Last night, tobacco company $Philip Morris(PM)$ caught market’s eyes again, it hit all time high again and now is the top 10 winners by YTD 2025 among $S&P 500(.SPX)$ stocks.

Read more>> YTD Winner! Why These 10 SPX Stocks Outperformed in 2025?

This tobacco company has been continuously hitting new highs over the past two years.

What’s its magic?[Miser]

$Philip Morris(PM)$ has risen by 44.64% in 2025 and has seen gains for two consecutive years, with a cumulative increase of 85.63%.

Another two tobacco companies, $Altria(MO)$ and $British American Tobacco PLC(BTI)$ , have also seen double-digit gains for two consecutive years, with cumulative increases of over 50%.

Data as of May 6th 2024

Main Business Introduction:

$Philip Morris(PM)$ 's main business includes traditional tobacco products and smoke-free products. It owns several well-known brands, such as Marlboro. Its smoke-free products, like the IQOS heated tobacco products, hold a leading position in the global market. PM further strengthened its competitiveness in the smoke-free product field by acquiring Swedish Match.

$Altria(MO)$ mainly focuses on the US market, with its business covering traditional tobacco products and smokeless tobacco products. MO has a high dividend yield, but its business growth mainly depends on the performance of the US market.

$British American Tobacco PLC(BTI)$ 's business covers traditional tobacco products and new types of tobacco products, such as heated tobacco products and e-cigarettes. BTI is listed in multiple markets, including the UK and the US, and its stock also has the concept of international business expansion.

Why has $Philip Morris(PM)$ continued to hit new highs and outperformed the other two companies?

$Philip Morris(PM)$ has outperformed $Altria(MO)$ and $British American Tobacco PLC(BTI)$ over the past two years for the following main reasons:

1. Successful Business Transformation with Strong Growth in Smoke-Free Products

Core driving force: PhilipMorris(PM) has achieved remarkable results in its transformation in the smoke-free product field. The net revenue share of its smoke-free products increased from 29.1% in 2021 to 39% in 2024. In 2024, the revenue from smoke-free products grew by 14% to $14.7 billion, far exceeding the growth rate of traditional tobacco business.

Specific product performance: PM's IQOS heated tobacco products hold a leading position in the global market. In 2024, the total number of IQOS users was about 24.9 million, of which about 17.8 million had switched to IQOS and quit smoking. The market share of heated tobacco units (HTUs) in the IQOS market rose to 8%, taking a dominant position in the smoke-free product market.

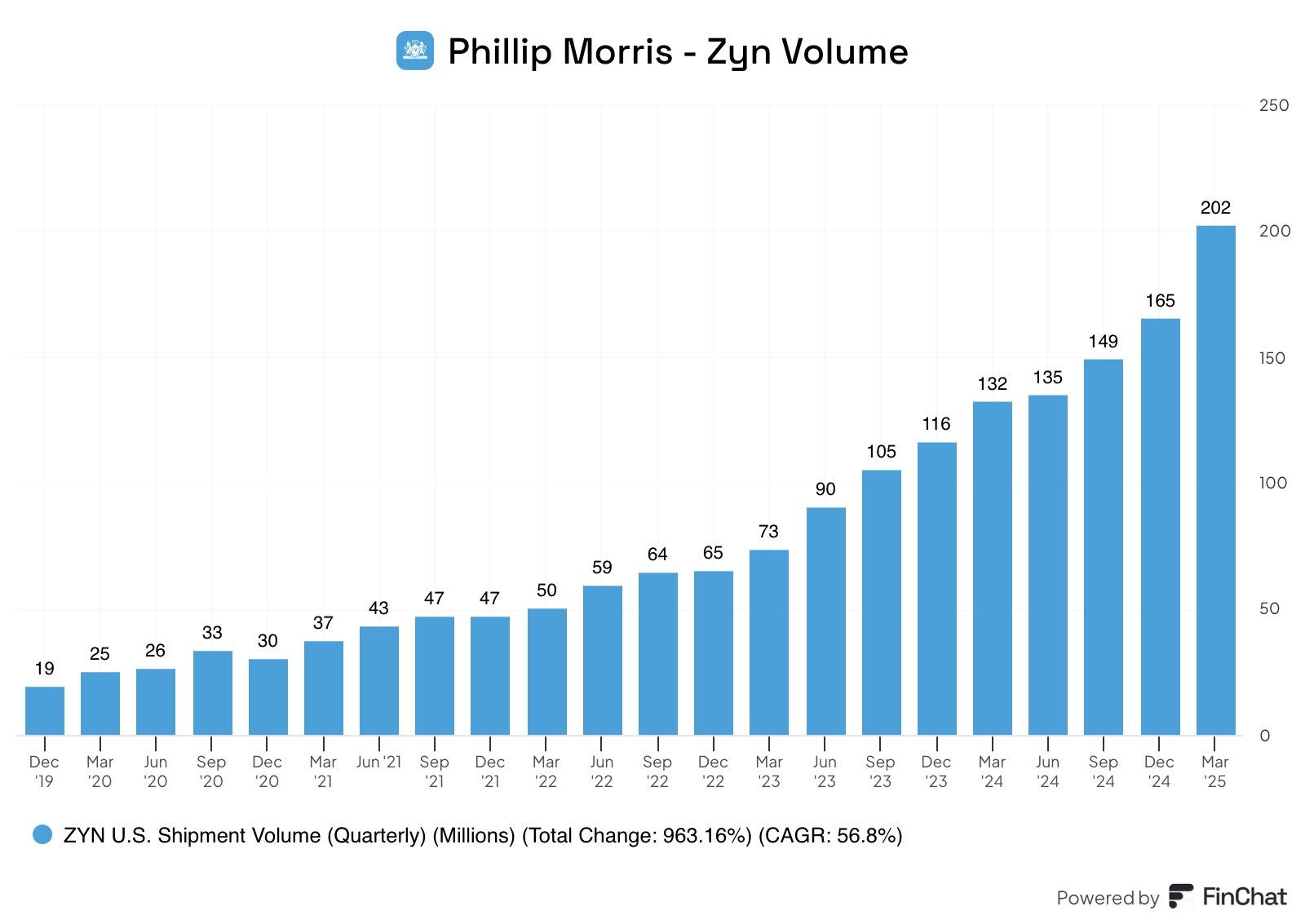

Acquisition boost: In 2022, PM acquired Swedish Match for $16.1 billion, strengthening its technological barriers in the smoke-free product field. The market share of the ZYN brand in the US increased from 36% in 2023 to 66% in 2024.

2. Robust Financial Performance with Enhanced Profitability

Revenue and profit: In 2024, PM's total revenue was $37.878 billion, up by 7.69% year-on-year. Although the net profit attributable to the parent company declined by 9.68% year-on-year, the core net profit (excluding non-recurring factors) increased by 13.3%, showing the strong profit potential of the smoke-free business.

Cash flow and shareholder returns: $Philip Morris(PM)$ had a free cash flow of $10.77 billion, supporting its continuous investment in research and development and shareholder returns. In 2024, the company paid out $8.2 billion in dividends (with a dividend yield of 3.7%) and enhanced shareholder value through share buybacks.

Profitability: In 2024, $Philip Morris(PM)$ 's gross margin was 64.84%, higher than the industry average. The net margin was 20.3%, up by 1.2 percentage points year-on-year, with significant cost optimization results.

3. Global Layout and Market Expansion

Global market coverage: $Philip Morris(PM)$ 's smoke-free products have covered 120 markets. It has accelerated its penetration in the US through cooperation with $Altria(MO)$ and also localized production in places like Indonesia and Turkey to reduce costs.

Brand reshaping and market perception: The "Marlboro" brand has extended from a traditional tobacco symbol to the smoke-free field, covering over 30 million users. Advertising focuses on "less harm but not less addiction," trying to change public perception.

4. Industry Trends and Competitive Landscape

Industry trend: The global tobacco industry is transitioning towards smoke-free products. $Philip Morris(PM)$ has taken the lead in the smoke-free field with products like IQOS and ZYN. In comparison, $Altria(MO)$ and $British American Tobacco PLC(BTI)$ have relatively lagged behind in the layout and growth speed of smoke-free products.

Competitive landscape: $Philip Morris(PM)$ has a market share of over 80% in the heated-not-burned (HNB) field. $British American Tobacco PLC(BTI)$ 's Vuse e-cigarettes have a market share of 50.2% in the US, but its new product Glo Hyper is not planned to challenge IQOS until 2025.

5. Macro Environment and Policy Impact

US dollar exchange rate: $Philip Morris(PM)$ has 80% of its loans in US dollars, while its US business is mainly conducted through $Altria(MO)$ , with only 5% of its own. It benefits from a weak US dollar.

Policy environment: $Philip Morris(PM)$ 's business is mainly concentrated in the international market, avoiding the pressure of the US cigarette market. In comparison, $Altria(MO)$ and $British American Tobacco PLC(BTI)$ have a relatively higher proportion of business in the US market and are more affected by changes in US market policies.

6. Stable Financial Performance:

Although $Philip Morris(PM)$ 's dividend yield is 4.5%, lower than $Altria(MO)$ (7.7%) and $British American Tobacco PLC(BTI)$ (8.4%), its stable financial performance and good growth prospects make it a more comprehensive investment choice.

7. Investment Value:

$Philip Morris(PM)$ 's valuation has historically been overvalued by 15%, but its best-in-class growth prospects still provide the potential for a stable return of 11% over the next five years.

$Altria(MO)$ and $British American Tobacco PLC(BTI)$ are still undervalued by about 17%, which may be worth buying. Their five-year expected total return potential is 127%, with an annualized return of 17%.

$British American Tobacco PLC(BTI)$ 's five-year consensus total return potential is 134%, with an annualized return of 18%. Although its stock price has risen nearly 40% this year, its attractive dividend and extremely low risk still provide excellent return potential.

Summary

The core reason for $Philip Morris(PM)$ 's strong performance over the past two years is its successful transformation and strong growth in the smoke-free product field, which has brought new growth engines and market competitiveness. At the same time, its robust financial performance, global market layout, brand reshaping, and adaptability to macro environment and policy changes have further consolidated its leading position in the industry.

In comparison, $Altria(MO)$ and $British American Tobacco PLC(BTI)$ have relatively lagged behind in the layout and growth speed of smoke-free products, resulting in their market performance not being as good as PM.

A tool to boost your purchasing power and trading ideas with CashBoost!

Open a CBA today and enjoy access to a trading limit of up to SGD 20,000 with upcoming 0-commission, unlimited trading on SG, HK, and US stocks, as well as ETFs. Find out more here.

Other helpful links:

Comments