1. Gold Assets Price Touchs ALL TIME HIGH

On April 10, the trading day, the price of the $SPDR Gold Shares(GLD)$ reached a new high.

Since the beginning of 2025, gold has been the top-performing industry in terms of price increase.

Data from Tiger Trade, Data as of April 10th 2025

Top market value stocks includes: $Newmont Mining(NEM)$, $Agnico Eagle Mines(AEM)$, $Wheaton Precious Metals(WPM)$ , $Barrick Gold Corp(GOLD)$ , $Franco-Nevada(FNV)$ $Gold Fields(GFI)$ $Anglogold Ashanti(AU)$ , $Kinross(KGC)$ $Alamos(AGI)$ $Royal(RGLD)$ and etc.

2. Reasons for the continuous rise in gold prices

A. Trade Frictions and Market Panic

Amidst the backdrop of heightened expectations of a recession in 2025, escalating trade frictions, and intensified geopolitical uncertainties, gold remains bullish in the medium to long term. Although short-term fluctuations may occur, the long-term trend continues to point upwards. Investors can allocate gold assets rationally according to their own risk preferences and seize market opportunities.

Since April 2, when President Trump signed an executive order to increase tariffs, it has triggered panic in the market. The escalation of trade frictions has led investors to worry about the economic outlook, causing a sharp decline in market risk appetite and the $Cboe Volatility Index(VIX)$ index breaking through 45.

Under such circumstances, investors have been seeking safe-haven assets, and gold, as a traditional safe-haven asset, has naturally seen its ETFs favored by capital.

B. Declining Attractiveness of the US Dollar and US Treasury Bonds

The $USD Index(USDindex.FOREX)$ fell by more than 1% on April 10, breaking below the 102 mark. Meanwhile, the yields on U.S. Treasury bonds have risen rapidly, weakening their safe-haven attributes. In contrast, the attractiveness of gold has increased significantly, with capital flowing out of assets like the dollar and U.S. Treasury bonds and into gold ETFs.

C. Central Bank Gold Purchasing Trends

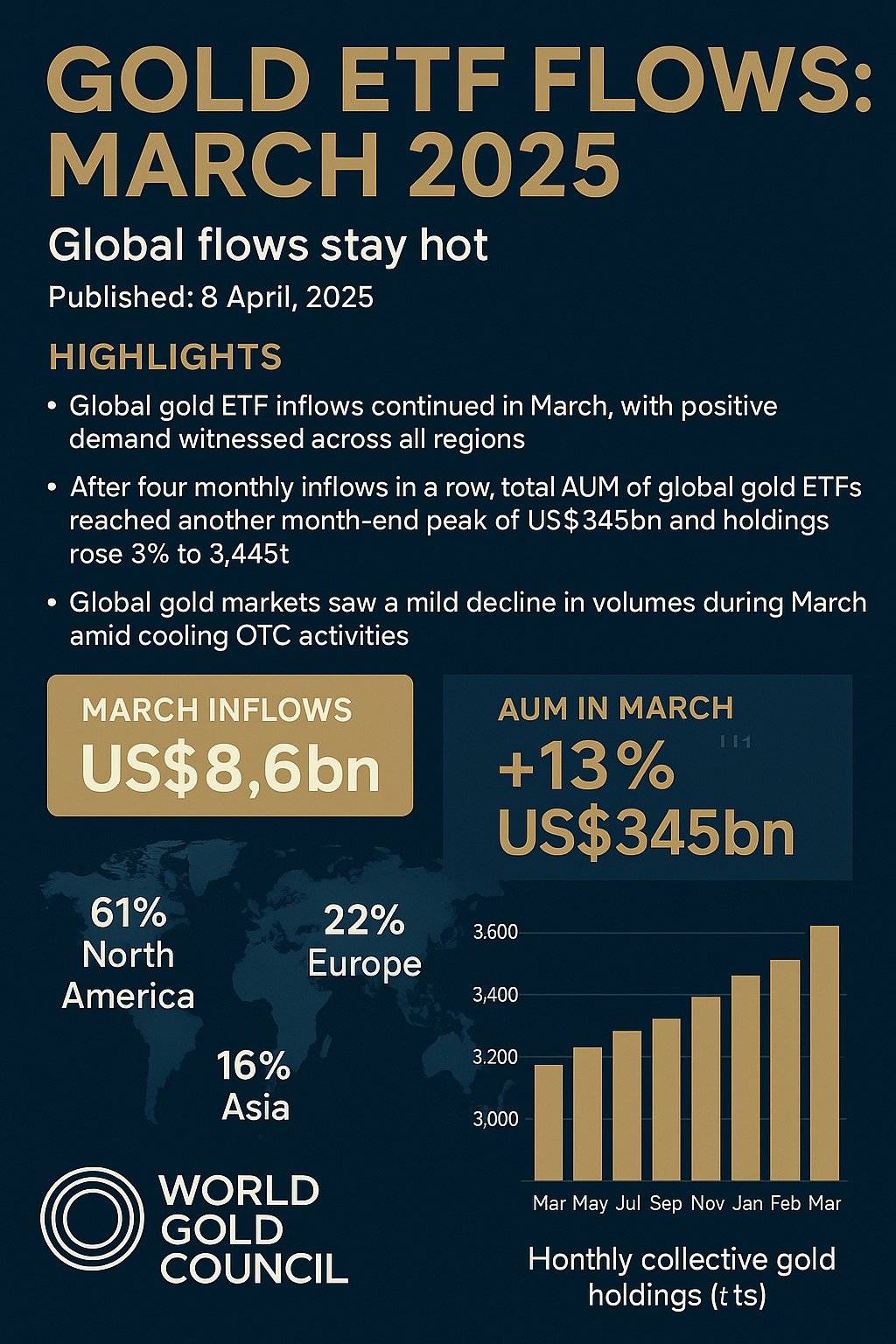

Central banks around the world have continued to expand their gold reserves for five consecutive months, providing long-term support for gold prices and enhancing investors' confidence in gold, which in turn has led to more capital flowing into gold ETFs.

D. Enhanced Market Confidence

The continuous capital inflow into gold ETFs and the rise in prices have bolstered market confidence in gold and reflected investors' concerns about current market uncertainties and their demand for safe-haven assets.

3. Future Trend Outlook

A. Call/Put Ratio Analysis,

However, as of the time of writing, on April 11, the Call/Put ratio for $SPDR Gold Shares(GLD)$ has reached 2.09. Is it time to be cautiously bullish on gold?

The Call/Put Ratio is the proportion of call options to put options, which can help us roughly gauge market sentiment and thus decide how to trade options.

Generally speaking, when the Call/Put Ratio is greater than 1: it means there are more people looking to sell, and the market expects the asset's price to drop.

When the Call/Put Ratio is very high (for example, greater than 2: it may indicate that although many people are bullish, the market might have already risen significantly and could be due for a correction.

At this point, it might be wise to be cautiously bullish and wait for a potential reversal: if you think the market sentiment is overly optimistic and a reversal is likely, you could buy put options, betting on a market decline.

But the Call/Put Ratio is just a reference and should not be relied on entirely.

It's also important to look at other indicators, such as the overall market trend, the fundamentals of stocks, or technical analysis charts, and make a decision based on a comprehensive assessment.

Based on previous analysis, with the increasing expectations of a global economic recession, escalating trade frictions, and heightened geopolitical uncertainties, gold is still expected to rise in the medium to long term.

B. Institutional Forecasts

Most institutions are optimistic about gold prices in 2025.

$Goldman Sachs(GS)$ has raised its year-end 2025 gold price forecast from $3,100 per ounce to $3,300 per ounce.

$JPMorgan Chase(JPM)$ and $Bank of America(BAC)$ both predict that gold prices will exceed $3,000 per ounce by the end of 2025.

4. Conclusion

Amidst the backdrop of heightened expectations of a recession in 2025, escalating trade frictions, and intensified geopolitical uncertainties, gold remains bullish in the medium to long term. Although short-term fluctuations may occur, the long-term trend continues to point upwards. Investors can allocate gold assets rationally according to their own risk preferences and seize market opportunities.

To be honest, it might be worth holding onto gold a bit longer.

A tool to boost your purchasing power and trading ideas with CashBoost!

Open a CBA today and enjoy access to a trading limit of up to SGD 20,000 with upcoming 0-commission, unlimited trading on SG, HK, and US stocks, as well as ETFs. Find out more here.

💰Join the TB Contra Telegram Group to Get $10 Trading Vouchers Now🎉

Comments

Great article, would you like to share it?