(Image Source: Photo by Lin Zhijia, TMTPost AGI Editor)

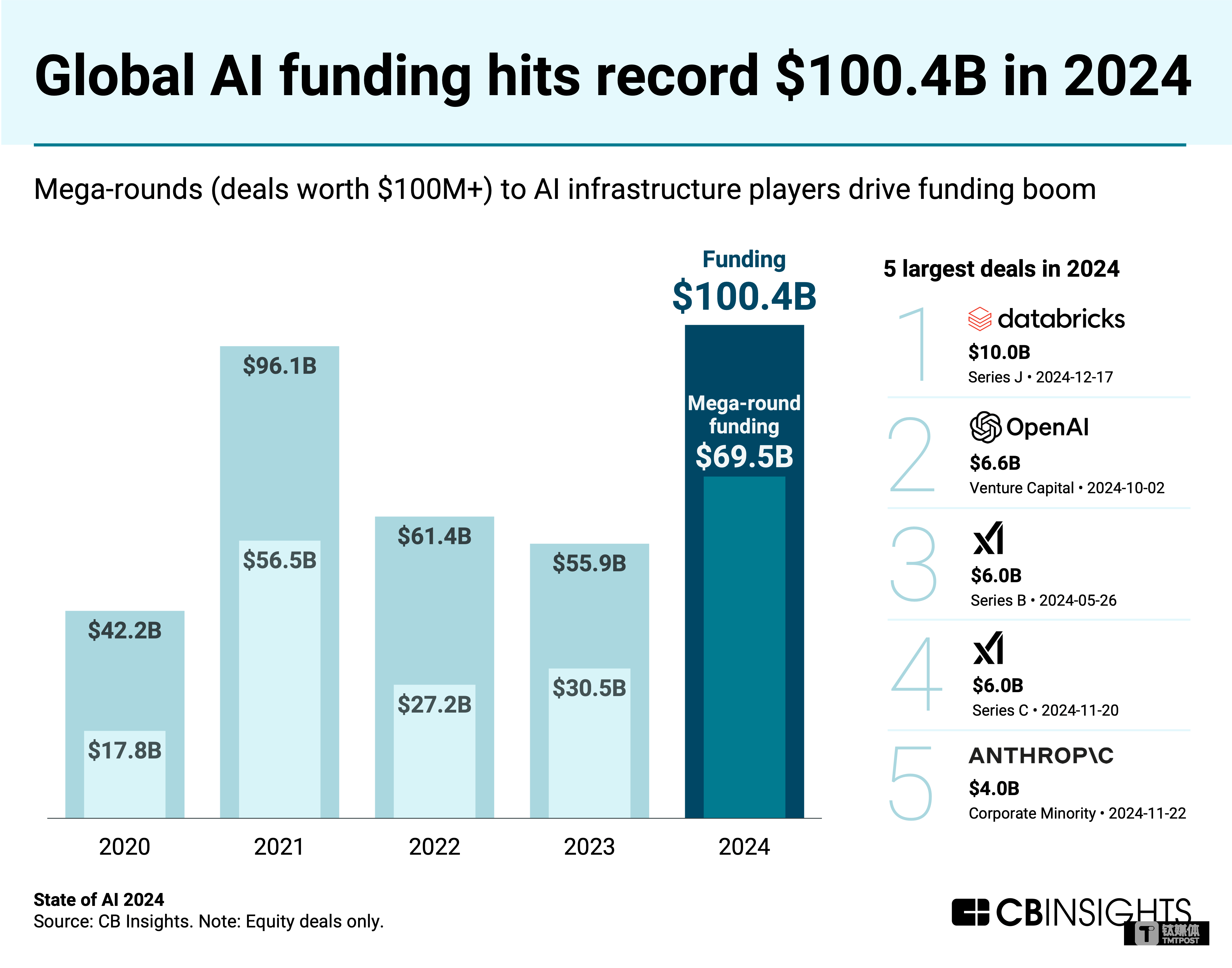

AsianFin – The global funding in AI startups reached $100.4 billion in 2024, marking a 79.61% year-over-year increase and the highest since 2020. The amount of global funding in AI startups came in at $42.2, $96.1, $61.4, $55.9 billion in 2020, 2021, 2022, and 2023 respectively.

Meanwhile, the funding for AI startups in 2024 accounted for 69% of total global investment. Despite this boom, China's AI startups lagged behind, securing only $5.2 billion in funding.

While the AI sector sees a rise in unicorns, with 44% of the 2024 newcomers focusing on AI, China's DeepSeek has disrupted the market with its cost-efficient, open-source approach, challenging the dominance of U.S. tech giants.

According to a recent CB Insights report, global AI investment activity surged in 2024, with 4,505 deals recorded—a 6.35% increase from the 4,236 deals in 2023.

In the fourth quarter of 2024 alone, global AI funding soared to $43.8 billion, a 159% quarter-over-quarter increase. This growth was driven by massive investments in AI models and infrastructure, including Databricks' $10 billion funding round and a combined $6.6 billion investment in OpenAI by Thrive Capital, Nvidia, and SoftBank.

However, despite DeepSeek’s rapid rise and technological breakthroughs, China’s AI startups secured only $5.2 billion in funding in 2024—just 7% of the $76.3 billion raised by U.S. AI startups.

In 2024, China recorded 301 AI investment deals with a total funding of $5.2 billion. In Q4 2024, China’s AI funding stood at just $1 billion, significantly lower than the U.S., which saw 548 AI investment deals totaling $38 billion in the same period.

Sector-wise, AI adoption in financial technology, digital healthcare, and retail technology has declined, dropping from 38% of total AI deals in 2019 to just 24% in 2024.

AI Unicorns on the Rise Despite Broader Investment Slowdown

Despite a global downturn in venture investment, AI unicorns have surged. CB Insights reported that global venture deals fell 19% year-over-year in 2024 to 26,961 transactions—the lowest level since 2016—while total funding reached $274.6 billion, up 4.5% from 2023 but still 37% lower than in 2022.

China, Canada, and Germany saw the largest declines in investment, with funding falling by 33%, 27%, and 23%, respectively. In contrast, Japan, India, and South Korea bucked the trend with increased investment.

AI startups have dominated the unicorn landscape, with 44% of the 72 new unicorns in 2024 being AI-focused. These companies reached unicorn status in a median time of two years, far faster than the nine-year median for non-AI firms. Moreover, AI unicorns had a median workforce of just 203 employees, half that of non-AI unicorns.

Currently, the world has 1,258 unicorn companies, collectively valued at over $4.325 trillion. China is home to around 162 of them, including ByteDance ($300 billion), RedNote ($17 billion), DJI ($15 billion), and AI firms like Zhipu AI ($3 billion), Moonshot AI ($3.3 billion), and Baichuan Intelligent Technology ($2.77 billion).

DeepSeek has seen its daily active users (DAUs) surpass 20 million, reaching 23% of ChatGPT’s DAUs. This momentum has prompted OpenAI to accelerate its o3-mini product rollout.

OpenAI CEO Sam Altman addressed concerns over DeepSeek, saying that the company does not intend to sue the Chinese AI firm. “We are going to just continue to build great products and lead the world with model capability,” Altman said. “DeepSeek is certainly an impressive model, but we believe we will continue to push the frontier and deliver great products.”

In contrast, DeepSeek has achieved breakthroughs with a team of fewer than 200 employees and a model training cost of just $5.6 million—far lower than the billions spent by OpenAI and other closed-source AI companies.

DeepSeek has been well received in China, with Alibaba Cloud, Baidu Cloud, Tencent Cloud, and ByteDance’s Volcano Engine integrating its models. Major Chinese AI chipmakers like Baidu Kunlun and Moore Threads, have rushed to adopt DeepSeek, while global semiconductor giants Nvidia, AMD, and Intel have also extended compatibility for DeepSeek.

"Never underestimate the ingenuity of Chinese scientists and engineers," Fu Cong, China's permanent representative to the United Nations (UN), said at a press conference at the UN headquarters in New York on Tuesday. "From Huawei to TikTok, and now to DeepSeek - how many more does the U.S. want to impose a ban [on]?"

DeepSeek’s impact on AI infrastructure costs and global AI strategy is profound, raising questions about the efficiency of massive AI spending by U.S. tech giants.

While DeepSeek’s open-source model challenges the dominance of closed AI systems, funding disparities remain stark. Since 2020, closed-source AI startups have secured $37.5 billion in investments, compared to just $14.9 billion for open-source AI firms.

Despite the popularity of open-source AI, even companies like Mistral AI and xAI have kept their flagship models proprietary. Given DeepSeek’s cost-effective training methods, industry observers speculate that more AI entrepreneurs may pivot toward commercial AI applications rather than large-scale foundational models.

As AI development costs rise—growing at an estimated 2.4x per year—DeepSeek’s lean approach presents a compelling alternative to the high-cost models of OpenAI and other tech giants.

The total funding for China's AI sector is only 7% of that of the U.S., which suggests that the overall AI gap between China and the U.S. is widening. Catching up with and replicating foundational models does not reflect the actual strength gap.

Comments