The S&P 500(SP500)(NYSEARCA:SPY)is experiencing its first correction since the spring 2020 COVID plunge.

The broader market cemented a drop of more than 10% from highs at the close Tuesday, the typical Wall Street definition of a correction.

"The entire COVID Crash only lasted 23 trading days while this correction is already at 34 trading days," Bespoke Investment tweeted.

History points to a rebound: Looking at recent history back to 1998, the stock market is higher a year after a correction. Twelve months later the S&P 500 (SP500) (SPY) is up 9.3%, rising 2/3 of the time, according to Dow Jones.

The bullish theme holds even if the market keeps falling after hitting correction territory.

"About half of the time a 10% correction becomes a 15% correction and a quarter of the time a 10% correction becomes a 20% correction," Andrew Slimmon, senior portfolio manager at Morgan Stanley Investment Management, said on Bloomberg TV. "If you bought down 10% it might get ugly earlier, which I think it will this time again, (but) a year later you've been well served to step up into corrections."

Here come the hikes: A big difference for 2022 is that the Federal Reserve is about embark on a rate-hike cycle, with the higher end of Wall Street forecasts indicating seven quarter-point hikes this year.

Don't forget that the S&P hit correction territory while the Fed is still EASING, with tapering of asset purchases not wrapping up until March.

Goldman Sachs notes that the S&P performs well during a rate-hike cycle (see chart below).

But that tends to be because of strong economic conditions and continued momentum. Now momentum is to the downside and there are concerns that the Fed is embarking on a policy mistake due to inflation sticker shock and will choke growth.

Charlie Biello of Compound Capital Advisors tweeted out the Fed response to S&P corrections since 2009, which illustrates the difference:

- 2010: -17%. Rates @ 0%, QE2.

- 2011: -21%. Rates @ 0%, Operation Twist.

- 2012: -11%. Rates @ 0%, QE3.

- 2016: -15%. Rates @ 0.25%, stopped hiking plan.

- 2018: -20%. Cut rates 3x in '19.

- Today: -12%. 3 more cuts priced in, 1st in March.

The S&P has already defied the historical trend of doing well in the three months leading up to the first hike in a cycle. The index rises 5.3% in those months, on average, according to UBS.

Recession risks: A notable outlier in the correction rebound trend is November 2007, when the market ended down 37% a year later due to the Great Recession.

The market is not pricing a recession now, but therisks are rising, as BofA said recently noting flows into Treasuries and credit weakness in cyclical sectors.

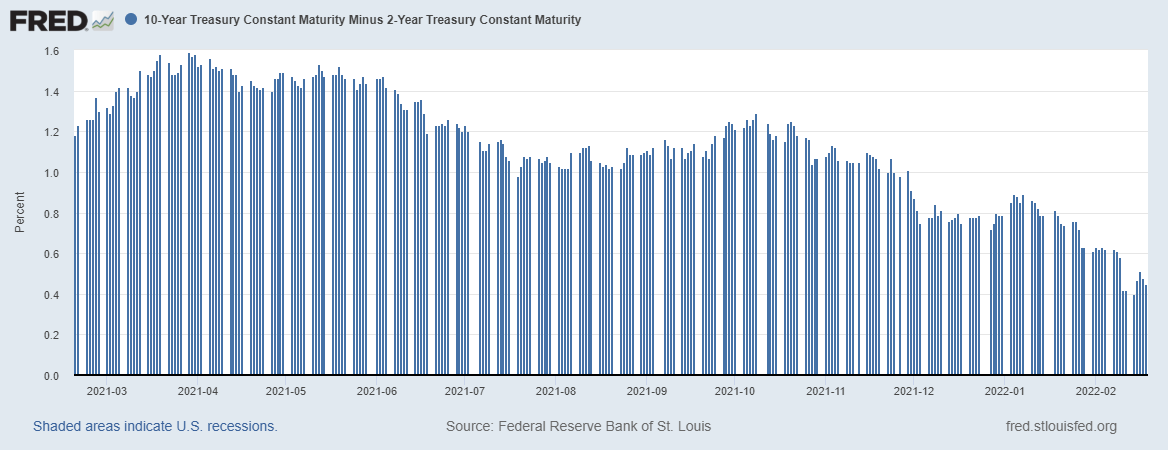

The yield curve(NYSEARCA:TBT)(NASDAQ:TLT)(NASDAQ:SHY)continues to flatten, with the 10-year/2-year spread now below 40 basis points, down from about 160 basis points a year ago. A yield curve inversion is considered a recession signal.

But "if the Fed were going to overtighten and kill the economy, cyclical stocks wouldn't be outperforming, Treasury yields would be dropping," Slimmon said. "They're not."

"The S&P has become a growth index," Slimmon said. "Top 10 stocks are largely tech stocks."

"While the S&P 500 is down just over 10% from its all-time high, the mega-cap FANG+ index(NYSEARCA:FNGG)(NYSEARCA:GNAF)is now down 22.6% from its 11/4/21 closing high," Bespoke said.

Digging down into the individual issues, all the big names are in correction territory, if not bear market territory or worse. But the moves are disparate.

Among the companies with market caps still above $1T, Apple(NASDAQ:AAPL)is holding up the best, down 10% from its high. Alphabet(NASDAQ:GOOG)(NASDAQ:GOOGL)is down 15% and Microsoft(NASDAQ:MSFT)is off 18%. Amazon(NASDAQ:AMZN)is just in bear territory, off 20%.

Faring worse, Nvidia(NASDAQ:NVDA)is down 30%, Tesla(NASDAQ:TSLA)is off 34% and Meta(NASDAQ:FB)has nearly been cut in half, down 47%.

"The safer growth stocks, which are the megacap tech stocks, are more vulnerable (now) because the high-flying growth stocks have been so thoroughly trashed," Slimmon said.

Can value take the baton? Slimmon argues that cyclicals can still outperform.

"Tacking away from (high-growth tech) and being overweight some of the value areas in a year where they are working - and they certainly are so far - (is advised)," he said. "At the end of the '70s the top 10 stocks were energy stocks and now they're tech stocks, so I think it's a great opportunity for active management."

Those leaning bearish would have to acknowledge we've likely already seen the highs for 2022.

"Last year saw more than 60 all-time closing highs for the S&P 500," Bespoke said. "This year we've seen just one and it was on the first trading day of the year."

"Would be something if this year sees exactly one all-time closing high and it's on the first trading day of the year. There's a first for everything though."

Comments