US streaming platforms$Netflix (NFLX) $The first-quarter financial report released after the market closed on Thursday showed that due to strong growth in subscription revenue and advertising revenue, the company's revenue and second-quarter performance guidance exceeded analysts' expectations, quarterly profit hit a record high, and advertising sales are expected to double in 2025., driving the stock price to rise nearly 5% after hours. As of press time, it rose 2.92%, and the stock price was reported at $1,001.4.

Key financial data:

Revenue:Netflix's first-quarter revenue was US $10.54 billion, higher than analysts' expectations of US $10.5 billion, a year-on-year increase of 12.5%

Operating margin:Netflix's operating margin of 31.7% in the first quarter beat estimates of 28.2% and 28.1% in the year-ago quarter

Net profit:Netflix's first-quarter net profit was $2.9 billion, 24% higher than estimates of $2.44 billion

Earnings per share:Netflix earned $6.61 per share in the first quarter, topping consensus of $5.68

Free Cash Flow:Netflix's first quarter free cash flow of $2.7 billion, up 25% sequentially

What is the bull put spread

The Bull Put Spread (Bull Put Spread) is a typical credit spread strategy for traders with moderate bullish expectations for the underlying asset. This strategy limits the maximum possible profit and loss while selling the short put with the higher strike price and buying the long put with the lower strike price at the same time, while obtaining net premium income.

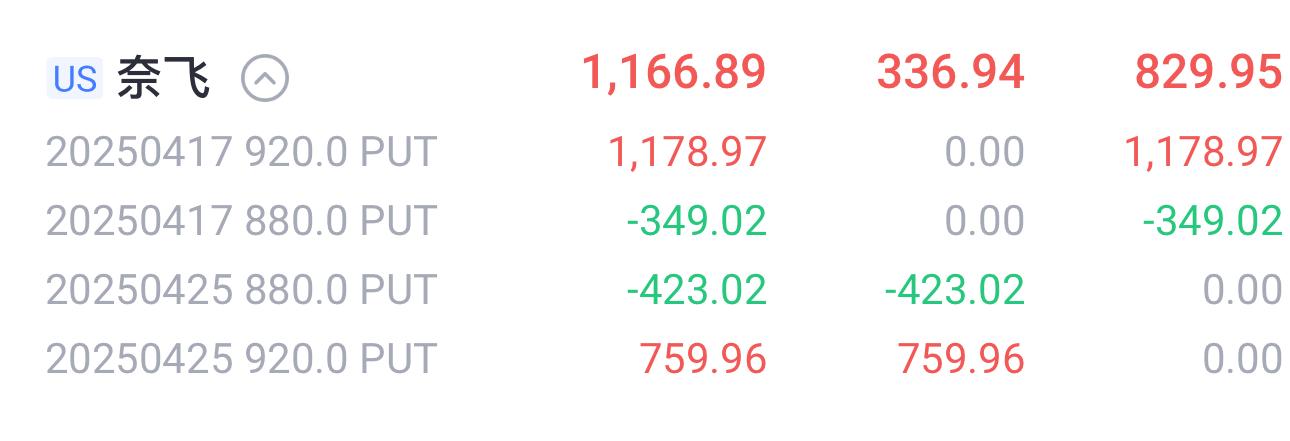

Before the financial report, we established two sets of bull market bearish spread strategies. Netflix was $973.03 before the financial report, and its stock price rose to $1,006.79 after the financial report.

A set of Put with an expiration date of April 17, selling a strike price of 920, gets $1,179 premium, and buying a Put with an strike price of 880, costs $349 premium.

The other set has an expiration date of April 25. Selling Put with an exercise price of 920 gets $2,860 in premium, and buying Put with an exercise price of 880 costs $1,623 in premium.

Netflix Financial Report Strategy Profit and Loss Analysis

Expiry date: April 17, 2025

Short legs (sell): A put option with an exercise price of 920 receives a premium of $1,179.

Long Legs (Buy): Put option with an exercise price of 880, paying premium $349.

Initial net credit (net premium):$1,179 − $349 =$830。

Net premium

Obtained when opening a positionNet premium(Net Credit) equals short-leg income minus long-leg expenditure: & gt; $1,179 − $349 =$830。

Maximum profit

When the underlying closes above the short-leg strike price, all put options expire and become invalid, and the trader retainsAll Net premium, namely: & gt;Maximum profit=$830。

Maximum loss

If the underlying falls below the long-leg strike price, the maximum loss is limited to the strike spread multiplied by the number of contracts and then minus the net premium:

& gt; Strike spread = 920 − 880 = 40 (USD/share)

& gt; Total contract = 100 shares/contract × 1 contract = 100 shares

& gt; Maximum loss = 40 × 100 − 830 =$3,170。

Break-even point

The breakeven point is equal to the short-leg strike price minus net premium (per share): & gt;Break-even point= 920 − 8.30 =$911.70。

Firm profit and loss at maturity

Target price at expiration: $1,006.79 (after hours, after earnings)

Due to $1,006.79 & gt; $920,Put options on both legs expire and become invalid, investors realizeMaximum profit。

Actual profit and loss=Maximum profit=$830。

Comments