On April 15, local time, the U.S. Department of Commerce announced that NVIDIA H20, AMD MI308 and similar types of AI chips have all added new Chinese export licensing requirements.

A spokesman for the U.S. Department of Commerce said:"The U.S. Department of Commerce is committed to implementing Trump's directives and safeguarding our national and economic security."

NVIDIA revealed that the U.S. government informed them on April 9 that H20 chips require a license to be exported to China. On April 14, it further informed NVIDIA that this regulation will be implemented indefinitely.

It's not clear how many such permits the U.S. government will issue, but it certainly won't be many.

$Nvidia (NVDA) $Admit that H20 exports to China are restricted, and it is expected that it will face losses of at least $5.5 billion.

NVIDIA H20 is the most exported AI chip to China, with sales increasing by more than 50% every quarter. It is believed to have contributed tens of billions of dollars in revenue to NVIDIA, while giants such as Tencent and Byte have purchased in large quantities.

Investors who are uncertain about Nvidia's prospects at this time had better use options to buy insurance for themselves and preserve the fruits of victory.

Lock in losses at low cost and beat downtrend (leading strategy case)

In the face of a falling market, investors usually want to buy put options to "insure" stocks, but usually the insurance cost is too high. Using the Collar option strategy, you can obtain insurance at "zero cost" or even "negative cost". It's so simple to control risks.

To protect the downside risk of stocks, there is a strategy of buying put options (Protective Put), and to reduce the cost of holding stocks, you can sell Covered Call options (Covered Call). In order to take care of both, Collar options-this new strategy was born.

The operation method of collar option is to buy an out-of-the-money put option as insurance on the premise of holding stocks, and at the same time sell an out-of-the-money call option to pay the cost of insurance. This is equivalent to putting a Collar on the stock, and the income of the stock is locked in it, hence the name of the Collar option. The collar option is in fact a combination of Protective Put and Covered Call, which limits the risk of downside at the expense of removing some of the possibility of upside profit.

Nvidia Collar Options Strategy Case

Suppose an investor holds 100 shares of Nvidia with a current price of $112. The investor is not sure how the price will change in the near future and wants to buy an insurance policy for his position. You can use the collar strategy.

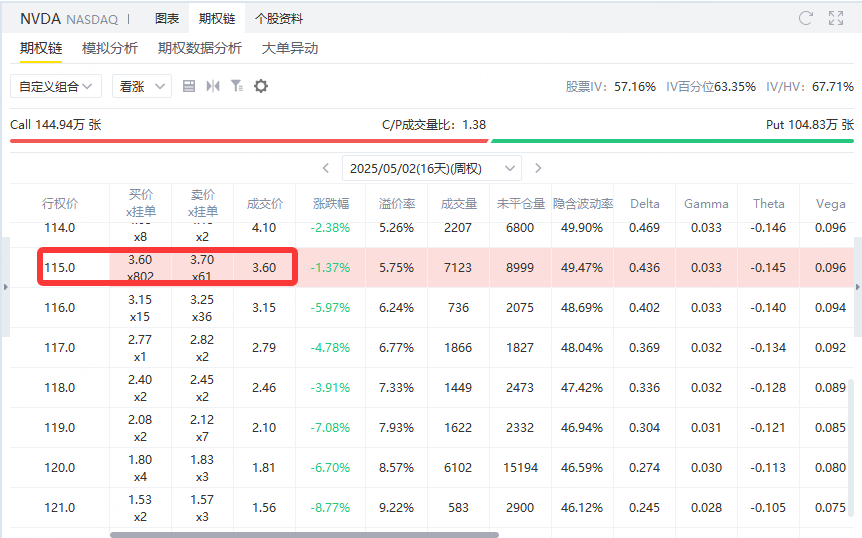

In the first step, investors can sell a call option with an exercise price of $115 and an expiration date of May 2 at a price of $3.6, earning $360.

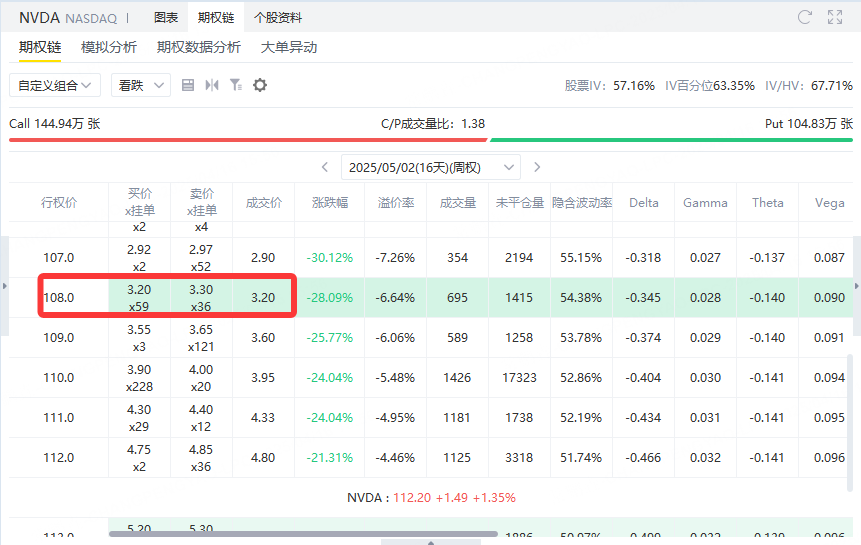

In the second step, you can also buy a put option with an exercise price of $108 and an expiration date of May 2 at a price of $3.2 (costing $320).

Strategy composition

Stocks held: 100 shares of Nvidia, cost price $112/share

Sell a call option: The exercise price is US $115, and the option premium is US $3.6/share

Revenue = $3.6 × 100 = $360

Buy a put option: The exercise price is US $108, and the option premium is US $3.2/share

Spend = $3.2 × 100 = $320

Net option income: $360 (Call)-$320 (Put) = $40

This equates to $0.40 in net income per share

This composition is the basic structure of the collar strategy (collar), that is, the income obtained by selling call options is used to partially offset the cost of buying put options, thereby providing downward protection for the position while giving up part of the upward income.

2. Profit and loss analysis

(1) When the stock price is higher than $115

Call Options: When the stock price exceeds $115, the buyer will exercise the call option, and you must sell the stock at $115/share; Therefore, the upside return of the stock is "capped".

Calculate profit and loss:

Stock trading gain = sell price $115-cost $112 = $3.00/share

Plus net option income = $0.40/share

Total surplus= 3.00 + 0.40 = $3.40/share

conclusion: No matter how much the stock rises, it can only make a profit of up to $3.40 per share.

(2) When the stock price is between $108 and $115

Calls and putsBoth expired because the stock price did not exceed $115 or fall below $108.

Calculate profit and loss:

Profit and Loss = Final Price of Stock-$112 (Cost) + Net Option Income $0.40

For example: if the stock closes at $112, earnings/loss per share = 112-112 + 0.40 = $0.40; If the stock closes at $110, profit/loss = 110-112 + 0.40 =-$1.60/share.

conclusion: Profit and loss will change linearly with the stock price.

(3) When the stock price is below $108

Put Options: When the stock price falls below $108, you can exercise a put option to sell the stock at $108/share, thus limiting your losses.

Calculate profit and loss:

Stock trading loss = $108 (exercise price)-$112 (cost) =-$4.00/share

Plus net option income = $0.40/share

Total loss=-4.00 + 0.40 =-$3.60/share

conclusion: No matter how sharply the stock falls, the maximum loss is fixed at $3.60 per share.

3. Summary

Maximum profit: $3.40 per share (when the stock price is ≥ $115)

Maximum loss:-$3.60 per share (when stock price ≤ $108)

This collar strategy not only provides downside protection for the position (by buying put options to ensure that the stock price will not cause greater losses when the stock price falls below $108), but also gains a certain income by selling call options to offset the cost, but at the same time, it also limits the upper limit of earnings when the stock price goes up ($115). In the case of uncertainty about the near-term price movement, this strategy allows investors to clearly know the worst and best profit and loss levels, thus enabling risk management.

Comments