Options traders are taking interest in gold mining concern

Newmont Corporation, after the company today reported a 41% year-over-year dip in second-quarter profit thanks to rising gold prices. What's more, a 33% rise in cost of sales weighed on the company's quarterly results, with earnings of 46 cents per share coming in below analysts' 63 cent forecasts, while revenue beat estimates by a slight margin. As a result, NEM was last seen 11% lower to trade at $45.70.

There's plenty of options activity taking place on both sides of Newmont stock's aisles. In fact, the 31,000 calls and 23,000 puts that have exchanged hands account for six times the intraday average. The most popular position by far is the weekly 7/29 48-strike call -- where new positions are being opened -- followed by the 60 call from the September series.

Analysts have yet to weigh in, but the majority in coverage remain hesitant toward NEM. Specifically, of the 10 in coverage, eight rate the security a tepid "hold," though the remaining two say "buy" or better, leaving no "sells" on the books. Meanwhile, the 12-month consensus price target of $73.13 is a 59.7% premium to the share's current perch.

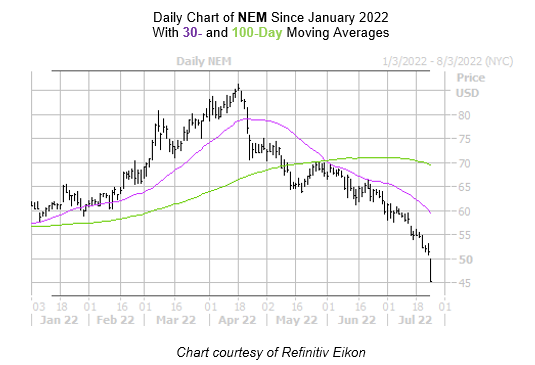

On the charts, today's post-earnings reaction has Newmont stock trading at its lowest level in more than two-years. Pressure from the 30-day moving average has pushed the shares lower since April, while the slightly longer-term 100-day trendline rejected a late-May rally at the $70 level. Year-to-date, NEM is down 27%.

Comments