Streaming media giant Netflix will release its Q1 financial report for fiscal year 2025 after the U.S. stock market closes on April 17, Eastern Time (early Friday, April 18, Beijing time).

Institutions generally expect that Netflix is expected to achieve revenue of US $10.508 billion in 2025Q1, a year-on-year increase of 12.14%; Earnings per share are expected to be $5.728, an increase of 8.49% year-on-year, higher than $5.28 per share in the same period last year.

Under the tariff war in the past period, Netflix's stock price has fallen by 12% from its February high, but compared with the Big Seven, its stock price is relatively "resilient". This is mainly because the tariff war mainly affects manufacturing and import and export trade, while Netflix's main business is online streaming media services, which belongs to the technology and entertainment industries and relies less on international trade, so tariffs have less impact on it.

As of the end of 2024, Netflix has 301.63 million users worldwide, with a net increase of 18.91 million subscribers in Q4, much higher than market expectations of 9.18 million. The net new users throughout the year were 41 million, setting a new record in the company's history.

However, Netflix will not disclose the number of subscribers for the first time in this financial report, and the focus of the market will shift to its revenue growth and profitability, followed by the expansion of its advertising business.

Netflix's strategic focus on content investment and monetizing its large user base is expected to yield positive results, with the company expecting content investment of $18 billion in 2025 and free cash flow of $8 billion.

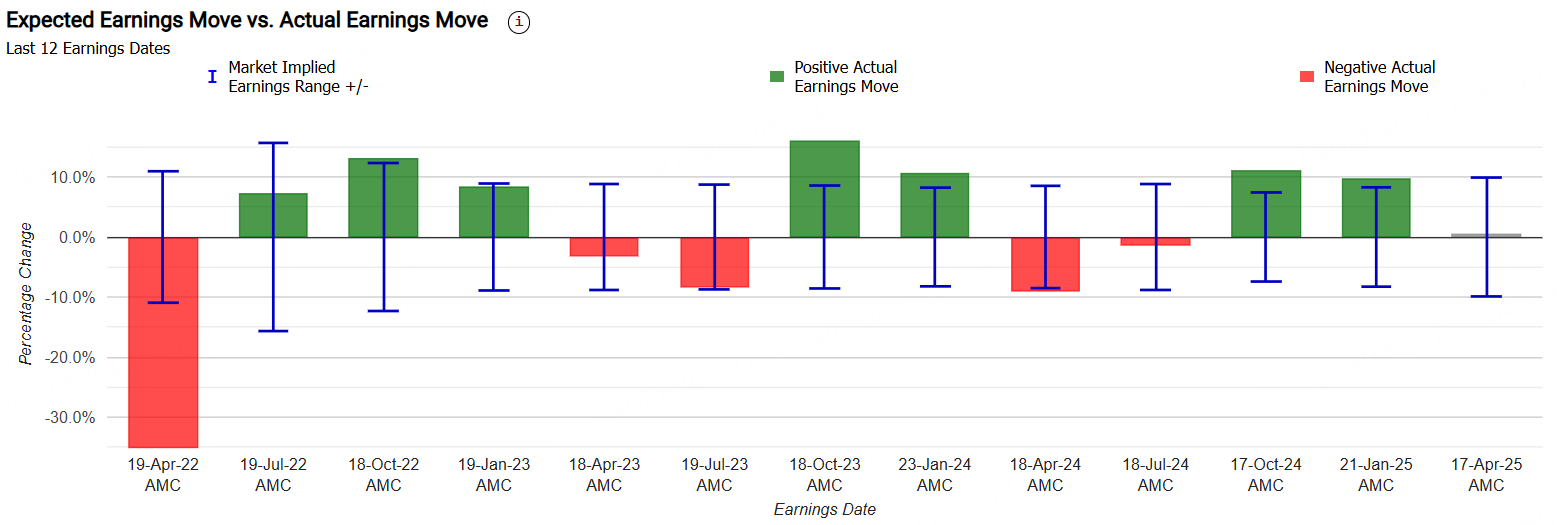

Netflix Earnings Season Performance Review

According to Market Chameleon, backtesting the past 12 quarterly results days, the average change in Netflix's stock price on the day of results release was±11.1%, the maximum increase is+35.1%, the minimum is+1.5%。

Currently, Netflix's implied changes are±10.59%, indicating that the options market bet on its single-day increase and decrease of 10.59% after its performance; In comparison, Netflix's post-performance average stock price change in the first four quarters was±7.8%, the market expects that the stock price volatility will increase after this performance.

In view of the upcoming Netflix financial report, investors can use the wide straddle strategy to trade.

What is the wide straddle strategy

In long wide straddle options, investors buy both out-of-the-money call options and out-of-the-money put options. The strike price of a call option is higher than the current market price of the underlying asset, while the strike price of a put option is lower than the market price of the underlying asset. This strategy has huge profit potential because the call option theoretically has unlimited upside if the underlying asset price rises, while the put option can make a profit if the underlying asset price falls. The risk of the trade is limited to the premium paid for these two options.

An investor shorting a wide straddle sells an out-of-the-money put and an out-of-the-money call at the same time. This approach is a neutral strategy with limited profit potential. Shorting a wide straddle option is profitable when the underlying stock price is trading within a narrow range between break-even points. The maximum profit is equal to the premium obtained by selling two options minus the transaction cost.

Netflix short-selling wide straddle strategy case

Stock Netflix is currently trading at $931. Investors can implement the short wide straddle strategy by:

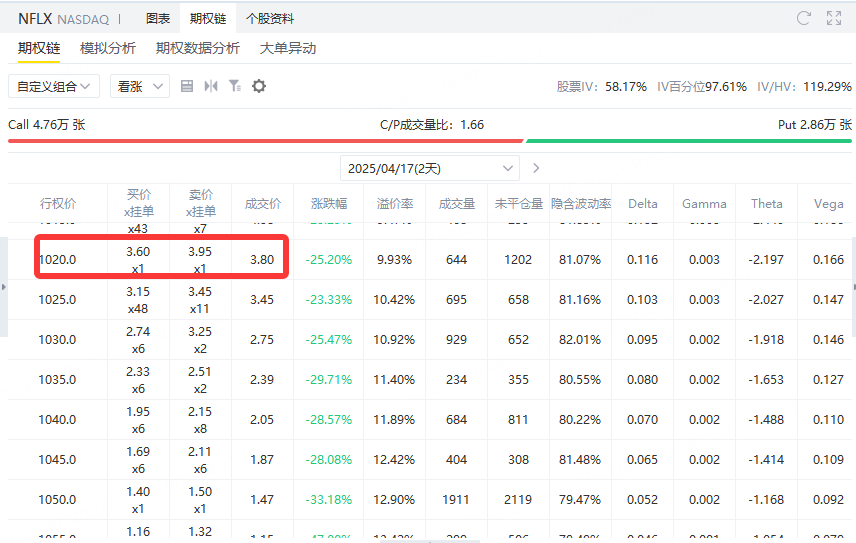

Sell a call option with a strike price of $1,020, and premium is $380.

Sell a put option with an exercise price of $860, and premium is $801.

Sell oneThe exercise price is 1020OfCall Options, collect premium$380

Sell oneThe exercise price is 860OfPut Options, collect premium$801

Total revenue (maximum profit) = $380 + $801 = $1,181

Maximum profit

Occurred inWhen NFLX closes between 860 and 1020, neither option will be exercised.

Maximum Profit = premium Received = $1,181

Maximum loss

TheoreticallyUnlimited, because both call options and put options are sold naked.

NFLX & gt; 1020, there is no upper limit to upward loss

NFLX & lt; 860, there is no upper limit for downward losses (although it is not as "bottomless" as upward)

Short wide straddle suitable forOn the eve of the financial report release and before the landing of major eventsCloth warehouse. For example: investors do not expect extreme trends after Netflix's financial report, andImplied volatility at a high level, after the incident landedVolatility falls back, can harvest a "volatility premium". If you judgeThe target will maintain fluctuations within a certain range for some time to come(For example, Netflix is consolidating between 860 and 1020), short wide straddle is an ideal choice. This strategy is also very effective in a market where the underlying price is "stable but not calm".

Comments