$SPDR S&P 500 ETF Trust(SPY)$

On Wednesday, there will be a Federal Reserve FOMC meeting, which is expected to keep the interest rate unchanged at 4.375%. The market anticipates a 100-basis-point rate cut before the end of the year, likely starting in July.

I think there may be brief volatility post-meeting, but the most important factor in the near term remains the tariff negotiations and their outcomes.

Speaking of recent volatility, we can't ignore the old saying about U.S. stocks: Sell in May and go away. However, based on the options open interest, this year's "selling in May" seems to specifically refer to options sellers.

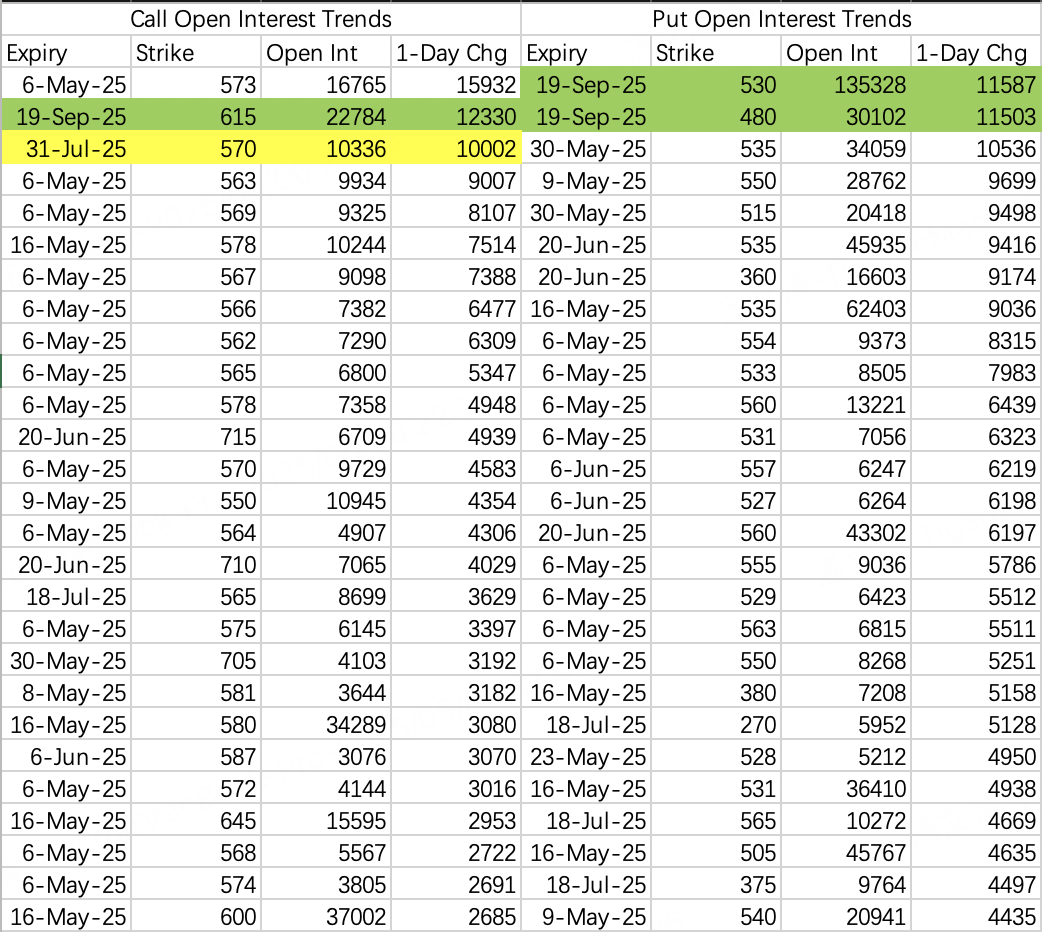

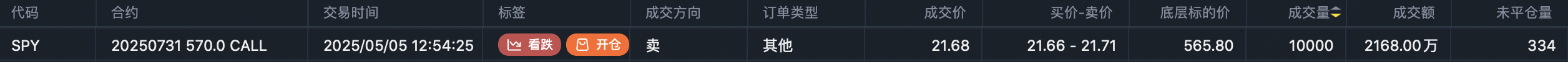

On Monday, there were two significant long-term large orders in $SPY, reflecting a bearish outlook on the broader market but also a reluctance to invest for a bottom.

The first major order was a sell call:

$SPY 20250731 570.0 CALL$ , with a volume of 10,000 contracts.

The strike price is an aggressive 570, but factoring in the premium of 21.68, it implies that as long as $SPY doesn't exceed 590 by July 31, the seller can profit. This suggests that the trader doesn't expect $SPY to break above its 120-day moving average by the end of July.

However, if the $SPY price surpasses 570, the margin pressure for the sell call position will be significant. So, the trader is likely betting on a scenario where $SPY stays below 570. Of course, it’s also possible that the trader is holding shares and thus doesn't face margin pressure.

Additionally, there’s a possibility that this was not a sell but a buy order. The transaction price was ambiguous relative to the bid-ask spread, so there’s a chance this was bullish. From a bullish opening perspective, the order would be a positive signal.

The second major order was a cost-neutral bearish strategy: selling an out-of-the-money call and put to cover the cost of a protective put. Generally, when traders are unwilling to pay for directional exposure, it suggests a higher probability of a flat or opposite trend:

Sell $SPY 20250919 615.0 CALL$ , volume: 11,500 contracts

Buy $SPY 20250919 530.0 PUT$ , volume: 11,500 contracts

Sell $SPY 20250919 480.0 PUT$ , volume: 11,500 contracts

Thus, the May pullback may be shallower than expected.

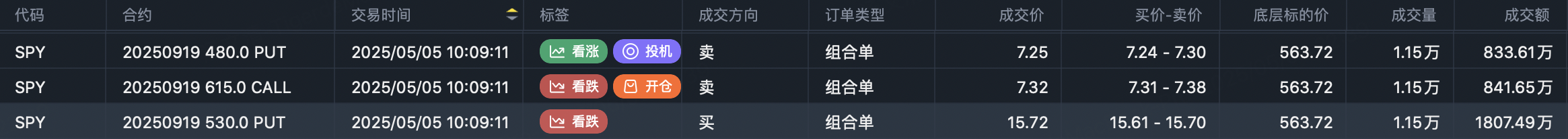

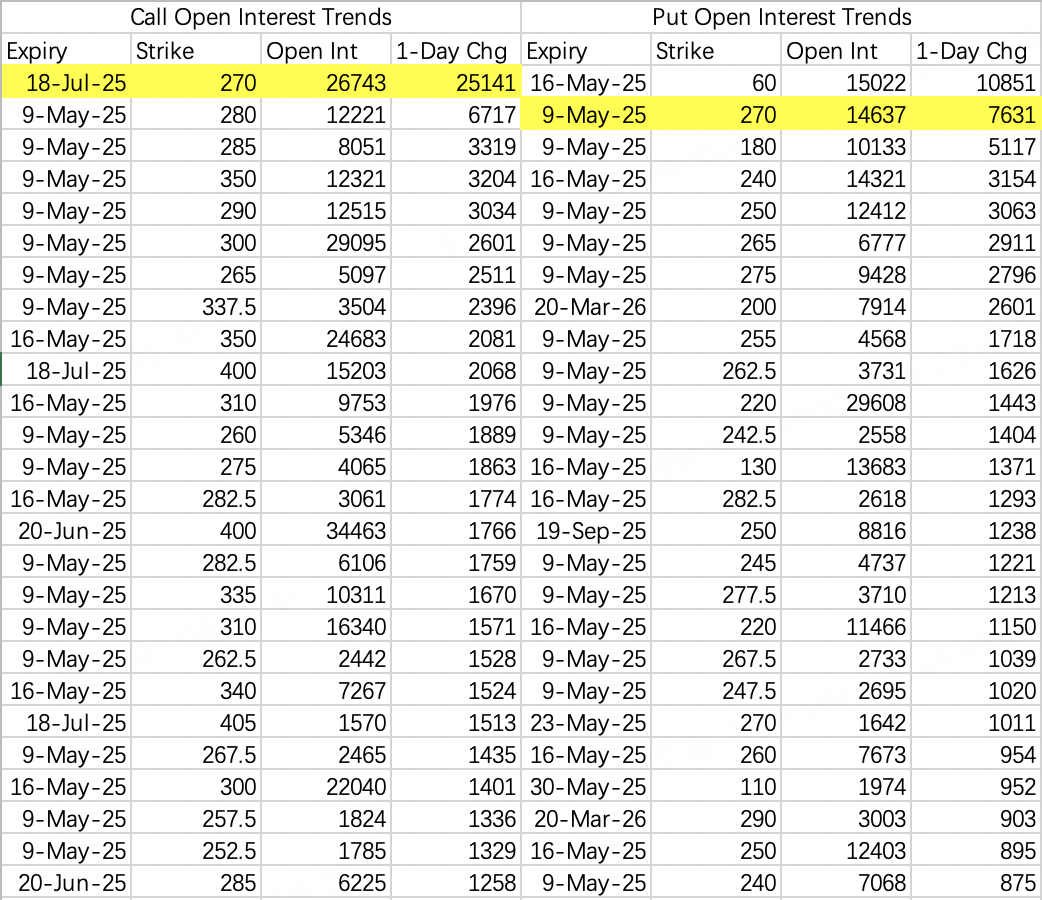

The same issue arises with $NVDA, as some large orders are focused on going long for the week of May 23. This suggests that the pullback over the next two weeks may also be milder than expected.

On Monday, bearish put options were opened for 117 puts $NVDA 20250523 117.0 PUT$ and 118 puts $NVDA 20250523 118.0 PUT$ , with open interest increases of 9,940 and 9,892 contracts, respectively. These were single-leg sell positions.

Considering that there were previous large bullish orders for $NVDA 20250523 115.0 CALL$ , the stock price may have a high probability of reaching $115–$118 before NVIDIA’s earnings report.

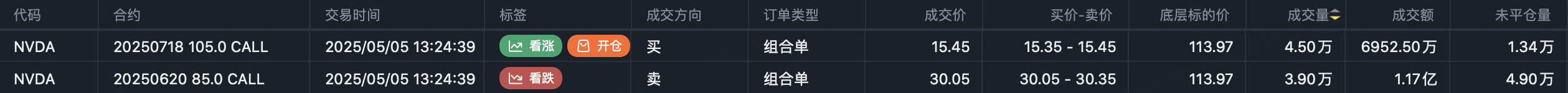

For bullish call options, institutions rolled their April long calls at 85 strike into July 105 calls: $NVDA 20250718 105.0 CALL$ .

Even though the market trend seems to be strengthening, it’s possible we may not see a pullback to $100. Given the opportunity cost of waiting, a small position in sell puts like $NVDA 20250516 100.0 PUT$ or at the $105 strike could be a compromise.

$VanEck Semiconductor ETF(SMH)$

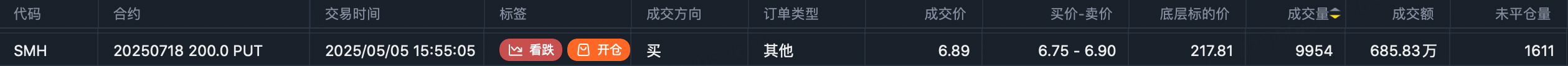

The semiconductor ETF has bearish orders predicting a pullback to $200:

$SMH 20250718 200.0 PUT$ , volume: 10,000 contracts.

This corresponds to a potential $NVDA pullback to $100. Some chip stocks may see earnings disappointments.

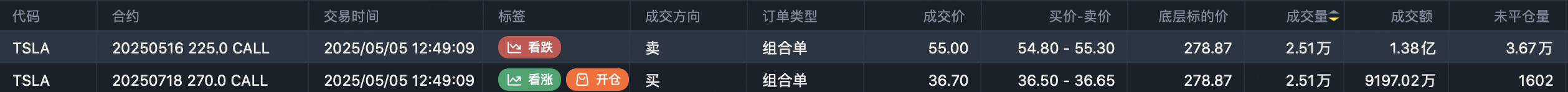

Good news: the 260 put $TSLA 20250509 260.0 PUT$ has been closed. Tesla has returned to fighting the $270 level.

Institutions rolled their long calls to $TSLA 20250718 270.0 CALL$ , with the volume unchanged at 25,100 contracts. Although the strike price was raised from $225 to $270, its reference value is limited.

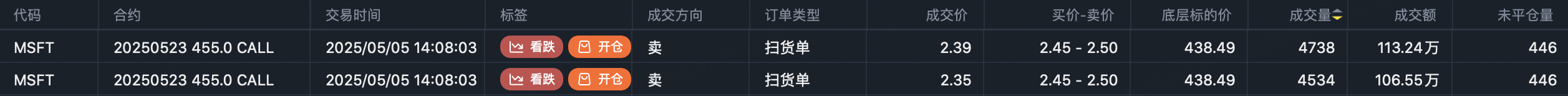

A major sell call order:

$MSFT 20250523 455.0 CALL$ , volume: 10,000 contracts.

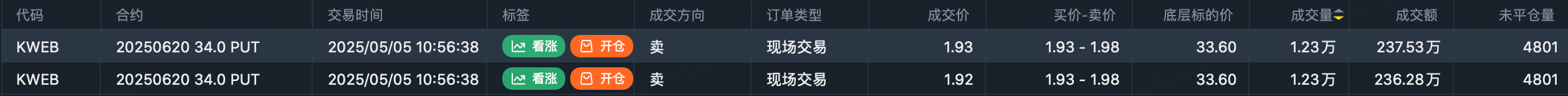

$KraneShares CSI China Internet ETF(KWEB)$

Chinese stocks are likely entering a consolidation phase.

A large sell put order in $KWEB:

$KWEB 20250620 34.0 PUT$ , volume: 25,000 contracts.

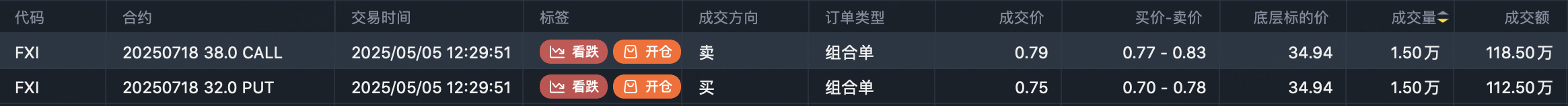

$iShares China Large-Cap ETF(FXI)$

The $FXI options market shows a zero-cost bearish trade—this is self-explanatory, indicating a high probability of sideways movement or continued bullishness.

Sell $FXI 20250718 38.0 CALL$ , volume: 15,000 contracts

Buy $FXI 20250718 32.0 PUT$ , volume: 15,000 contracts

Comments