Morgan Stanley's new Tesla report title blinded my dog's eyes: "Revisiting our Tesla Robotaxi and Mobility Model: Target to $430, Bull Case $800"

What's the main driver for Tesla's stock price increase? It's physical AI!

However, for such an important driving force, the article didn't provide specific quantitative data - those who know, know.

The article ends with three price targets: base case $430, bull case $800, and bear case $200.

After reading, I'm at a loss for words - can only say it's invincible, though I won't specify in what way.

Also, institutions' sell call 405 from yesterday got squeezed. Well, let's wait for earnings.

$KraneShares CSI China Internet ETF(KWEB)$ & $iShares China Large-Cap ETF(FXI)$

After the large leveraged ETF options positions were closed, the market rebounded.

Theoretically, such a large market shouldn't target one small foreign position. Besides coincidence, there's no reasonable explanation. As a wise elder once said, get rich quietly.

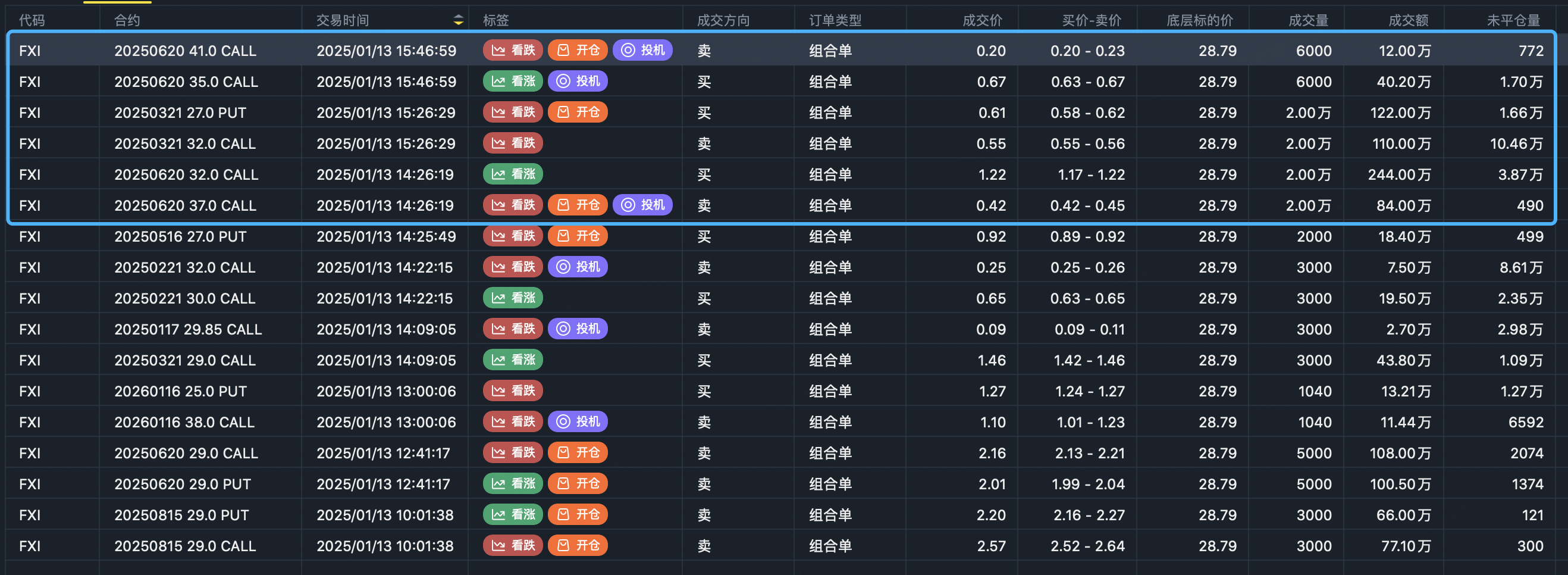

As leveraged ETF options positions closed, regular ETF options positions entered. $KWEB$ and $FXI$ Monday options total volume fell by half compared to 90-day average, but over 70% came from institutions.

KWEB mainly saw single-leg trades, while FXI saw more spreads.

FXI's two highest volume spread strategies were bull call spreads:

Buy $FXI 20250620 32.0 CALL$ , volume 20,000 contracts

Sell $FXI 20250620 37.0 CALL$ , volume 20,000 contracts

And collar:

Hold stock

Buy $FXI 20250321 27.0 PUT$ , volume 20,000 contracts

Sell $FXI 20250321 32.0 CALL$ , volume 20,000 contracts

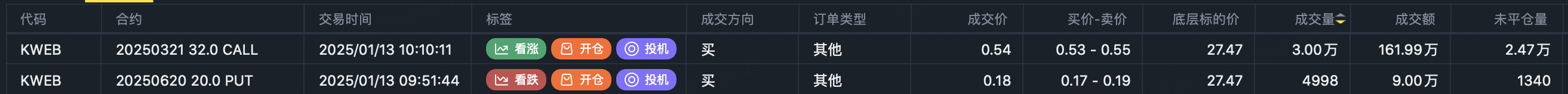

KWEB's main large positions were single-leg 32 call $KWEB 20250321 32.0 CALL$ and 20 put $KWEB 20250620 20.0 PUT$ , volumes of 30,000 and 5,000 contracts, trading values of $1.62M and $90K respectively.

Monday's large positions were mostly bullish. Some might wonder if these trades will be targeted, but it's unlikely as $1-2M trading value is normal and controllable upside, unlike those billion-dollar trades.

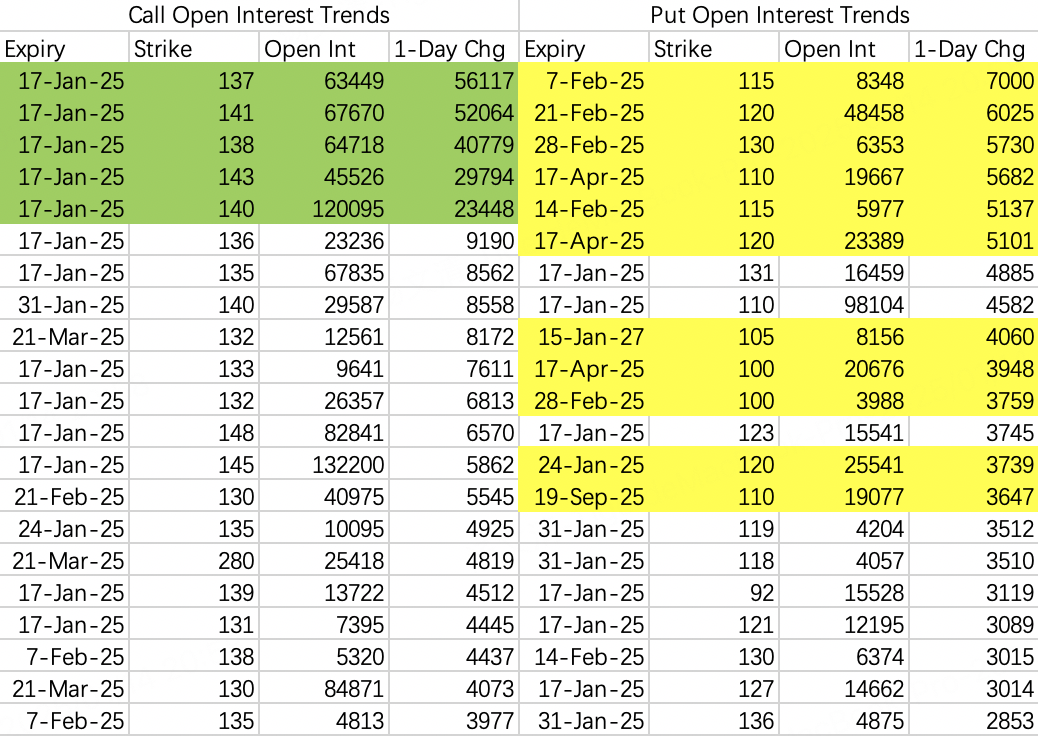

Put option opening was classic. New put strike prices were discontinuous compared to calls, showing strategic retreat.

Likely stable this week, between 130-140, selling 145 call $NVDA 20250124 145.0 CALL$

Monday opened down, institutions adjusted sell call positions, creating another squeeze setup. High probability below 140 this week, small chance of squeeze above 141.

Bit regrettable yesterday - should have quickly added sell puts when 125 put $NVDA 20250117 125.0 PUT$ saw high-volume closing at open, but didn't react fast enough.

$Financial Select Sector SPDR Fund(XLF)$

Pre-earnings rebound seen at 49

Comments