I like $Hims & Hers Health Inc.(HIMS)$ very much, but I missed the bottom in the week before the holiday and watched it rise for several days.

However, it is indeed time for a short-term correction as the positive financial report has materialized.

What does $Hims & Hers Health Inc.(HIMS)$ company do:

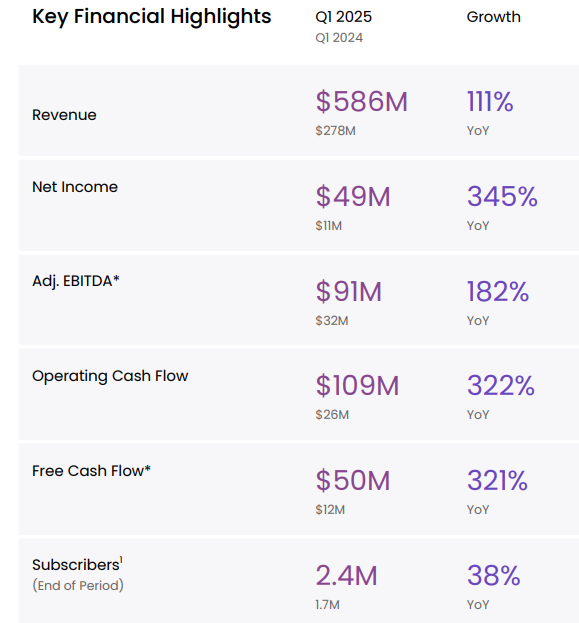

$Hims & Hers Health Inc.(HIMS)$ just released exciting first quarter 2025 results on May 6:

✔ Revenue of $586 million, up 111% year-over-year

✔ Subscribers grew to 2.4 million, up 38% year-over-year

✔ 60% of subscribers choose personalized solutions on the platform

In addition to the first quarter results, $Hims & Hers Health Inc.(HIMS)$ 's vision for the future.

Describes where its company is headed in the future and how it plans to get there.

$Hims & Hers Health Inc.(HIMS)$ has set an ambitious goal: to reach $6.5 billion in revenue and $1.3 billion in adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) by 2030.

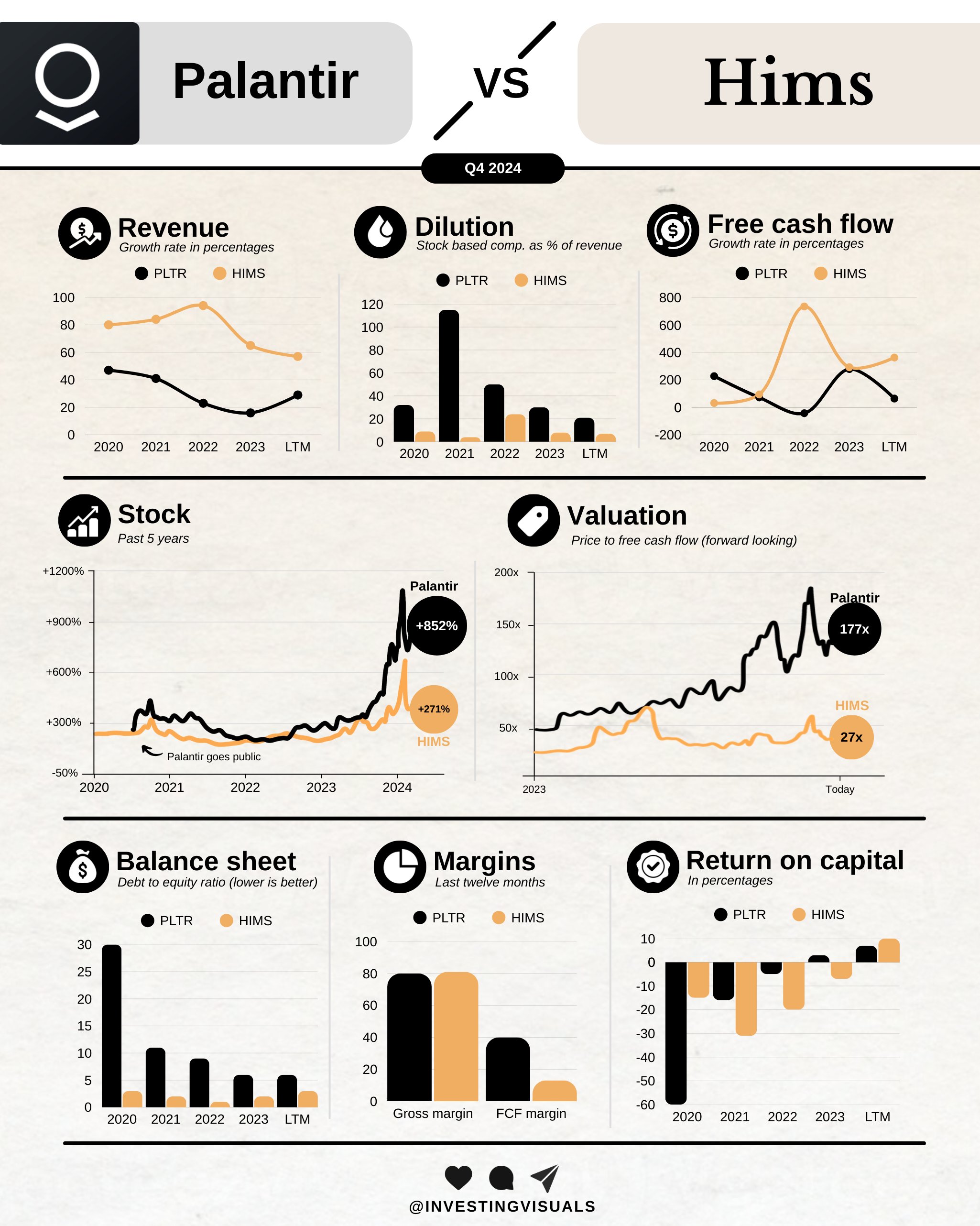

Just talking about the 3-digit growth of $Hims & Hers Health Inc.(HIMS)$ may not be intuitive enough.

But it has stronger performance growth than the popular $Palantir Technologies Inc.(PLTR)$ . The revenue difference is only more than 2 million US dollars.

But the price of $Palantir Technologies Inc.(PLTR)$ is three times that of $Hims & Hers Health Inc.(HIMS)$.

The interpretation of the above chart is: $Palantir Technologies Inc.(PLTR)$ and $Hims & Hers Health Inc.(HIMS)$ show different growth in different aspects:

Revenue Growth:

Palantir's revenue growth rate fluctuates greatly, but is generally higher than HIMS.

Stock Performance:

Palantir's stock has increased by 852% in the past five years, while HIMS has increased by 271%. From this perspective, Palantir's stock performance is stronger.

Valuation:

Palantir's price to free cash flow ratio (P/FCF) is significantly higher than HIMS, indicating that the market has higher expectations for Palantir's future growth.

Margins:

Palantir's gross profit margin and free cash flow margin are both higher than HIMS, showing stronger profitability.

Overall, $Palantir Technologies Inc.(PLTR)$ shows stronger growth potential in terms of stock performance, valuation, and profitability. However, $Hims & Hers Health Inc.(HIMS)$ performs better in terms of dilution and return on capital, showing a more stable financial situation. Therefore, Palantir is more outstanding in terms of growth, but HIMS may have an advantage in terms of stability.

I think I will continue to look for opportunities to intervene.

Comments