I have to say, Wall Street is truly going all out - tight on time with heavy tasks, needing both a pullback and Christmas celebration, completing the correction in one day and the Christmas rally in three days. It's truly eye-opening.

Trump's visit to the exchange wasn't for nothing. The leadership is watching, and even before officially taking office, the stock market has become a key focus. Tesla's valuation seems to need reconsideration.

Two signals: This week's 123 put positions were closed $NVDA 20241227 123.0 PUT$ , and recent bullish positions have been very active.

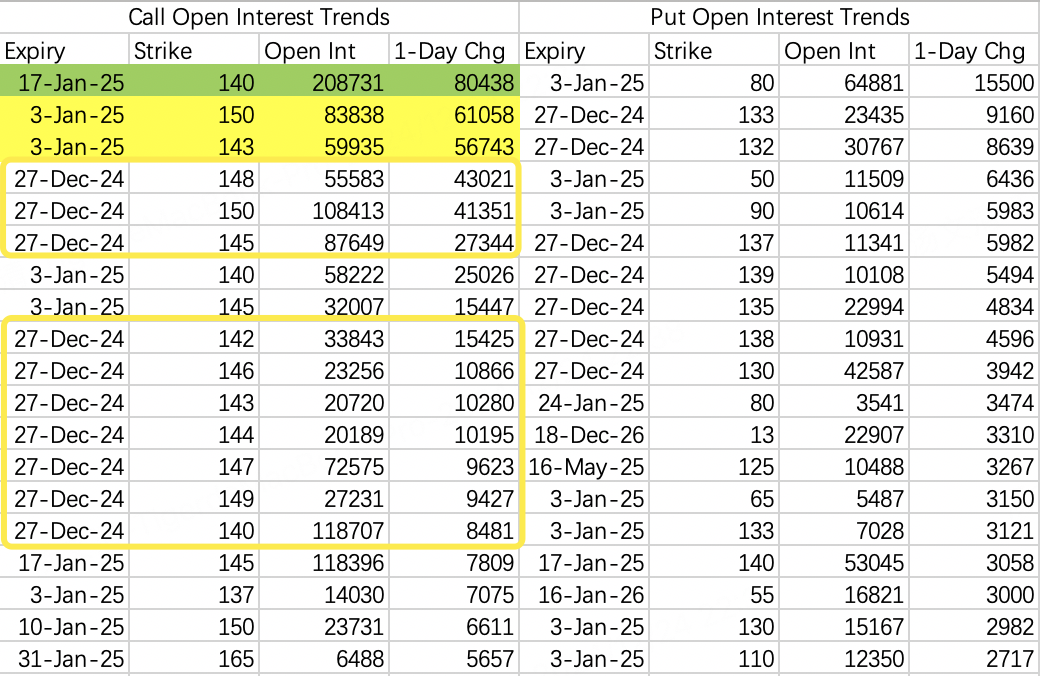

The bullish positioning is so aggressive that there's a small chance of a squeeze to 150 this week. NVIDIA will likely close between 130-140 this week, with a small probability of surging to 150.

Being cautious, institutions rolled their sell call positions, selling 143 calls and buying 150 for next week.

Sell $NVDA 20250103 143.0 CALL$

Buy $NVDA 20250103 150.0 CALL$

Given the less bearish outlook for the next two weeks, I implemented a sell put at 135 $NVDA 20250103 135.0 PUT$ .

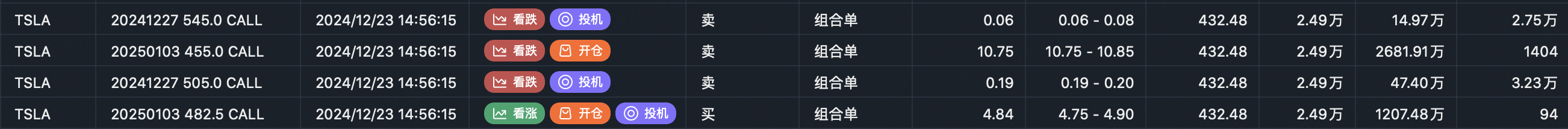

Next week's bullish spread large order is selling 455 and buying 482.5, which feels a bit intriguing.

Sell $TSLA 20250103 455.0 CALL$

Buy $TSLA 20250103 482.5 CALL$

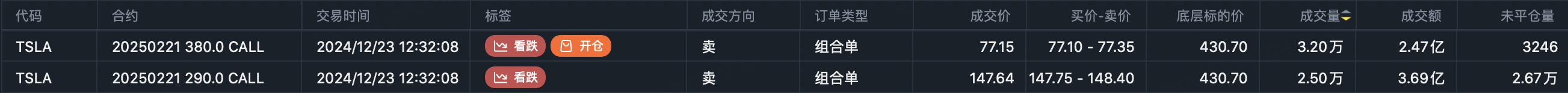

The bullish position roll chose 380 strike price, which can serve as a price anchor going forward.

Merry Christmas to everyone!

Comments