Fellow traders, there’s more drama to watch.

Someone has placed a massive bet that chip stocks won’t fall below their previous lows before April 25th. Specifically, the trades involve selling $SMH 20250425 175.0 PUT$ , $TSM 20250425 130.0 PUT$ , and $MU 20250425 60.0 PUT$ . The positions are for 120,000 contracts, 70,000 contracts, and 50,000 contracts, respectively.

If this isn’t based on insider information, then something’s definitely fishy.

However, as my regular readers know, such blatantly targeted large trades are like waving cash in front of market makers—they’re irresistible bait.

It’s possible that chip stocks really won’t fall below their previous lows before April 25th, but staying just a dollar or two above the lows won’t provide much comfort either. For the next two weeks, retail traders like us should focus on risk management.

Let’s break down these trades.

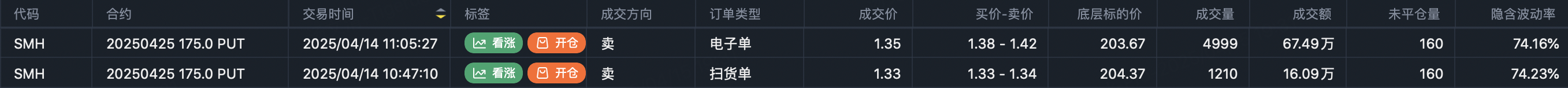

$VanEck Semiconductor ETF(SMH)$

The trade: Selling $SMH 20250425 175.0 PUT$ , opening 120,000 contracts with a total transaction value of over $16 million.

To be honest, I don’t quite understand this strategy—it’s both overly optimistic and overly pessimistic. Chip company management teams are hesitant to give clear growth forecasts for this year during earnings calls, so how can anyone confidently say the previous low is the bottom?

On the other hand, using the previous low as the basis for selling puts suggests that expectations for this earnings season are downright terrible.

$Taiwan Semiconductor Manufacturing(TSM)$

The trade: Selling $TSM 20250425 130.0 PUT$ , opening 70,000 contracts with a total transaction value of over $9 million.

It’s hard not to suspect that the TSM strategy comes from the same trader as the SMH one. If that’s the case, I’m worried about their risk management.

TSMC’s earnings report is unlikely to be great—this is a widely held consensus. Currently, the market is expecting annual revenue growth to fall below 20%. Institutions are selling calls at the 165 strike and hedging with calls at 177.5, implying a projected upside of less than 5%.

The likelihood of a drop seems higher, so setting the lower bound at the previous low isn’t unreasonable. But with such expectations of a drop, wouldn’t selling calls or using a buy-put-sell-put strategy be a better approach?

$Micron Technology(MU)$

The trade: Selling $MU 20250425 60.0 PUT$ , opening 50,000 contracts with a total transaction value of over $5 million.

This trade seems to be part of the same plan as the SMH and TSM trades. I initially thought the trader would choose AVGO, but they opted for the memory chip company MU instead.

$Apple(AAPL)$

On a more positive note, there was a bullish options strategy involving Apple on the same day. Someone executed the following trades:

Bought $AAPL 20250718 230.0 CALL$ , opening 13,000 contracts.

Sold $AAPL 20250718 250.0 CALL$ , opening 7,000 contracts.

Sold $AAPL 20250815 280.0 CALL$ , opening 7,000 contracts.

This strategy suggests the trader is bullish on Apple and expects it to rise above $230 before July, reflecting optimism about its upcoming earnings season.

However, there’s an issue with the $AAPL 20250815 280.0 CALL$ data—it shows an open interest of 130,000 contracts, but only 20,600 contracts were traded yesterday with no after-hours activity. It’s unclear who will ultimately take responsibility for this discrepancy.

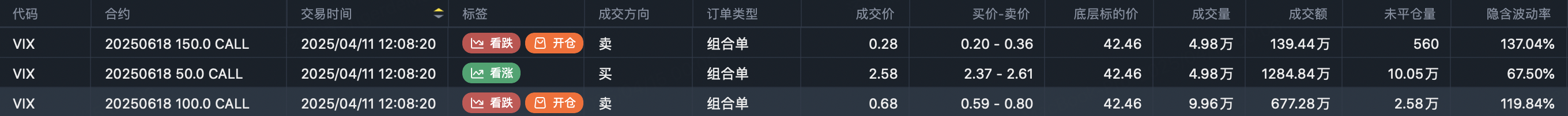

$Cboe Volatility Index(VIX)$

In the current market environment, Apple’s bullish trades don’t necessarily mean much. After all, someone placed a butterfly strategy on the VIX, aiming to profit if it spikes above 50 by mid-June, with maximum profits at 100:

Bought $VIX 20250618 50.0 CALL$ , 49,800 contracts.

Bought $VIX 20250618 150.0 CALL$ , 49,800 contracts.

Sold $VIX 20250618 100.0 CALL$ , 99,600 contracts.

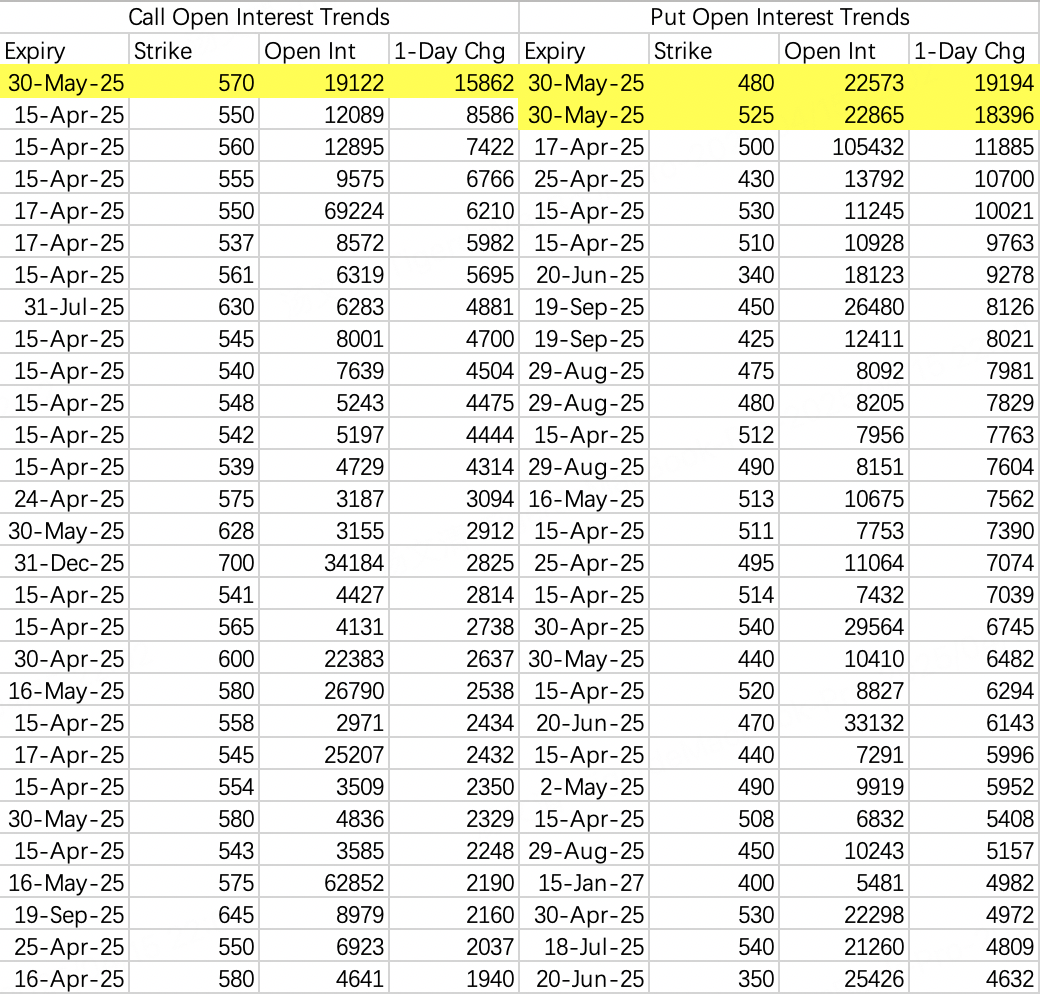

$SPDR S&P 500 ETF Trust(SPY)$

On Monday, large bearish trades in SPY included a straightforward and cost-effective strategy:

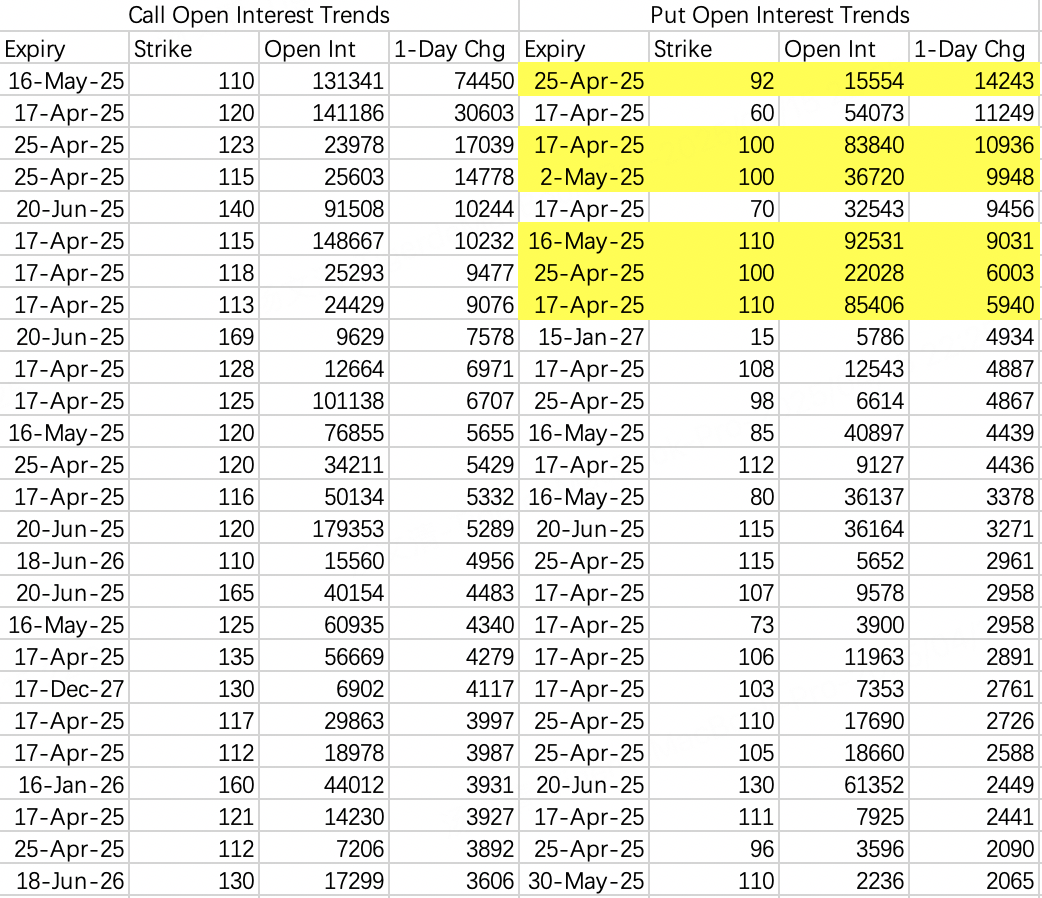

$NVIDIA(NVDA)$

Since there’s a sell-put strategy on SMH, you’d expect NVIDIA to have similarly high bearish open interest, right?

Surprisingly, the top bearish trade was a buy-dominated $NVDA 20250425 92.0 PUT$ . While the strike price isn’t below the previous low of 86, it’s not far off.

$Wal-Mart(WMT)$

On a related note, $WMT 20250620 80.0 PUT$ opened 16,000 contracts. Based on transaction prices and spreads, the trade is most likely a buy rather than a sell.

Finally, the $KWEB 20250425 35.0 CALL$ trade from last Friday saw 50,000 contracts closed on Monday, possibly because the performance didn’t meet expectations.

Conclusion: Brace for a Tough Earnings Season

Overall, this earnings season has extremely low expectations. Traders should prioritize risk management, reduce leverage, and prepare cash to pick up bargains during potential sell-offs.

Comments