Gold hit a new high as Fed Chairman Jerome Powell's warning about the impact of the trade war added to volatility on Wall Street, sending stocks and the dollar down sharply.

Gold rose 0.4% to $3,357.78 an ounce, after jumping 3.5% on Wednesday for its biggest one-day gain since March 2023. The dollar fell to a new six-month low as traders were once again battered by a flurry of tariff news and Powell stifled hopes that the Federal Reserve would act quickly to reassure investors, underscoring the unpredictability of Washington's tariff announcements.

Gold is up nearly 28% this year, outpacing the 27% gain it saw in 2024, as the escalating trade war raised fears of a possible global recession. Meanwhile, the Trump administration is preparing to put pressure on countries to restrict trade with China in U.S. tariff negotiations.

Goldman Sachs emphasized that despite$SPDR Gold ETF (GLD) $Up, but the position is not too high yet. Their current optimistic forecast for year-end gold prices is $3,700 an ounce, and if there is a potential change in Fed policy, gold prices could reach $4,500 an ounce under the tail risk scenario.

Goldman Sachs believes the current rally is sustainable, supported by strong physical demand and investor inflows from Asia. Position allocation is still far from optimistic levels, which supports its optimistic outlook, while macro risks may trigger a super surge in gold prices in the coming months.

"The combination of increased uncertainty surrounding tariffs, slowing economic growth expectations, inflation concerns and the increasing prospect of interest rate cuts create the perfect backdrop for further gains in the precious metal," ANZ analysts Brian Martin and Daniel Hines said in a note.

Options Strategy: Using Put Options to Go Long Gold

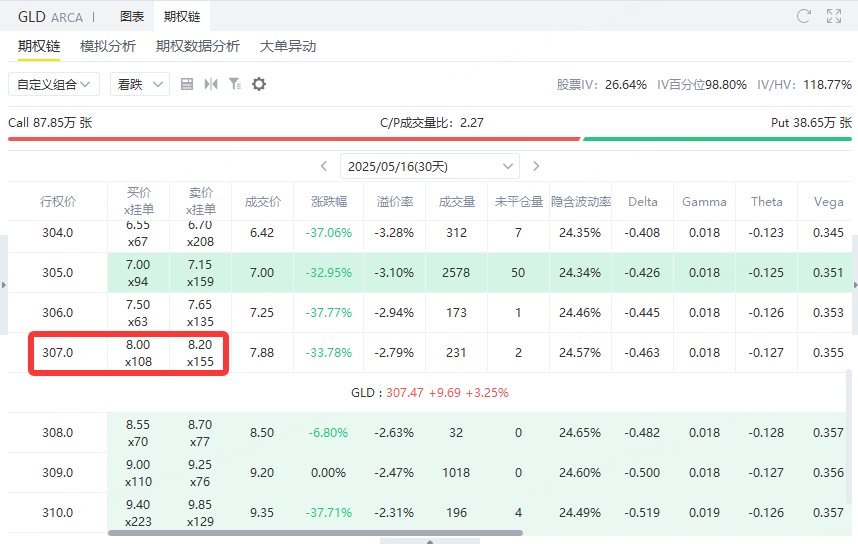

In the face of the strong trend of gold, we can use the option strategy to make efficient long trading. The current gold price is 307.47dollar, we can sellExpires May 16, 2025, exercise price $307, premium $810Put Option to go long gold.

This strategy can not only make profits when gold rises, but even if gold prices move sideways or fall slightly, you can still rely on premium to earn gains.

Current price of the underlying asset: $307.47

Option Type: Put Option (Put)

Exercise price: $307

Expiry date: 16 May 2025

Premium: $810 (100 shares per contract or $8.10 per share)

Maximum profit: premium revenue

The maximum profit of the seller is the premium received of US $810. As long as the underlying price at expiration is ≥ US $307, the option will be invalid and the seller will keep all premium income.

Break-even point: Exercise price − premium per share = 307 − 8.10 =$298.90

The overall profit is only when the underlying price is above $298.90 at expiration; Breakeven at $298.90; Below this price, there will be a loss.

Maximum loss: (exercise price − expiration underlying price) × 100 shares − premium (exercise price − expiration underlying price) × 100 shares − premium (exercise price − expiration underlying price) × 100 shares − premium reaches the maximum when the underlying price falls to 0

Calculation: $307 × 100 shares − $810 =US $29,890

The loss occurs in the extreme case where the underlying price is completely zero.

sum up

In the face of Trump's aggressive policies, the unstable global situation, and the overweight of central banks, gold has become a real safe haven tool. Using the options market, we can efficiently go long gold while controlling risks through the strategy of selling put options. This is not only a smart way of trading, but also a sound investment choice that conforms to market trends.

Comments