related to equity index ETFs are popular with investors, with 7.69 million SPDR S&P500 ETF Trust (SPY) and 2.26 million Invest QQQ Trust ETF (QQQ) options contracts trading on Tuesday.

Total trading volume for SPY and QQQ decreased by 11% and 27%, respectively, from the previous day. 56% of SPY trades bet on bearish options.

U.S. chip maker Advanced Micro Devices Inc (AMD) on Tuesday posted revenue that beat Wall Street targets and said it expected business to improve in the second half, enthusing investors who saw the company gaining on rival Intel. Although AMD's forecast was behind expectations, it was not as weak as some worried. Shares rose about 1.4% in after hours trading.

There are 603.9K AMD option contracts traded on Tuesday. Call options account for 54% of overall option trades. Particularly high volume was seen for the $75 strike call option expiring February 3, with 24,136 contracts trading. The next just is the $80 strike call option expiring February 3, with 23,293 contracts trading.

Snap Inc on Tuesday said current quarter revenue could decline by as much as 10%, sending its shares down almost 15% as the company struggles with weak advertising demand. The owner of photo messaging app Snapchat is the first of the major digital advertising platforms to report fourth-quarter results, which provides an early clue for platforms like Facebook owner Meta Platforms Inc and Alphabet's Google.

There are 568.3K Snap option contracts traded on Tuesday. Call options account for 53% of overall option trades. Particularly high volume was seen for the $12 strike call option expiring February 3, with 20,690 contracts trading.

Unusual Options Activity

Pfizer Inc on Tuesday forecast a bigger-than-expected drop in sales of its COVID-19 vaccine and treatment for 2023, intensifying investor concerns over demand for the products as governments cut orders and work through inventories. Shares fluctuated between gains and losses before ending the day higher by 1.4% amid a broader market rally.

There are 301.9K Pfizer option contracts traded on Tuesday. Put options account for 56% of overall option trades. Particularly high volume was seen for the $43 strike put option expiring February 3, with 66,908 contracts trading.

General Motors Co shares jumped 8.4% on Tuesday after it reported higher net income for the fourth quarter, forecast stronger-than-expected earnings for 2023 and said it would cut $2 billion in costs.

There are 240.4K GM option contracts traded on Tuesday. Call options account for 66% of overall option trades. Particularly high volume was seen for the $36 strike call option expiring February 3, with 17,268 contracts trading.

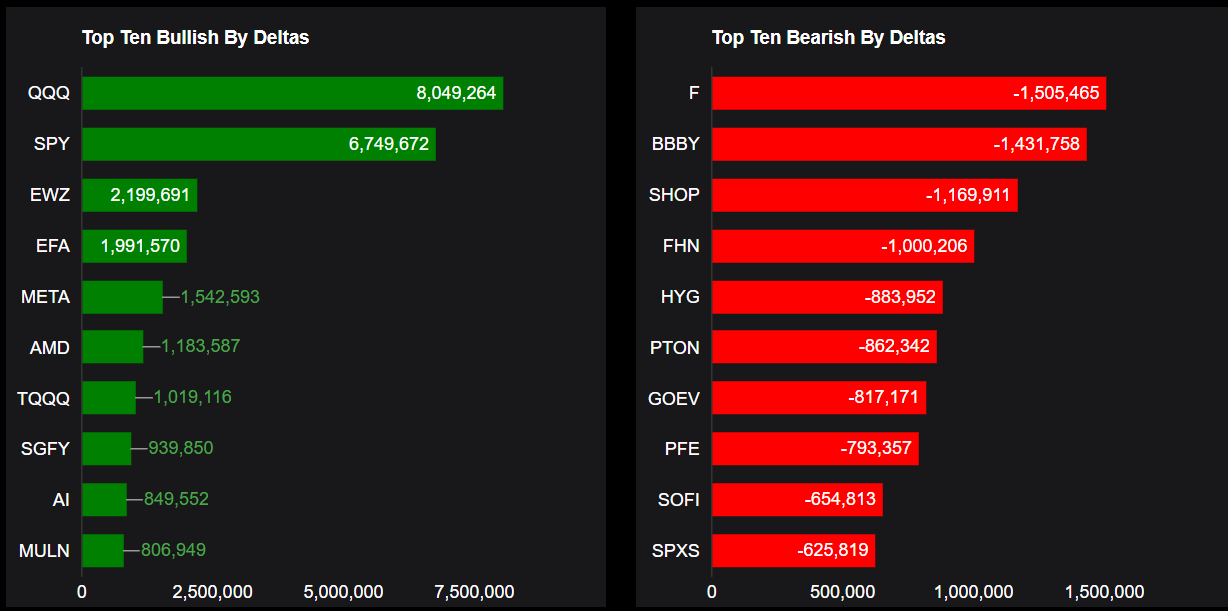

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: QQQ, SPY, EWZ, EFA, META, AMD, TQQQ, SGFY, AI, MULN

Top 10 bearish stocks: F, BBBY, SHOP, FHN, HYG, PTON, GOEV, PFE, SOFI, SPXS

If you are interested in options and you want to:

- Share experiences and ideas on options trading.

- Read options-related market updates/insights.

- Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments