1. Establish a basic understanding of selling call options

Friends who have never been exposed to options may have difficulty understanding selling options. They often have doubts such as "How can I sell without options?", "What is the point of selling options?" Here we can sell used cars in real life. The case helps everyone understand selling call options.

Let's say you have a used car and the current market price is 20,000 yuan. You don't think the price of this car will increase significantly in the next few months. So, you decide to sell a call option.

Buyer: Friend B has his eye on your car, but doesn't have enough funds to buy it at this time. He hopes to have the opportunity to buy your car for 20,000 yuan in the next three months.

Seller(You): You sell a call option, agreeing to give Friend B the right to buy your car for 20,000 yuan in the next 3 months, and collect 1,000 yuan in premium as compensation.

There are two possibilities:

Vehicle prices have not risen or fallen: If in the next 3 months, the used car market price remains at or below 20,000 yuan, Friend B will not exercise his rights because he can buy the same car in the market at the same price or lower. You keep the car and receive a premium of 1,000 yuan.

Car price rises to 25,000 yuan: If the car price rises to 25,000 yuan, Friend B will exercise his right to buy your car for 20,000 yuan. Although you sold the car at a relatively low price, you still got the car payment of 20,000 yuan and the previous premium of 1,000 yuan, totaling 21,000 yuan, which was 1,000 yuan more than the original premium, but a possible potential appreciation of 5,000 yuan less.

Going back to the stock itself, because all items in the capital market are priced at a fair value, the seller does not need to own a "second-hand car" to sell call options, as long as there are enough funds to finally buy a second-hand car in the market. Just deliver and meet the other party's requirements.

Selling a call option is equivalent to you taking a portion of the fee (premium) upfront as compensation for being willing to sell the asset at a fixed price at some point in the future. You can get this premium immediately, but if the price increases significantly, you may lose higher profits.

2. Case of Google selling call options

$Google (GOOG) $The results for the first quarter of 2025 will be released after the market closes on April 24 (Thursday) Eastern Time. According to market consensus expectations, Google Q1 will achieve revenue of US $89.18 billion, a year-on-year increase of 10.73%; Earnings per share were US $2.005, a year-on-year increase of 6.1%.

Looking forward to this performance, investors focus on cloud services, advertising business, and AI empowerment. At the same time, the capital market pays more attention to its capital expenditure.

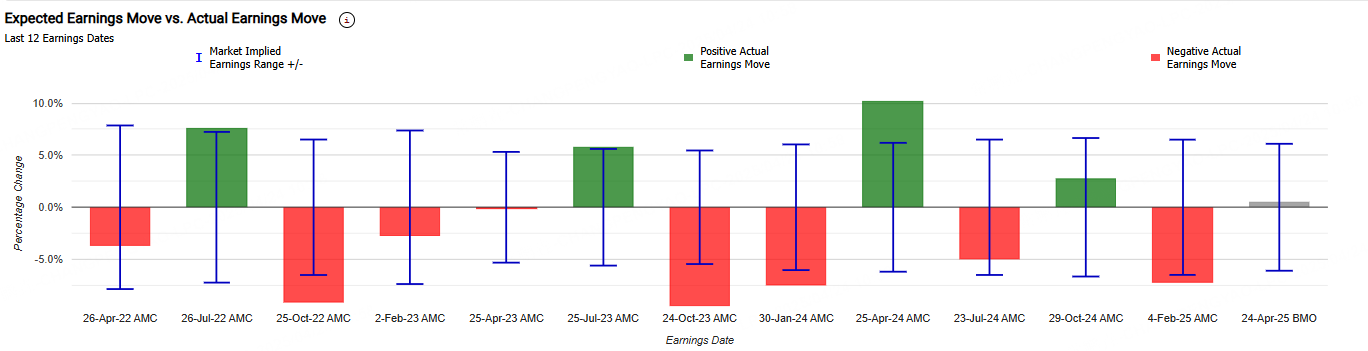

Currently, Google's implied changes are±6.25%, indicating that the options market is betting on its single-day rise and fall after its performance6.25%。 In comparison, Google's post-performance average stock price change in the first four quarters was±6.3%。

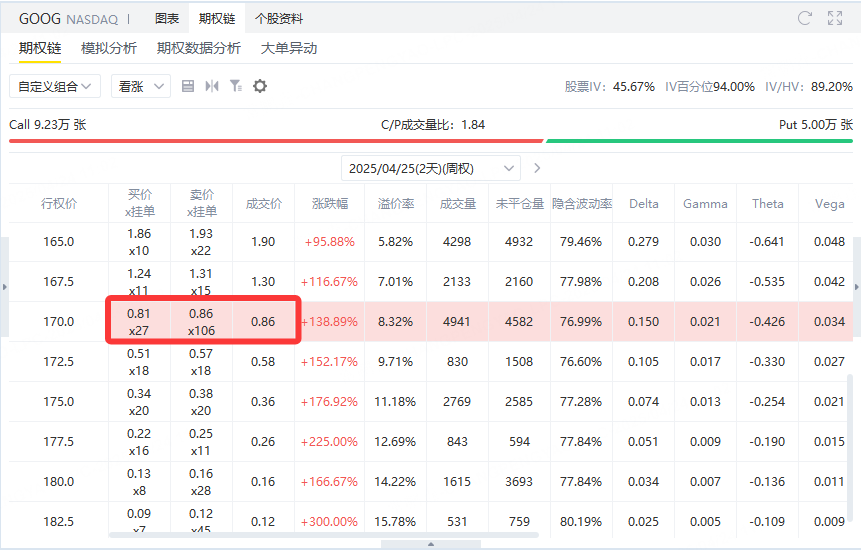

If investors expect that after this financial report, Google's increase will not exceed 8%, and Google's current price is 157.72, investors can sell call options with an exercise price of 170 and get premium $86.

This is a strategy of selling call options naked. Investors sold Google call options with an exercise price of $170 at a premium of $86 each.

Google's current market price is $157.72 per share.

Maximum benefit:

If Google's stock price does not rise above $170 by the time the option expires, the buyer will not exercise the option. At this time, investors can retain all premium rights.

The maximum yield of this transaction is the premium that investors collected at the beginning, which is $86.

Break-even point:

When Google's stock price rose to $170.86 per share, investors' profits and losses were just even. This price is derived from the exercise price of $170 plus a premium of $0.86 per share.

Profitability:

If Google's stock price is lower than or equal to $170 at expiration, the option will not be exercised, and investors can retain all premium, that is, $86, which is the maximum profit of investors.

Loss:

If Google's stock price is above $170.86 at expiration, investors will start losing money. For every dollar that the stock price increases, investors' losses increase by $100. Since there is no cap on how much stock prices can rise, there is no cap on how much investors can lose.

Risk warning:

The strategy is extremely risky because investors take on the obligation for the share price to rise without owning Google shares. Once Google's stock price rises sharply, investors may face losses far more than the premium they gained in the first place.

In addition, brokerages usually require investors to pay higher margins to cope with potential risks.

If investors want to control risks, they can consider opening a covered position (that is, holding Google stock and then selling call options), or constructing limited risk strategies such as bull market call spreads.

3. Applicable scenarios for selling call options

Selling a call option is usually suitable for the following scenarios:

1. The market is bearish or sideways

A selling call option is applied when an investor has a bearish or neutral view on the price of the underlying asset. In other words, investors don't expect the price of the underlying asset to rise significantly, or even fall. By selling call options, investors can earn premium when the market is down or flat.

2. Stable position income

If an investor already holds shares of the underlying asset and does not expect large price fluctuations in the short term, they can sell the corresponding call option (known as a "covered call"). This can increase the income from holdings through the premium.

3. Hedging strategy

Selling call options can also be used as a hedging strategy. For example, an investor holds a long position in an asset, and by selling a call option, the potential loss of the long position can be offset to some extent.

4. Strategies for collecting premium

With the main purpose of earning option premiums (premium), some investors choose to sell call options when they are not strongly optimistic or bearish about the price direction of the underlying asset, so as to earn relatively stable returns.

However, selling call options also carries greater risks. If the price of the underlying asset rises beyond the strike price, the investor faces unlimited losses. Therefore, this strategy is suitable for investors with high risk tolerance and needs to be used under appropriate risk control.

4. Frequently asked questions about selling call options

1. How to close the position after selling the option?

After selling 1 contract, the number of shares held is-1. -1 +1 = 0, so you can close the position after buying a contract.

2. How will profits change during the shareholding period?

Profit affected byTimeAndshare priceImpact, as the expiration date approaches, the time value portion slowly decreases (the seller earns the gain). The more the stock price falls below the strike price, the more the seller earns. If the stock price exceeds the strike price + option premium, the seller begins to lose money.

3. How to calculate the break-even point?

Break-even point = strike price + option premium

4. What is the difference between the profit and loss of exercising after expiration and unexpired liquidation?

Because the time of the contract is valuable, the time value of the contract after expiration is 0, and the contract that has not expired has a certain time value. As a seller, hold the contract until the date of the contract, without any operation, the contract will automatically be invalid and the full time value will be obtained. If you close your position early, you will lose part of your time value.

5. What happens when the call option sold expires?

If the price of the underlying asset at expiration is lower than or equal to the strike price of the call option, there is no reason for the buyer to purchase the asset at a strike price higher than the market price, so the option will not be exercised.

If the price of the underlying asset is higher than the strike price of the call option at expiration, the buyer has the right to buy the underlying asset from the seller at a strike price lower than the market price, and if the seller has shares, it needs to sell the underlying asset to the buyer at the strike price. If the seller does not hold the underlying asset, it must buy the underlying asset at a higher price in the market, and then sell it to the buyer at the execution price, which is reflected as a negative corresponding stock position in the account.

Comments