$Microsoft(MSFT)$

Microsoft will release its earnings after the close on Wednesday, but the outlook isn’t very optimistic. Azure’s business is facing macroeconomic uncertainty, leading to decreased demand. Microsoft’s FY25/FY26 total revenue estimates have been revised down to $27.52 billion and $30.648 billion, respectively.

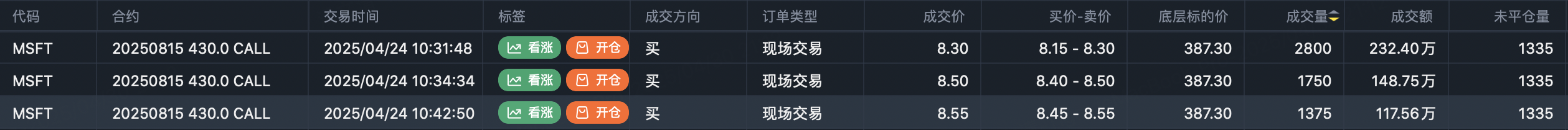

However, institutions seem optimistic about Microsoft’s trend. On April 24, options activity showed 16,600 contracts of $MSFT 20250815 430.0 CALL$ were bought, with a transaction value of over $10 million.

On April 29, a significant bullish call spread strategy was executed on the exchange:

Sell $MSFT 20250620 460.0 CALL$ .

Despite the earnings outlook, the stock price probably won’t perform too poorly, as the negative factors have mostly been priced in after a quarter of declines. It seems likely to follow a pattern similar to Google’s earnings, with an expected price range of 370–410.

$Amazon.com(AMZN)$

Amazon’s earnings are likely to surprise on the upside. Q1 results are expected to exceed market consensus, driven by strong AWS growth and AI demand, with tariffs having limited impact on its retail business.

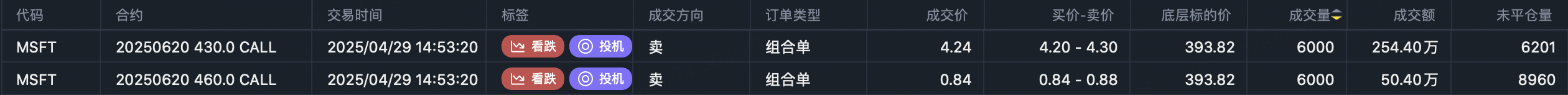

Institutions have executed a bullish call spread strategy expiring this week:

Sell $AMZN 20250502 197.5 CALL$ ,

This week’s sell call strike price of 197.5 is higher than last week’s 192.5, aligning with the upper end of the expected earnings fluctuation range of 170–195. I believe Amazon’s earnings movement will mirror Google’s trend.

Similarly, there’s institutional optimism for Amazon’s future trend, as shown by another bullish call spread strategy:

Sell $AMZN 20250620 240.0 CALL$ .

$Apple(AAPL)$

Apple’s earnings are also expected to be strong, with 2Q (March quarter) results likely exceeding market expectations and 3Q (June quarter) guidance meeting expectations.

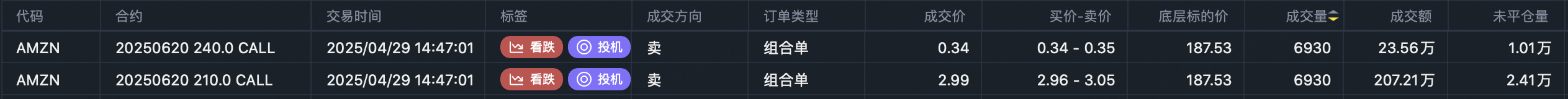

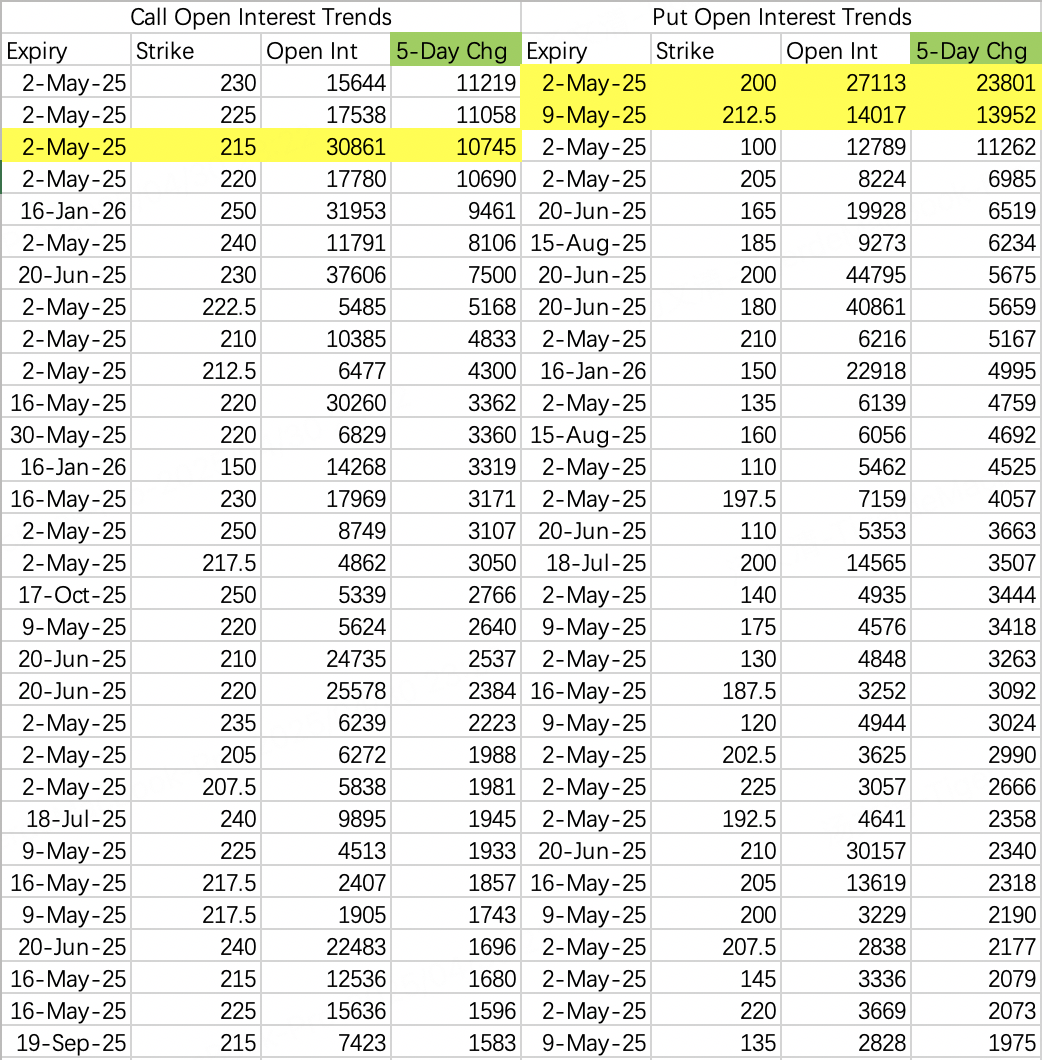

It’s worth noting that options activity over the past five days suggests Apple’s earnings-related price movement may be confined to a very narrow range.

A significant number of 215 calls expiring this week ($AAPL 20250502 215.0 CALL$ ) were bought, indicating expectations that the stock price will stay below 215 after earnings.

Meanwhile, 212.5 puts expiring May 9 ($AAPL 20250509 212.5 PUT$ ) saw significant volume, mostly on the sell side, suggesting next week’s price will stay above 212.5.

From this, we can infer a super-narrow range of movement between 212.5 and 215 for the next two weeks.

Additionally, this week’s 200 puts ($AAPL 20250502 200.0 PUT$ ) also saw heavy volume, which was confirmed to be sell-side activity. This suggests Apple’s post-earnings price will likely fluctuate within the 200–215 range.

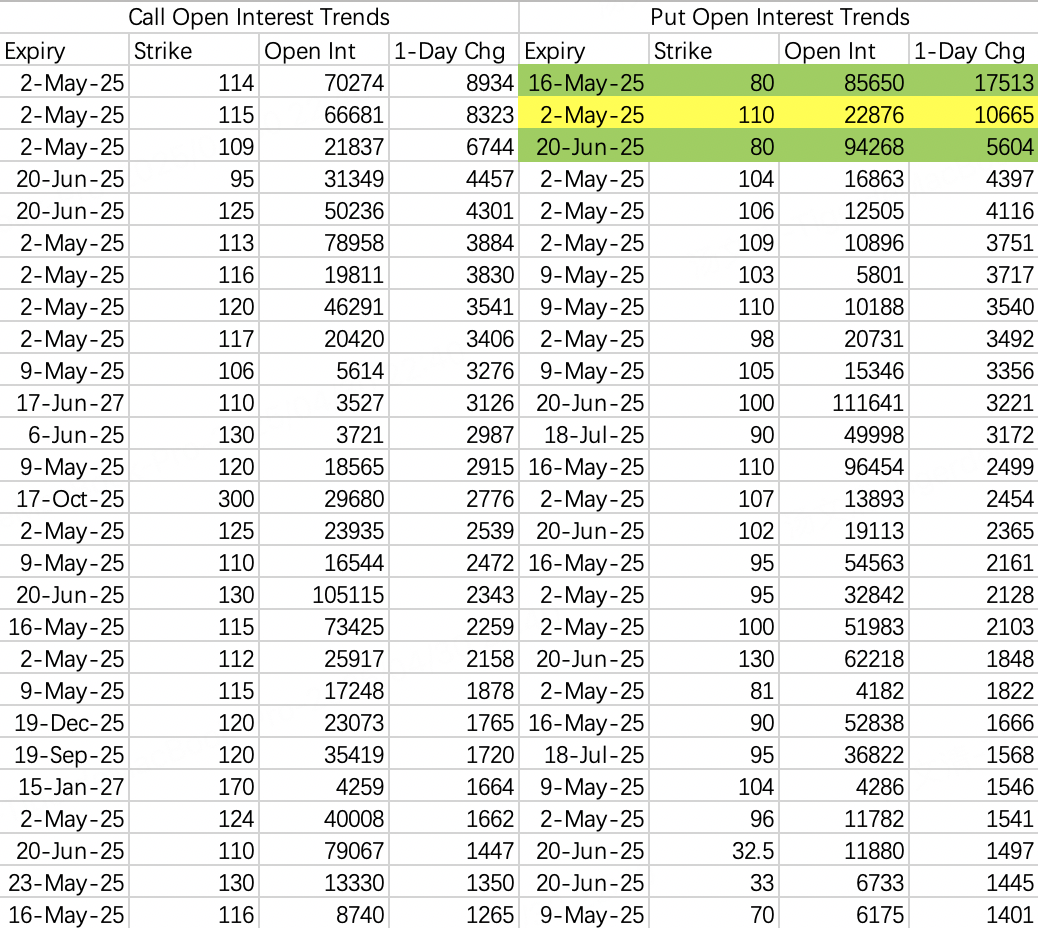

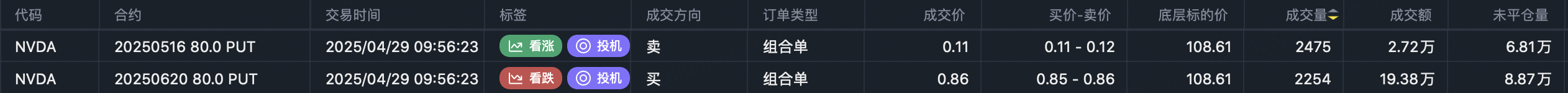

$NVIDIA(NVDA)$

There weren’t many notable new positions for NVIDIA this week, and the expected fluctuation range remains 100–113. However, a standout position was opened for 110 puts expiring this week ($NVDA 20250502 110.0 PUT$ ), where someone sold puts at a high level. Unsurprisingly, they are likely to be trapped today.

Another notable development is the volume for 80 puts, with two consecutive days of trades involving bearish put spread strategies:

Buy $NVDA 20250620 80.0 PUT$ ,

Sell $NVDA 20250516 80.0 PUT$ .

This suggests that June’s market may see increased turbulence.

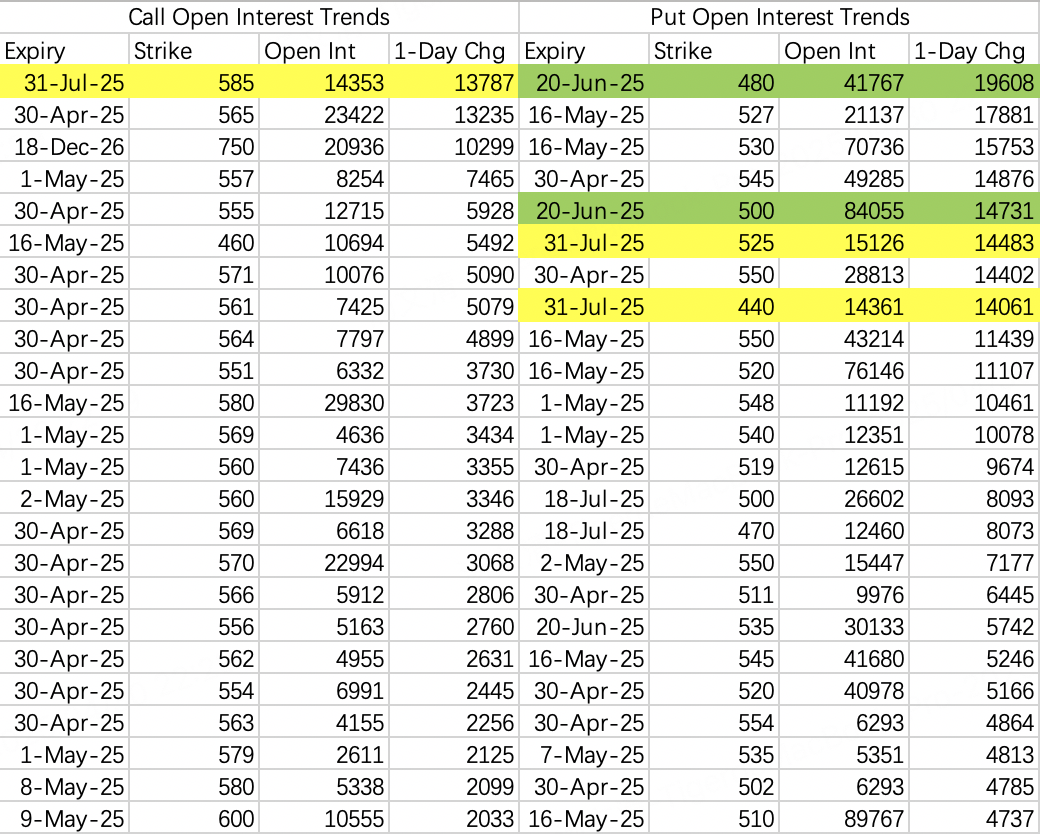

$SPDR S&P 500 ETF Trust(SPY)$

The target remains a pullback to 520–530, with SPY’s expected pullback to 530 correlating with NVIDIA’s pullback to 100.

Comments