From May 9 to May 12, there will be U.S.-China talks. However, the options market remains unusually calm, with very low implied volatility. Based on past experiences, the market tends to remain stable before monthly options expiration. However, after the May 16 expiration, volatility could increase.

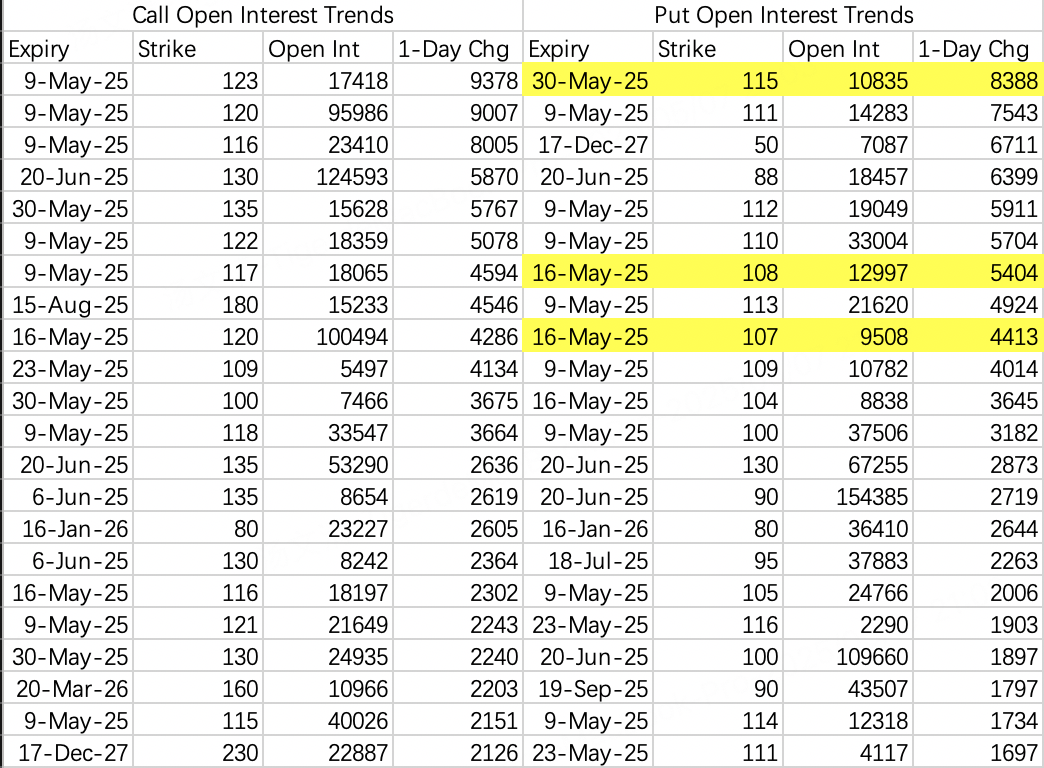

For this week, $NVDA is likely to close between $110 and $115. Bearish positions opened recently seem to support the idea of a potential drop after monthly options expiration. A significant trade combines a sell put for May 16 expiration and a buy put for May 30 expiration:

This suggests that the broader market may remain stable until the week of May 16 or even May 23. However, there could be risks during NVIDIA's earnings week.

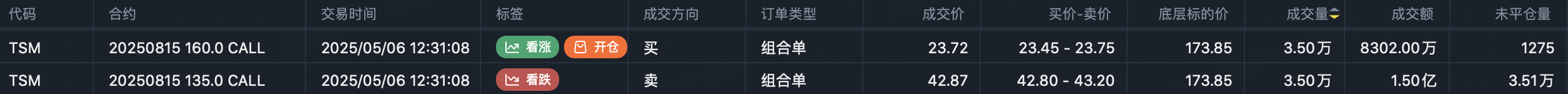

$Taiwan Semiconductor Manufacturing(TSM)$

A significant long call roll trade was observed, rolling to an August 15 expiration at a $160 strike:

$TSM 20250815 160.0 CALL$ , volume: 35,000 contracts

Interestingly, on Tuesday, there were large purchases of long-dated bullish options for semiconductor stocks expiring in 2027:

I later found that NVIDIA also had similar long-dated bullish positions opened for the same expiration:

The breakeven price for this long call is $142. It's hard to imagine NVIDIA not reaching $142 by 2027, making this trade appear low-risk. However, I'm choosing to wait and see regarding this leveraged bottom-fishing strategy.

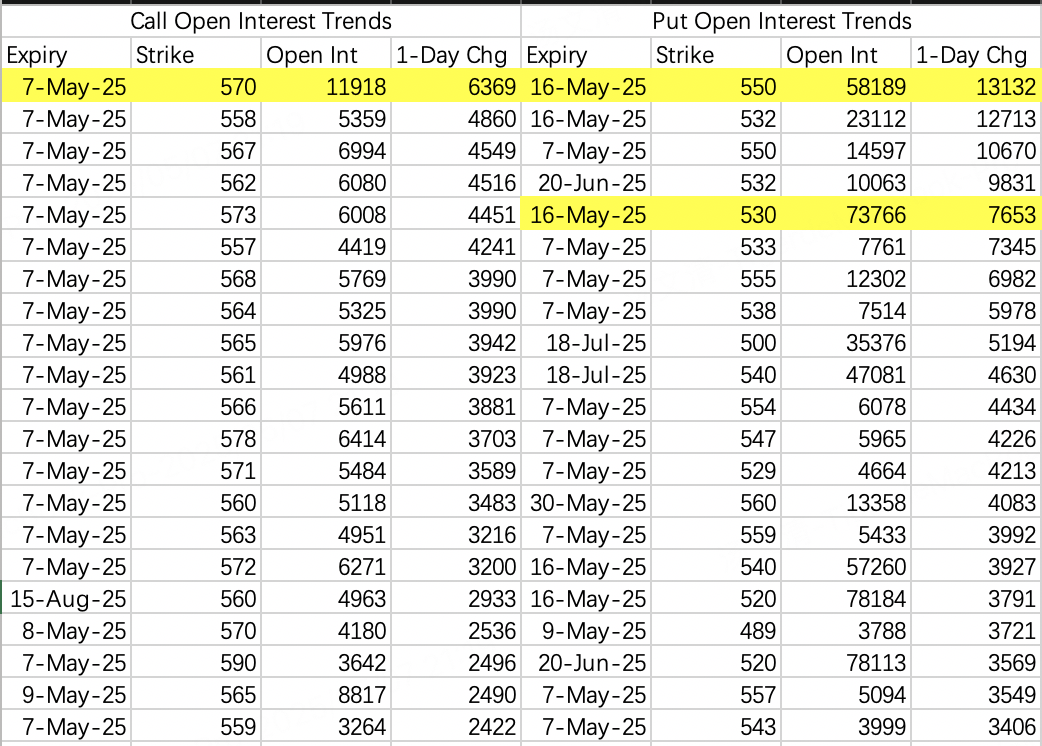

The outlook remains stable, with a pullback target of $530–$550.

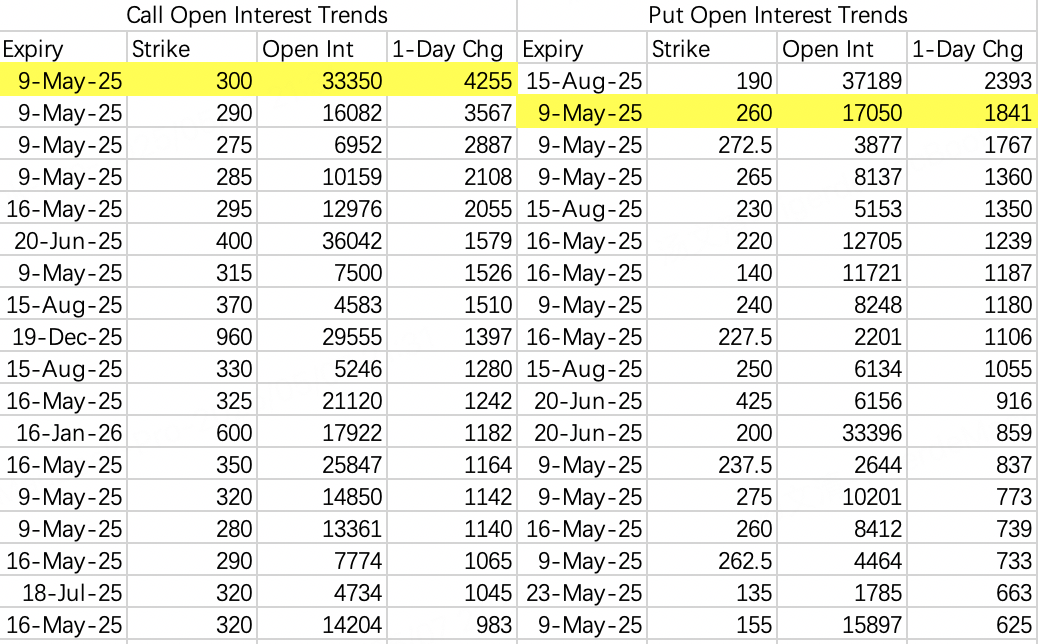

Tesla also remains steady, with even the volume of newly opened options positions decreasing. This week's expected range is still $260–$300.

$Palantir Technologies Inc.(PLTR)$

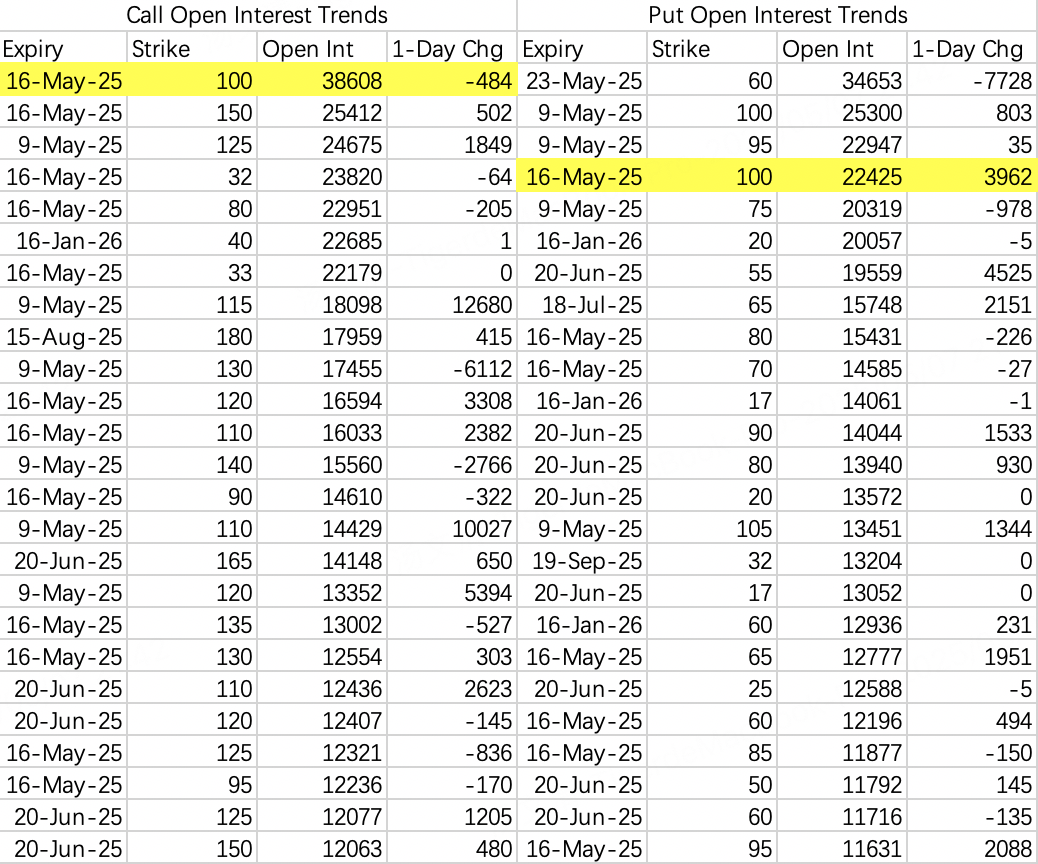

Palantir often serves as an early indicator of broader market trends. Although its earnings were solid, the stock price still dropped post-earnings, signaling a potential broader market pullback. The May monthly options pullback target price is $100.

Comments