$NVIDIA(NVDA)$

TSMC reported earnings and maintained its original 20%–30% growth forecast, with robust AI demand. Still, this isn’t enough to reverse the overall weakness in chip stocks—prices are likely to retest previous lows.

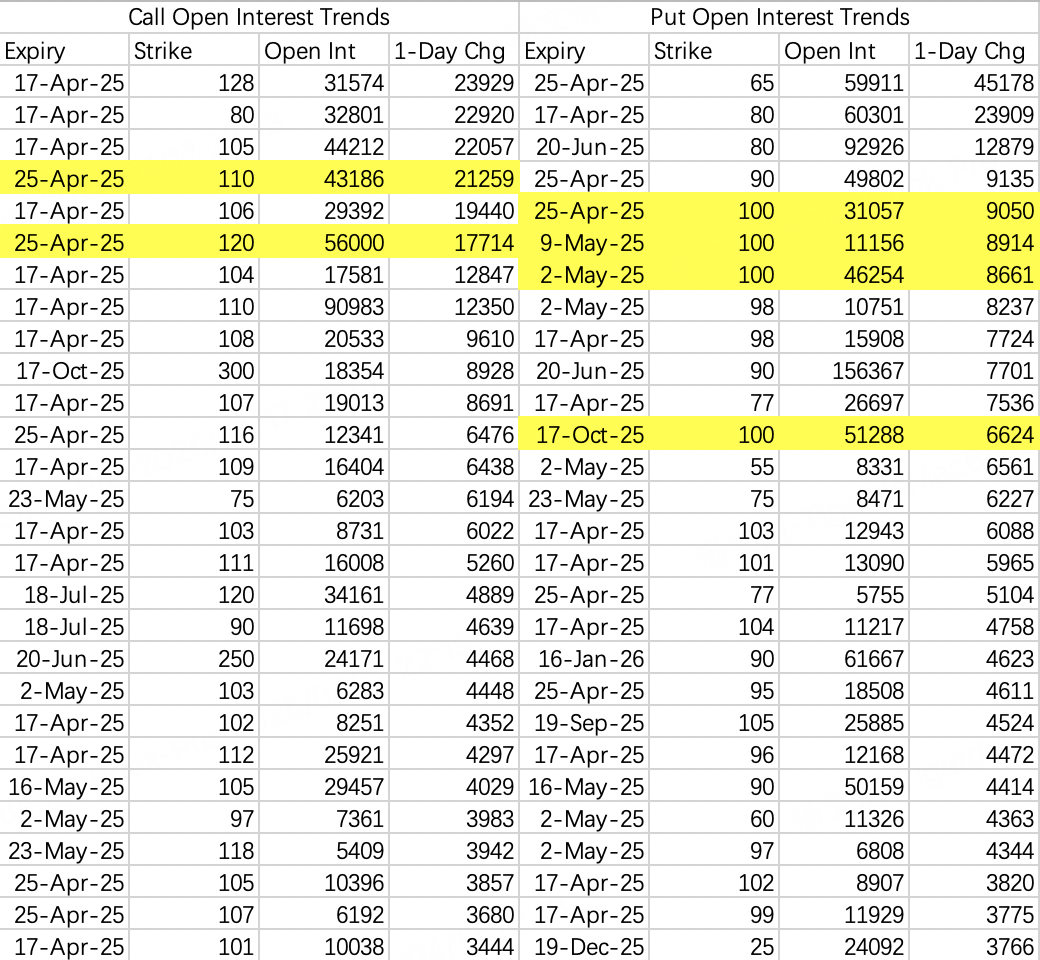

The largest bearish options position opened on Wednesday was the $NVDA 20250417 65.0 PUT$ , with 45,000 contracts. Not that anyone thinks it's going to $65$—this is more about trading volatility.

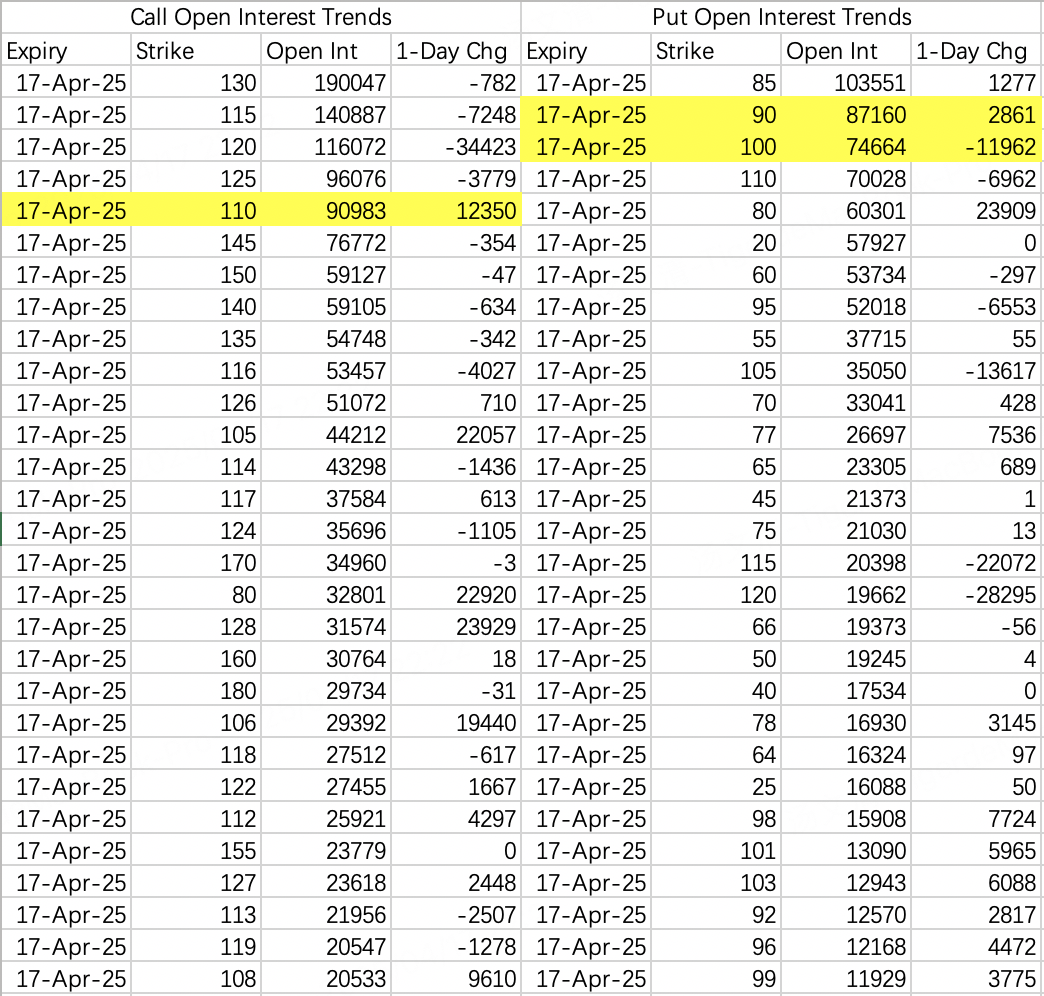

So there are basically four bearish camps: $100$, $90$, $80$, and sub-$80$. Below $80$, it’s more about playing volatility, while most people see the range as below $100$, above $90$.

Chances are, NVDA closes above $100$ this week. But if you’re holding short puts and thinking about rolling them to next week to avoid assignment, that might not be a great idea.

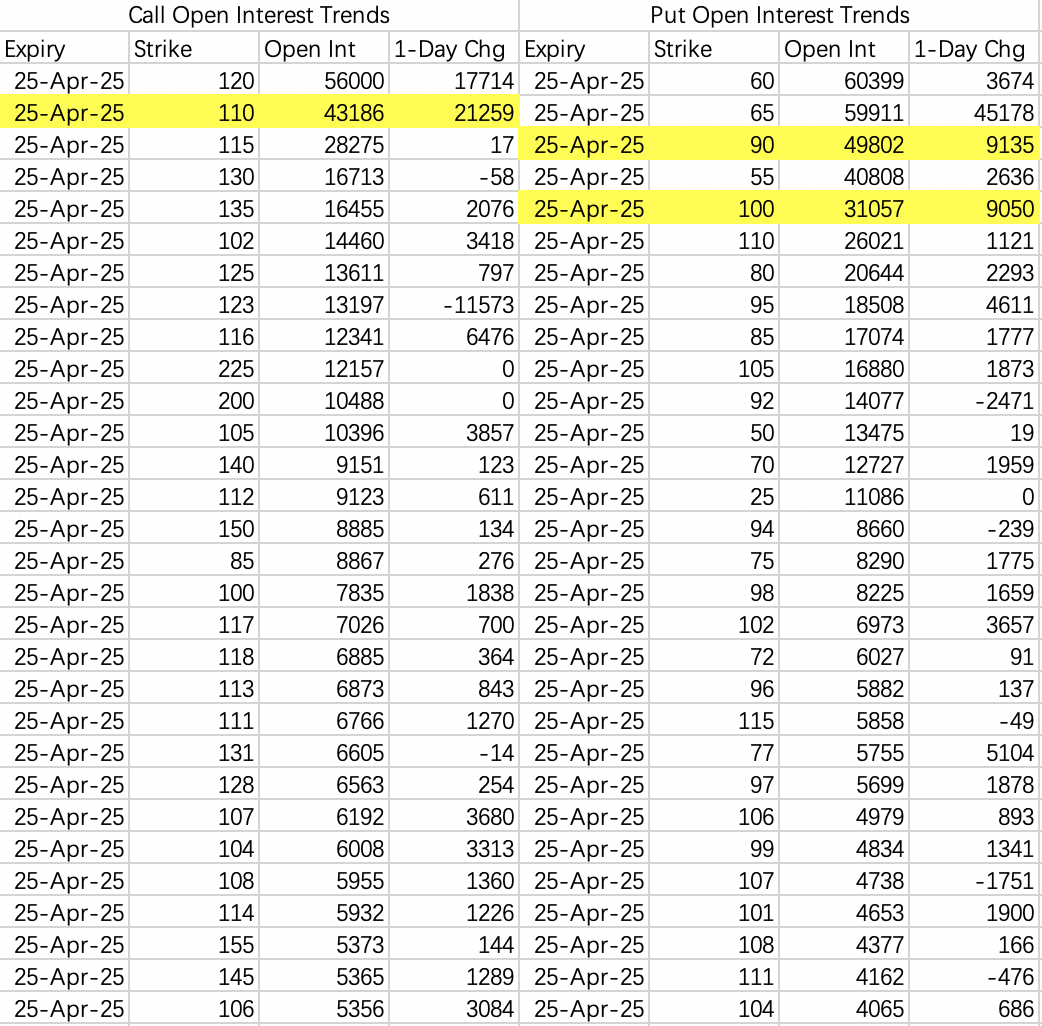

For the week of April 25, the downside for puts is $90$—likely to test the previous low. The upside is $110$, the latest sell call strike from the institutions.

$SPDR S&P 500 ETF Trust(SPY)$

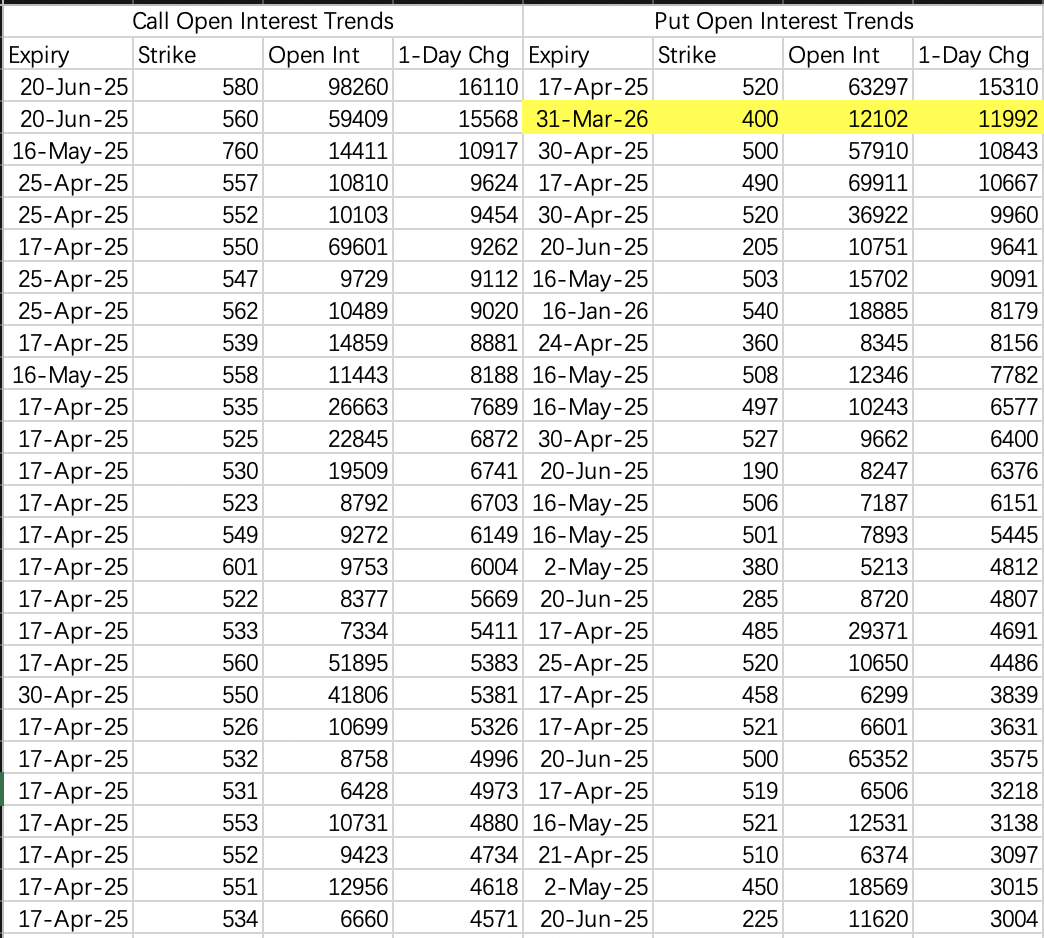

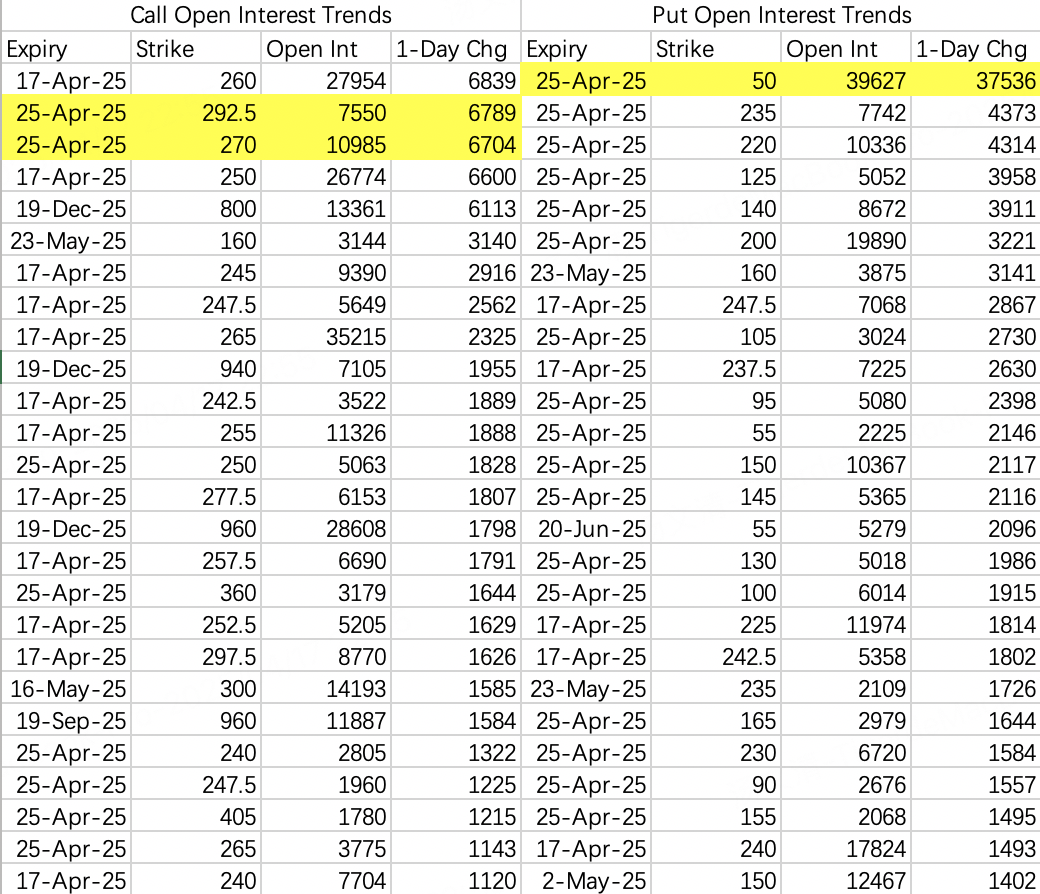

At first glance, SPY options open interest looks okay; bearish bets are mostly in the $520$–$480$ range.

But a big opening of long-dated puts at $400$—$SPY 20260331 400.0 PUT$ —makes me uneasy, like someone’s positioning for much more downside ahead.

$Tesla Motors(TSLA)$

Tesla reports earnings next week. Q1 deliveries were very weak: 337,000 vehicles, a 32% drop from last quarter and 13% down year-over-year. Global consumer demand has fallen sharply, and JPMorgan analysts have set a $120$ price target.

Judging from institutional sell call activity, they don’t seem to expect a significant drop in the week of April 25. Selling the $270$ call to hedge a $292.5$ call, same as this week’s upper bound. Of course, it’s possible they’re just not making a call on earnings week action.

The bearish side is a bit wild. Not sure when it started, but there’s this “50 put guy” who buys the $50$ put every week. Don’t be fooled by the small notional—every time, he tops the bearish volume list. On Wednesday, he opened 37,500 of the $TSLA 20250425 50.0 PUT$ . Not sure what to say—good luck to him.

For regular bearish bets, people are still looking at previous lows, above $200$.

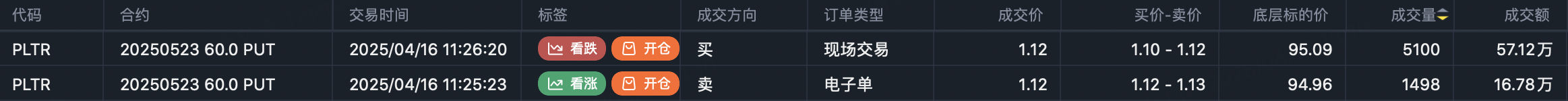

Last but not least, last time’s crash signal $Palantir Technologies Inc.(PLTR)$ is seeing another spike in bearish opening—20,000 contracts of the May 23 $60$ put: $PLTR 20250523 60.0 PUT$ .

Comments