$Apple(AAPL)$

The market as a whole has rebounded to pre-tariff levels. However, not all tech stocks have received the same treatment. For instance, Apple saw a significant sell order of 26,000 contracts for the June-expiring 240 call option ($AAPL 20250620 240.0 CALL$ ) on Friday.

The 240 level carries some significance—it was the price level prior to the U.S. stock market crash on March 10. On that day, concerns about the health of the U.S. economy shifted investor risk preferences, and the dollar index fell to its lowest point since November of last year.

$NVIDIA(NVDA)$

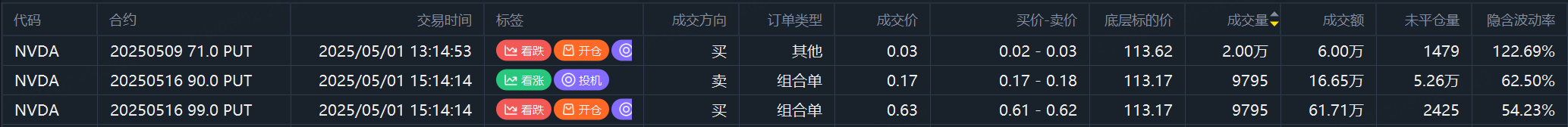

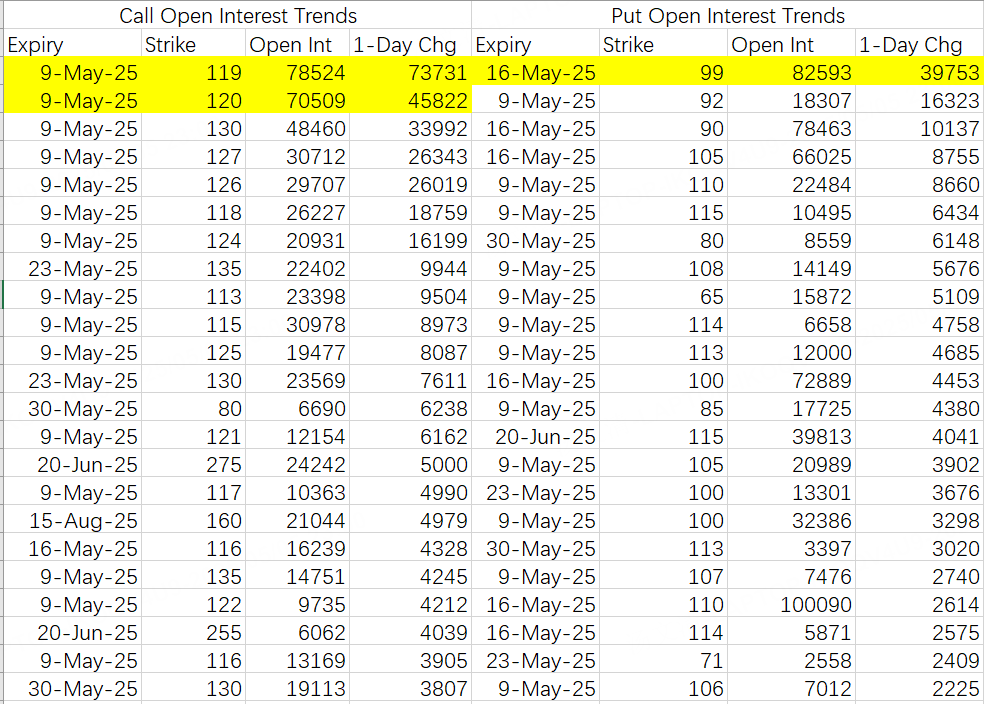

Microsoft's positive earnings report helped the market rebound to pre-tariff levels on Friday. However, this level is highly contentious. For Nvidia, it sits in a mixed zone of bullish expectations ahead of earnings and bearish pullback pressure.

Specifically, on Thursday, traders opened long positions of 70,000 contracts for the May 23-expiring 115 call option ($NVDA 20250523 115.0 CALL$ ).

On the bearish side, short sellers on Thursday and Friday continuously opened positions with bearish spread strategies: buying $NVDA 20250516 99.0 PUT$ and selling $NVDA 20250516 90.0 PUT$ .

After two days of concentrated trading, the open interest for the May 16 99 put has reached 82,000 contracts. This indicates that Nvidia has a likelihood of pulling back to around $100 in the next two weeks.

In terms of price ceilings, institutional investors have adopted bullish spread strategies this week: selling the $NVDA 20250509 120.0 CALL$ and buying the $NVDA 20250509 130.0 CALL$ . This suggests a weekly trading range of $100–$120.

However, the $120 ceiling appears to have been forced higher by last week’s rally. In reality, the ceiling may not be that high.

Overall, whether the bullish $115 call ($NVDA 20250523 115.0 CALL$ ) or the bearish $99 put ($NVDA 20250516 99.0 PUT$ ) plays out in the next two weeks, the current situation and monthly open interest suggest that aggressive bullish bets are not advisable.

$Advanced Micro Devices(AMD)$

Institutional bullish spread strategies this week involve selling the $AMD 20250509 105.0 CALL$ and buying the $AMD 20250509 114.0 CALL$ , setting the weekly ceiling at $105. For a stock reporting earnings this week, such a price target suggests rather modest expectations.

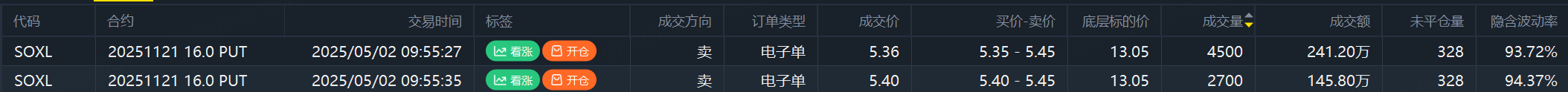

$Direxion Daily Semiconductors Bull 3x Shares(SOXL)$

A large sell order of 9,522 contracts for the $SOXL 20251121 16.0 PUT$ was executed this week.

This order falls into a gray area between being strategic and questionable. The concern lies in the fact that $16 represents the price level prior to the April 2 tariff announcement. While ETFs like SMH and SOXX have already rebounded to these levels, SOXL—a 3x leveraged ETF—remains below $16.

Is it possible that SOXL’s failure to rebound to $16 stems from leveraged decay rather than arbitrage opportunities?

If the seller of this large order is not acting recklessly, then this trade could be a well-thought-out move, suggesting that selling the $16 put at the current level is a profitable strategy.

That said, the trade still seems odd. Overall, it can be summed up as a “deep-pocketed” move.

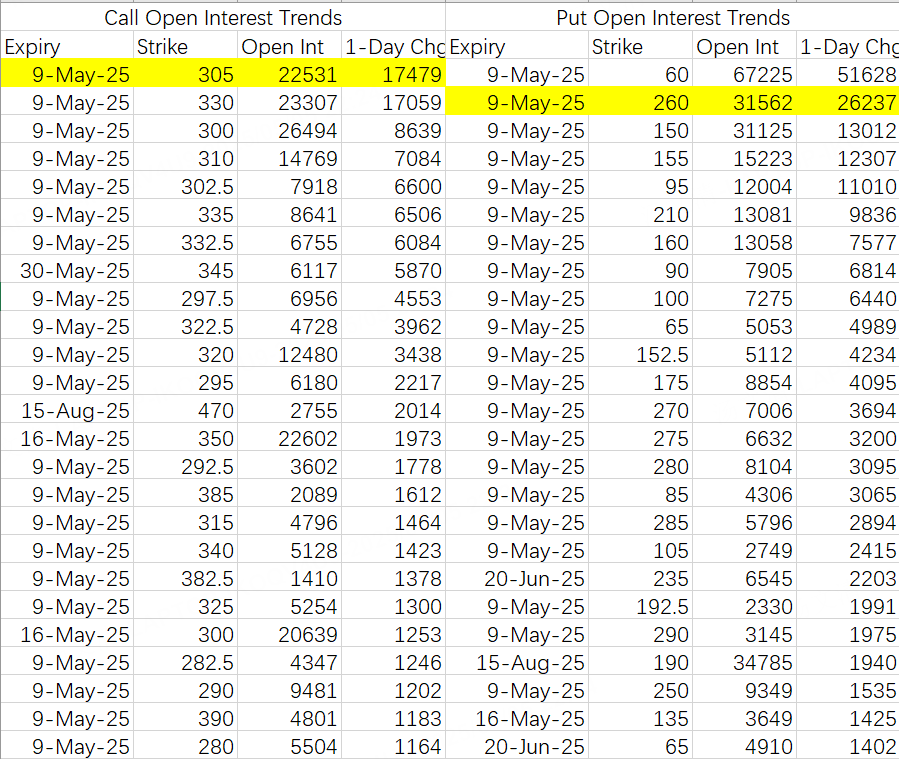

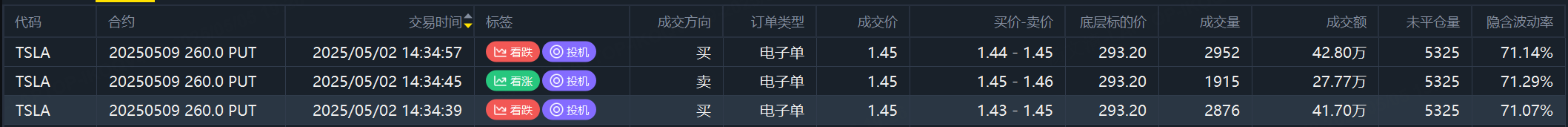

$Tesla Motors(TSLA)$

This week’s trading range is $260–$305. The $305 ceiling comes from institutional sell-call strike prices, while the $260 floor is set by bearish traders. On Friday, 26,000 contracts of the $TSLA 20250509 260.0 PUT$ were opened.

$Amazon.com(AMZN)$

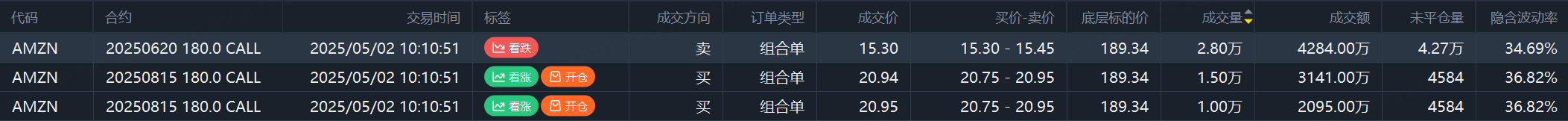

Amazon saw a significant roll of long call positions. Contracts for the $AMZN 20250620 180.0 CALL$ were rolled to the $AMZN 20250815 180.0 CALL$ , maintaining the $180 strike price as expected.

$Microsoft(MSFT)$

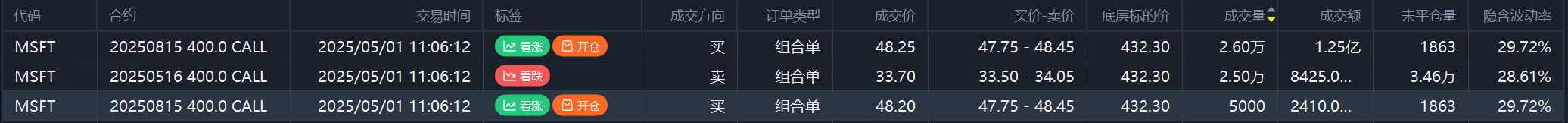

Interestingly, despite the bullish breakout in Microsoft’s earnings report, institutional long call rollovers opted for a conservative strike price of $400 ($MSFT 20250815 400.0 CALL$ ). Additionally, the volume increased from 26,000 to 31,000 contracts after the rollover.

Comments