A moment of tranquility that needs no words, feeling very peaceful.

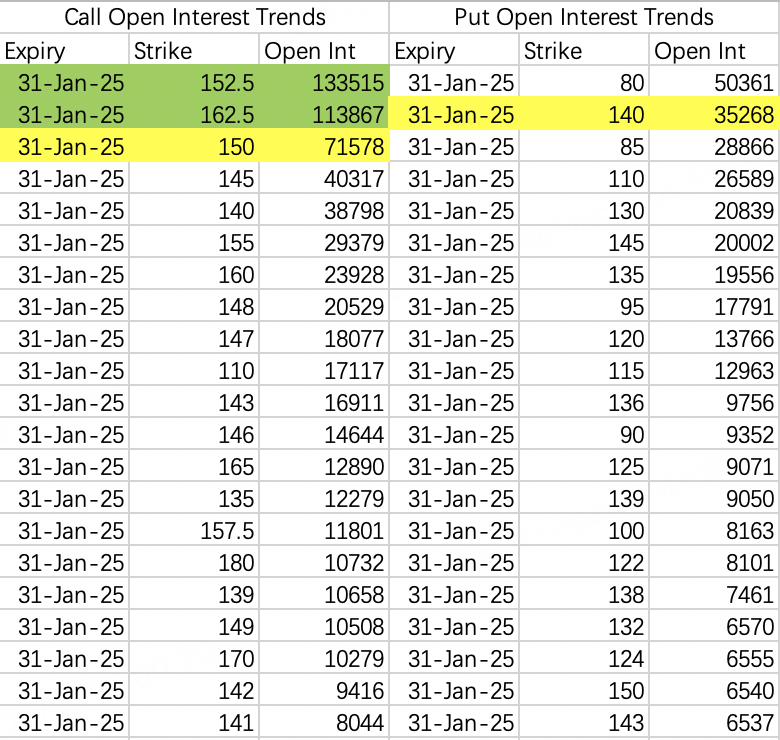

Expected price range next week is 140-150. Friday's pullback is normal, no need to worry.

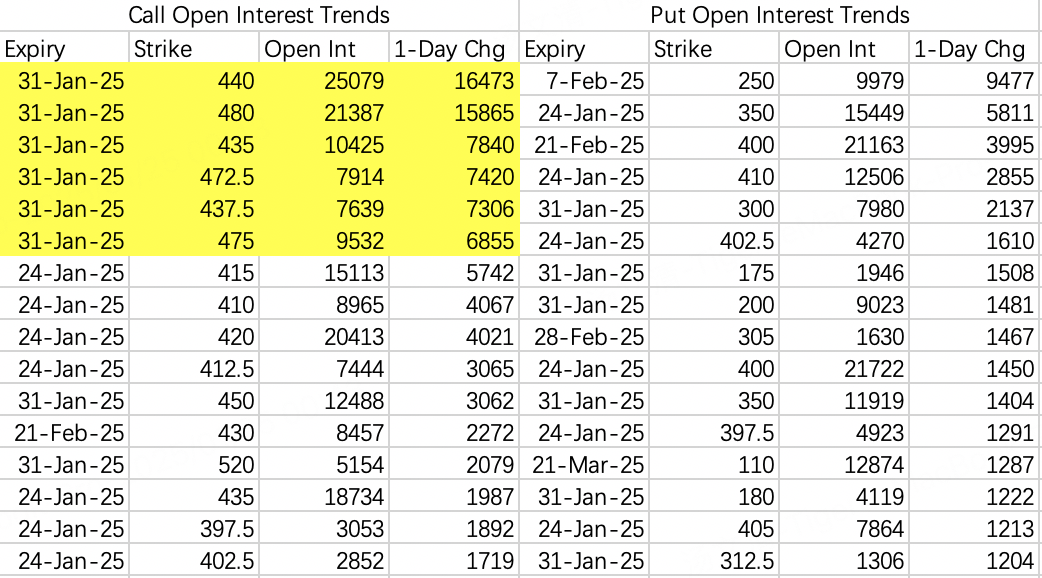

Tesla has earnings next week. Looking at institutional strike prices sold, there seems to be intentionally high pricing, even possibility of post-earnings rise.

Could also be to avoid hurting short sellers after earnings when selling calls, though I don't see many short positions.

Main institutional selling ranges are 440-480, 435-472.5, and 437.5-475.

Next week's earnings will mainly depend on Musk's future promises. Tesla's current high valuation mainly comes from FSD iterations, Cybercab/Robotaxi deployment milestones, Optimus humanoid robot demonstrations, and autonomous driving legal compliance progress. None of these promises will have very specific numerical expectations. In fact, if there were clear data that could be incorporated into valuation, the stock price might actually fall.

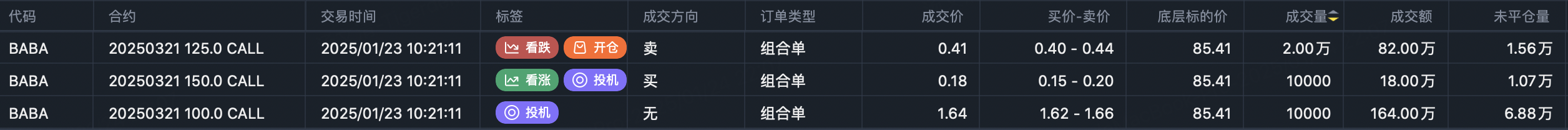

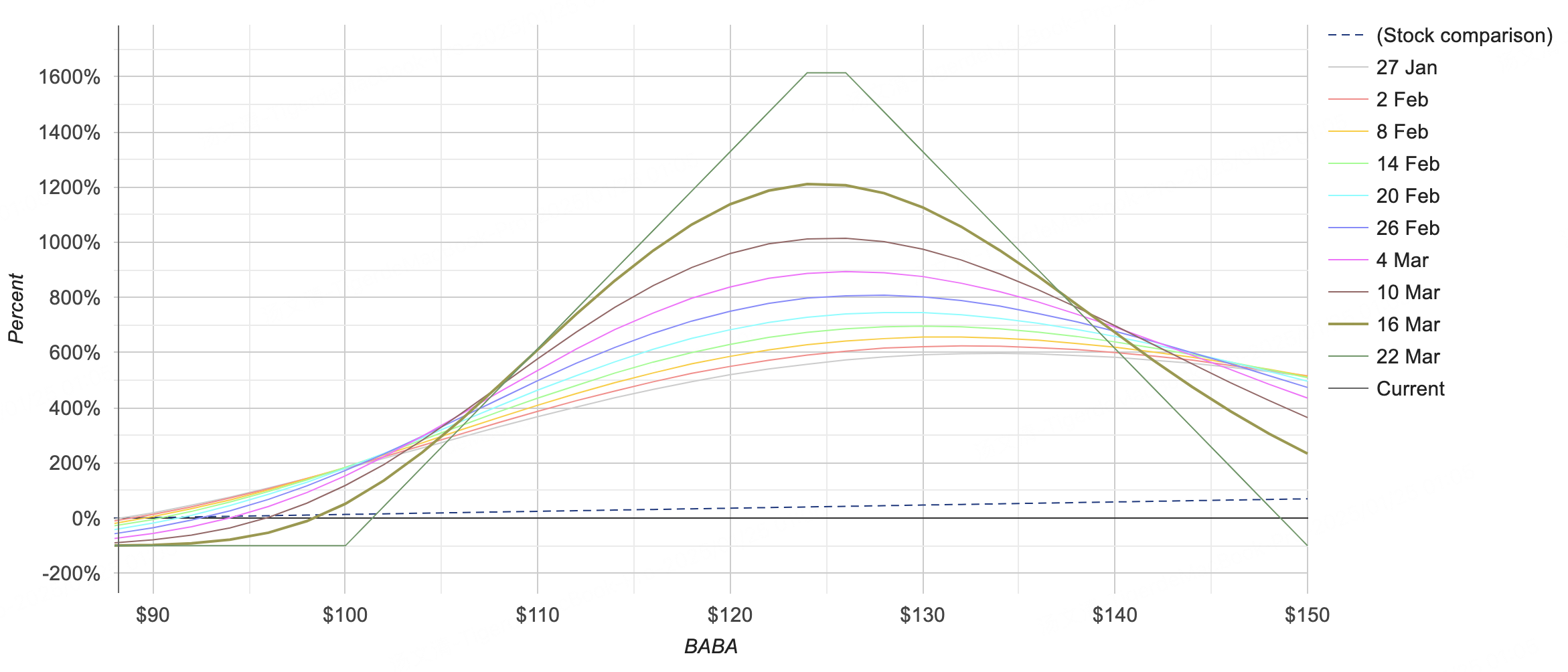

A rare butterfly call strategy:

Buy $BABA 20250321 100.0 CALL$ , volume 10,000 contracts

Sell $BABA 20250321 125.0 CALL$ , volume 20,000 contracts

Buy $BABA 20250321 150.0 CALL$ , volume 10,000 contracts

Maximum profit at $125, limited loss below $100 or above $150. In essence, traders are betting BABA could reach $125. As for why BABA is rising, bullish outlook on kweb, ashr, and fxi means constituent stocks should also be bullish.

Comments