Unity Software Inc. said its board has unanimously agreed the $17.5 billion buyout offer from AppLovin Corp. isn't in the best interests of shareholders.

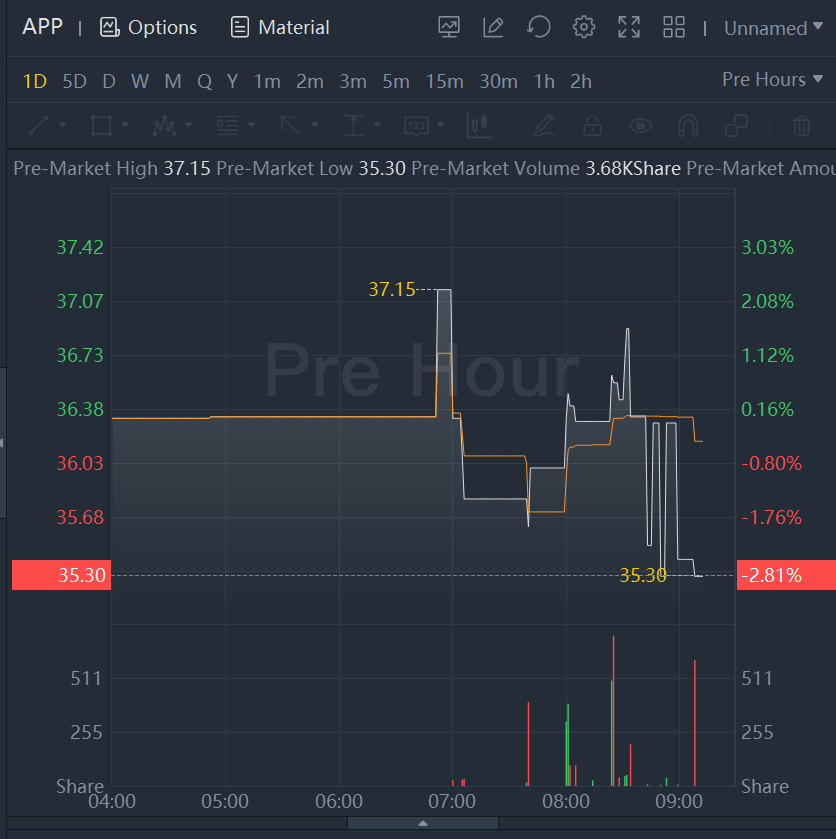

Unity and AppLovin shares slid 5.39% and 2.81% respectively in premarket trading.

Unity recommended shareholders vote against the AppLovin deal and instead vote in favor of Unity's planned deal to buy IronSource Ltd. for $4.4 billion, a merger that was agreed upon last month. IronSource runs a platform for publishing and scaling mobile games and other apps.

"We remain committed to and enthusiastic about Unity's agreement with ironSource and the substantial benefits it will create for our shareholders and Unity creators," Unity Chief Executive John Riccitiello said.

Last week, AppLovin offered to buy Unity in an all-stock deal valued at $58.85 a share. Under AppLovin's proposal, Unity shareholders would control 55% of the combined company and appoint a majority of the board but have only 49% of voting rights. The company would be led by Mr. Riccitiello, while AppLovin CEO Adam Foroughi would be chief operating officer.

Representatives for AppLovin didn't immediately return the Journal's request for comment.

AppLovin makes tools for app developers to improve marketing and revenue generation. Unity operates a platform for developing mobile, console and computer videogames as well as other interactive software applications. Together, they essentially would provide a one-stop shop of tools and resources for mobile-game and other app developers.

Comments