$SPDR S&P 500 ETF Trust(SPY)$

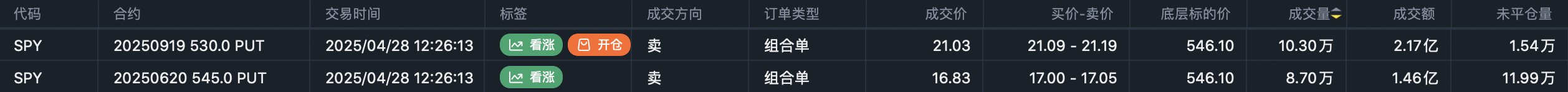

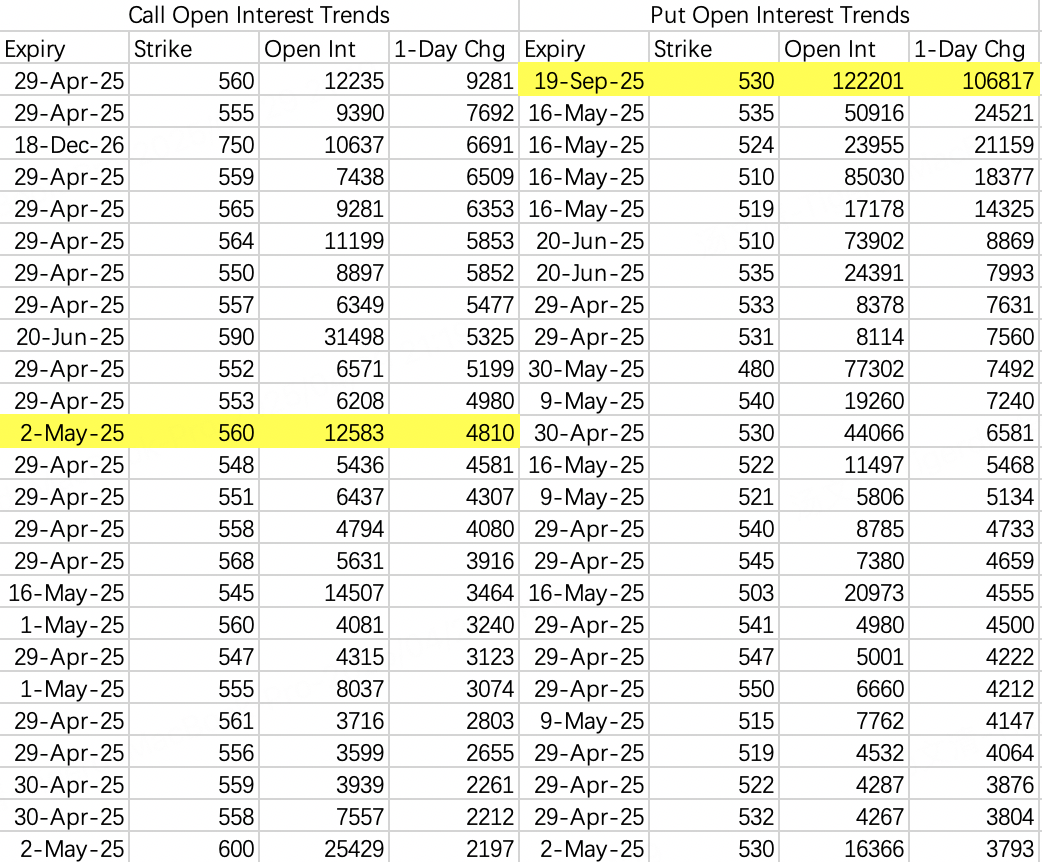

The most indicative SPY long put large order rolled positions, shifting from the June-expiry 545 put $SPY 20250620 545.0 PUT$ to the September-expiry 530 put $SPY 20250919 530.0 PUT$ . The respective volumes were 87,000 and 103,000 contracts.

The rolled put option’s strike price is 530, which is lower than the original 545 strike price, suggesting a less optimistic outlook. However, compared to SPY's current price of 550, this pullback expectation is already relatively positive.

Why is this the most indicative? The $SPY 20250620 545.0 PUT$ was originally opened on December 26, 2024, when SPY’s price was at a lofty 600, and institutions were forecasting a 2025 SPY target price of 650.

At the time, I noticed this large order but assumed it was just a hedge. Who would have thought that three months later, SPY would actually fall to 540? It turns out this wasn’t an extreme low-probability event but a reasonable macro-based prediction. The strike price’s precision cannot be understated.

Thus, the rolled put option $SPY 20250919 530.0 PUT$ can undoubtedly be considered the institution’s forecast for SPY’s price over the next two quarters. By the end of Q3 in late September, SPY is highly likely to remain at lower levels.

How do we interpret this? Well, Q3 doesn’t have much good news. The 90-day tariff suspension will end, the Jackson Hole symposium will take place, and the Treasury's cash reserves will hit zero. It seems prudent to consider going long on volatility.

That wraps up the explanation of Monday’s significant SPY open interest.

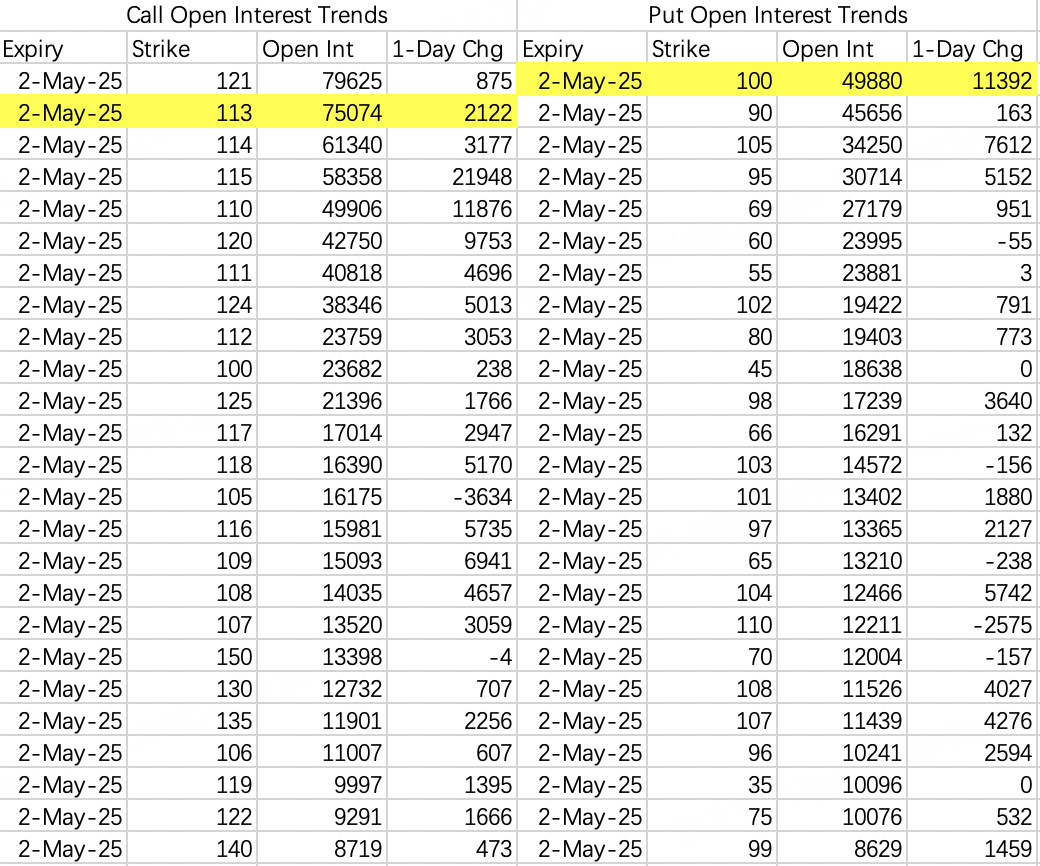

$NVIDIA(NVDA)$

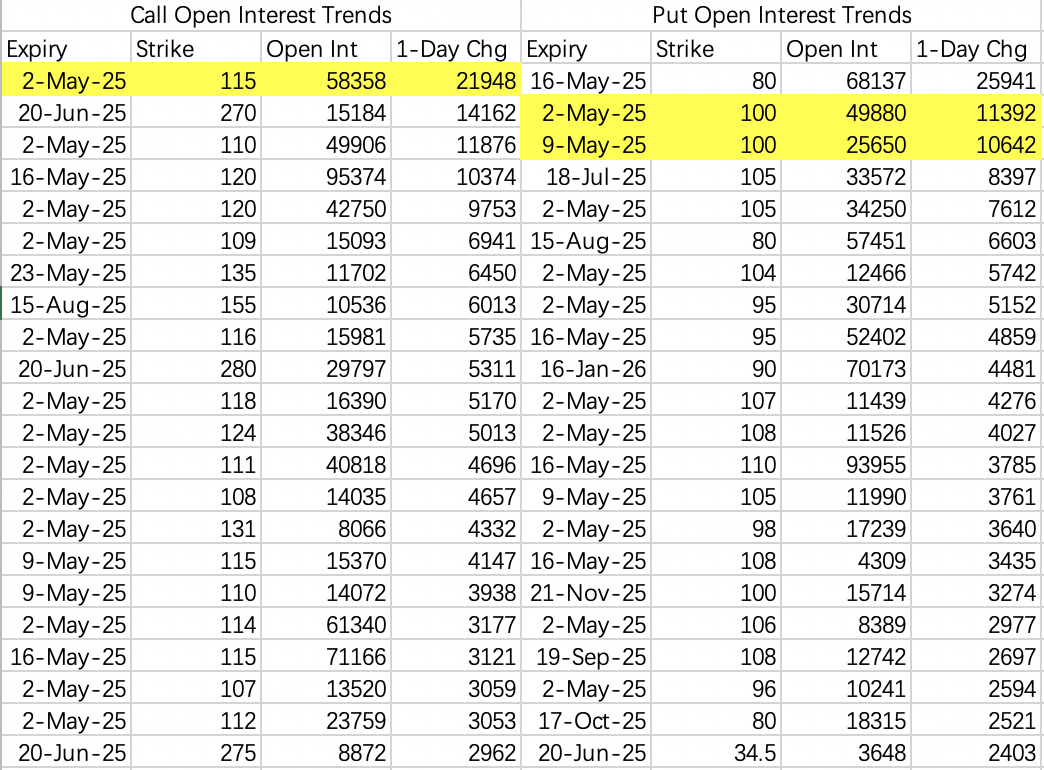

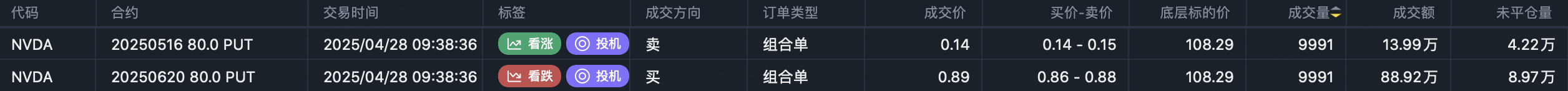

Yesterday, NVIDIA fell intraday, triggering a surge in open interest for the 100-strike put. Objectively speaking, the increased open interest at the 100 level indicates a growing probability of NVIDIA pulling back to 100, and the trend may evolve into high volatility.

From a strategy perspective, current prices should guide decisions. For example, with the current price at 109, consider selling calls above 113, such as $NVDA 20250502 113.0 CALL$ , and wait for the price to drop before selling puts.

The $NVDA 20250516 80.0 PUT$ saw 25,900 contracts opened on the sell side, betting that there won’t be any extreme crash in May.

Based on Monday’s open interest data, NVIDIA’s closing price range this week is expected to be 100–113.

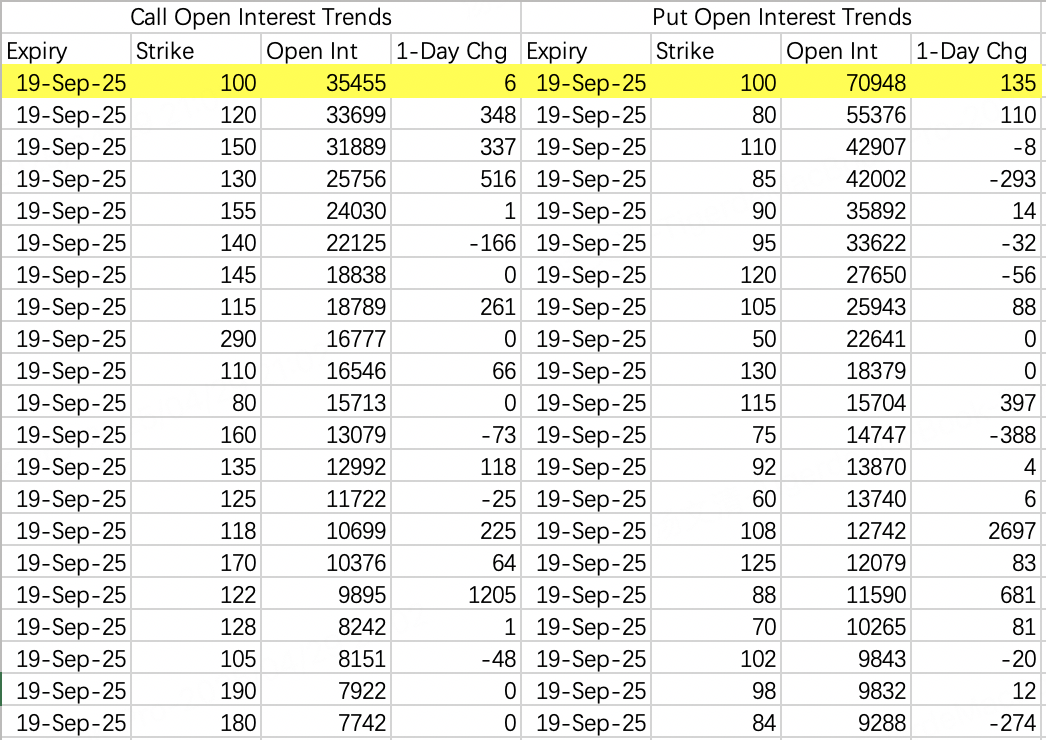

Additionally, looking at September’s open interest data, it’s evident that NVIDIA is expected to hover around 100 in September, which coincides with SPY’s 530 forecast. Therefore, when planning trading strategies over the next two quarters, adhering strictly to a buy-low-sell-high approach is recommended.

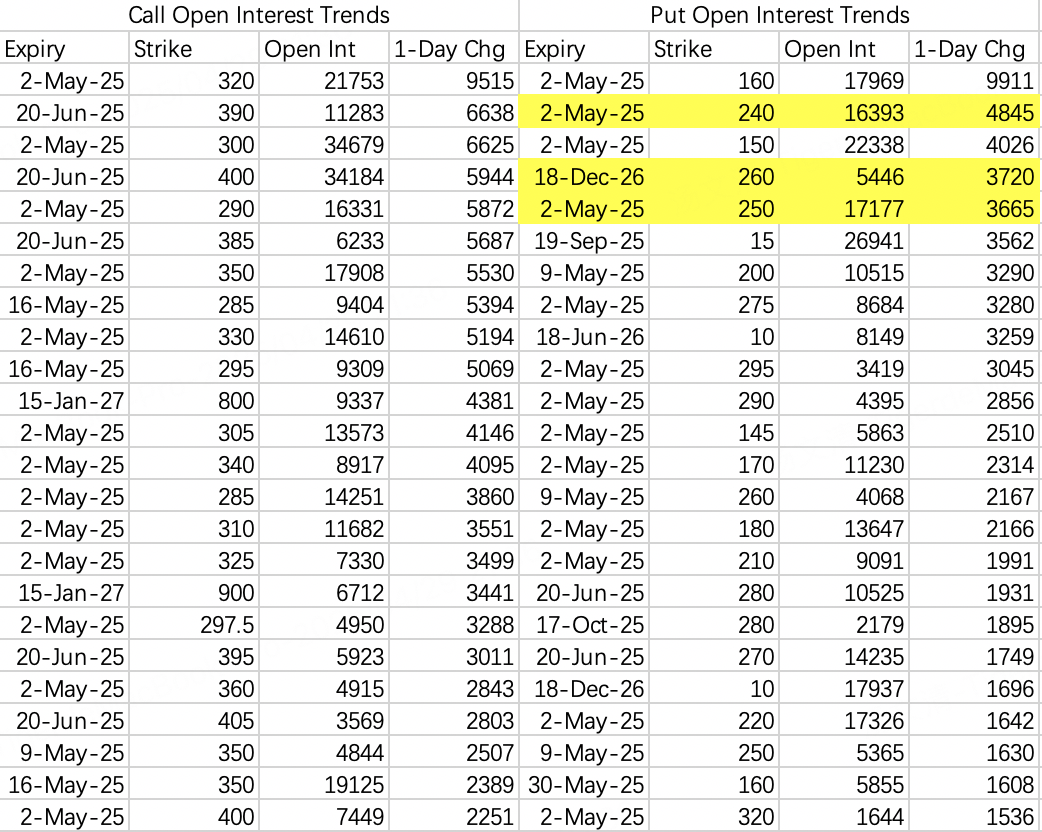

$Tesla Motors(TSLA)$

Tesla remains strong this week, stabilizing in the 240–290 range.

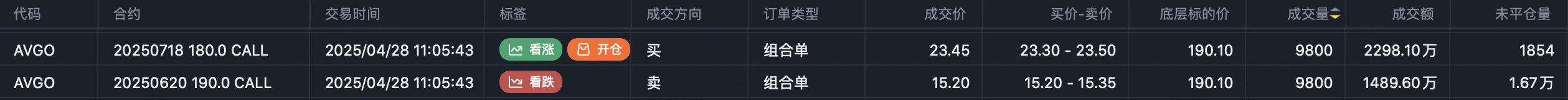

$Broadcom(AVGO)$

Broadcom’s long call large order rolled positions, with the bad news being that the rolled strike price was lowered.

Closed position: Sold $AVGO 20250620 190.0 CALL$ (9,800 contracts).

Opened position: Bought $AVGO 20250718 180.0 CALL$ (9,800 contracts).

Comments