Some thoughts on future trends:

The market correction target anchors to early November, the position before election results announcement.

For three specific stocks: SPY target 565, Tesla below 380, NVIDIA below 125.

These correspond to SPY large put position ($SPY 20250321 565.0 PUT$ ), Tesla call position exit ($TSLA 20250221 380.0 CALL$ ), and NVIDIA call strike price reduction roll-over ($NVDA 20250221 125.0 CALL$ ).

Trump strongly dislikes market crashes and will severely pursue short sellers' responsibility, so short positions need legitimate reasons for significant drops.

Short positions opened before December 16 FOMC meeting have high credibility, timing seems very reasonable.

January has 4 major events, any could trigger a decline: Tesla delivery report, Non-farm payroll data, CPI data, January 31 FOMC meeting.

Traditionally, FOMC meetings more easily become crash catalysts.

Market might be relatively stable during January 8 CES and January 16 Trump's official presidency.

Predicting a correction to 565 from current highs seems dramatic, and US markets have longer bull runs than bear markets. If wrong, January efforts could be wasted. However, Tesla's 380 call exit is a crucial signal. Combined with NVIDIA's long call strike reduction, Q1 likely won't perform well. Even without shorting, hedging seems necessary.

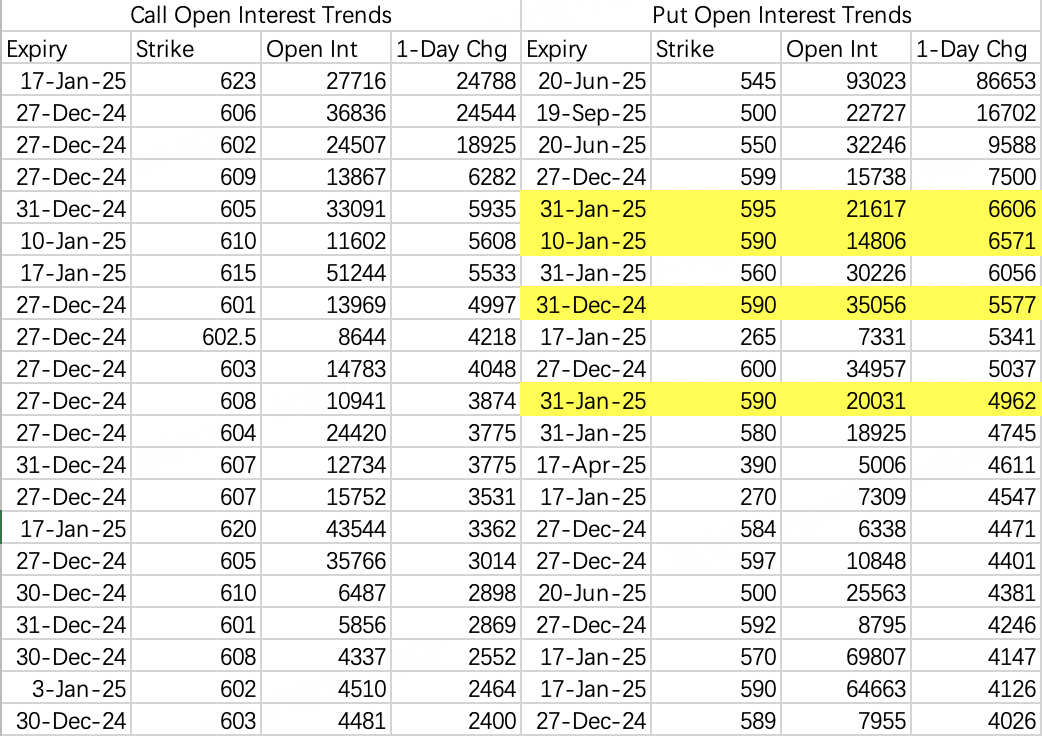

$SPY$

Thursday's long-dated put openings look scary but focus on long-term positions and hedging. Near-term puts concentrate at 590 strike, already touched Friday. Next reference needs Friday's opening positions.

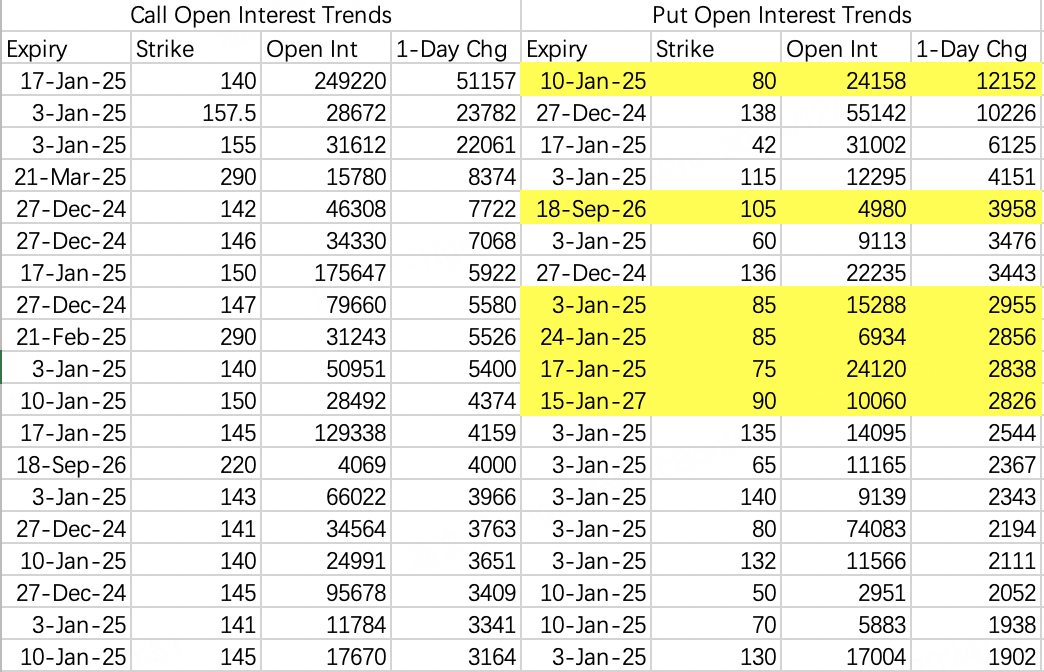

$NVDA$

Most put openings are speculative. January 10 expiry 80 puts had 12,000 contracts but only $50,000 total value. Notable is September 2026 105 put ($NVDA 20260918 105.0 PUT$ ) with 4,000 contracts totaling $5.44 million.

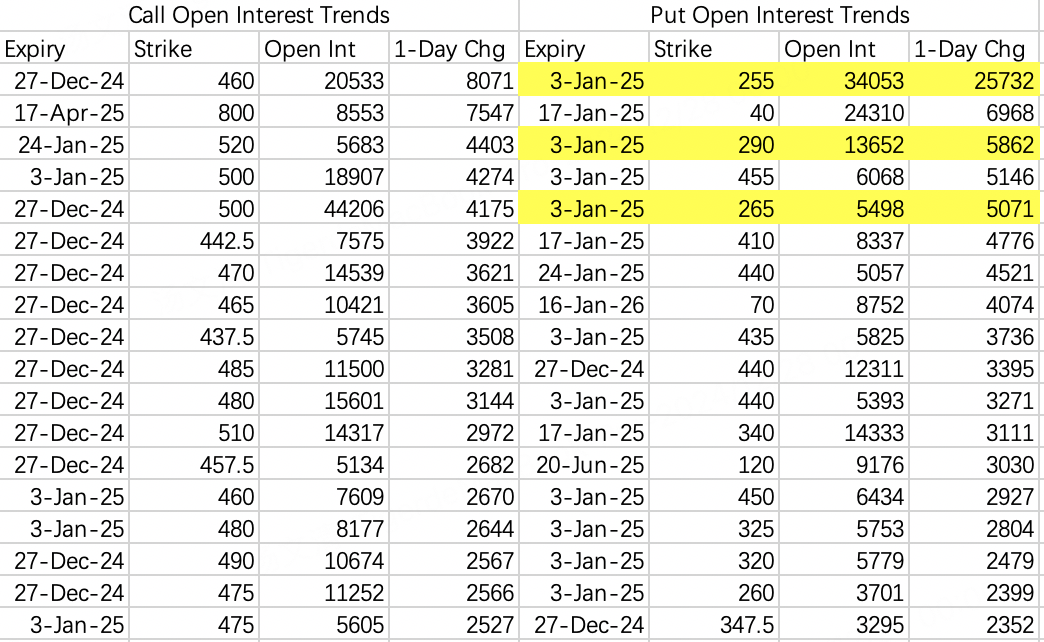

$TSLA$

Reviewing COIN's large position patterns, when expecting COIN's October 31 earnings crash, long call institutions only reduced strike prices and positions. In hindsight, institutions saw bullish momentum outweighing earnings risks, justifying continued long calls with reduced risk.

Tesla long call ($TSLA 20250221 380.0 CALL$ ) direct closure suggests no bullish catalyst, or any call held until February end would severely lose.

Tesla likely corrects below 380, possibly below 300, but not within next week.

Thursday's put openings remain mostly speculative, with January 3 expiry 255 puts opening 25,000 contracts but only $500,000 total value, similar to earnings bets with low win rates. For shorting or hedging, longer-dated options are better.

Comments