On Monday, April 7, legendary investor Duan Yongping decisively bought the dip during intraday trading. His trading list spans multiple pages, with two main strategies: buying stocks outright and selling puts. Duan reportedly invested $400 million in U.S. blue-chip stocks and Tencent.

Most of the sell puts he wrote have strike prices near the current stock price, with expiration dates covering every week over the next month. Selling at-the-money puts essentially signals a willingness to take ownership of the stock.

So, is selling puts the best way to buy the dip? Let’s analyze:

$NVIDIA(NVDA)$

Before discussing dip-buying, let’s assess future expectations.

Expected Range:

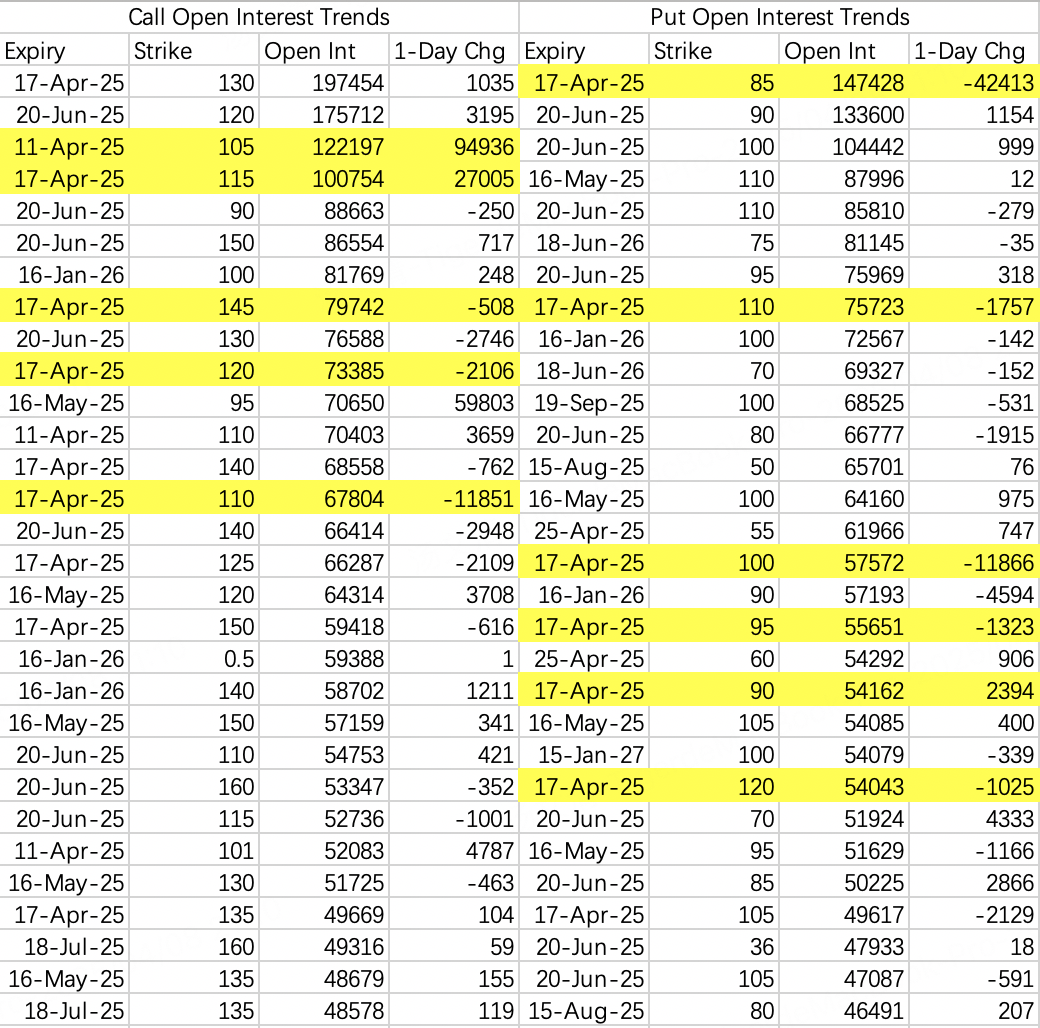

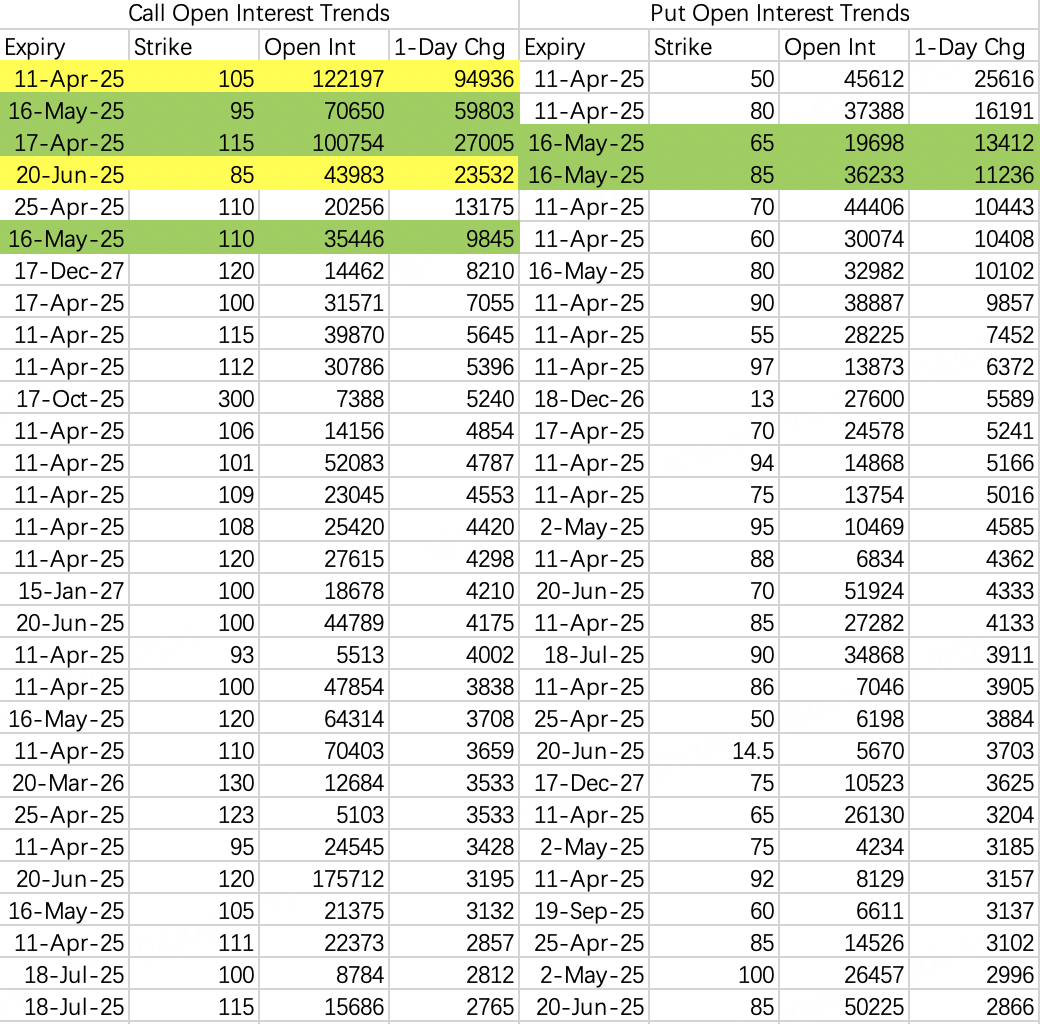

After Monday’s strong rebound, the expected range for this week is $85–$105. Looking ahead, a key resistance point through the end of April is $110.Options Open Interest:

Based on open interest data for options expiring April 17, call options with strikes above $110 and put options with strikes below $110 dominate the market, indicating that the stock is likely to oscillate within this range for the month.Monday’s Activity:

A large order of 95,000 contracts for the $105 call expiring this week ($NVDA 20250411 105.0 CALL$ ) was opened on Monday, contributing to a short squeeze that pushed the stock price above $100.

However, the market hasn’t priced in high expectations—$110 remains a difficult resistance level to break.

Two Major Institutional Trades on Monday:

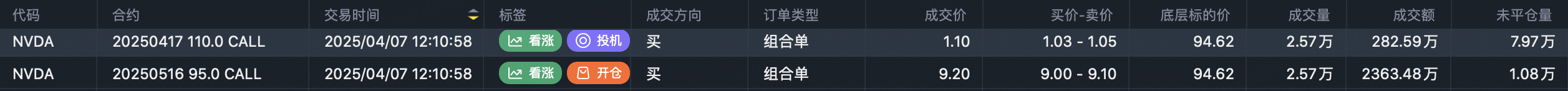

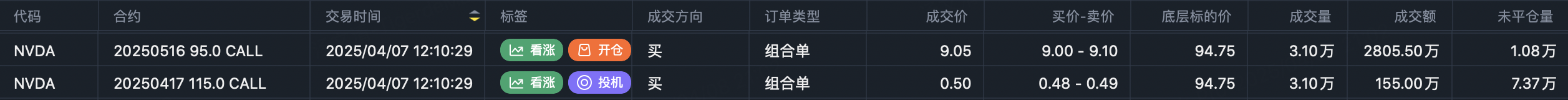

Rolling Contracts:

Rolled April $110 calls ($NVDA 20250417 110.0 CALL$ ) into May $95 calls ($NVDA 20250516 95.0 CALL$ ).Spread Strategy:

Likely bought $NVDA 20250516 95.0 CALL$ and sold $NVDA 20250417 115.0 CALL$ .

Key Trades:

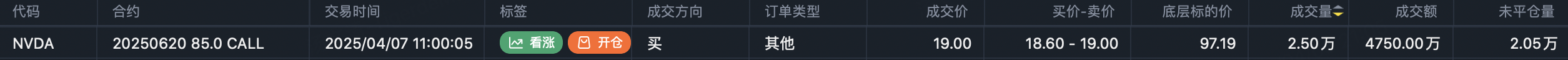

Bullish:

A massive order for 25,000 contracts of $NVDA 20250620 85.0 CALL$ with a notional value of $47.5M suggests expectations of a significant rally or a price above $105 by late June.

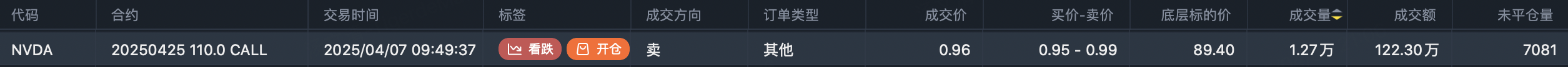

Bearish:

A large sell order for 12,700 contracts of $NVDA 20250425 110.0 CALL$ , with a notional value of $1.22M, indicates expectations that NVIDIA’s price will stay below $110 by the end of April.

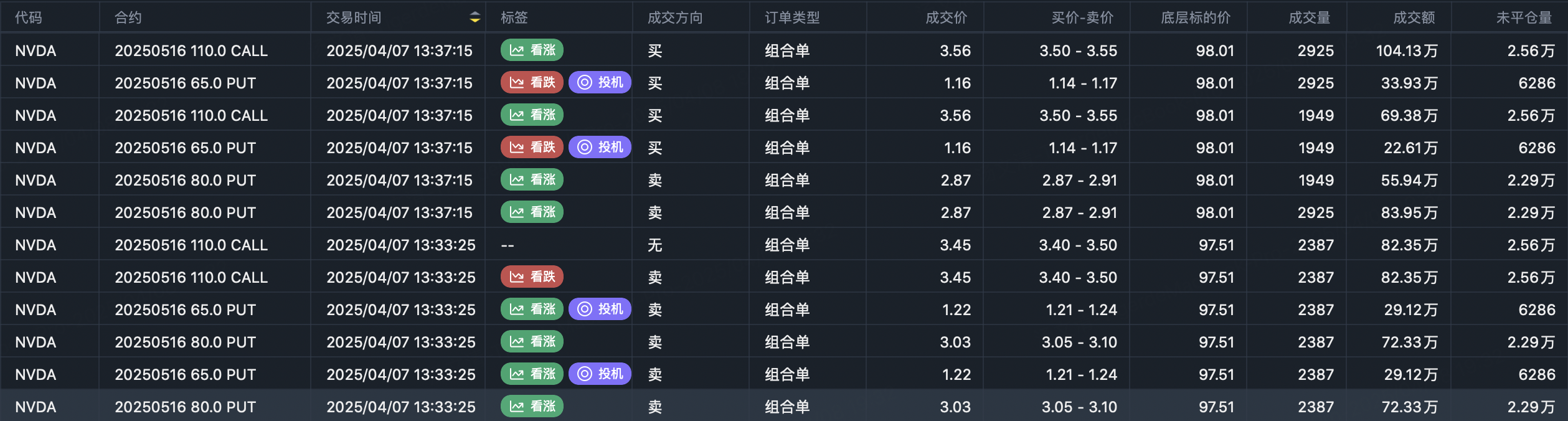

Conservative Bullish Strategy:

Institutions are employing a balanced strategy to hedge risks:

Summary for $NVDA$:

The price on Monday was indeed attractive for dip-buying, but it wasn’t suitable for aggressive strategies. The rebound wasn’t driven by positive catalysts but by a combination of favorable prices, short covering, and a short squeeze. The near-term price ceiling remains at $110.

Regarding dip-buying strategies, selling puts can be a profitable approach, offering dual benefits: collecting premiums from volatility and potentially buying shares at a lower price. However, this strategy only works well if leverage or margin isn’t overused.

For single-leg calls, at-the-money options could have been considered, though current prices are no longer as favorable. Combination strategies, such as spreads, reduce margin requirements and offer moderate leverage.

Ultimately, the safest long-term strategy remains buying the stock outright, as the economic impact of tariffs is just beginning to unfold, and holding shares at low prices is a more stable approach.

$S&P 500 ETF (SPY)$

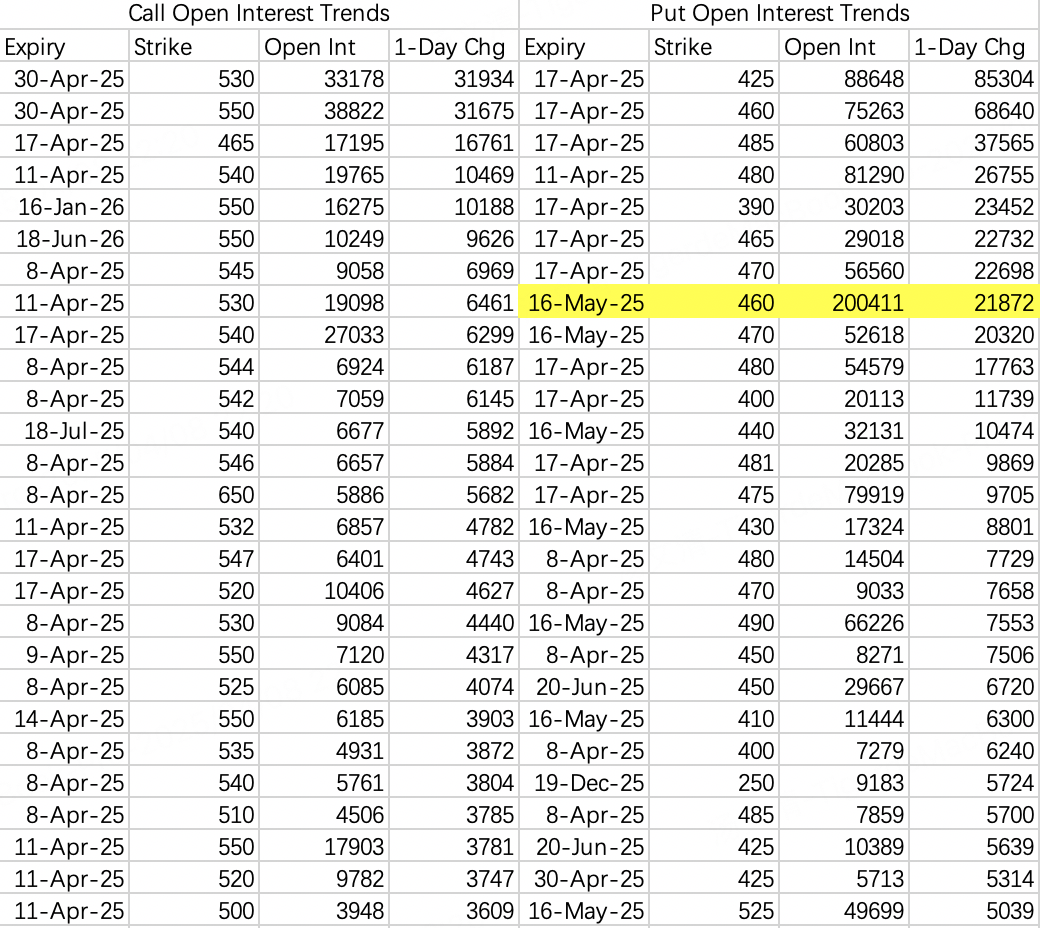

Monday’s Open Interest:

$SPY$ activity aligned with expectations, with bearish sentiment suggesting a continued decline to $480 next week and possibly $460 by May.Friday’s Puts:

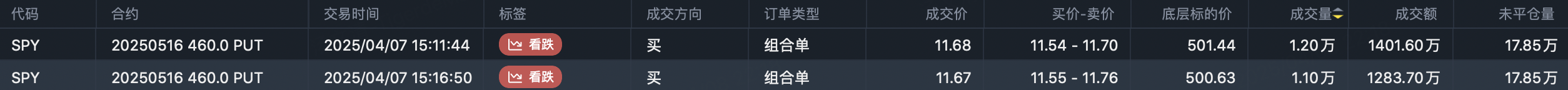

Bearish open interest on Friday perfectly matched the market’s subsequent performance, which is incredibly rare. The sell-off hit precisely the expected levels, a phenomenon I can hardly recall seeing before.Notable Trade:

A massive single-leg buy for $SPY 20250516 460.0 PUT$ was executed, with a total volume of 23,000 contracts and a notional value of $26.85M.Butterfly Spread Strategy from March 24:

Reviewing the $460 put’s open interest reveals that 150,000 contracts were initially opened on March 24 as part of a butterfly spread:Short 2x $SPY 20250516 460.0 PUT$

The butterfly strategy profits most when the stock price lands near the middle strike ($460) at expiration. It begins to generate profits between $425 and $495, with fixed losses outside this range. This indicates that the trader anticipated a major sell-off as early as late March. Unfortunately, I misinterpreted this strategy at the time as simple hedging.

Comments

Great article, would you like to share it?