Super-cheap stocks can offer investors a nice margin of safety in a rocky market.

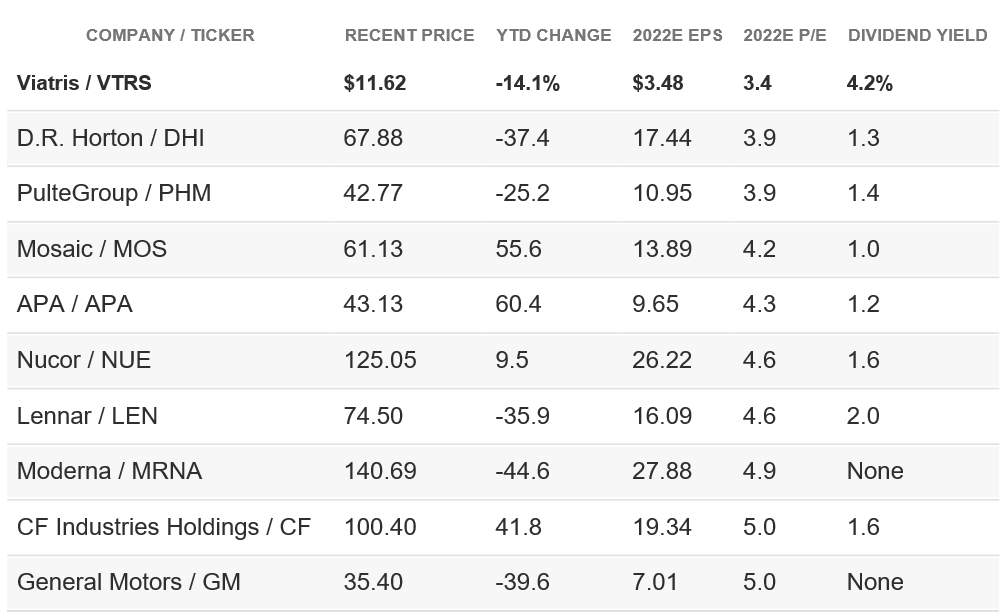

One simple way to find them is to screen for stocks with the lowest price/earnings ratios. Barron's screened the S&P 500 index using FactSet data for the 10 companies with the lowest P/E ratios, based on 2022 projected earnings.

All 10 stocks trade for rock-bottom valuations of five times earnings or less -- against the index's P/E multiple of around 17.

They include industry leaders like Nucor (ticker: NUE) in steel, D.R. Horton (DHI) and Lennar (LEN) in homebuilding, General Motors (GM) in autos, Moderna (MRNA) in biotechnology, and Mosaic (MOS) and CF Industries Holdings (CF) in fertilizer. Rounding out the list is Viatris (VTRS), PulteGroup (PHM), and APA (APA), formerly Apache.

There are two common themes among most of the stocks. The first is that investors don't believe that elevated current earnings will persist into 2023 and 2024. The other is that nearly all these companies have strong balance sheets, which could mitigate downside risk.

Cheap Stocks

Here are the 10 stocks in the S&P 500 with the lowest price/earnings ratios.

Homebuilders account for three of the 10 stocks. The group has been hammered in 2022, with Horton and Lennar down 35% or more. The fear is that robust conditions in the housing market will deteriorate going into 2023, due to a two-percentage-point increase in mortgage rates this year, to more than 5%, and sharply higher home prices over the past two years.

Housing bull Stephen Kim of Evercore ISI wrote recently that "the setup is particularly intriguing because the homebuilding stocks are valued as if the industry's demise is a foregone conclusion."

Horton, Lennar, and Pulte all trade for around four times projected 2022 earnings, with Lennar, at around $75, fetching only a small premium to book value. Lennar's super-voting class B shares (LEN/B) are even cheaper, at $63. Industry balance sheets have never been better and companies like Pulte are buying back a lot of stock.

Moderna shares, at around $137, are down 70% from their peak of nearly $500 last year and trade for just five times projected 2022 earnings of about $28 a share.

Investors worry that Covid vaccine sales, which make up nearly all Moderna's revenue, will fall sharply in 2023, and that earnings will collapse to $9 a share. Covid vaccine sales, however, could prove more durable than analysts fear, and the company is developing a raft of new drugs. Downside could be limited since Moderna is sitting on $19 billion of cash, or about $47 a share.

Barron's wrote favorably recently about GM , arguing that the stock, now around $36, offers a cheap play on the company's ambitious plans in electric vehicles. GM is valued at just five times projected 2022 earnings.

Nucor is the largest steel producer in North America and has prospered from a surge in steel prices over the past 18 months. Investors worry that steel prices, now around $1,200 a ton, will fall below $1,000 later this year. Some of that concern, however, is reflected in Nucor's stock price. At around $125, it is down from a recent high of $188.

Credit Suisse analyst Curt Woodworth has an Outperform rating and a $165 price target, but he's not thrilled by Nucor's pricey recent deal for CHI Overhead Doors, a maker of garage doors. He wrote that Nucor's inexpensive stock is a better value than the $3 billion CHI deal.

Fertilizer stocks have been buoyed by strong pricing that investors fear won't persist. As a result, Mosaic and CF Industries trade for four to five times estimated 2022 earnings. JPMorgan analyst Jeff Zekauskas calls Mosaic one of "the most inexpensive of the agricultural companies."

He has a price target of $80, against a recent price of $61. The company is benefiting from high prices of potash due in part to restricted supply from Russia and Belarus.

APA produces oil (roughly half its output) and natural gas in the U.S. and internationally, including in Egypt. Like many in the industry, APA has been boosting its capital returns to shareholders, although it favors stock buybacks over dividends. Its yield is just 1%.

JP Morgan analyst Arun Jayaram favors APA, citing a roughly 20% free cash flow yield, and has a price target of $56, compared with a recent price of $43.

Viatris, a maker of generic drugs, is a perennially cheap stock, but that hasn't translated into strong investor returns due to tough industry conditions. It also has a sizable amount of debt. The company was formed from the merger of Mylan and Pfizer's Upjohn division in 2020.

Comments