In the U.S. stock market on Wednesday, the stock price of Google's parent company Alphabet plunged, and the decline expanded rapidly, falling more than 9% at one point. Apple's stock price turned lower during the day, falling more than 2% intraday. The decline of Google and Apple caused the U.S. stock market to fall. The Nasdaq 100 turned down during the session. The Nasdaq 100 once rose 1% after the U.S. stock market closed last day.

On the news,Apple is "actively considering" a major overhaul of its Safari browser on its devices, focusing on an AI-powered search engine. This decision may end the years-long partnership between Apple and Google, trigger a major change in the entire industry, and pose a severe challenge to Google's dominance in the search field. The search era dominated by Google may be coming to an end.

Google parent company Alphabet closed down nearly 7.3% on Wednesday to close at $151.38.

Eddy Cue, Apple's senior vice president of Internet software and services, revealed the news on Wednesday when he testified in an antitrust lawsuit filed by the U.S. Department of Justice against Google's parent company Alphabet.

At the heart of the Justice Department's lawsuit is a deal between Apple and Google valued at about $20 billion a year that makes Google the default search engine on Apple devices. If they lose the case, the case may force the two technology giants to cancel their cooperation agreement and subvert the way devices such as iPhone have been running for a long time.

Cue pointed out that AI search engines need to improve their search indexes to truly improve performance. But even if these improvements can't be implemented quickly, some of their other features are already "powerful enough for users to want to make the transition".Regarding the migration from traditional search to AI search, Cue said, "Now that the capital is sufficient and the number of players is large, I don't see a reason why this transition won't happen."

Cue also said that large language models will continue to improve, which will further prompt users to change their usage habits.

The market took Eddy Cue's testimony as a signal that both Alphabet and Apple face challenges as they may have to abandon the lucrative arrangement. This also explains why, in addition to Google's plunge on Wednesday, Apple's share price also fell by more than 2%.

Apple's own AI technology has always lagged behind its peers. The company doesn't yet have its own AI search engine and has been forced to postpone major upgrades to Siri that were originally planned to use users' personal data to help complete query tasks. Apple will hold its annual developer conference on June 9, when it plans to launch an improved version of its AI platform "Apple Intelligence".

Investors who want to buy Google at the bottom can consider applying the Protective Put strategy at present.

Protective Put Options Strategy

Among the option strategies, there happens to be a strategy suitable for the current situation of "bargain hunting:" called Protectvie Put. This strategy can help investors incur limited losses even in the situation of "bargain hunting halfway up the mountain", allowing investors to bargain hunting boldly. The method is very simple. When buying stocks, buy the corresponding Put option (Put), that is, Long stock + long Put.

Investors typically choose protective put strategies for two different reasons;

1. Limit risk when buying stocks for the first time.

2. Protect previously bought stocks when the short-term forecast is bearish but the long-term forecast is bullish.

Google Options Strategy

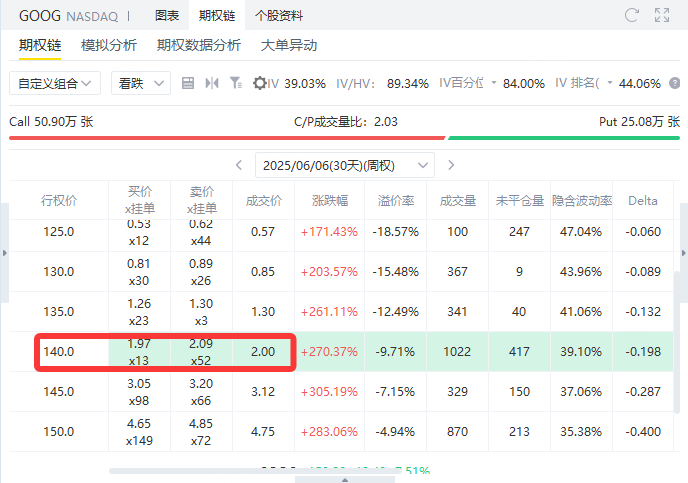

Investors bought 100 shares of Google, each worth $152.8. Investors believe that stock prices will rise in the future. However, investors want to hedge against the risk of unexpected price declines. Therefore, the investor decides to buy a protective put contract with a strike price of $140 (a put contract contains 100 shares), and the protective put costs $200.

Buy 100 Shares of Google, price is $152.80/share, total cost = $15,280

Buy a put option with a strike price of $140, premium cost = $200

The put option expires at a future date and the investor has the right to sell 100 shares at $140 before expiration

1.If S & gt; 152.80 (share price rise)

Stock Earnings = (S-152.80) × 100

Option voided, loss of $200 in premium

Total Profit and Loss = Stock Earnings-$200

2.If 140 & lt; S & lt; 152.80 (down slightly)

Stock Loss = (S-152.80) × 100

Options remain void, losing premium $200

Total profit and loss = stock loss-$200

3.If S ≤ 140 (sharp drop)

Put option exercised and stock sold for $140

Actual loss on stock = (152.80-140) × 100 = $1,280

Option Gains Offset Stock Losses

Total loss = stock loss + option expense = $1,280 + $200 =$1,480 (maximum loss)

Maximum loss limited: Even if the stock price plummets, the maximum loss is $1,480 (it will not increase after the stock price falls below $140)

Unlimited profit margin: The stock price rises, and the stock brings potentially unlimited gains (but subtracts the $200 option cost)

Comments