Market Overview

U.S. stocks closed lower in volatile trading on Wednesday following a policy announcement by the Federal Reserve that raised interest rates by an expected 50 basis points, but its economic projections see higher rates for a longer period.

The Dow Jones Industrial Average fell 0.42%, the S&P 500 lost 0.61% and the Nasdaq Composite dropped 0.76%.

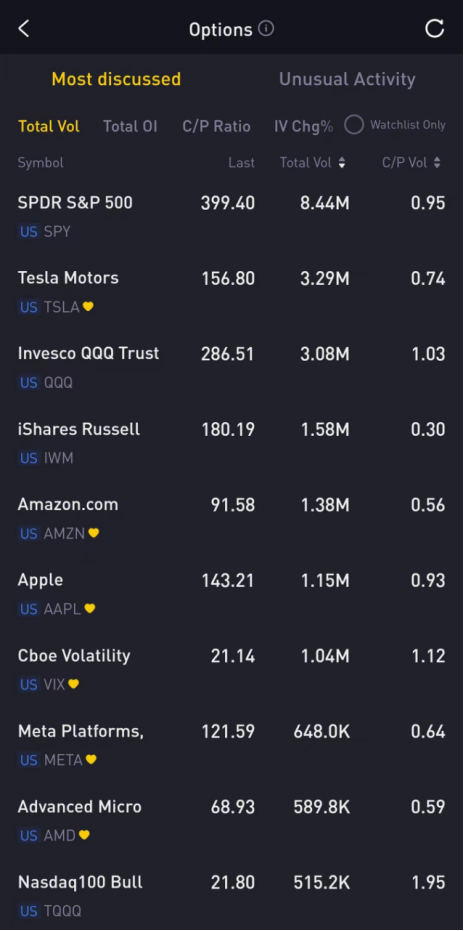

Regarding the options market, a total volume of 40,296,315 contracts was traded on Wednesday, down 4.95% from the previous trading day.

Top 10 Option Volumes

Top 10: SPY, TSLA, QQQ, IWM, AMZN, AAPL, VIX, META, AMD, TQQQ

There are 8.44 million SPDR S&P 500 ETF Trust and 3.08 million Invesco QQQ Trust options contracts trading on Wednesday. Their trading volumes slid 18.06% and 16.53% from the previous day separately. 51% of SPDR S&P 500 ETF Trust trades bet on bearish options.

Advanced Micro Devices slid 3.8% on Wednesday and was one of the biggest losers among the tech sector following today's Fed decision to raise interest rates by 50 basis points.

There were 589,800 Advanced Micro Devices options trading on Wednesday. Put options account for 63% of overall option trades. Particularly high volume was seen for the $68 strike call option expiring December 16th, with 34,480 contracts trading on Wednesday.

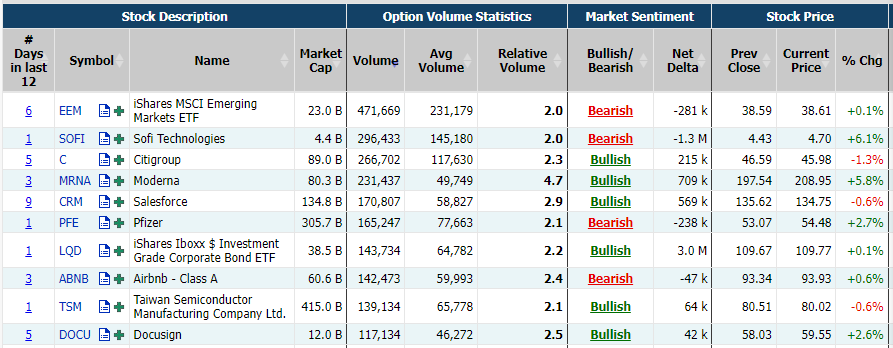

Unusual Options Activity

SoFi Technologies Inc. gained 6.09% on Wednesday after its CEO Anthony Noto purchased $5M in common stock. The reported transactions were executed in multiple trades between Dec 9-13, 2022.

There were 296,800 SoFi Technologies Inc. options trading on Wednesday. Call options account for 76% of overall option trades. Particularly high volume was seen for the $5 strike call option expiring December 16th, with 45,335 contracts trading on Wednesday.

Pfizer rose 2.66% on Wednesday as China Meheco Group Co Ltd had signed an agreement with it to import and distribute its oral COVID-19 treatment Paxlovid in mainland China. The agreement is valid until Nov. 30, 2023.

There were 165,100 Pfizer options trading on Wednesday. Call options account for 77% of overall option trades. Particularly high volume was seen for the $55 strike call option expiring December 16th, with 14,932 contracts trading on Wednesday.

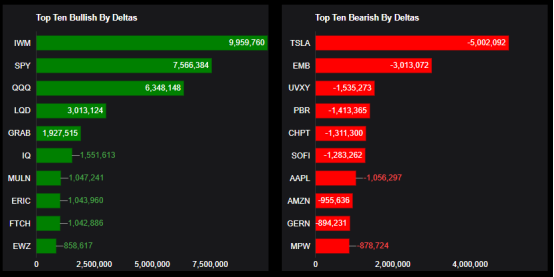

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: IWM, SPY, QQQ, LQD, GRAB, IQ, MULN, ERIC, FTCH, EWZ

Top 10 bearish stocks: TSLA, EMB, UVXY, PBR, CHPT, SOFI, AAPL, AMZN, GERN, MPW

If you are interested in options and you want to:

- Share experiences and ideas on options trading.

- Read options-related market updates/insights.

- Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments