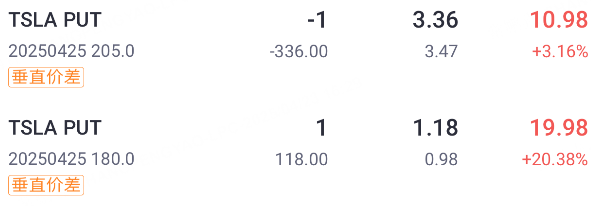

This time$Tesla (TSLA) $Before the financial report, we sold a put option with an exercise price of 205, gained premium of $347, and bought a put option with an exercise price of 180, which cost $97.

In terms of margin, the margin spent on this combination strategy is US $2,500, which is calculated based on the maximum income of US $250 and the position holding time of 2 days.

The maximum return is $250, the margin is $2500, the single yield: 10%, and the annualized simple interest: 1825%.

Tesla Earnings Strategy Profit and Loss Analysis

If Tesla Shares Above $205 at Expiration, then the 205 put option sold by investors and the 180 put option bought will bothExpired without value, investors will retain all net income$250, this is the strategyMaximum profit。

If Tesla stock is between $202.5 and $205 at expiration, then the 205 put option sold will partially incur a loss, but because the investor still retains part of the net premium,Still profitable overall, just a profit of less than $250. The closer the share price gets to $202.5, the lower the profit.

If the stock expired exactly at $202.5, the value of the 205 put option sold by the investor is $2.5 (that is, $250), which is exactly equal to the net premium received by the investor, soProfit and loss level。

If Tesla stock is below $202.5 but above $180 at expiration, the loss of the 205 put options sold by investors gradually expanded, while the 180 put options bought by investors have not yet started to make profits, and the entire portfolioWill gradually lose money, the loss rises as the stock price falls.

If the stock price falls to $180 or below, both of the investor's options enter the real-money territory, but as the 180 put option bought limits the maximum loss, ultimately the investor'sThe maximum loss will be limited to $2,250, that is, the spread between the two strike prices of $25 × 100 shares = $2,500, minus the net premium initially received by the investor of $250.

Tesla is currently at $250 after-hours, and investors are expected to receive if they hold to maturity$250。

Principles of bull market put spread strategy

A bull put spread involves selling a put option while buying another put option with the same expiration but a lower strike price (for the same underlying asset). Because the premium of selling put options is higher than the premium of buying put options, investors usually net earn premium.

When investors expect the market price to rise, but the increase is limited, and investors do not want to bear the consequences of a sharp market drop, they can use the bull market put spread strategy.

Before setting up the strategy, Tesla was trading at about $227.5. If investors don't expect Tesla to plummet, they can adopt a bull market put spread strategy.

Choosing to sell a $205 put option, calculated based on the then price of $227.5, actually means that investors expect Tesla not to plummet by more than 9.8% after the financial report.

Strategic Advantages

The probability of profit is high, as long as Tesla does not fall below 205, it will make a profit

Maximum loss fixed, risk known

Earnings locked in early, not dependent on rising stock prices

Risk warning

Maximum loss if share price drops sharply below 180 before expiration

Although the profit and loss are clear when opening the position, you may experience a large floating loss halfway

Comments