On Monday, when the eyes of all market participants were attracted by the roller coaster market of US stocks triggered by the "tariff extension rumor", the really strange market actually happened in the US bond market...

In the past 24 hours, the U.S. bond, which was regarded as the "king of safe haven" last week, suffered a sharp plunge at lightning speed, and the 10-year U.S. bond yield almost completely returned to Trump's level before the reciprocal tariff was announced last week!

This historic sell-off caused almost all medium-and long-term U.S. bond yields to surge by more than 20 basis points in intraday trading on Monday, with the 30-year bond yield rising nearly 23 basis points in late trading, setting a record in 2020. The biggest one-day gain since the early COVID-19 pandemic.

It can be said that the way U.S. Treasury Bond traded on Monday was almost incredible: unlike U.S. stocks that skyrocketed and fell due to "false rumors" of "tariff extensions" that day, U.S. bond yields kept rising almost all day. Market traders seemed determined from the beginning, selling bonds all over the day.

In other words, the U.S. market actually suffered a "double kill of stocks and bonds" during the European and American hours last Friday.However, the decline in U.S. bonds at that time was not particularly obvious compared to U.S. stocks, but by Monday, the "protagonist" of the market plunge had completely become a "safe-haven asset" U.S. bonds in the eyes of many people.

There is no doubt that this scene is very "desperate" for many Wall Street people-against the background of the sluggish performance of the two major safe-haven assets, the U.S. dollar and gold, last week, U.S. debt now seems to be proving that it is not completely safe. A "safe haven", even White House senior officials such as Powell and Bescent, have been very eager to see the yield of U.S. bonds fall recently to realize the plan of "debt reduction"...

Judging from the interpretation of Wall Street institutions, industry insiders do not have a clear consensus on the reasons for the panic selling of U.S. bonds on Monday, but there are roughly the following speculations:

Basis trading has encountered large-scale liquidation, hedge funds have begun to sell U.S. debt to meet the demand for margin calls due to losses in other assets, and U.S. "overseas creditors" may seek to reduce their holdings of U.S. debt under the threat of tariffs...

Basis betting liquidation and cash requirements

Gennadiy Goldberg, strategist at TD Securities, said, "This sell-off trend reflects an'all-encompassing, ubiquitous' transaction." He added that cross-cutting funds are trying to deleverage, which has led to "sell everything" deals.

Many investors and analysts specifically mentioned those hedge funds that take advantage of the small difference between Treasury Bond prices and related futures contracts to arbitrage, that is, the so-called "basis traders". These funds are large players in the fixed income market, and as they cut their exposure, they unwashed these positions, triggering a sell-off in U.S. bonds.

A broader hedge fund sell-off is "destroying" liquidity-the ability to easily buy and sell assets-on Treasury Bond, highly rated corporate bonds and mortgage-backed securities, according to a hedge fund manager who attributed the yield move to basis trading.The fund manager said that "there is a massive deleveraging happening right now, and any source of liquidity is being tapped."

James Athey, portfolio manager at Marlborough Investment Management, also pointed out, "There may be a misalignment between bond and derivatives cash prices, and U.S. bond yields have risen sharply from their lows today and look like they did in March 2020, when we saw These wild volatility may be related to basis trading. Last week, we saw no signs of hedge funds stopping trading on bond futures basis, but all of a sudden you saw a spike in yields. "

Ed Al-Hussainy, senior interest rate analyst at Columbia Threadneedle Investments, said, "I think investors are turning to cash and cash-like assets to cope with this market volatility.The simplest explanation for (yield movement) is that investors start to sell what they can and go on the defensive. But selling stocks now will lock in losses, so the most readily available option is to sell Treasury Bond to raise cash. "

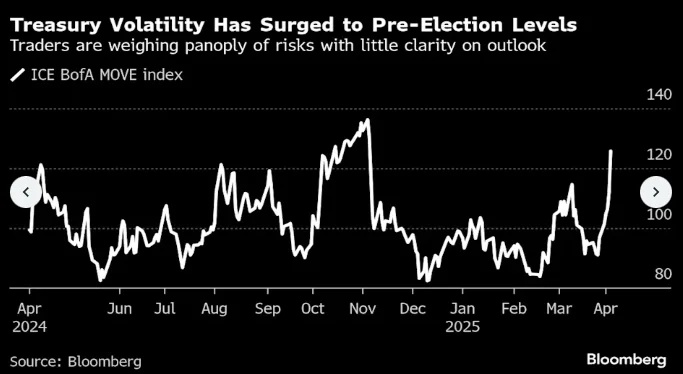

From the perspective of volatility indicators, the Bank of America MOVE Index, which measures the implied volatility of U.S. bonds, soared above 125.7 on Monday, setting a new high for the year.

Deeper worries

Of course, in addition to the impact of the above-mentioned short-term position changes and liquidity situation, some people in the industry currently believe that what needs to be worried more may be whether Trump's tariff measures to "go to war" on global trade will further affect or impact the traditional safe-haven status of US debt.

Some traders are watching for any signs that large overseas holders of U.S. debt may reduce their holdings of U.S. debt, and are worried that there will be little demand from overseas buyers in U.S. debt auctions in the coming days.

The U.S. Treasury Department will auction a total of $119 billion in interest-bearing Treasury Bond this week, and the demand for U.S. debt may face a test. That includes $58 billion of three-year bonds on Tuesday, $39 billion of 10-year bonds on Wednesday and $22 billion of 30-year bonds on Thursday.

Macro strategist Simon White believes that U.S. Treasury Bond is losing its safe haven status. With the decline of the reserve currency status of the US dollar, capital is flowing out of the United States at a faster and faster rate, and the economic recession is likely to push the fiscal deficit to a level far exceeding 10% of GDP, putting the US debt facing the serious risk of buyers' strike.

White said that the U.S. Treasury Bond will eventually be unable to escape this critical shift in capital flows. After the Russia-Ukraine conflict, Russian assets have been seized, and foreigners have become more cautious about holding U.S. Treasury Bond. The discussion of the Mar-a-Lago agreement further weakened people's shaken confidence, and made people doubt the principle that the US dollar is a tool free from political interference.

For investors who want to take advantage of the low level of U.S. bonds to buy U.S. bonds at the bottom, they can consider using the diagonal spread strategy.

What is a diagonal spread?

diagonal spread refers to the spread established using options with different strike prices and different expiration dates. Generally, the duration of the long leg in the spread is longer than that of the short leg. Diagonal spreads include diagonal bull spreads versus diagonal bear spreads.

The diagonal bull spread is basically similar to the bull subscription spread strategy, except that it has been upgraded and improved again.The difference is that the two options for the diagonal spread have different expirations, the trader buys a longer-term call option with a lower strike price and sells a shorter-term call option with a higher strike price. The number of call options bought and sold is still the same.

TLT Diagonal Spread Case

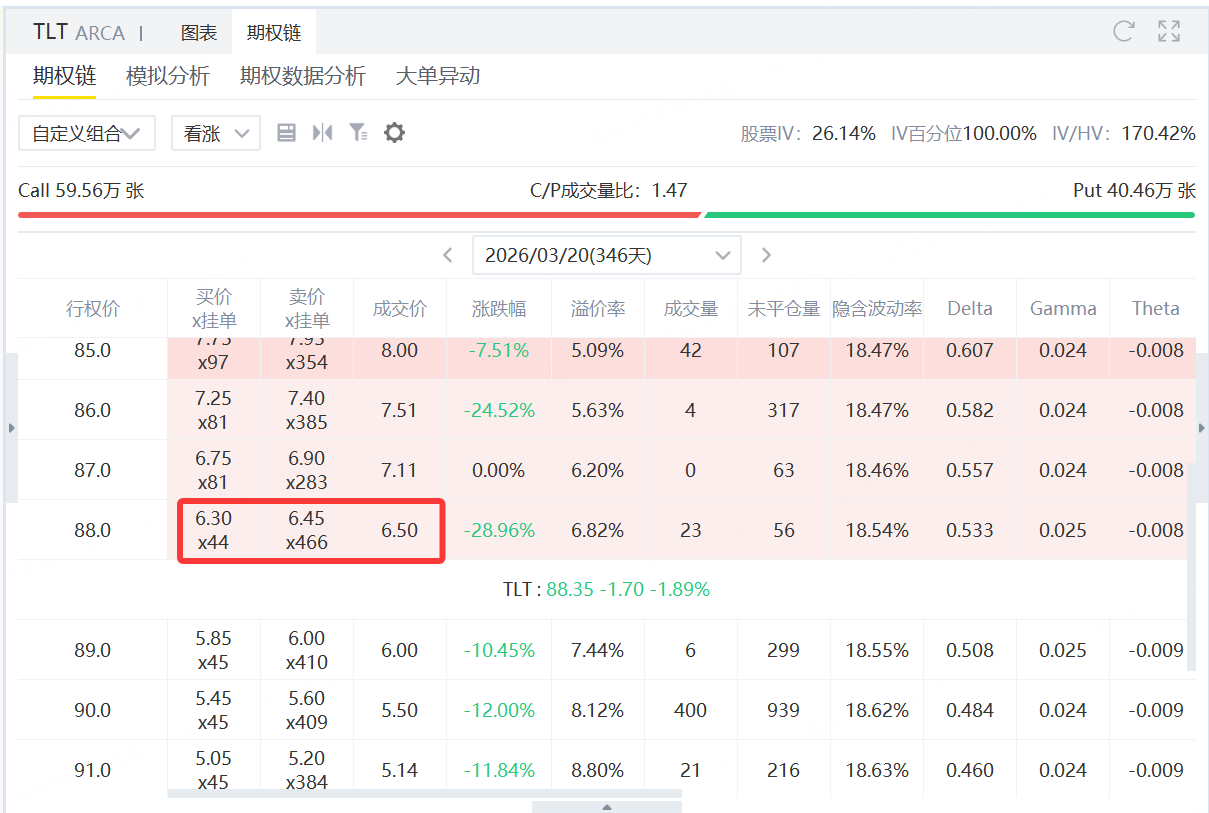

Assuming investors are bullish for the next yearTLT, you can directly buy the call option with an exercise price of 88 and an expiration date of March 20, 2026. This option becomes our long leg, which costs $650 at the latest transaction price.

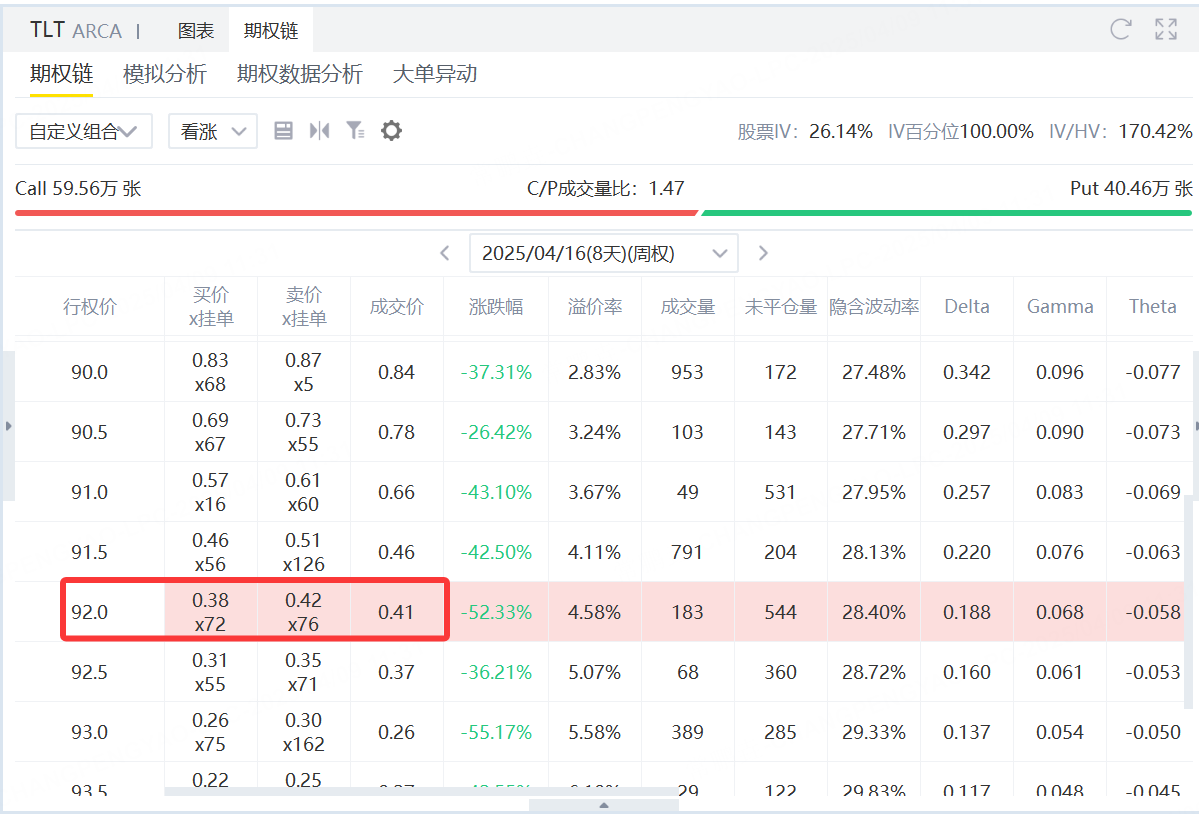

After the long leg is established, we can establish the short leg according to a shorter cycle than the long leg. Here, we can choose to establish it on a weekly basis. Choose to sell the call option with an exercise price of $92 and an expiration date of April 16 and get premium of $41.

Here, if the call option sold is not exercised, it will generate a profit of $41, which is about 6.3% relative to the cost of $650 on the long side. However, the short leg can be executed once a week. When the remaining date of the long leg is as long as 346 days, investors can sell dozens of call options. If some sold call options can successfully obtain premium, it will greatly reduce the cost of buying the call option itself, and even get the call option for free.

Compared with buying bulls alone, the diagonal spread obtains an additional premium income, which reduces the overall net premium expenditure of the strategy, and the break-even point of the strategy is also shifted to the left, and the winning rate is also increased accordingly. AdditionallyThe selling point of the diagonal spread can be controlled by investors themselves, so different short-selling efforts can be selected in different cycles to facilitate investors to control risks. Diagonal spreadEssentially, it is a low-cost call option strategy that is worth investors studying.

Comments