As investors fled U.S. stocks, some executives quietly increased their positions.

Washington Service data shows that in the first two weeks of this month, no less than 180 company executives increased their holdings of their own company stocks, and the buying-selling ratio rose to 0.40, close to the highest level since the end of 2023. The higher this ratio, the more people buy than sell, and the more confident they are.

Matt Lloyd, chief investment strategist at Advisors Asset Management, said that this is a positive signal. Now investors' sentiment towards the market is particularly bad. As the stock market tries to gain a foothold, whether the trend of executives buying stocks can continue is crucial.

Public confidence in the economic outlook has fallen to its lowest point in nearly 30 years. According to Bank of America's latest global fund manager survey, 82% of Wall Street professional investors expect the global economy to weaken further, and almost a record number of respondents said they would reduce their allocation to U.S. stocks. But interestingly, this survey is called a "inverse indicator" because they predict it wrong every time. The same respondents were bullish in record February, and as a result, the market collapsed.

All sentiment indicators are turning red, and the market seems to be about to crash at any moment. At this time, corporate executives did the opposite, buying large sums of stock in their own companies. The media pointed out that although company executives usually buy stocks for various reasons, this increase in purchases shows that they have confidence in the company's prospects, because they know the most and are closest to the truth.

This does not mean that people can rush into the market with their eyes closed. Some cautious people remind you not to think that the market is safe just by looking at executives buying stocks. Adam Phillips, head of investment at EP Wealth, said:

"Like other companies, these companies are crossing the river by feeling the stones, waiting for clarity on trade policy."

On the other hand, the market is still on the sidelines. Many investors are still worried about rising inflation and the possibility of economic recession caused by global trade conflicts, especially some Democratic supporters who believe that the U.S. economy may fall into recession in a survey by the University of Michigan.

Investors who want to buy bottoms in the negative market can use the bull put spread strategy.

Bull Put Spread Strategy

A bull put spread involves selling a put option while buying another put option with the same expiration but a lower strike price (for the same underlying asset). Since the premium of selling put options is higher than the premium of buying put options, investors usually net earn premium.

When investors expect the market price to rise, but the increase is limited, and investors do not want to bear the consequences of a sharp market drop, they can use the bull market put spread strategy.

What are the functions of the bull spread strategy?

1. Earn premium with low risk: When investors want to earn premium income, the bull put spread strategy is ideal, and the degree of risk is lower than selling put options.

2. Buy stocks at lower prices: A bull put spread is a great way to buy a desired stock at an effective price below the current market price.

3. Make a profit in a volatile market: When the market falls, due to the huge risk of selling put options, by limiting the downside risk, the bull market put option spread can make a profit in a volatile market.

STRATEGY

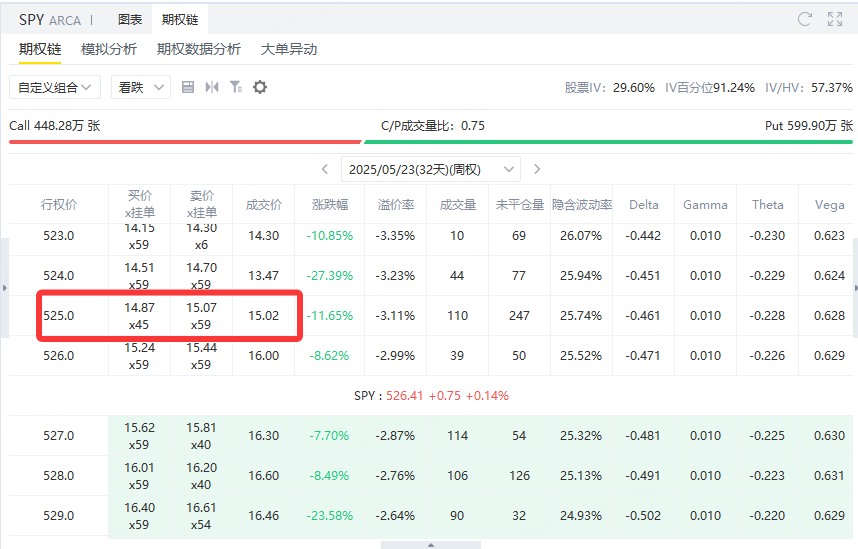

SPY now at $526, sell$S&P 500ETF (SPY) $Put option with strike price of 525 (expires 5/23/25): Get premium = $1502.

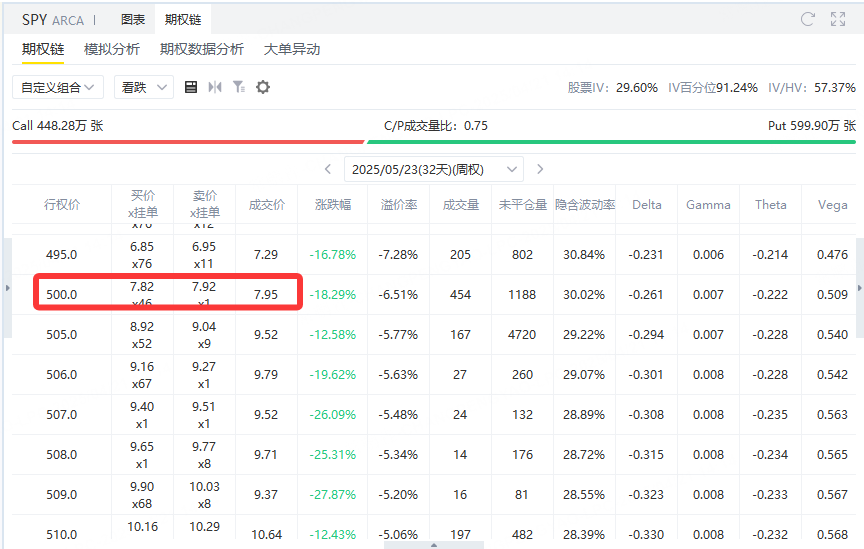

Buy put option at SPY 500 strike price (expires 5/23/25): Pay premium $795.

This strategy built by investors is the bull put spread of SPY:

Sell a put option with an exercise price of 525 and get premium of $1,502;

At the same time, buy a put option with an exercise price of 500 and pay premium $795;

Net income was $707.

The logic of this strategy is: As long as SPY doesn't fall below 525 at expiration, investors can retain the entire net premium gain, which is $707. If SPY falls, the gains will gradually decrease; If it falls below 500, the loss will reach its maximum.

The maximum loss is calculated as follows:

The strike spread is 525 minus 500, which is equal to 25 points; This corresponds to an option contract value of $100 per point, so the total difference is $2,500. This is the worst-case difference in intrinsic value of two-legged options.

Since the investor has collected $707 in premium income in advance, the maximum loss is:

2500 minus 707, equals$1793。

That is:

When the SPY expiration price is higher than or equal to 525, the strategy obtains a maximum profit of $707;

When the SPY expiration price is lower than or equal to 500, the strategic loss is fixed at $1,793;

The break-even point is at 517.93, that is, when SPY falls to this price, the profit and loss will be zero;

This strategy is suitable for investors to use when they hold a neutral-bullish judgment on the target. The winning rate is high but the returns are limited, and the risks are clearly controllable.

Comments