$NVIDIA(NVDA)$

At the current price level, it’s neither high enough nor low enough—both bulls and bears have reasons to feel nervous.

Friday’s Action:

The $55 put $NVDA 20250425 55.0 PUT$ opened on Friday was closed prematurely. It was closed at NVIDIA’s intraday high of $105, so the position didn’t make much profit.Market Reaction to Tariff News:

Despite China's pre-market announcement of retaliatory tariffs (a 50% increase on all U.S. imports), the market didn’t continue to drop.Tuesday’s Option Activity Highlights:

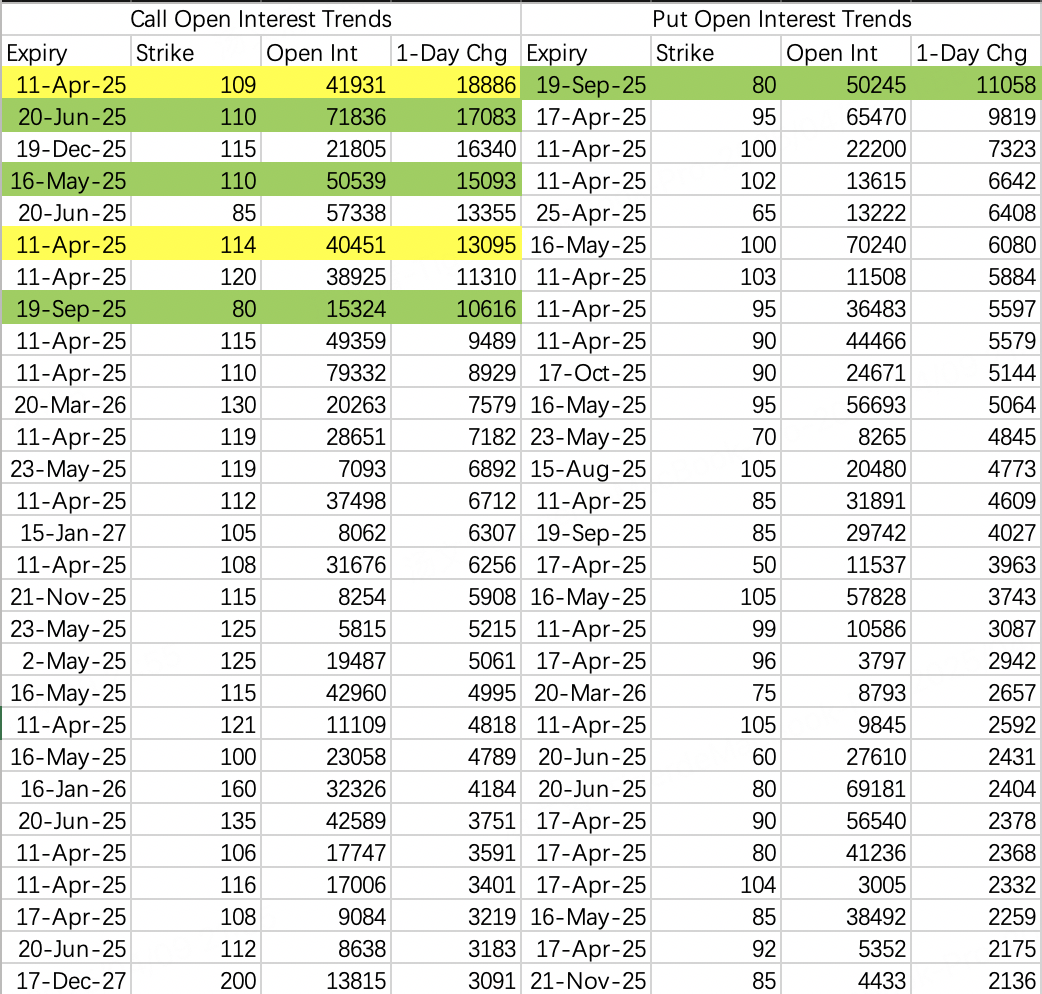

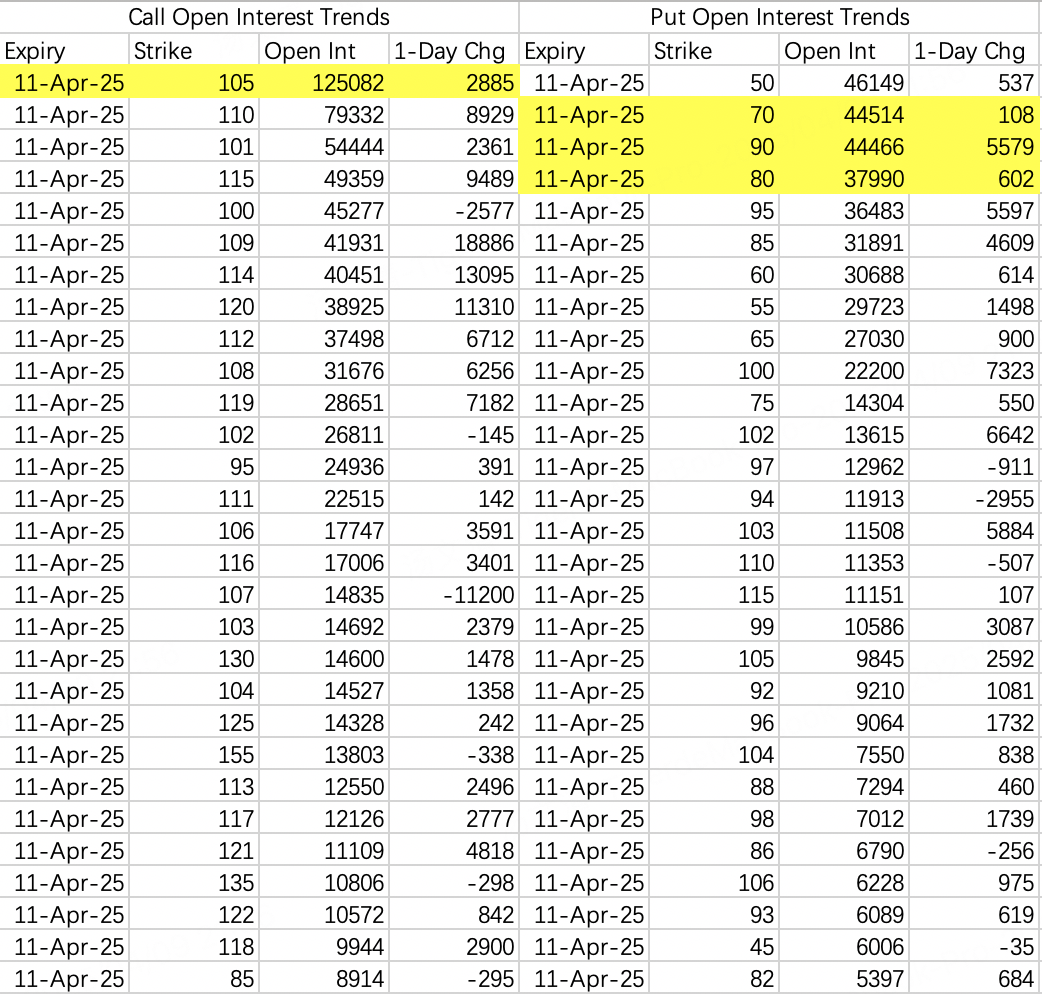

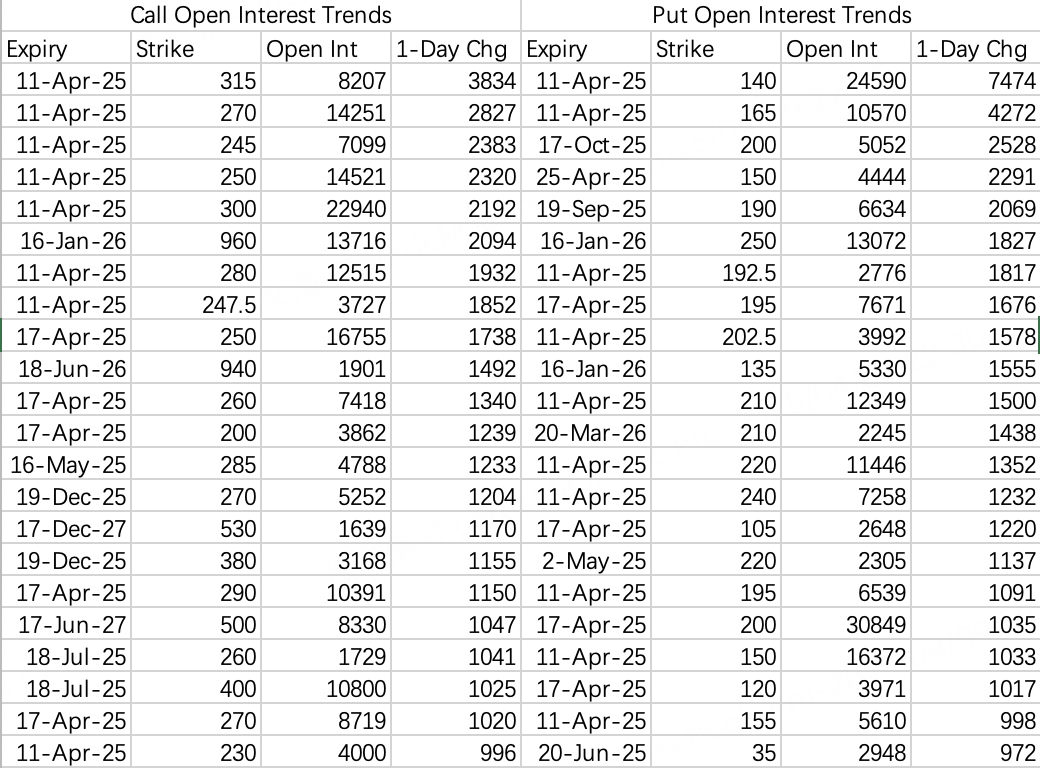

Institutional players closed their $99 calls and rolled them into $109 calls. Meanwhile, they continued to hold sell positions for $100, $101, and $102 calls.

Large orders were concentrated in options with the same expiration date and strike price, such as:

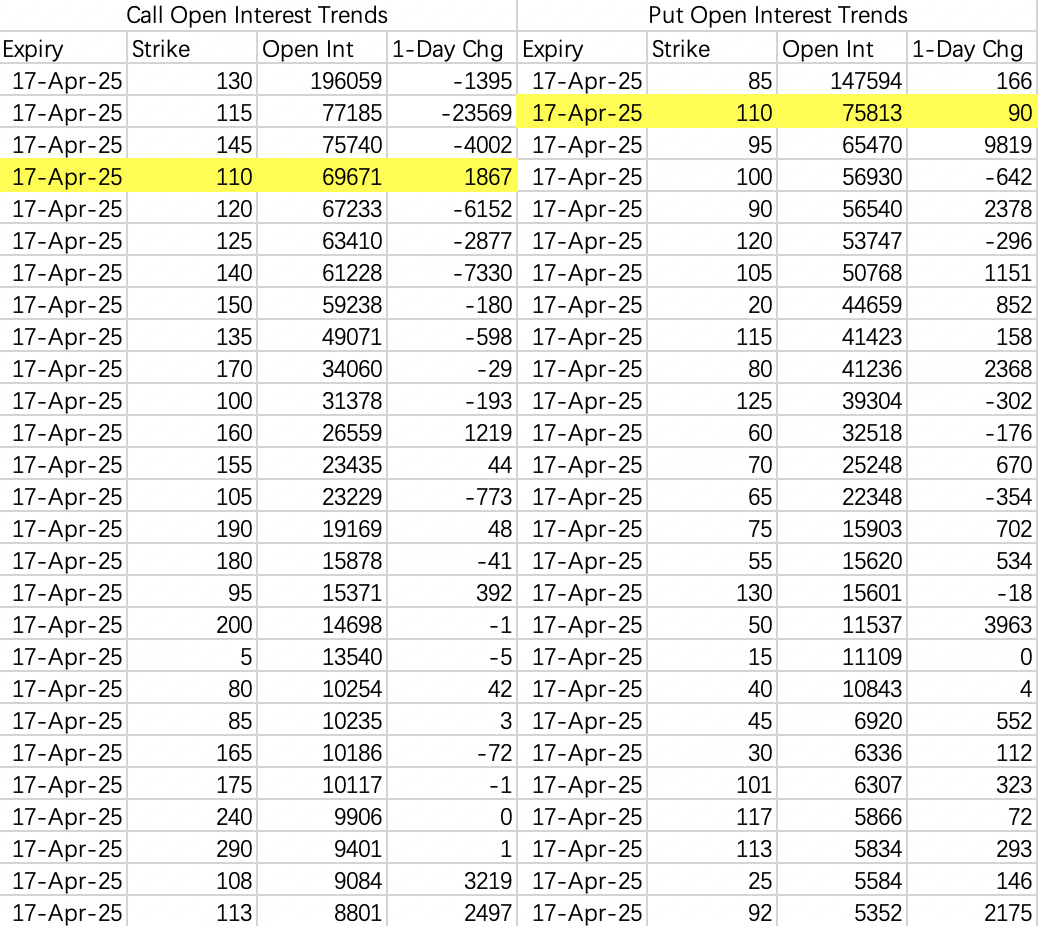

Institutions appear to be hedging for long-term scenarios. While the May and June $110 hedges seem reasonable, the September $80 strike requires further observation.

Key Takeaways:

Positive Outlook: If nothing unexpected happens, many extreme bearish puts will likely expire worthless this week.

Negative Outlook: If there are unexpected developments, the stock could continue its sharp decline. However, considering the $55 puts expiring on the 25th were closed in a hurry, it’s unlikely that the stock will drop below last week’s low.

Next Week’s Outlook:

Based on next week’s open interest, the market is expected to stabilize or improve slightly. The primary focus will be on the $110 level.

$SPDR S&P 500 ETF Trust(SPY)$

Short-Term vs. Long-Term Sentiment:

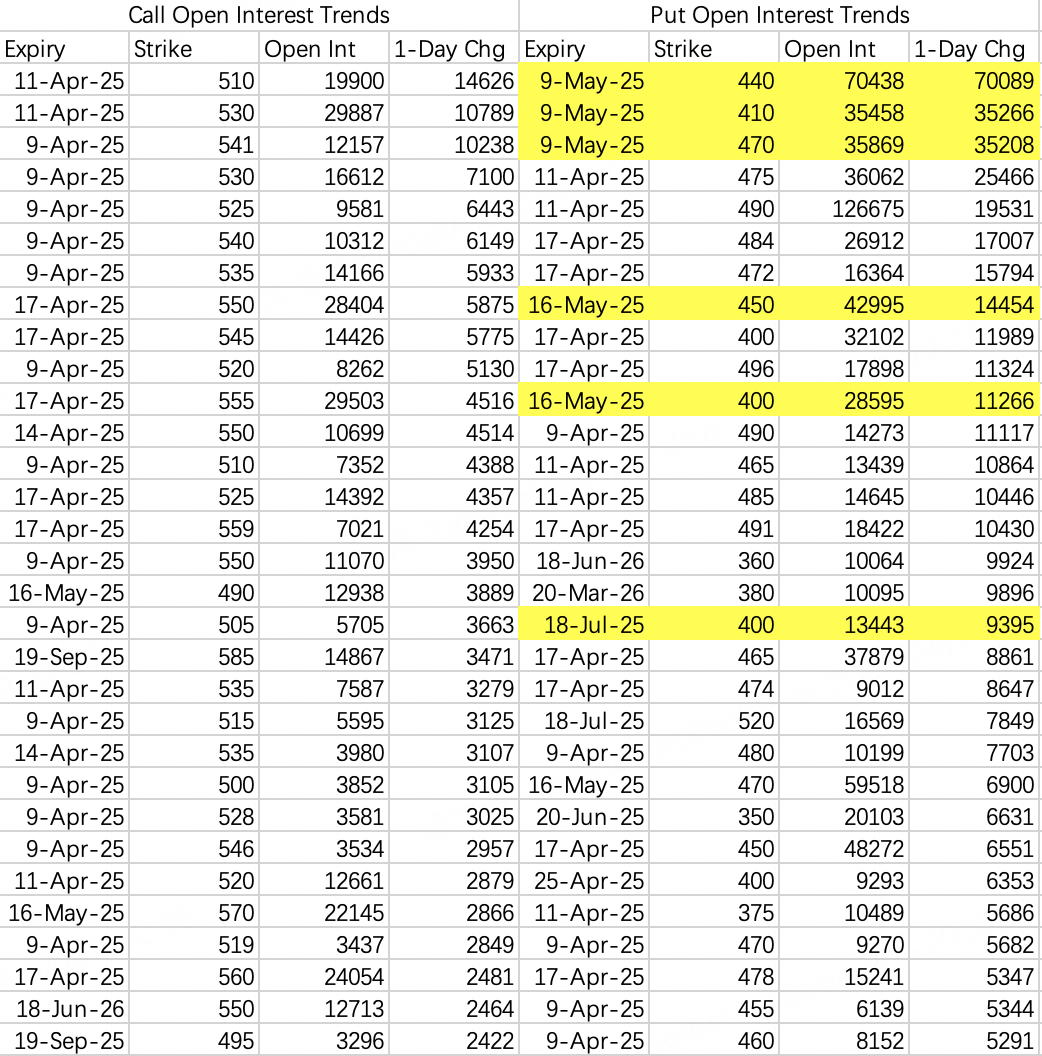

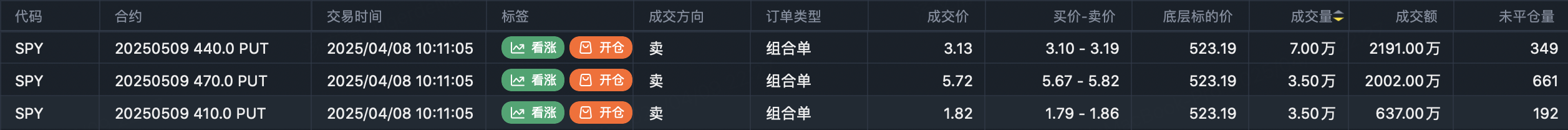

While short-term bearish sentiment has eased, long-term bearish positioning has become more aggressive.Tuesday’s Bearish Butterfly Strategy:

A notable butterfly spread was opened, betting on $SPY$ dropping below $470 by May 9, with maximum profit at $440.Buy $SPY 20250509 410.0 PUT$ (35,000 contracts)

Sell $SPY 20250509 440.0 PUT$ (70,000 contracts)

Buy $SPY 20250509 470.0 PUT$ (35,000 contracts)

$Tesla (TSLA)$

Tesla’s recent option activity doesn’t provide strong directional guidance. The bearish open interest is still dominated by speculative short-sellers. It’s sufficient to glance at the data without much concern for insider trading patterns.

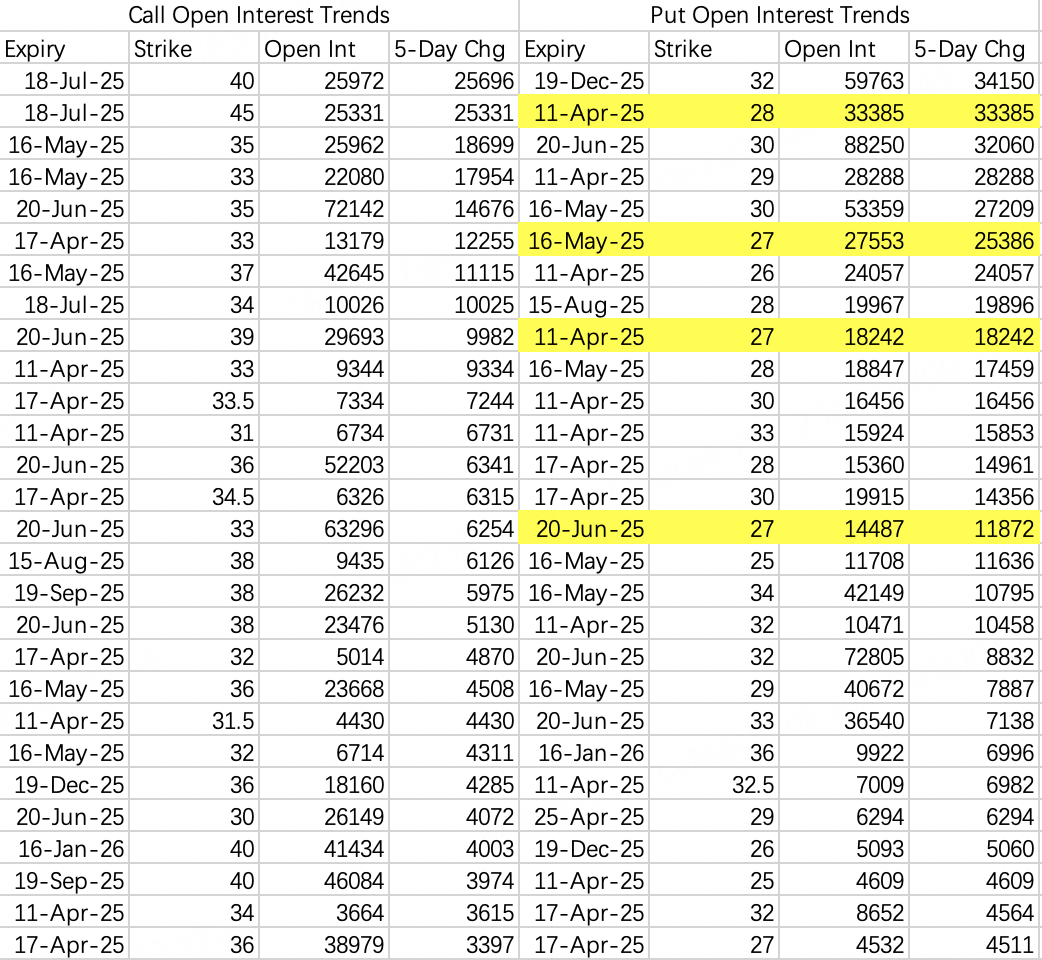

$iShares China Large-Cap ETF(FXI)$

Chinese stocks are currently at low levels, and if they continue to drop further, the next potential bottom could be around $27.

Options Outlook:

Based on current open interest, there’s little expectation of aggressive options-driven price movement over the next two months.

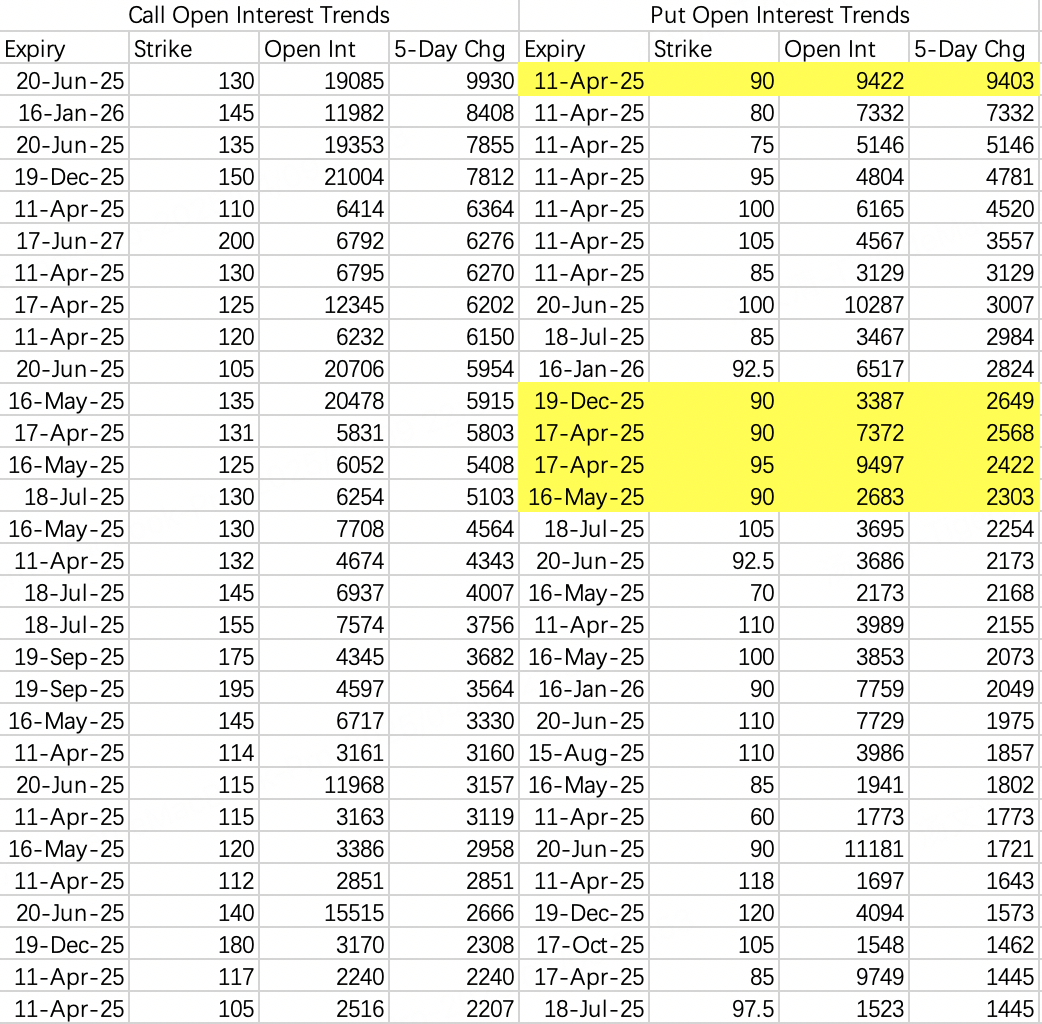

$Alibaba(BABA)$

Alibaba’s recent downside target is $90.

Comments