How should we understand the idea of "The market rebounded, but it's still unsafe"?

Wednesday was absolutely absurd—arguably the most unforgettable trading day of this year. But as long as Trump remains in office, I believe this "most" will inevitably be outdone.

At 1:24 PM on April 9th (U.S. time), Trump posted on his Twitter account, announcing that over 75 countries had contacted U.S. representatives to negotiate issues related to trade, trade barriers, tariffs, currency manipulation, and non-monetary tariffs. As a result, a 90-day suspension measure had been approved. This suspension applies to reciprocal tariffs, lowering them to 10% during this period, and it takes effect immediately.

Unsurprisingly, the market soared collectively.

This 13-hour tariff suspension announcement was essentially Trump being forced to "listen to the market" and back down. In other words, Trump folded under pressure.

Trump essentially went "all-in" at the start of the session, only to have to backtrack and soften his stance mid-game. The result? He didn't gain much and ended up exposing all his cards to the market—he's in for a wild ride over the next three years.

The most amusing part? Trump tweeted at market open, claiming it was the best time to buy DJT.

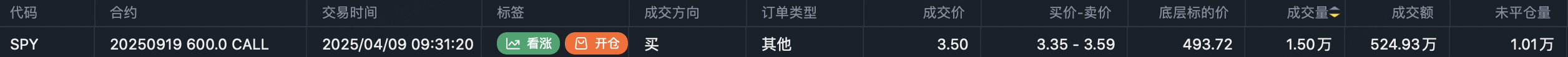

The problem is, while Trump posted the tweet at 9:37 AM, someone had already bought 15,000 contracts of SPY September 600 call options at 9:31 AM:

Do they have better foresight than the President?

This kind of move might fly because Trump is the U.S. President. If it were anyone else, the SEC would have been knocking on their door the same day.

If you regret missing the hints yesterday, don't worry—there will be plenty of opportunities like this over the next three years.

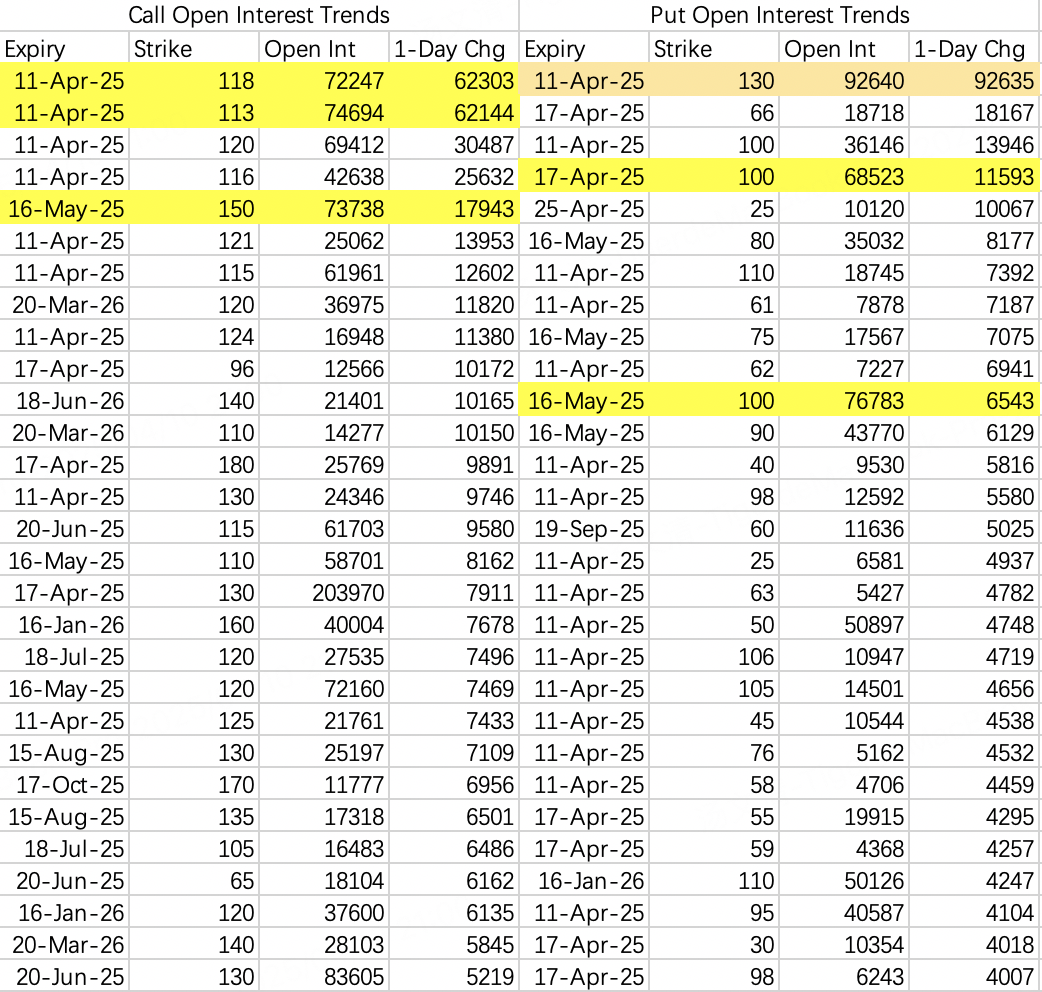

Today, our focus isn't on insider trading. After Wednesday's rebound, there was a massive order involving NVIDIA. Specifically, 92,600 contracts of this week's 130 puts were opened:

As shown in the chart, the trade happened near the close, two hours after Trump announced the tariff suspension. We can assume the trader had ample time to think things through. Moreover, since the trade didn't happen earlier, we can tentatively rule out insider trading.

What was the direction of this 130 put trade? That's right—it was a sell! In other words, this tycoon sold 90,000 contracts of this week's 130 puts.

The 130 level is deep in the money. By this Friday's close, this tycoon will very likely take over 9 million shares of NVIDIA at $130 per share. After deducting the premium income of $15.4 per share, their effective purchase price is around $115. The total transaction value? A whopping $10 billion!

Now we face the classic scenario: the tycoon has gone all-in at the table—how will everyone else react? Should they follow suit?

First, I considered that market makers probably won't give this trader too much trouble. The market will likely move as it should this week.

This person is clearly prepared to take on the shares, so they probably won't close their position early. As long as their goal isn't profit through early closure, market makers won't interfere.

For other players at the table, the significance is clear: a tycoon is making a huge purchase at the $115 level.

In terms of the purchase price, it's roughly on par with what Duan Yongping paid for NVIDIA. However, Duan Yongping simultaneously sold $120 calls while buying the stock. It remains to be seen whether this individual will follow the same strategy after taking over the shares.

Future Trends and Risks

To determine whether $115 is "too expensive," we need to consider future trends and risks.

After Wednesday's surge, institutions rolled their sell call positions to higher strikes. The upper limit for this week is now around $113–$114. As for the lower limit, before the tariff suspension was announced, the expected bottom for this week was unpredictable. However, after the suspension, the lower limit has risen to around $100. In other words, the general expectation has returned to the $100–$120 range we saw a few weeks ago.

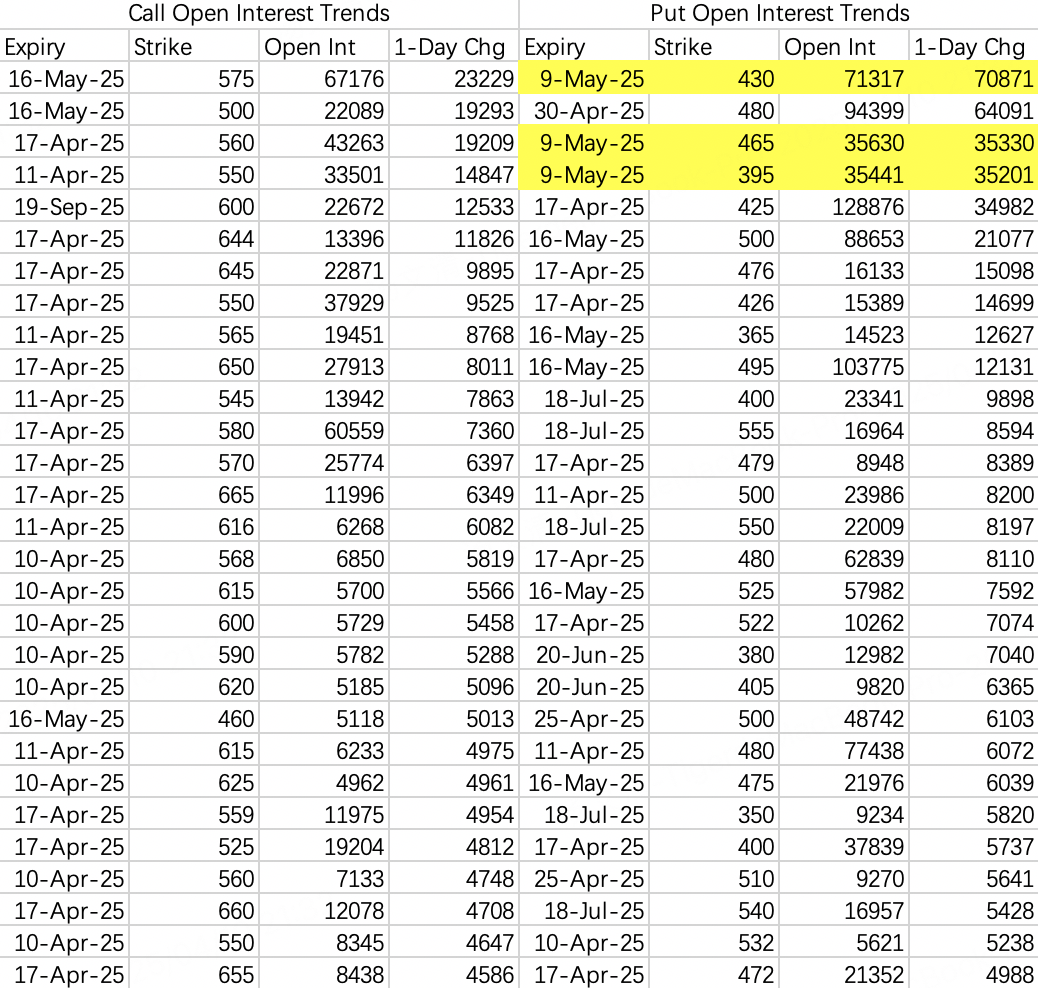

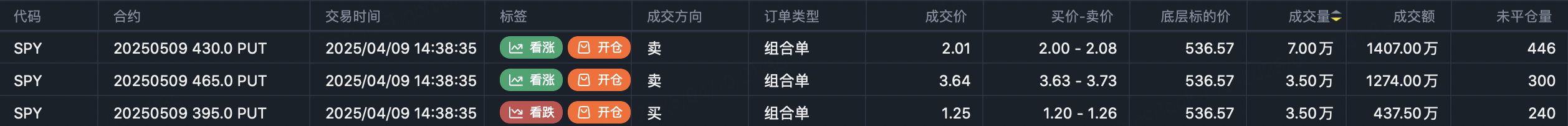

However, following the tariff suspension announcement, the market wasn't entirely bullish. Instead, there were several extreme bearish bets, such as one involving SPY.

The top bearish trade of the day was a butterfly strategy predicting SPY could drop below $465 by early May:

Why would the market hedge against an extreme drop after the tariff-related bearish news had been temporarily mitigated?

This brings us back to the point at the beginning of this article: "The market rebounded, but it's still unsafe." Trump's political goals remain unfulfilled. He only softened his stance because the market was in shambles. This reveals his lack of understanding of how his policies impact the economy and markets. Until he achieves his goals, he will likely try other policies. If those policies go as "expected," their market impact will be no less destructive than this one.

So yes, you can buy into the rebound, but don't go overboard with leverage. The shocks and surprises Trump brings to the market have only just begun.

Comments