$KraneShares CSI China Internet ETF(KWEB)$

The level of information leakage has reached absurd proportions.

Over the weekend, news broke that the U.S. Customs and Border Protection (CBP) announced a new tariff rule on April 11th (Eastern Time). This rule exempts categories such as automatic data processors, computers, communication devices, displays and modules, and semiconductors from the "reciprocal tariffs" imposed by the Trump administration.

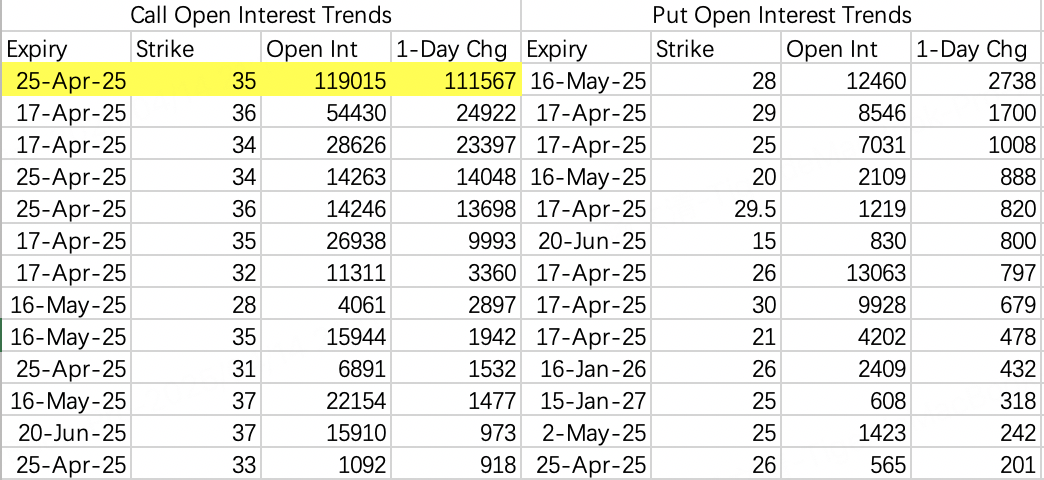

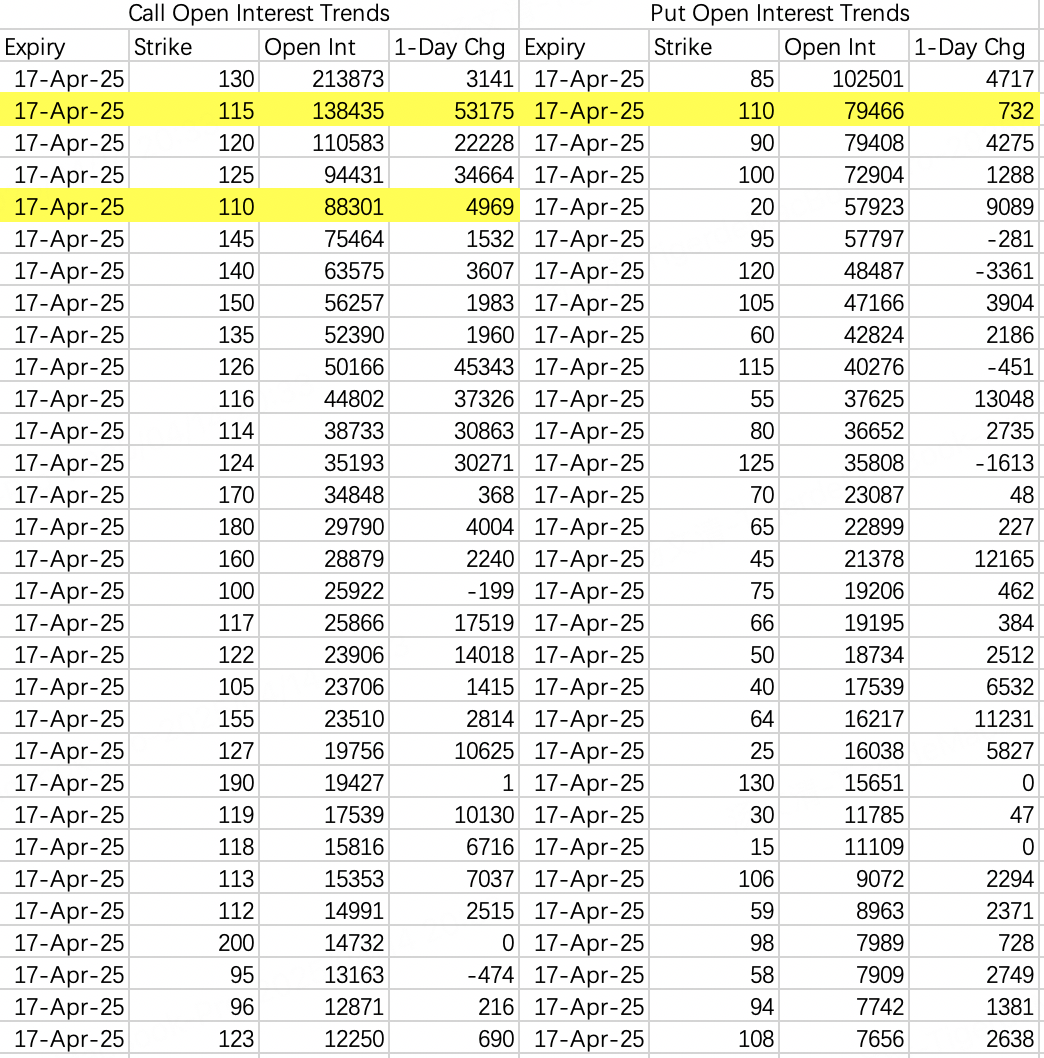

However, prior to the official announcement, on Friday, April 11th, unusual activity in KWEB options was observed. A massive order for 110,000 contracts of $KWEB 20250425 35.0 CALL$ was opened, with a total transaction value of over $5 million.

It appears that the large order was split into two transactions. The first purchase occurred during regular trading hours, about an hour before the close, and was executed on the open market. The second purchase took place after-hours, undoubtedly another institutional order. The after-hours price was outside the bid-ask range, so the software may have incorrectly labeled it as a sell. However, upon further investigation, it was confirmed to be a buy order.

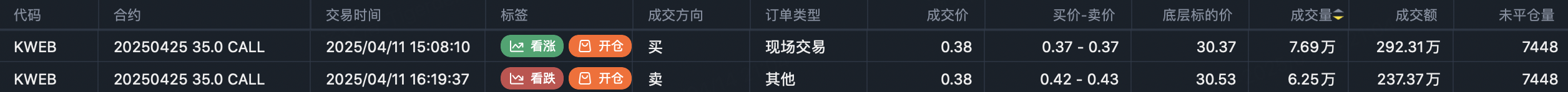

On the same Friday, similar unusual activity was seen in Alibaba call options. Someone opened positions for $BABA 20250620 120.0 CALL$ and $BABA 20250718 125.0 CALL$ , with 17,800 and 10,000 contracts respectively, all purchased as buy orders.

Although KWEB's massive 110,000 call order is a bold move given the short time to expiration, it does leave some room at the top based on the overall open interest. There may be opportunities to participate cautiously.

Looking back, last week's 130 sell put on NVIDIA also seemed to be a well-prepared move. However, it ended up being shaken out by the market makers, and no profits were realized. This highlights that even having insider information doesn't necessarily reduce the psychological cost of holding positions. When facing market makers who are even better at bluffing, there's often no chance for a proper exit.

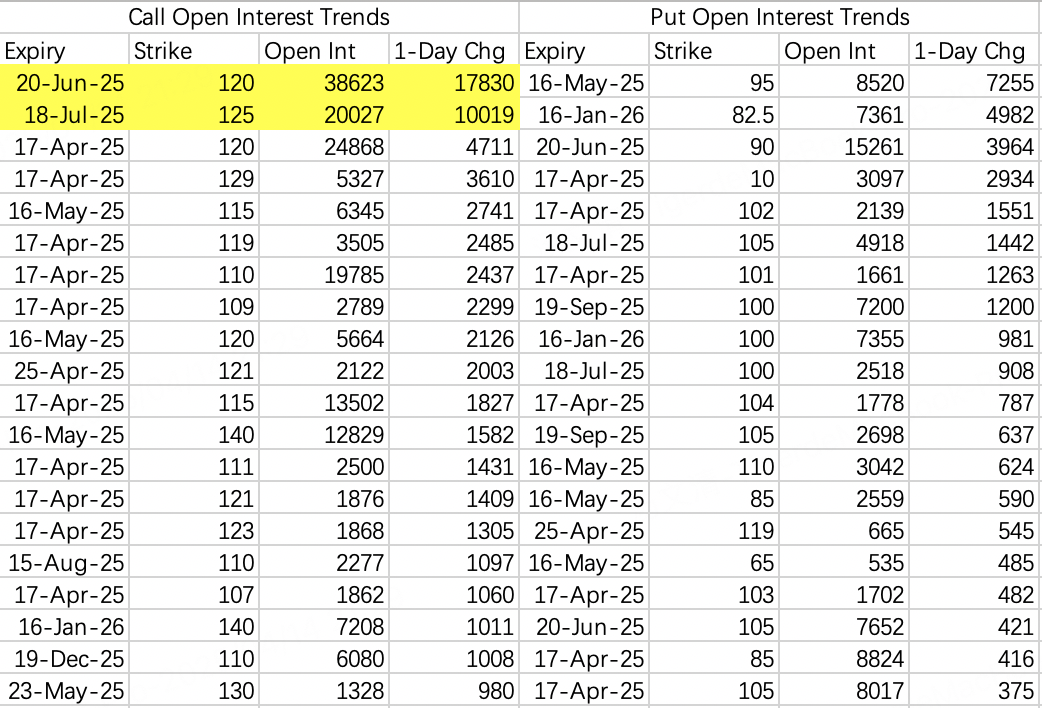

Despite the recent string of positive news, risks remain unchanged. For call options, institutions are selling calls in the 114–117 range while hedging with calls in the 124–127 range. Theoretically, this gradient makes short squeezes and sharp rallies possible. However, the pessimism in put option activity suggests a need for caution. It might be wise to reduce positions and add hedges.

With April monthly options expiring this week, the ideal closing price range is projected to be 100–110.

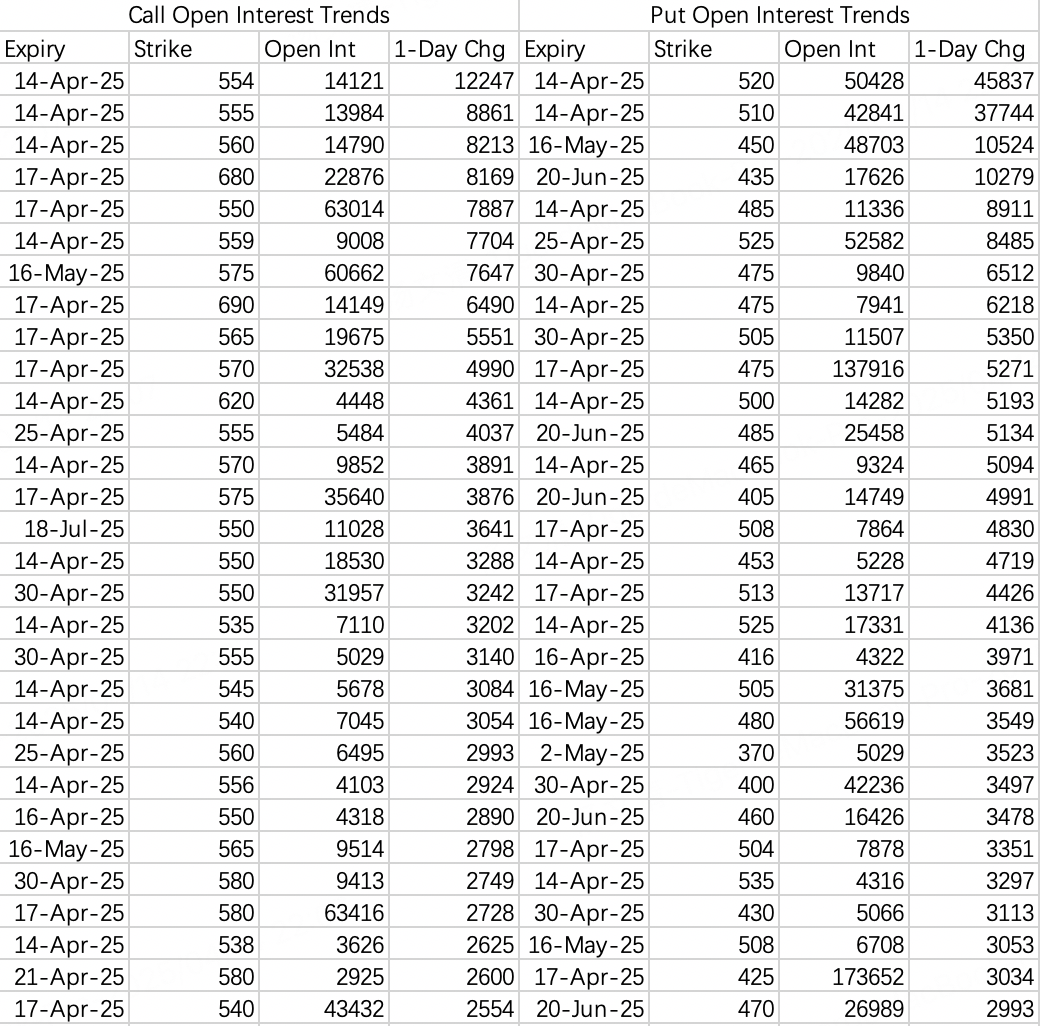

Currently, there are numerous large bearish trades in SPY, focusing on put spreads and collar strategies. For instance:

Buying the 500 puts while selling the 480 puts.

Selling the 560 calls, buying the 535 puts, and selling the 475 puts.

The market seems to be actively preparing for a potential second bottom.

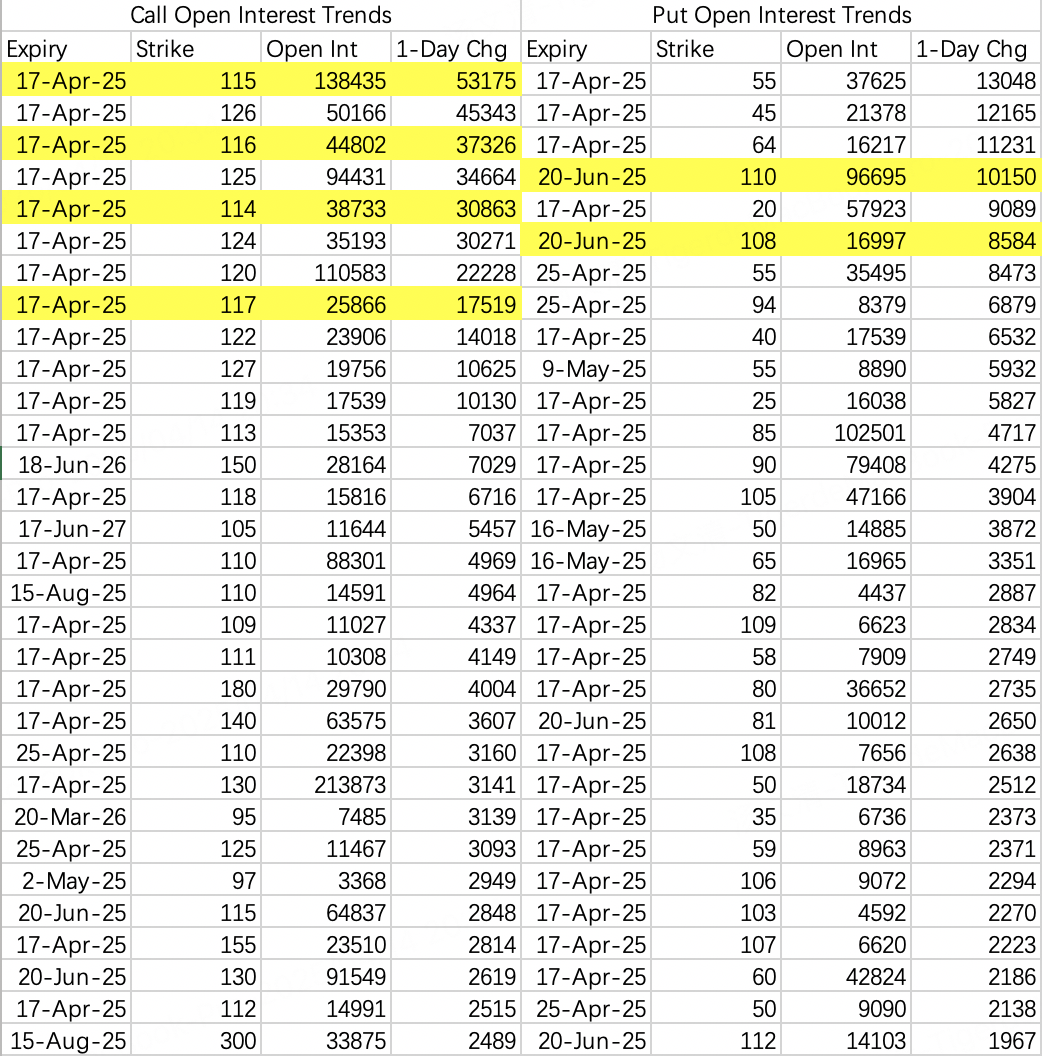

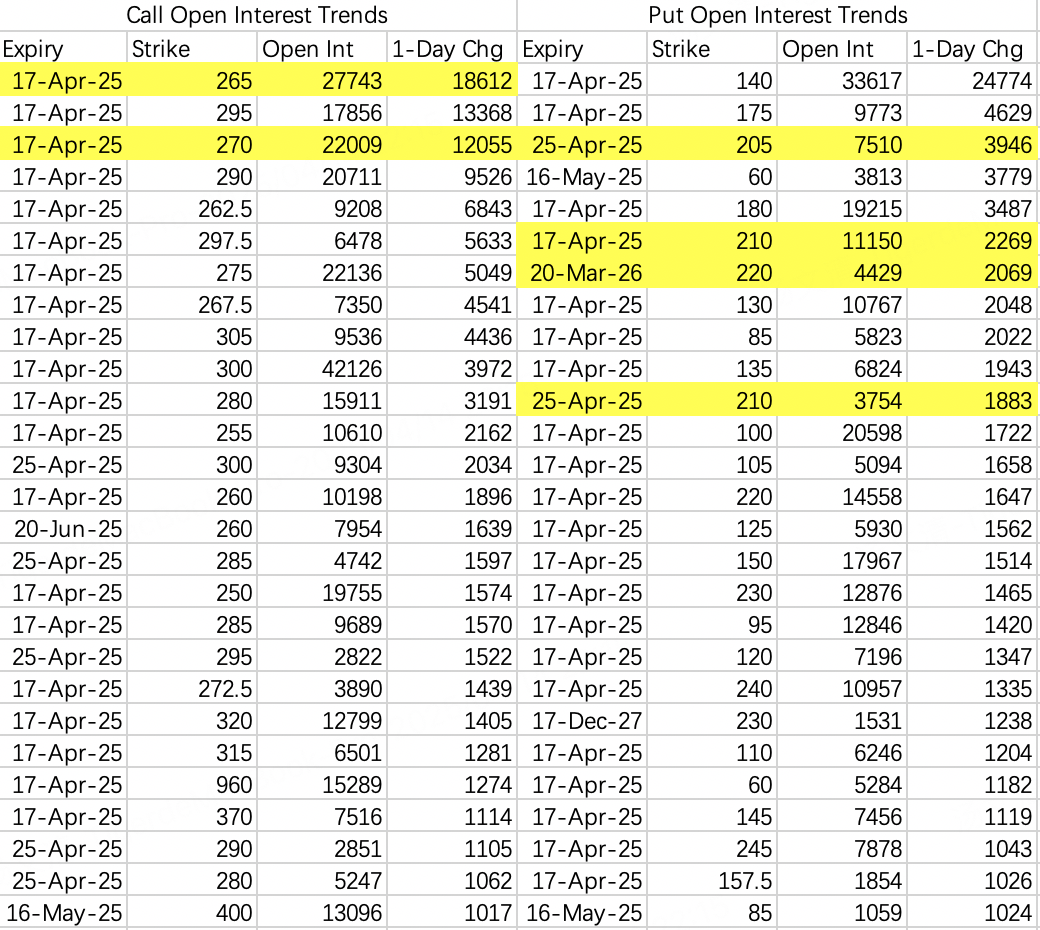

Institutions have been selling calls in the 265–270 range while hedging with calls in the 290–295 range. Monday is likely to mark the high point for the week.

The bearish positions in Tesla are as grim as those in NVIDIA. For downside targets, you can refer to the previous lows.

Comments