The earnings season of technology giants in the first quarter has begun, and global investors will once again focus on the earnings performance of the seven technology giants in the US stock market. Tesla is the first to debut and will release its first quarter results for 2025 after the market closes on April 22 (Tuesday), Eastern Time.According to market consensus expectations, Tesla will achieve revenue of US $21.54 billion in Q1, a year-on-year increase of 1.12%; Earnings per share were US $0.37, a year-on-year increase of 8.24%.

At the end of last year, as the dust of the U.S. election settled, Tesla's stock price went up all the way, hitting an all-time high of $488.54 in December, but then quickly turned downward. Since the beginning of this year, Musk and Tesla have continued to face challenges. Tesla's stock price has fallen by more than 40% this year, which is close to "halved" compared to the historical high.

Looking forward to this performance, investors focus onIn terms of automotive business revenue, energy storage business, AI-related business, and the impact of Trump's tariff policy, in addition, Tesla's upcoming full-year vehicle delivery volume will also become a key factor in the market response.

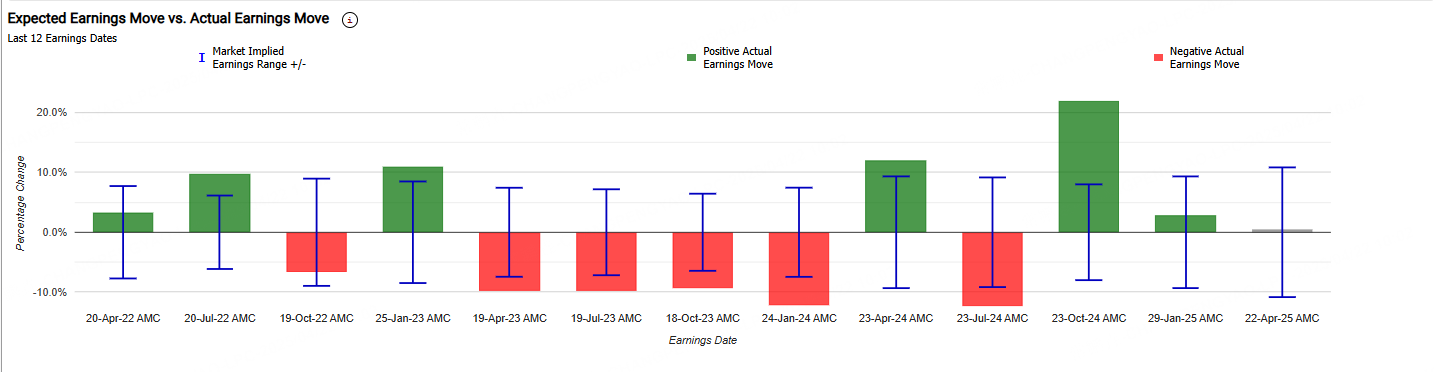

How has the stock price performed on previous earnings days?

Currently, Tesla's implied changes are±10.96%, indicating that the options market is betting on its single-day rise and fall after its performance10.96%。 In comparison, Tesla's post-performance average stock price change in the first four quarters was±12.3%, showing that the current option value of the stock isUnderestimate。

From the perspective of option volatility skewness, market sentiment has an impact on Tesla's market outlookBearish。

Bull Put Spread Strategy

A bull put spread involves selling a put option while buying another put option with the same expiration but a lower strike price (for the same underlying asset). Because the premium of selling put options is higher than the premium of buying put options, investors usually net earn premium.

When investors expect the market price to rise, but the increase is limited, and investors do not want to bear the consequences of a sharp market drop, they can use the bull market put spread strategy.

Tesla Earnings Options Strategy

Stock Tesla is currently trading at around $227.5, and investors can employ a bull put spread strategy if they don't expect Tesla to plunge.

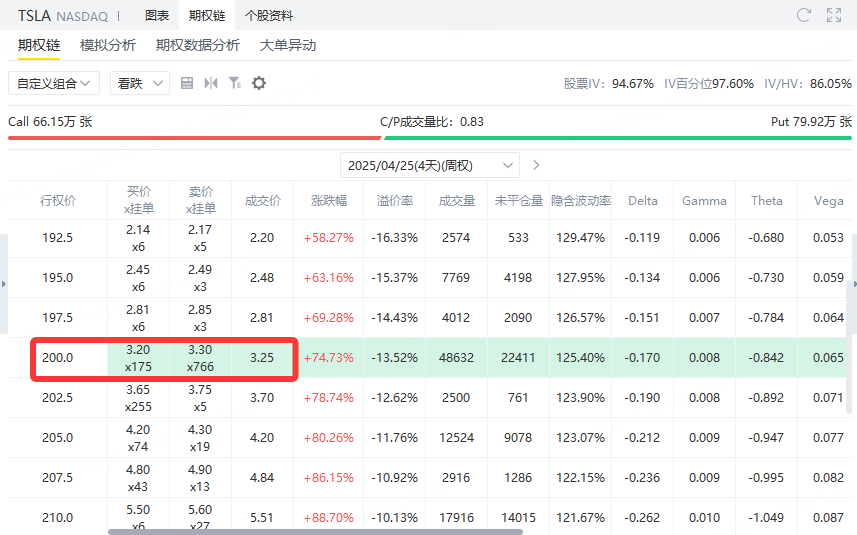

In many ways, investors can sell Tesla put options with an exercise price of 200 and an expiration date of April 25, and gain a premium of $325.

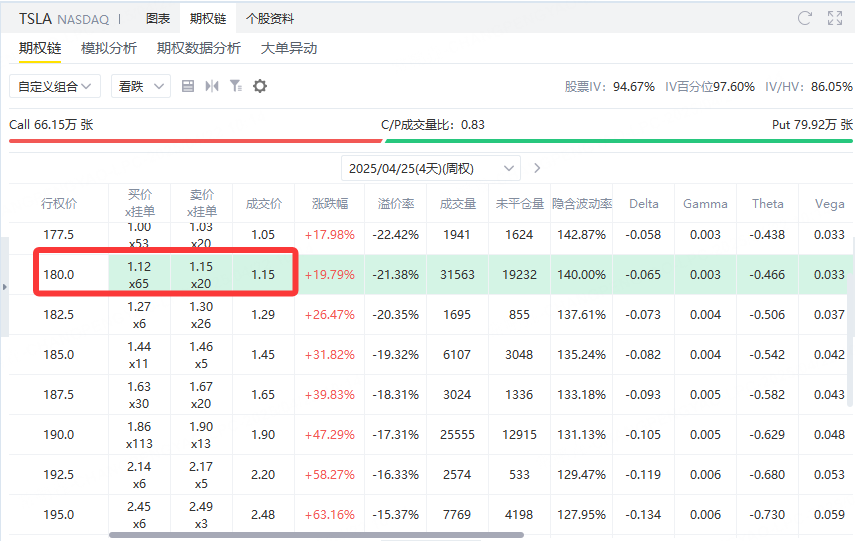

In terms of protection, investors can buy a Tesla put option with an exercise price of 180 and an expiration date of April 25, and pay premium $115.

Investors don't expect Tesla shares to fall below $200 before April 25, so they adopt a bull-put spread strategy:

Sell put with strike price of 200, collect $325 from premium

Buy put with strike price of 180, pay premium $115

Revenue (maximum benefit): 325-115 = $210, which is the maximum gain an investor can achieve in this strategy, and occurs when Tesla's stock price is $200 or above at expiration.

Maximum loss: The price difference between the legs is 200-180 = $20 (per share), corresponding to a total loss of $2000, minus premium revenue of $210, and the maximum loss = 2000-210 = $1790.

PROFIT AND LOSS

The profit and loss of this strategy can be understood as follows:

If the Tesla stock price is above $200 at expiration, neither option will be exercised, and the investor can keep all premium and make a profit of $210, which isMaximum benefit。

If the stock price is exactly $180, the selling leg loses $2,000, and the buying leg gains $2,000, which is just a hedge, and ultimately retains the premium income, that is,Earnings $210。

If the stock price falls below $180, say 175 or lower, and the spread between the two options is completely eaten, investors will faceMaximum loss $1790(loss of 2000 minus income of 210).

Strategic Advantages

The probability of profit is high, as long as Tesla does not fall below 200, it will make a profit

Maximum loss fixed at $1790, risk known

Earnings locked in early, not dependent on rising stock prices

Risk warning

Maximum loss if share price drops sharply below 180 before expiration

Although the profit and loss are clear when opening the position, you may experience a large floating loss halfway

Comments