Goldman Sachs analysts said that at the end of last month, some large technology companies involved in artificial intelligence (AI) released better-than-expected performance reports, indicating that investors have the opportunity to rearrange this sector after the recent correction.

The artificial intelligence sector, which has driven the market up in the past two years, has performed sluggishly after entering 2025. In January this year, the emergence of DeepSeek raised questions about the need for U.S. companies to invest billions of dollars in building AI systems, and chip manufacturers and AI-related stocks plummeted. Recently, the trade war initiated by US President Trump has triggered concerns about the slowdown of US economic growth or even recession.

Alphabet's earnings report showed that its profit margins remained strong despite concerns about AI spending. Microsoft's financial report showed good execution and continued demand signals in an uncertain environment.

Goldman Sachs analysts led by Louis Miller said in a note: "It can be said that the current market is very pessimistic about the AI theme. We believe that this is an opportunity to buy the AI sector on dips."

Louis Miller said: "Valuations for all AI themes are currently lower than they were at the beginning of the year and last year. From a long-term profitability perspective, the valuations of various AI stocks are cheaper than those during the previous AI boom, close to the level before ChatGPT came out (except for software, which is usually more sensitive to interest rates). Combined with the performance and profitability of our 'Broad AI Stock Basket', this type of stock is still cheap at present, while profitability remains stable. "

In addition, Goldman Sachs' report pointed out that the overall market sentiment is also improving, and "tariff risk factors are gradually being digested". Analysts don't expect economic data over the next month to show a significant impact from tariffs, and expect U.S. consumers to continue spending unless prices rise sharply or unemployment rises, none of which will occur in the near term.

For investors who want to go long in the AI sector while controlling risks, you can consider using the bullish spread strategy.

Use the bullish spread strategy to go long on the AI sector

For the average investor, buying these stocks outright may be costly or risky. But byCall Spread Strategy, can participate in the potential upside of these stocks at a lower cost while controlling risk.

Call spreadThe operations include:

Buy a lower strike Call Option (Call Option), obtain the right to rise in the stock in the future;

Sell a call with a higher strike price, recycling some premium while limiting potential revenue.

For example: If investors are bullish on Nvidia, the following strategies can be constructed:

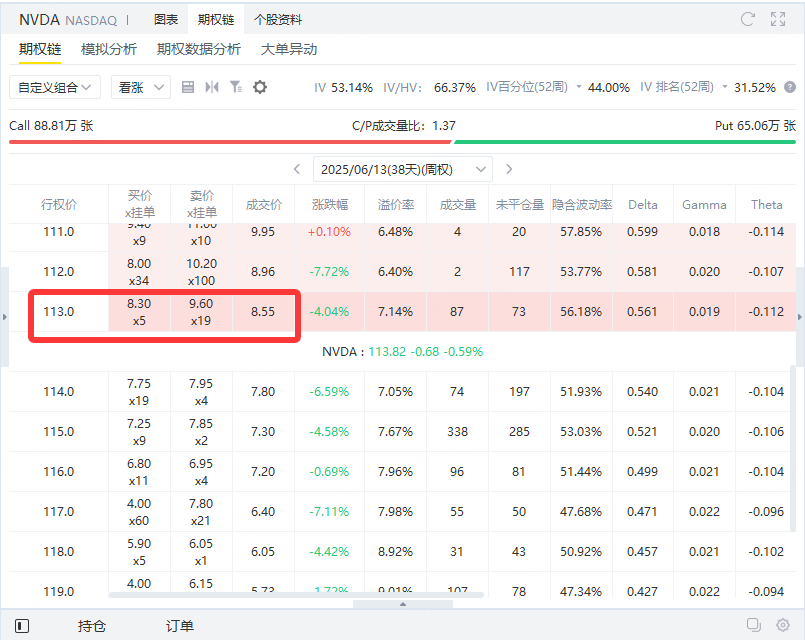

It costs $855 to buy a call option expiring June 13 with a strike price of $113.

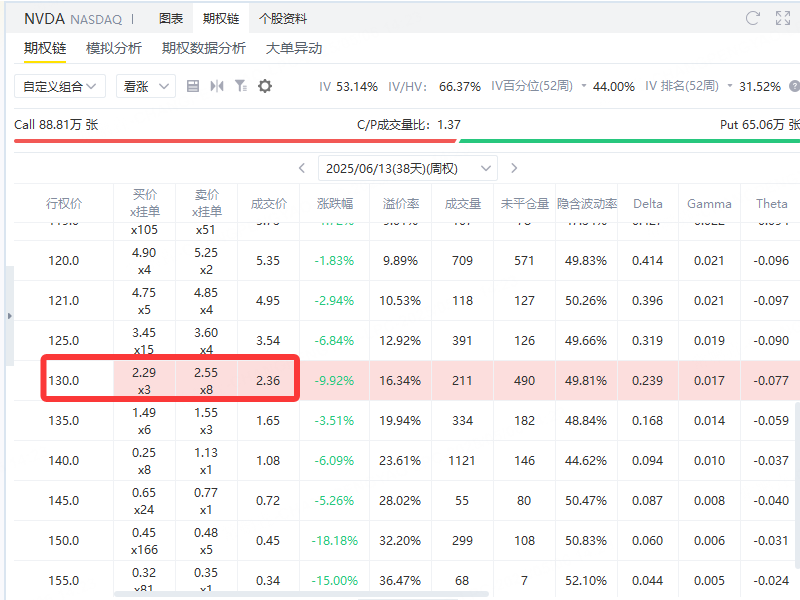

Sell a call option expiring on June 13 with a strike price of $130 and get a premium of $236.

If Nvidia's stock price rises above $113, the strategy will reap the most. On the contrary, if the stock price fails to rise, the maximum loss is limited to the net premium paid.

Advantages of Call Spread Strategies

In volatile markets, a call spread strategy has the following advantages:

Low capital requirements:Compared with buying stocks directly, it requires less funds;

The risks and benefits are clear:The maximum loss is the net premium paid, and the maximum gain is the difference between the two strike prices minus the net premium;

Volatility Impact Less:Since there are both call and put options in the strategy, it is less sensitive to changes in implied volatility.

Comments