Summary

- Apple's March-quarter results set a new non-holiday record with a sales and earnings beat despite slowing consumption and ongoing supply constraints.

- Yet, the stock's performance has been pressured by broad-based market volatility in response to macro challenges that include tightening financial conditions, which do not bode well with growth stocks.

- Considering Apple's robust balance sheet and continued market strength even under the currently harsh market climate, the stock remains a safe investment with reasonable expectations for further gains ahead.

- With the impending roll-out of new segments like automotive and virtual reality buoying entry into new markets and fresh growth opportunities, the current market turmoil creates an attractive buying opportunity for Apple's strong valuation prospects over the longer term.

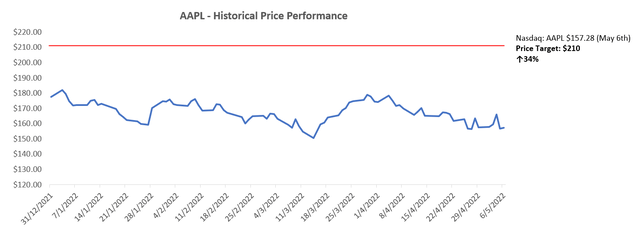

The Apple stock's (NASDAQ:AAPL) zig-zag formation since reporting a record-setting March-quarter sales and earnings beat in late April underscores investors' continued struggle with weighing strong fundamentals against uncertainties on the global economic growth outlook. Investors awarded the stock with an intraday rally of as much as 6% to a high of close to $166 (April 29th) immediately following release of Apple's blockbuster results.

However, persistent market jitters in the days leading up to the May FOMC meeting reversed the earnings beat rally as the stock plunged towards the $150-level. Then, the stock recovered slightly on improved market sentiment following last Wednesday's (May 4th) Fed decision on a 50 bps rate increase and release of commentary regarding policy tightening plans in coming months. But it lost momentum and slid again alongside broad-based market declines as market participants braced for the "cold reality of tightening financial conditions" that face rising threats of a looming recession.

Despite current market woes, Apple remains the "single member of the [FAANG] group that is still outperforming the S&P 500" this year. This, again, corroborates investors' debate between prizing the stock for consistent demonstration of fundamental strength and paring valuation premiums on "fears of an economic slowdown".

It is true that Apple is not without downside risks. The underlying business remains at the forefront of exposure to protracted industry-wide chip supply shortages and other supply chain constraints that have been compounded by the latest COVID-related lockdowns in China. The challenges are weighing on consumer spending levels in Apple's Chinese market, and adding fuel to an inflationary environment around raw material, labour and freight costs that risk margin contraction. Management has quantified the estimated impact at $4 billion to $8 billion in the current quarter, with some expected to be recapturable in later quarters, and others foregone permanently. Apple has also highlighted impacts pertaining to its recently pullout from the Russian market following the country's instigation of war against Ukraine.

But Apple's ability to keep wowing investors with stronger-than-expected growth despite a quarter "blighted by Ukraine war, spiking inflation and China's COVID Zero lockdowns" is what makes the results all the more impressive. And new product and segment launches that await over the coming months and years bolster further expansion of its total addressable market ("TAM") and reach into installed users' pockets over the longer-term, underscoring greater valuation prospects ahead for the stock.

The company's yearslong effort in bringing its strong net cash position down to neutral through attractive shareholder returns in the form of buybacks and dividends is also a "nice struggle" to have. Apple's strong balance sheet, which provides insulation from rising borrowing costs and sufficient dry powder to fund additional growth in coming years, makes it a safe investment pick in the face of tightening financial conditions. Despite the near-term challenges, Apple remains one of the most attractive investments with remarkable fundamental performance that continues to outshine peers in today's macro climate.

What is Apple's Long-Term Outlook? Here's What Apple's FY/2Q22 Earnings Beat Suggests:

Apple's March-quarter results exceeded expectations across the board, including its iPad segment which posted a year-on-year sales decline due to supply constraints. The company generated total revenue of $97.3 billion in the period (+8.6% y/y; -22% q/q), topping consensus estimate of $94 billion (+5% y/y; -24% q/q). Net income came in at $1.52 per share, exceeding the average analyst estimate of $1.42.

And for the current quarter, management expects the strong showing in its Services segment to continue, which makes sense given its reduced exposure to current supply chain challenges. The anticipated shift in sales mix to higher-margin Services is expected to offset some of increases to product costs in the current inflationary environment. Despite current macro challenges, company has guided gross margin of 42% to 43%, which is still among the best over the past 10 years. And as supply constraints ease over the longer-term with increasing efforts in "accelerating the in-sourcing of key components such as processors, sensors, displays, batteries and cameras", the company is well-positioned for sustained margin improvements ahead.

iPhone

iPhone sales continued to account for the bulk of the company's consolidated topline, generating $50.6 billion in revenues (+5% y/y; -29% q/q), which also exceeded the average estimate of $49.2 billion (+3% y/y; -31% q/q). The segment's outperformance underscored robust demand for the latest 5G-enabled iPhone 13 and iPhone SE devices, despite acute supply constraints and a tough prior year compare which overlapped a late-year iPhone launch timing.

The upcoming Worldwide Developers Conference ("WWDC") in June, Apple's annual keynote event, is also expected to bolster the company's iPhone sales in the latter half of both the fiscal and calendar year. All eyes are on the iPhone 14 launch expected for later this year. Based on Apple's "three-year cycle for new hardware designs" observed for the iPhone in recent years, the iPhone 14 will likely retain the exterior design of the iPhone 13 which debuted with the iPhone 12.

Because larger models typically garner greater demand than the smaller models, there is speculation that Apple will "rethink" its iPhone line-up. It is likely that Apple will offer a 6.7" screen option for a non-Pro model for the first time starting with the iPhone 14, which is expected to capture better customer reception given greater affordability compared to Pro models. If Apple does proceed with such plans, it is also expected to cushion some of the impact from slowing consumer spending in China at the moment given its contracting economy - the max-sized models are particularly popular in region, so offering a more affordable non-Pro option will likely improve Apple's reach into Chinese consumers' wallets.

Further improvements to the camera and processing power / performance on the iPhone 14 is also expected to encourage greater upgrades and switches, and buoy continued iPhone segment growth. The iPhone 14 Pro line-up is expected to feature a "new 48-megapixel sensor for the wide-angle camera…[and] get Apple's new A16 chip". With more than a quarter of Apple's iPhone installed base being older than 3.5 years (circa iPhone 8 and iPhone X - I personally still use the iPhone 7 which is considered "vintage" by some of my peers"), the upcoming iPhone 14 upgrades will be hard to resist.

Mac

The Mac also "continued its resurgence", posting strong double-digit year-on-year growth for the seventh quarter in the past two years with March-quarter sales totalling $10.4 billion (+15% y/y; -4% q/q). The combination of robust demand and supply constraints have now pushed wait times for some of the highly coveted computing devices out to June. And Apple's transition to its in-house designed silicon has a significant role to play in restoring favourable growth trends observed in recent quarters.

The M1 Ultra, which powers the Mac Studio desktop, is now the "world's most powerful chip for PC". It enables 7x faster performance than its predecessor, drawing favourable demand from creative professionals spanning app developers to video creators looking for computing power that can handle demanding workloads without compromising performance. The reimagined M1 Pro- / Max-powered MacBook Pro has also been a hit.

With Apple silicon consistently proving quality and performance for the Mac line-up, the company has rapidly rose to the top spot by market share in PC sales. Macs represented 18.8% of total PC shipments in the March-quarter, beating long-time industry leader Dell (DELL) and HPE (HPE). Close to half of Mac buyers in the March-quarter noted they were new to the product, underscoring Apple's continued market share gains.

iPad

On the iPad front, heightened supply constraints have continued to weigh on sales despite robust demand. iPad sales generated $7.7 billion (-2% y/y; +5% q/q) in revenues in the March-quarter, which still topped average analyst estimates. The segment's installed base reached a record high, with more than half of iPad customers indicating they were new to the device. The all-new M1-powered iPad Air, which includes 5G support, was also well-received. Despite declining March-quarter iPad sales due to supply constraints, Apple led tablet market sales in the period and grabbed close to 40% of market share, beating rival and runner-up Samsung's 20.4% by wide margins.

The iPad remains a market favourite despite softening consumer demand. The rapid transition to remote collaboration in the post-pandemic era has marked an inflection point for adoption of multi-purpose tablets. In addition to robust demand from the retail market, Apple's iPads have also been in high demand within the commercial sector. During the March-quarter, Apple iPad Pros were procured by Alaska Airlines (ALK) to replace its legacy check-in kiosks, thanks to the portable device's seamless integration into the airline's existing operations. With rising deployment of tablet devices in the commercial sector to accommodate rapid digital transformation trends and remote working demands in the post-pandemic era, continued innovation empowered by Apple silicon is expected to drive higher growth for the less-lucrative iPad segment once supply headwinds subside.

Wearables, Home and Accessories

The Wearables, Home and Accessories segment also pulled through with strong double-digit growth in the quarter. Related revenues totalled $8.8 billion (+12% y/y; -40% q/q), consistent with consensus expectations. The category continues to benefit from strong Apple Watch demand driven by increasing consumer preference and attention to health and fitness.

The company has been ramping up investments into developing new technology offerings for the wearable product to address increasing user demand for health features, including the "highly anticipated blood-pressure monitor" that is expected to debut in 2024, a body-temperature sensor, as well as a "non-invasive blood sugar monitor". The upcoming watchOS 9 software update debuting in June is also expected to include improvements to the smartwatch's heart rate monitor, a "new low-power mode that is designed to let its smartwatch run some apps…without using as much battery life", and additional "workout types and metrics…within the Workout app on the watch". And later this year, Apple is expected to unveil up to three new Apple Watches that include the highly anticipated Series 8 model, an affordable SE model, and an upscale option with "rugged casing that is aimed at extreme athletes". The new developments to both software and hardware features are expected to reinforce the segment's growth prospects by extending its reach to new users while also expanding Apple's TAM for wearable technology.

Services

Services was a particular bright spot for Apple in the March-quarter. The segment - which houses sales related to Apple Care, App Store, payments, ads, and other subscription services like Apple TV+ and Apple Music - generated revenues of $19.8 billion (+17% y/y; +2% q/q) in the period, which were "slightly above projections". Apple added more than 165 million net new subscriptions in the past 12 months, bringing its total paid user base for Services to 825 million. And with accelerating penetration into the commercial sector, alongside rapid consumer adoption of Apple media and entertainment subscription services bolstered by its convenient and accessible hardware-service ecosystem, the company has guided double-digit growth again for the current quarter.

Apple TV+: Despite increasing competition within the segment, as evidenced in the hardships experienced by industry leader Netflix (NFLX) in retaining market share over recent months, Apple TV+ continued to deliver on upbeat results, buoyed by positive viewer response to original productions that include "Severance", "Ted Lasso" and "CODA", which became the first streaming service to win an Oscar for Best Picture.

While Apple TV+'s market share of global streaming services remains comparatively nominal when put against rivals like Netflix, HBO Max (WBD), and Disney+ (DIS), the convenient ecosystem Apple maintains to enable easy access remains a strong competitive advantage in driving further share gains in coming years. Apple is well-positioned to benefit from favourable streaming uptake trends ahead with the "seamless integration of hardware, software and services at the center of [its] work and philosophy". Total consumer spending on entertainment and media is expected to advance at a compounded annual growth rate ("CAGR") of 3.9% into a $915 billion market of its own by mid-decade. And much of this acceleration will be driven by demand for video streaming services, which is expected to expand at a CAGR of more than 18% over the next five years and blossom into a $190 billion opportunity. As Apple continues to encourage sign-ups with competitively priced offerings like Apple Bundle and engaging content, Apple TV+ has potential for acceleration over the longer-term and further bolster Services growth.

Commercial Services: The company's increasing penetration into commercial markets with the latest launch of "Apple Business Essentials" also drives greater market share expansion and growth for its Services segment in coming years. The new service offering targeting small- and medium-sized businesses ("SMBs") pairs well with already-strong uptake rates of Apple devices across the industry, and remains a prudent strategy for driving greater adjacent revenue growth in the Services segment. Apple Business Essentials combines all device management services spanning 24/7 technical support to security and cloud storage into one convenient offering, making Apple device adoption in the workplace a more convenient and efficient process for commercial users.

With digital transformation being progressively viewed as a business strategy for remaining economically competitive, Apple Business Essentials is expected to further Apple's capitalization of commercial opportunities ahead. And Apple's upcoming launch of the "Tap-to-Pay" feature, which will allow SMBs to "accept payments through Apple Pay, credit cards and digital wallets" using near field communication ("NFC") straight from the iPhone, is also expected to strategically provide mutual reinforcement for both hardware and service sales within the commercial landscape in coming years.

App Store: Continued growth in market demand for mobile applications will also be a boon to Apple's fast-growing services segment. The global market for mobile applications is expected to grow at a CAGR of 18.4% and reach a market value of more than $400 billion over the next five years. With AAPL hosting one of the largest and most used app stores in the world, it would be reasonable to assume that related revenues would grow at a similar pace.

Despite mounting global regulatory scrutiny over Apple's alleged antitrust violations with its App Store, the company's continued focus on ensuring user privacy, security, and ease of transactions remains key strategies for retaining user adoption. According to a survey of 4,000 Apple product users performed by Morgan Stanley across the U.S. and China, most have indicated loyalty to Apple's App store due to the "value of security, privacy and ease of transactions" provided, despite developers pushing for rights to transact outside of Apple's ecosystem.

What to Look for After Earnings

For the current quarter, management has warned of continuing supply headwinds stemming from COVID-related disruptions and industry-wide silicon shortages. On the demand side, COVID disruptions observed in China - which represents almost a fifth of total Apple sales - have slowed domestic consumption. Paired with the company's recent pullout from the Russian market following the Ukraine war, which drove a 150 bps decrease to sales growth in the March-quarter, the company is expecting a quantified impact of $4 billion to $8 billion from the combined challenges for the June-quarter.

But these impacts to the company's fundamental strength and valuation prospects are expected to remain minimum given their transitory nature. Yes, they will bring about some volatility in the near-term for sure, but the stock's bullish narrative in the long run, backed by continued growth and a strong balance sheet, remains intact.

China's COVID Situation: Production at most of Apple's most notable assemblers in China, including Pegatron, Foxconn and Quanta have resumed after temporary suspensions in response to China's attempt to curb the resurgence of omicron infections. Most are currently operating out of a "closed-loop system", where "workers live on-site and are tested regularly" to reduce chances of a widespread outbreak.

But logistical challenges remain intense due to strict quarantine controls levied on the country's trucking fleet, which is responsible for transporting about 75% of total freight in China. Key industrial hubs like Jiangsu, Guangdong, Shanxi and Shanghai saw road freight volumes decline by close to a fifth in March compared to the prior year. Only some easing has been observed since late April, as China continues to struggle with getting a grip on persistent infection rates, especially in the Shanghai corridor that houses some of Apple's final assembly plants. Despite the return to closed-loop operations, the assembly plants are facing heightening risks of exposure to dwindling inventory levels as a result of ongoing logistical challenges. As such, we consider Apple's recent guidance of an upward adjusted estimate on product disruption for the current quarter a prudent decision in setting market expectations in the near-term.

Silicon Shortages: Industry-wide silicon shortages have been going on more than a year now, with the aftermath of pandemic-era disruptions to production still lingering to this day. Increased demand for chips in the face of accelerating cross-industry digitization, compounded by raw material supply constraints due to the Russia-Ukraine war has also further complicated the situation.

Apple continues to suffer from the shortage of legacy nodes, which have caused an acute impact to iPad supply. This has led to multiple consecutive periods of declining sales for the segment, despite refreshed demand from both retail and commercial consumers. As the easing timeline on chip shortages remains highly uncertain, we expect related impacts to fluctuate in the range of $3 billion to $6 billion through the rest of the year and potentially through the first half of 2023. This is consistent with observations in the past three quarters prior to added pressure from China's recent lockdowns and the Russia-Ukraine war.

Russia Exit: Apple noted lost sales growth of about 150 bps in the March-quarter due to its exit from the Russian market following the country's attack on Ukraine. Considering 9% year-on-year growth observed in the March-quarter, Apple is expected to have lost about $1 billion in sales as a result of pulling out operations from Russia, which is immaterial from both a fundamental and valuations point of view. We also consider Apple's immediate exit from the Russian market following the onset of the Russia-Ukraine war a prudent move, which precluded the company from exposure to impacts pertaining to ensuing sanctions levied on Russia by the U.S. and its allies.

Tightening Monetary Policy: As discussed in our recent coverage, we consider the Apple stock one of the strongest shields against adverse impacts from the Federal Reserve's monetary policy tightening measures to quell the hottest inflation in 40 years. While tightening financial conditions have largely deterred investors from risky assets like growth stocks, Apple has remained comparatively resilient given its outperformance of key benchmark indexes still, despite overall year-to-date declines.

Sustained by robust demand still for its existing offerings, and new opportunities arising from nascent technologies like AR/VR and autonomous vehicles in the long run, Apple is expected to re-emerge from the current market rout stronger than its peers thanks to its fundamental strength. As mentioned in earlier sections, Apple's strong net cash position also provides sufficient dry powder to fund additional growth in coming years without incurring additional costs of capital amidst rising interest rates.

The company's robust balance sheet is also backing generous shareholder returns in the form of share buybacks and dividends, which is a positive gesture under the current market climate. The company returned $27 billion to shareholders in the March-quarter through a combination of $22.9 billion in share buybacks and $3.6 billion in dividends. The company has also promised a dividend increase of 5% to $0.23 per share for the current quarter, and authorized an additional $90 billion in share buybacks as the company works to get its checkbook down to cash neutral over time.

Is Apple Stock a Buy, Sell or Hold?

As Apple continues to press through production challenges and macroeconomic headwinds with outperformance, we are maintaining our 12-month price target for the stock at the $200 to $210 level. This would represent upside potential of more than 30% based on the stock's last traded share price of $157.28 (May 6th).

As the broad-based market rout continues amidst still-fluid macroeconomic challenges spanning runaway inflation, tightening monetary policies, hard-to-tame COVID outbreaks, and intensifying geopolitical tensions, the current turmoil in equities could "provide a near-term stock pullback which [could be used] as a buying opportunity". We believe the stock's market value is currently non-reflective of its fundamental strength, and growth trajectory ahead of robust demand and new product / segment launches that include AR/VR headsets and the Apple car over coming years.

Comments