US stock AI application giant$AppLovin Corporation (APP) $The first quarter results will be announced after the market closes on May 7, Eastern Time. The agency expects Applovin to achieve revenue of US $1.379 billion in Q1 2025, a year-on-year increase of 30.28%; Earnings per share were US $1.438, a year-on-year increase of 114.57%

Last quarter, after Applovin disclosed its 2024 Q4 results, its stock price soared by more than 35% that day, while hitting a record high. Later, due to the systemic risks brought by Trump's tariffs and the attacks of many short-selling institutions, Applovin's stock price experienced a pullback/retracement for dozens of days, returned to the position where the Q3 results were released in November last year, and then fluctuated and consolidated.

Short selling by many institutions drags down stock prices

On February 27, Applovin was questioned by many short-selling institutions. Both Culper and Fuzzy Panda pointed out that,Applovin abuses application permissions to automatically install applications in the background of users' mobile phones without users' consent. This practice is the key to its revenue growth, but it violates Google and Apple App Store policies and risks regulatory scrutiny and huge fines.

The short-selling report revealed the details of the operation, that is, Applovin's ad-driven installation can be completed with just one click-and this click is usually inadvertently triggered by users, which is attributed to the company's notorious user experience (UX) design techniques. Culper claims that this process is a key driver of the company's success in mobile gaming because AppLovin's revenue is earned on a per-install basis.

The second major allegation relates to Applovin's e-commerce business, which Culper describes as a "blind game," noting that its operations depend on control of advertisers.Culper believes that AppLovin requires advertisers to first prove that they spend at least $600,000 a month on Meta to be allowed on its platform. This allows AppLovin to "peek" into Meta's ad traffic and manipulate attributions, Culper claims.

Just a month later,Muddy Waters, which is famous for its short-term concept stocks, also struck hard. Muddy Waters accused AppLovin of abusing data and violating the platform's terms of service.According to the report, AppLovin's ad delivery strategy "systematically" violated the App Store's terms of service by "improperly extracting the proprietary IDs of Meta, Snap, TikTok, Reddit, Google and others." Muddy Waters said that it pushed targeted advertisements to users without their consent.

In addition, Muddy Waters also pointed out that Applovin is losing e-commerce advertisers, whose customer churn analysis was derived by looking at e-commerce sites that were still using AppLovin's AXON pixel code on January 3, 2025.

UBS holds a different view on the accusations of short-selling institutions.UBS said these short reports exaggerate the importance of clicks/installs compared to advertiser return on investment (ROAS).Specifically, what drives gaming/e-commerce advertisers to invest more in installations/clicks isn't the installations/clicks themselves, but the spend these installations/clicks bring from end users.

UBS is also optimistic about Applovin's growth prospects, especially in the advertising sector. Analysts believe the company can achieve a compound annual growth rate (CAGR) of more than 40% in revenue in the advertising space over the next three years. Whether Applovin can shatter doubts with strong earnings will also determine whether its stock price can return to its peak.

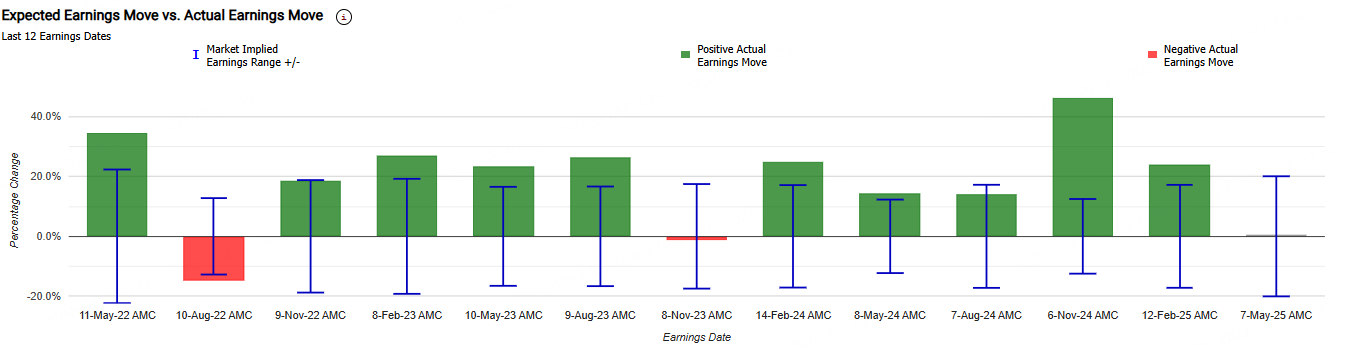

How has the stock price performed on previous earnings days?

Currently, the implied change for Applovin is±21.41%, indicating that the single-day increase and decrease of the options market after betting on its performance reached 21.41%; In comparison, Applovin's post-performance average stock price change in the first four quarters was±24.7%, showing that the current option value of the stock isUnderestimate。

What is the wide straddle strategy

In long wide straddle options, investors buy both out-of-the-money call options and out-of-the-money put options. The strike price of a call option is higher than the current market price of the underlying asset, while the strike price of a put option is lower than the market price of the underlying asset. This strategy has significant profit potential because the call option theoretically has unlimited upside if the price of the underlying asset rises, while the put option can make a profit if the price of the underlying asset falls. The risk of the trade is limited to the premium paid for these two options.

An investor shorting a wide straddle sells an out-of-the-money put and an out-of-the-money call at the same time. This approach is a neutral strategy with limited profit potential. Shorting a wide straddle option is profitable when the underlying stock price is trading within a narrow range between break-even points. The maximum profit is equal to the premium obtained by selling two options minus the transaction cost.

Short-selling wide straddle strategy case

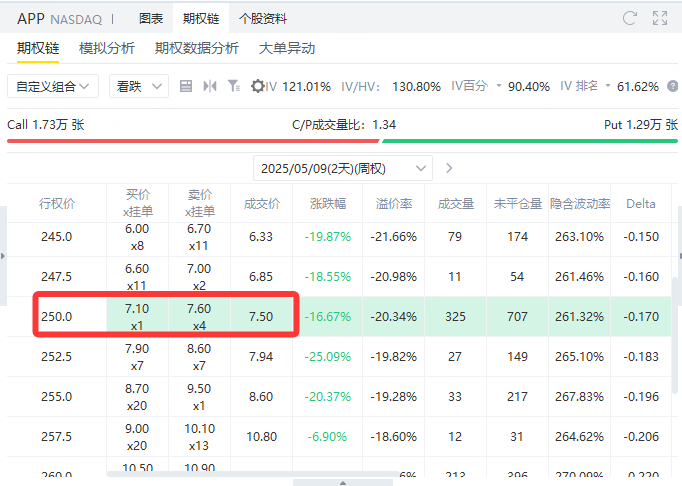

Stock APP is currently trading at $308. Investors can implement the short wide straddle strategy by:

Sell a call option with a strike price of $400, and premium is $430.

Sell a put option with a strike price of $250, and premium is $750.

Investors perform the following operations:

Sold 1 sheetExercise price $400Call options, obtain premium$4.30/share ($430 total)

Sold 1 sheetStrike price $250Put options, obtain premium$7.50/share ($750 total)

Total earnable premium income is:

430 + 750 = $1180 (per contract)

The maximum profit of this strategy is this $1,180. When the price of APP stock at expiration is between $250 and $400, the options at both ends will be invalid, and investors will retain all premium gains.

The break-even points are at both ends of the price: $238.20 below (250 minus 11.80) and $411.80 above (400 plus 11.80). In other words, as long as the price of the APP at expiration falls between $238.20 and $411.80, the strategy is profitable; Beyond this range, there will be a loss.

However, it must also be emphasized that this is a high-risk strategy, especially when there is a large unilateral market, which may lead to a rapid expansion of losses. Therefore, it is only recommended for investors with sufficient margin and risk awareness, and strictly control their positions.

Comments