$VanEck Semiconductor ETF(SMH)$

Yesterday, we mentioned in our article that someone made a big move—selling 120,000 contracts of the $SMH 20250425 175.0 PUT$ , which is a “sell put” strategy. Literally speaking, this means he believes SMH won’t break below its previous low before April 25.

But here’s the question: if you rewind to before Tuesday, was this strategy really in line with the current trend? New options traders probably think it’s fine, but seasoned players might raise an eyebrow after seeing this.

Then on Tuesday, there was another big trade—44,000 contracts opened on the $SMH 20250425 175.0 PUT$ , but this time it was on the buy side, i.e., buying puts to short SMH, which was the other side of Monday’s trade.

Theoretically, both the “buy 175 put” and the “sell 175 put” trades could make money, but in practice, buying the put seems more reasonable.

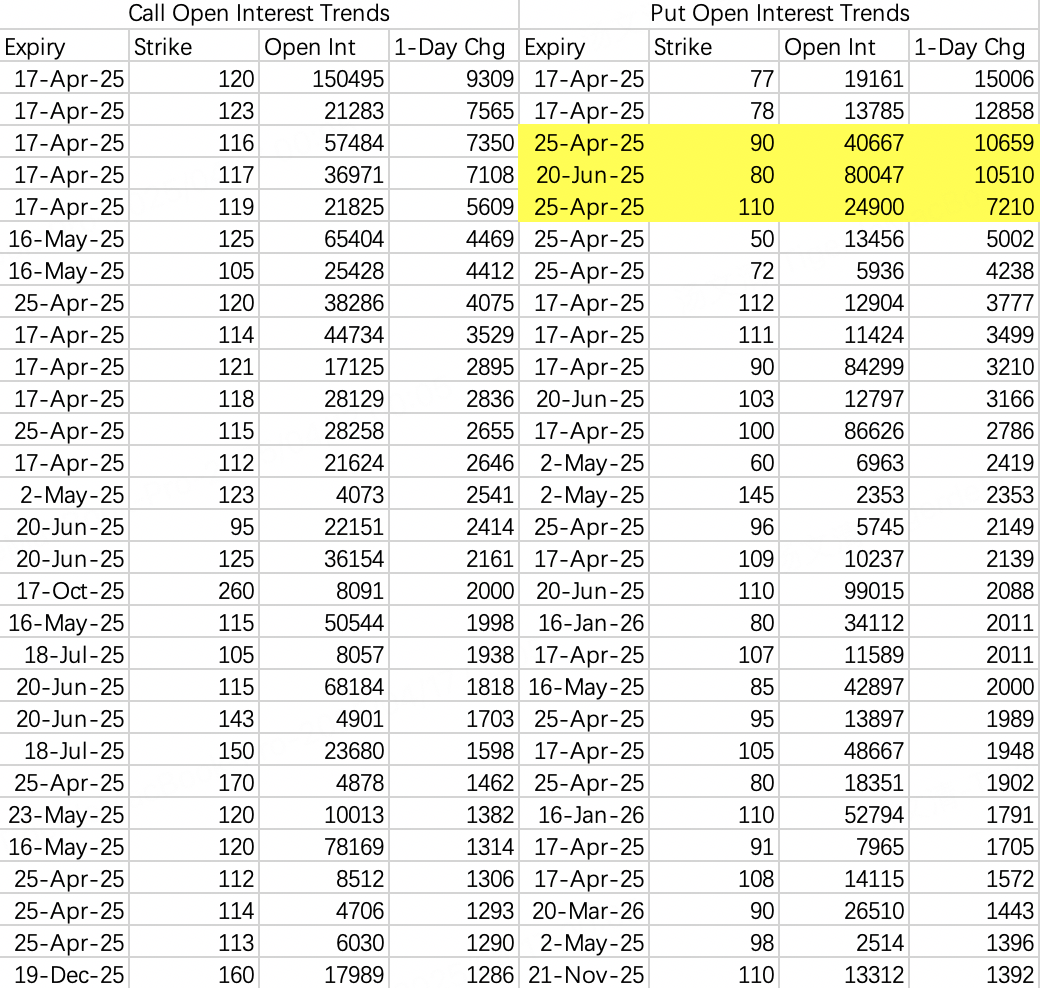

$NVIDIA(NVDA)$

Nothing special to say about the bullish opening trades. For the bearish side, next week’s expiring $90$ and $110$ puts are roll-down bearish positions: $NVDA 20250425 90.0 PUT$ and $NVDA 20250425 110.0 PUT$ . Everyone’s pretty aware of the recent negative sentiment.

There was also a sell put at $80$, $NVDA 20250620 80.0 PUT$ , with 10,000 contracts opened. At least it’s not a buy put at $80$, but to be honest, the outlook for selling puts at $80$ isn’t great either.

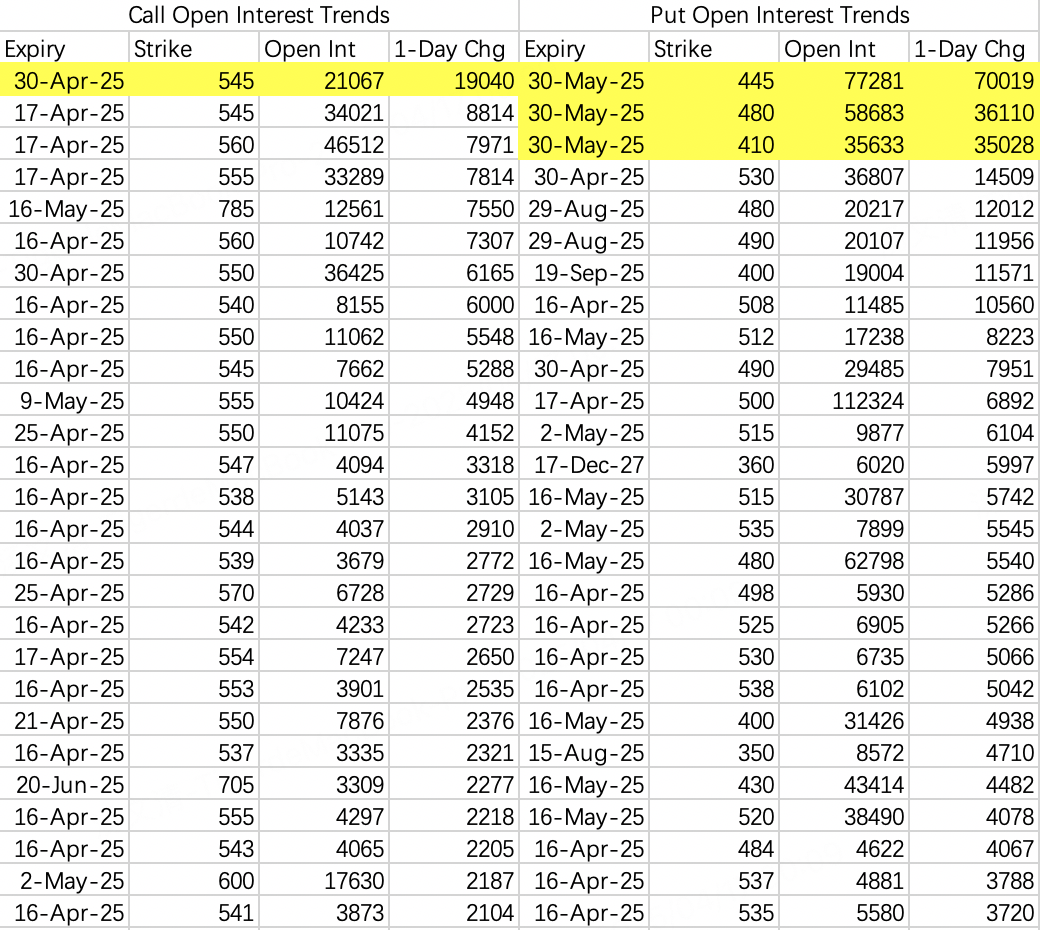

$SPDR S&P 500 ETF Trust(SPY)$

On the bullish side, there was a covered call sell at $545$—$SPY 20250430 545.0 CALL$ . On the bearish side, there are new positions expecting a big pullback by the end of May, possibly down to below $480$. Hard to say if this refers to a major correction during this earnings season.

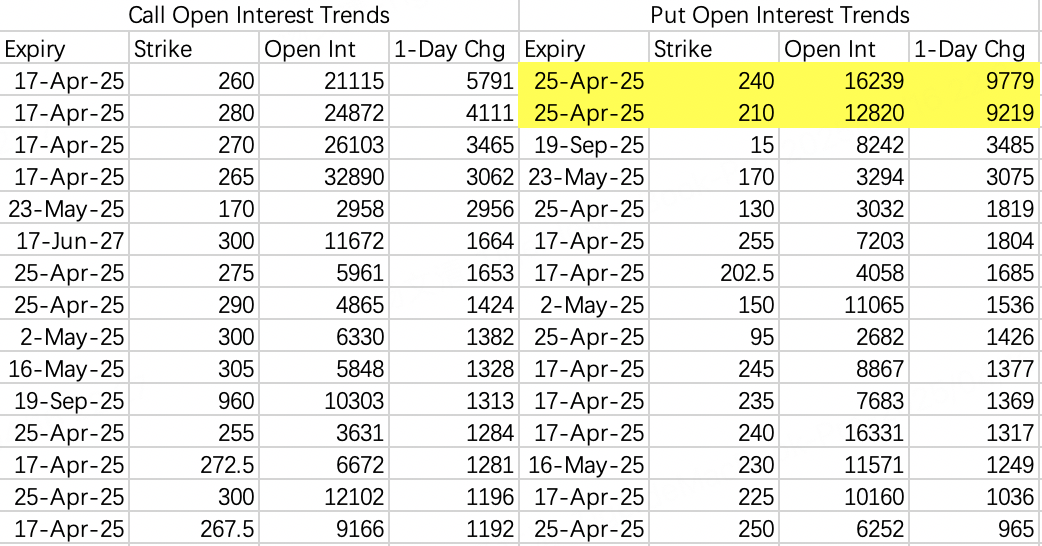

$Tesla Motors(TSLA)$

We finally saw some meaningful strike prices on the bearish side—someone put on a put spread for next week. Judging by the trade prices, it’s not clear which side was opened, but most likely it’s buying the $240$ put and selling the $210$ put:

On the Chinese ADR side, the main large order was a single-leg sell of the $FXI 20250516 36.0 CALL$ , opening 16,000 contracts.

Comments