Many of you are probably wondering about three key questions right now:

How low will the stock price go?

How long will it keep dropping?

How will it rebound?

Let’s analyze these questions using options data. One thing is certain: while implied volatility can be strategically shorted, the stock price itself may not have reached its bottom yet.

$NVIDIA(NVDA)$

This Week’s Range: If we had to set a range, it would be $85–$100. The $100 upper limit is typically determined by institutions selling calls, while the $85 lower limit is more speculative, representing the short sellers' target price. A "safe" price point might be closer to $60.

The Current Issue:

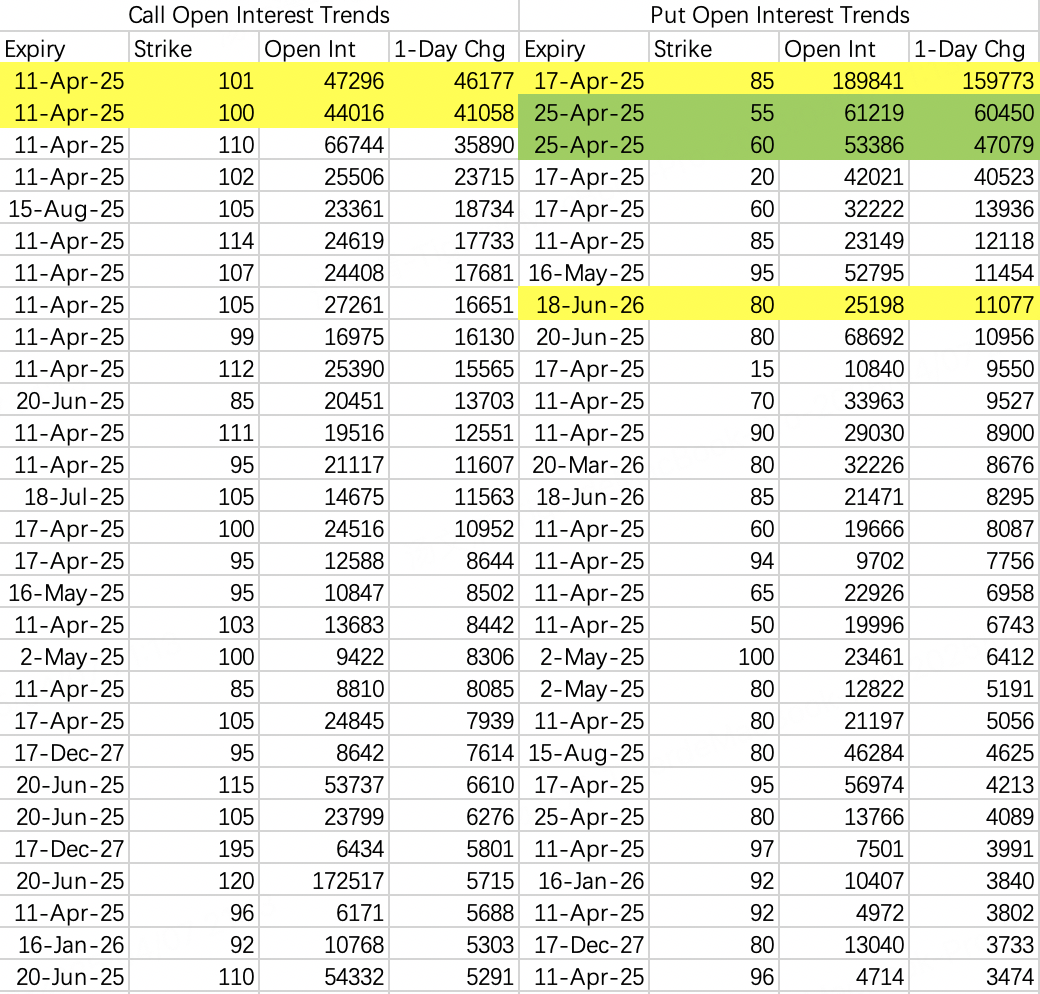

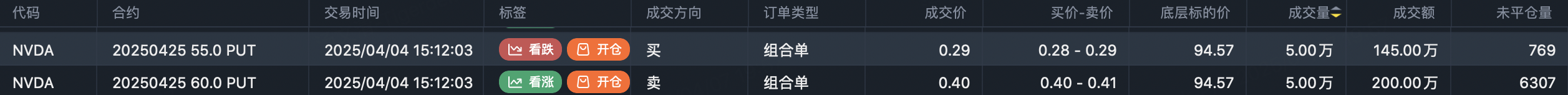

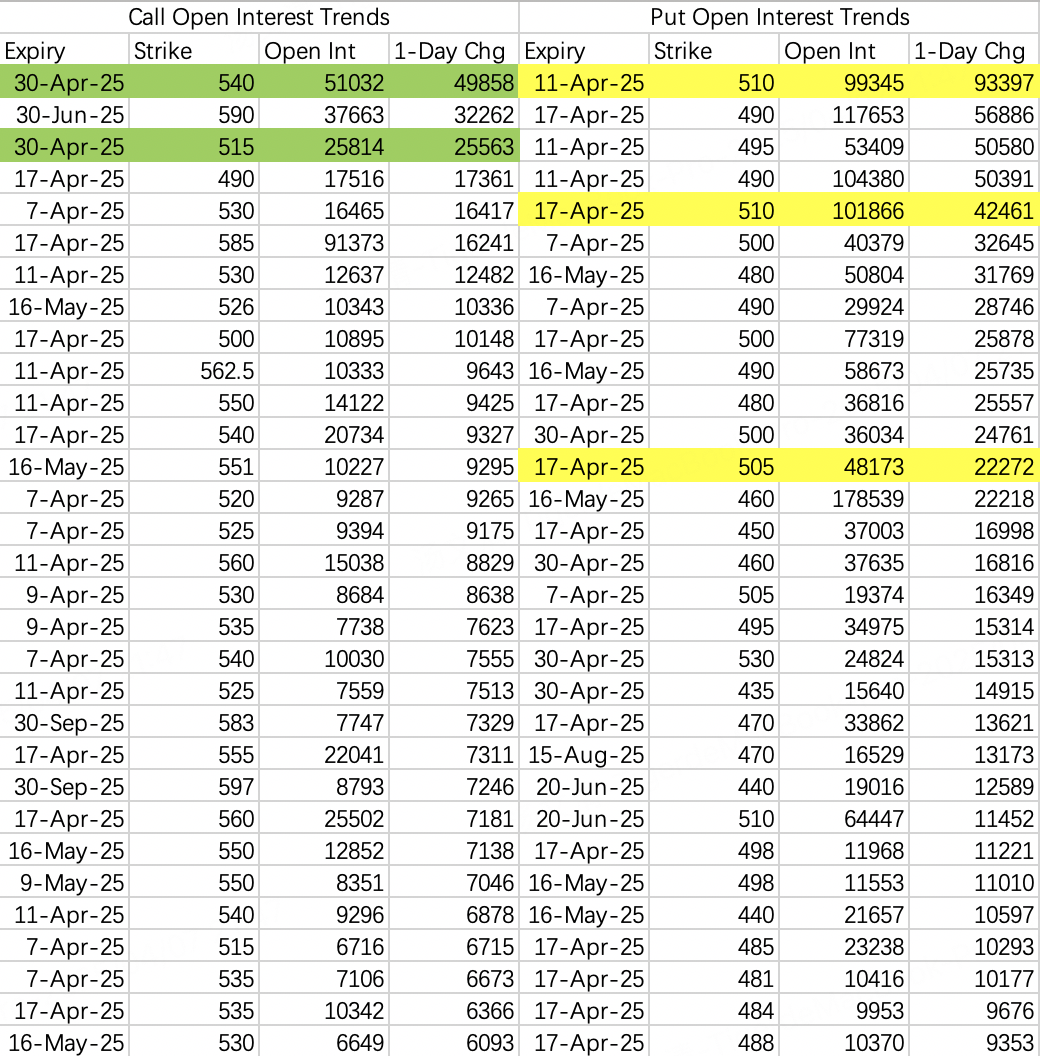

Theoretically, the stock price has dropped enough, but that doesn’t mean it can’t fall further. Based on April 4th open interest data, the concentration of put option positions extends beyond this week, contrasting sharply with the shorter-term concentration of call options. This suggests that a prolonged tug-of-war at the bottom is likely.

Institutional Activity Last Friday:

Institutions sold calls at $102 $NVDA 20250411 102.0 CALL$ , $101, $100, and $99 strike prices, effectively hedging their positions for call options with strike prices above $110. It’s clear that they don’t expect a rebound this week.

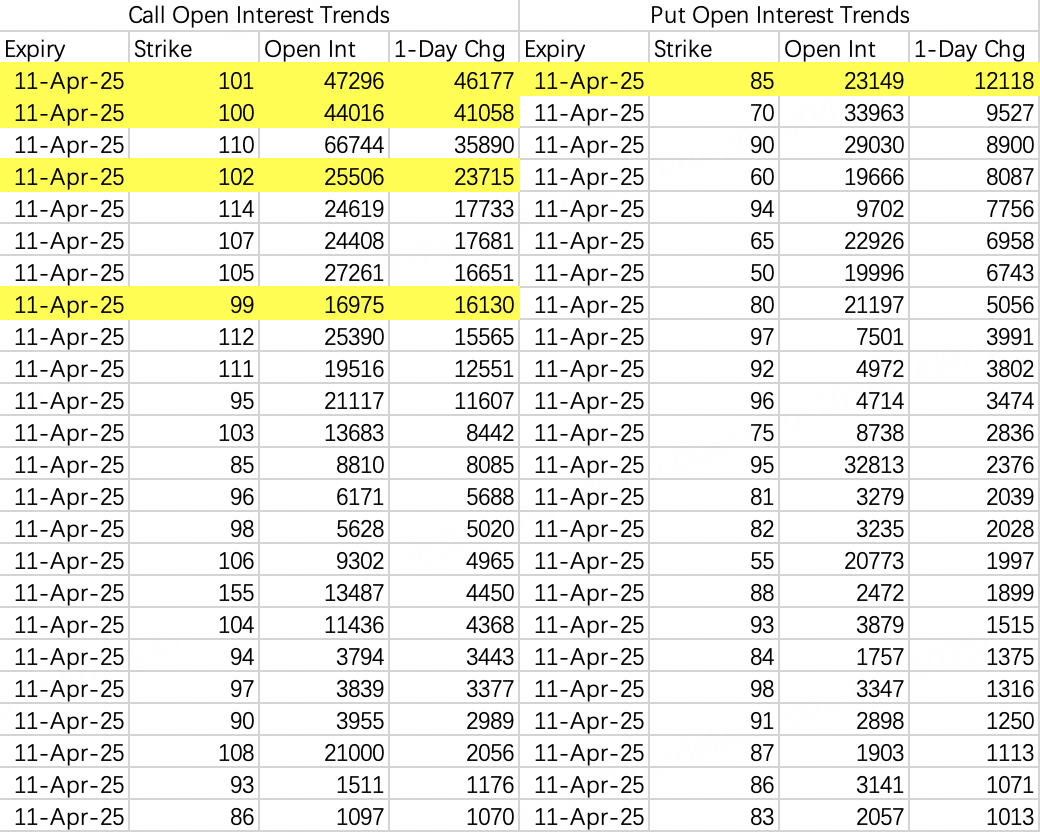

Volatility Shorting:

Institutions are employing put spread strategies to short volatility. For example:Selling the $60 put $NVDA 20250425 60.0 PUT$ expiring on April 25th

Buying the $55 put $NVDA 20250425 55.0 PUT$ expiring on April 25th

Key Date – April 9:

April 9th is the implementation date for tariffs, and it seems the market doesn’t expect Trump to back down. In the best-case scenario, the stock stabilizes at $85 this week. In the worst case, it continues to plummet.April Options Data:

Open interest for April monthly options also indicates that $85 is a critical support level.

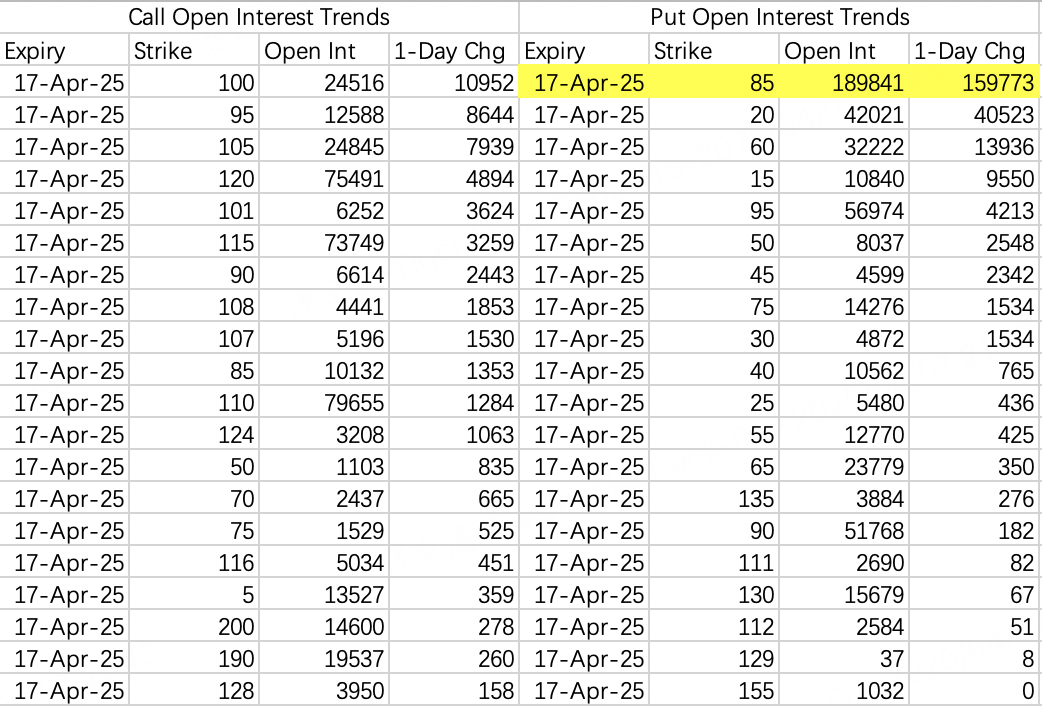

$SPDR S&P 500 ETF Trust(SPY)$

While NVIDIA’s put open interest isn’t particularly pronounced, $SPY$ has clearly reached a key anticipated support level.

Volatility Expectations:

Open interest data indicates that high volatility is expected to persist through the end of April. However, the concentration of strike prices remains within the $480–$510 range, suggesting the market views this as a critical phase for a potential bottom.

Bullish Activity:

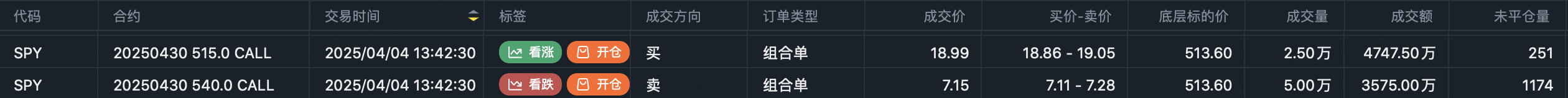

Most bullish open interest is concentrated in selling call options. The only notable bullish trade is a somewhat ambiguous spread:Buying the $515 call $SPY 20250430 515.0 CALL$

Selling twice the quantity of the $540 call $SPY 20250430 540.0 CALL$ to reduce the cost of the bullish position.

Summary

Currently, the market seems to be testing an unstable bottom. While it is theoretically possible to "buy the dip," caution is warranted given the potential for additional downside risk, especially if compounded by unforeseen "black swan" events.

Comments