Still 'strong chance' bounce is a 'tradeable' bear-market rally: Jefferies

Here's another wrinkle in the market-bottom versus bear-market bounce debate.

The pace of the stock market's rise as it continues a bounce off the June lows is nearing a magnitude that's preceded "huge" moves in the past. The dilemma for investors is that those moves can be in "either direction," analysts at Jefferies observed in a weekend note.

Through Friday, the S&P 500 had bounced more than 13% off its 2022 closing low of 3,666.77, set on June 16. While the S&P 500 remains in a bear market, having tumbled more than 20% from its Jan. 3 record close, the Dow Jones Industrial Average traded above the threshold -- 32,877.66 -- that would mark its exit from a market correction, before trimming early gains on Monday. The Nasdaq Composite temporarily traded above the level -- 12,775.32 -- that would signal an exit from its brutal bear market. The Dow eked out a small gain Monday, while the S&P 500 and Nasdaq ended 0.1% lower.

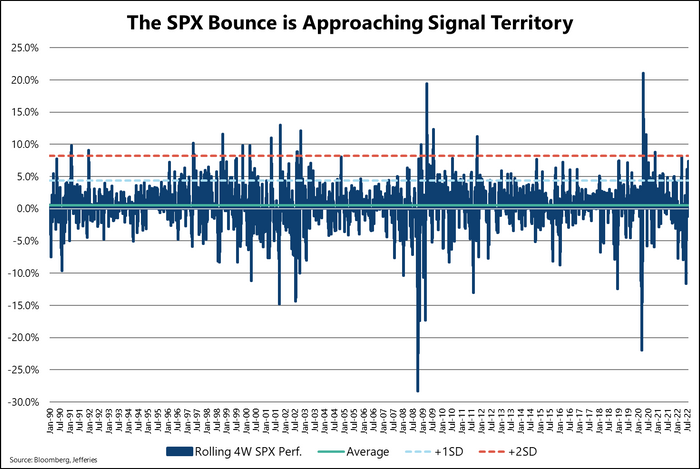

But it's the large-cap benchmark S&P 500's more-than-7% rise over the past four weeks that is "dangerously close to extremely interesting from a signal perspective," wrote Jefferies strategists, including Andrew Greenebaum, in a Sunday note.

A rise of just more than 8% over four weeks would mark a two-standard deviation for S&P 500 rallies, they observed, based on data going back to 1990, which means the market won't need "much more juice" to hit statistically significant territory.

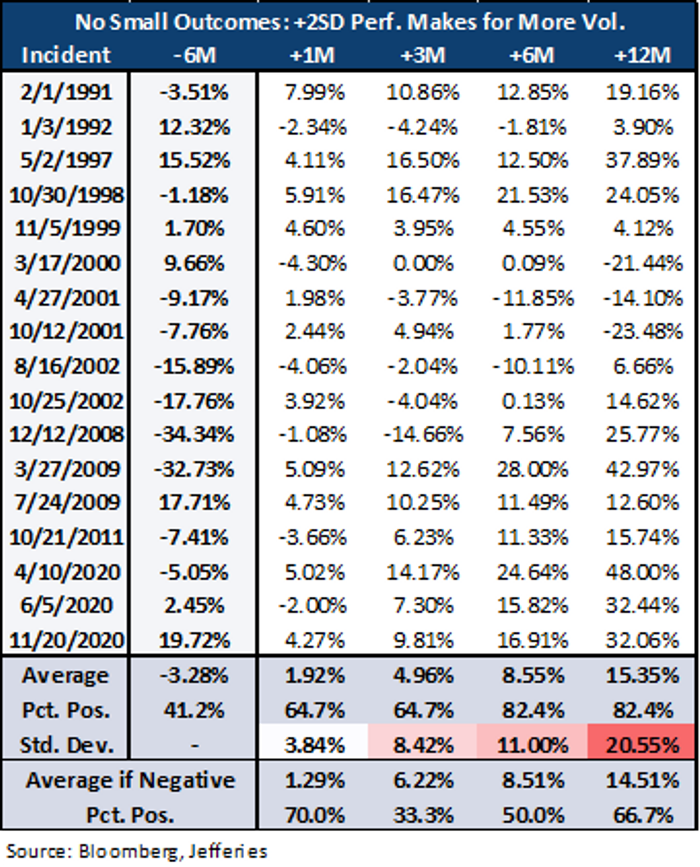

And in the 17 times the S&P 500 has hit that threshold, the subsequent performance "looks massive," they wrote, averaging 9% over the next six months. But there's a notable caveat in that there were also several instances that saw double-digit negative returns. And when the prior six months were negative -- as would be the case this time around -- "the likelihood of positive returns drops precipitously," they wrote (see chart and table below).

The takeaway, they said, is that "while the seemingly unstoppable bounce may lure folks in, there is still a strong chance it's just a (quite tradeable) bear market rally."

Comments