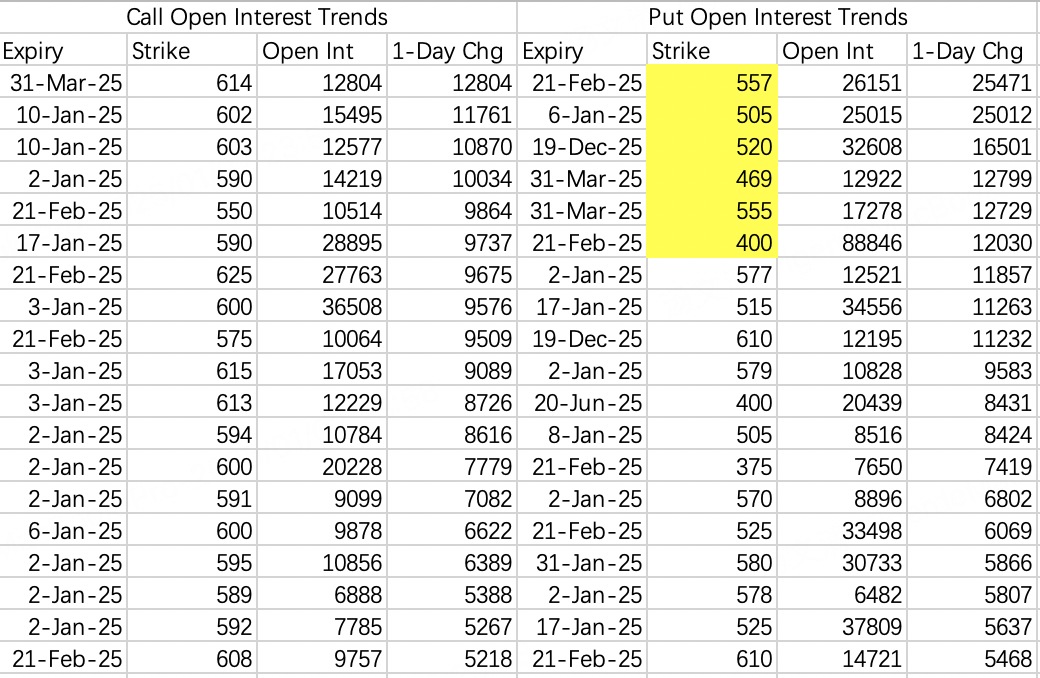

$SPDR S&P 500 ETF Trust(SPY)$

The bearish expectations for the market are rather exaggerated. The volume of new positions opened is quite high. We can't use the excuse that all professional investors are on vacation.

Although there is an electronics consumer show next week, it seems insufficient to support the overall market. It won't reach 557, but it's likely to touch 580.

The short selling of call options is very intense, but the overall market is so weak that it lacks the strength to rise through forced buying.

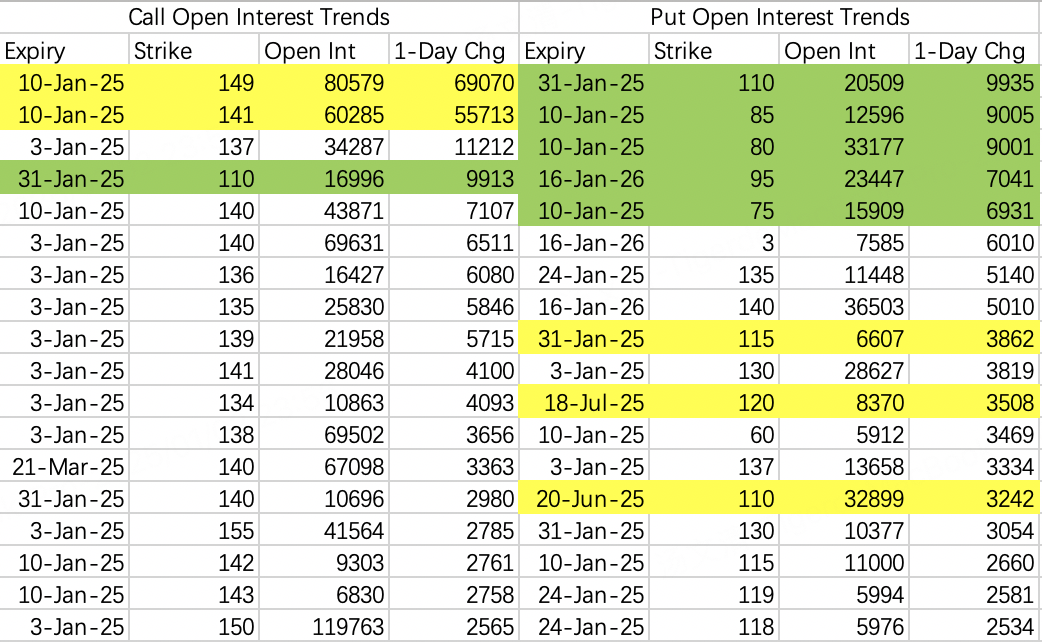

$NVIDIA(NVDA)$

Considering closing out the 140 sell put on Friday, the positive impact of the CES Consumer Electronics Show seems limited.

This week, a considerable number of call options were opened. In theory, there should be a round of short selling. If there isn't by Friday, it indicates that the current trend is indeed very weak.

The institution plans to open a sell call position next week by selling 141 calls, with the strike price chosen to be lower than this week's 143. This also indicates that there is a high probability that CES will not have any better-than-expected news next week.

Sell $NVDA 20250110 141.0 CALL$

Buy $NVDA 20250110 149.0 CALL$

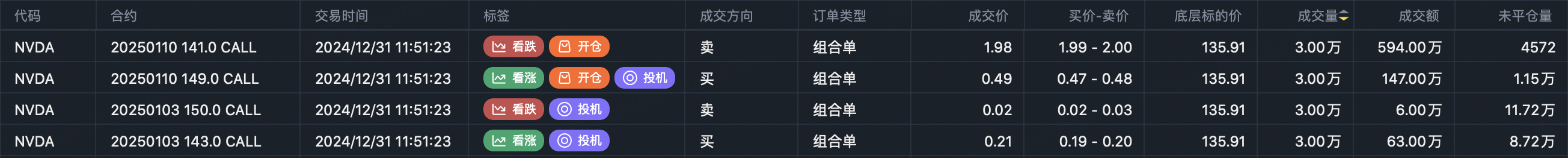

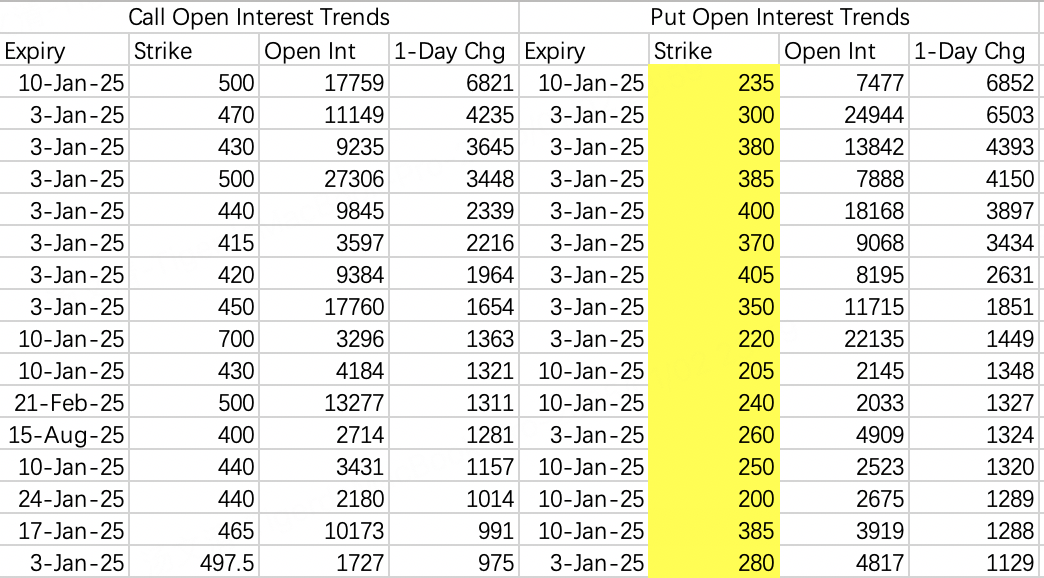

$Tesla Motors(TSLA)$

Tesla still has to continue to pull back. The strike price for opening a put option position is really hard to describe. It's obvious that there is no consistent expectation of a pullback.

The institution plans to open a position by selling 400 call options next week. The strike price chosen is quite bold, with only a 4.7% difference from the underlying asset's price at the time of selling. The expected volatility for next week is 3.4%. This close call indicates that the institution remains bearish for next week.

Sell $TSLA 20250110 400.0 CALL$

Buy $TSLA 20250110 430.0 CALL$

By the way, the two big positions of Chinese concept stocks, yinn27 and chau15, haven't been closed out yet.

Comments